US equities open choppy, with the SPX fully filling last Friday’s gap. VIX has also filled last Friday’s gap.

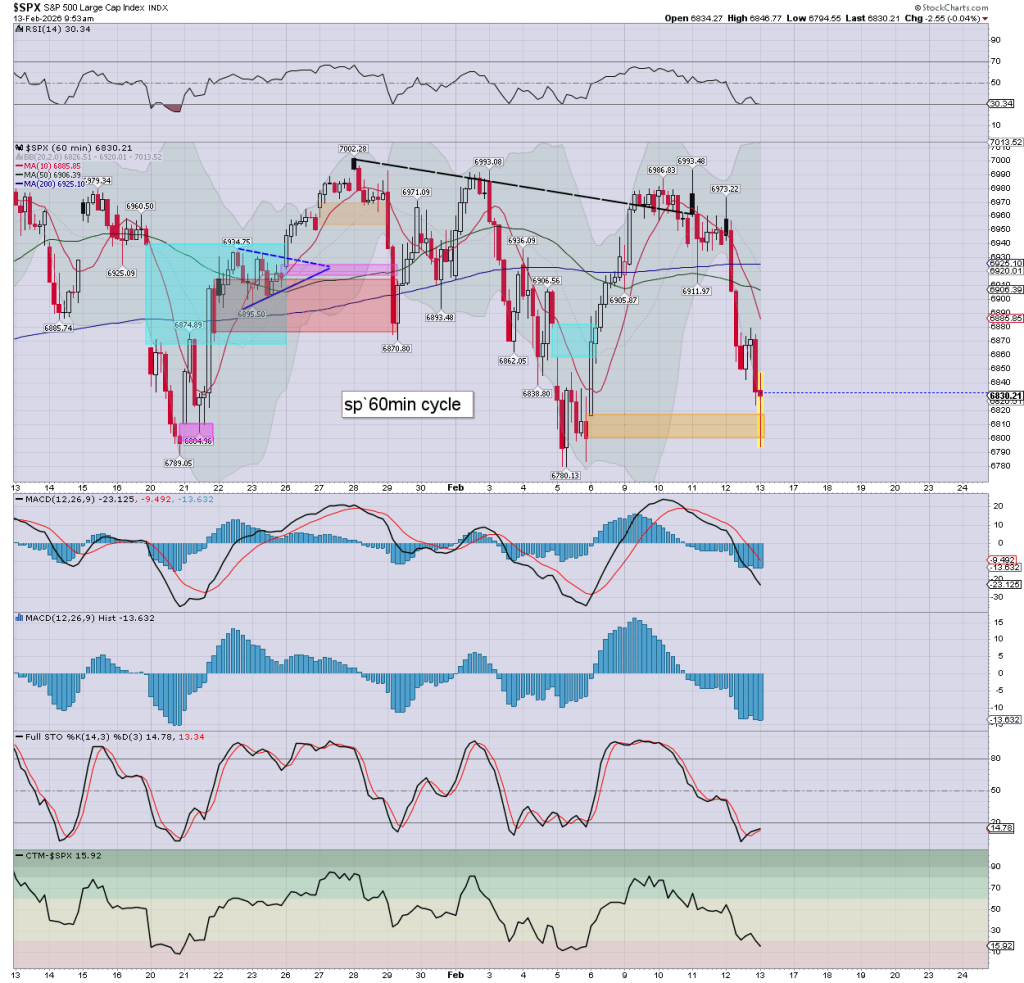

sp’60min

VIX’60min

Summary

The inflation data was certainly better than expected…

Headline y/y: 2.4% vs 2.7% prior

Core y/y: 2.5% vs 2.6% prior

… giving the market renewed confidence of rate cuts.

I expect the next cut…post Powell, in June.

As for equities… we’re s/t cyclically low, and inclined for net upside into the long weekend.

–

notable stock: AAPL

Daily momentum due to turn negative later today, or at the Tuesday open.

–

notable weakness: CLF

Yesterday saw an ugly close beneath key price threshold and the 200dma.

Today isn’t much better.

–

notable silver ETF: SLV, 5min

I’d consider buying on any cooling wave, but ahead of a long weekend… not really.

–

notable miner: PAAS

Higher with silver