US equities are a little choppy. Meanwhile, the precious metals are a little mixed, Gold u/c, with Silver -0.4%. The miner ETF of GDX is currently -0.8% at $28.12.

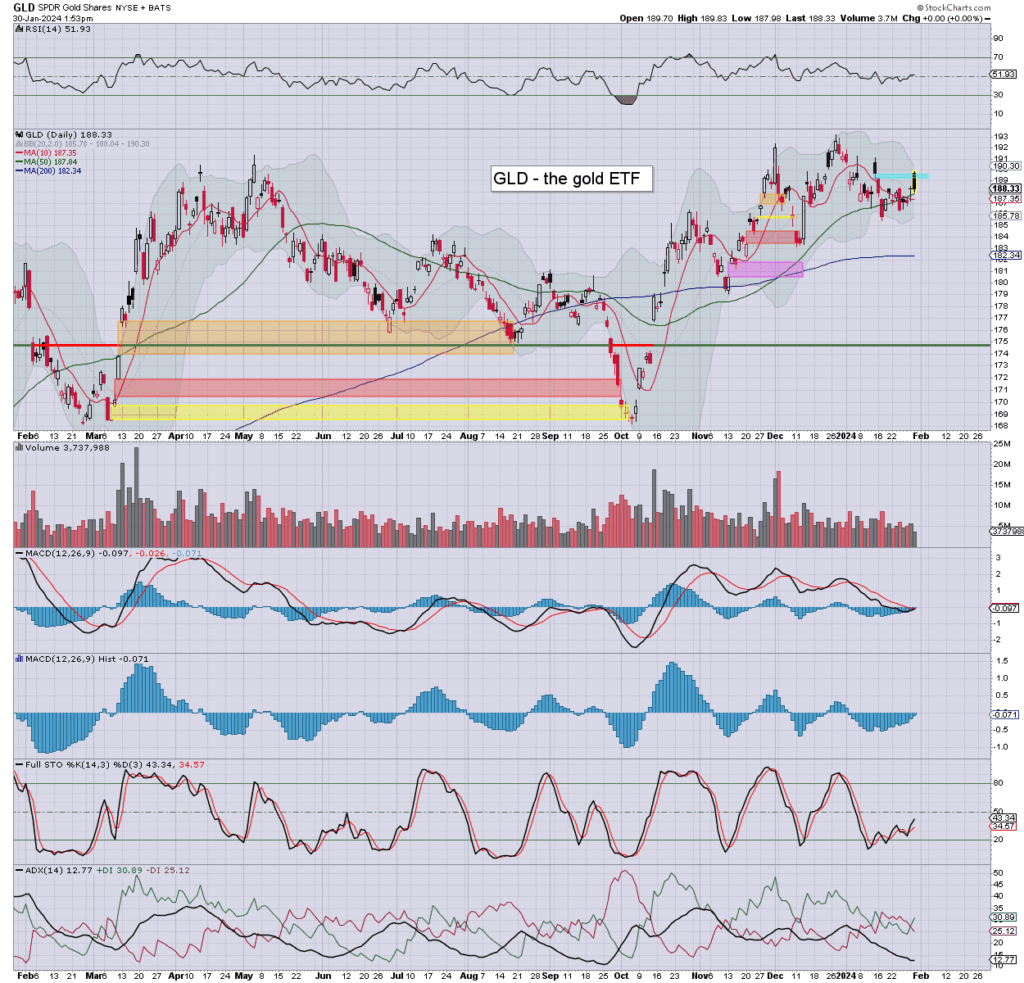

GLD daily

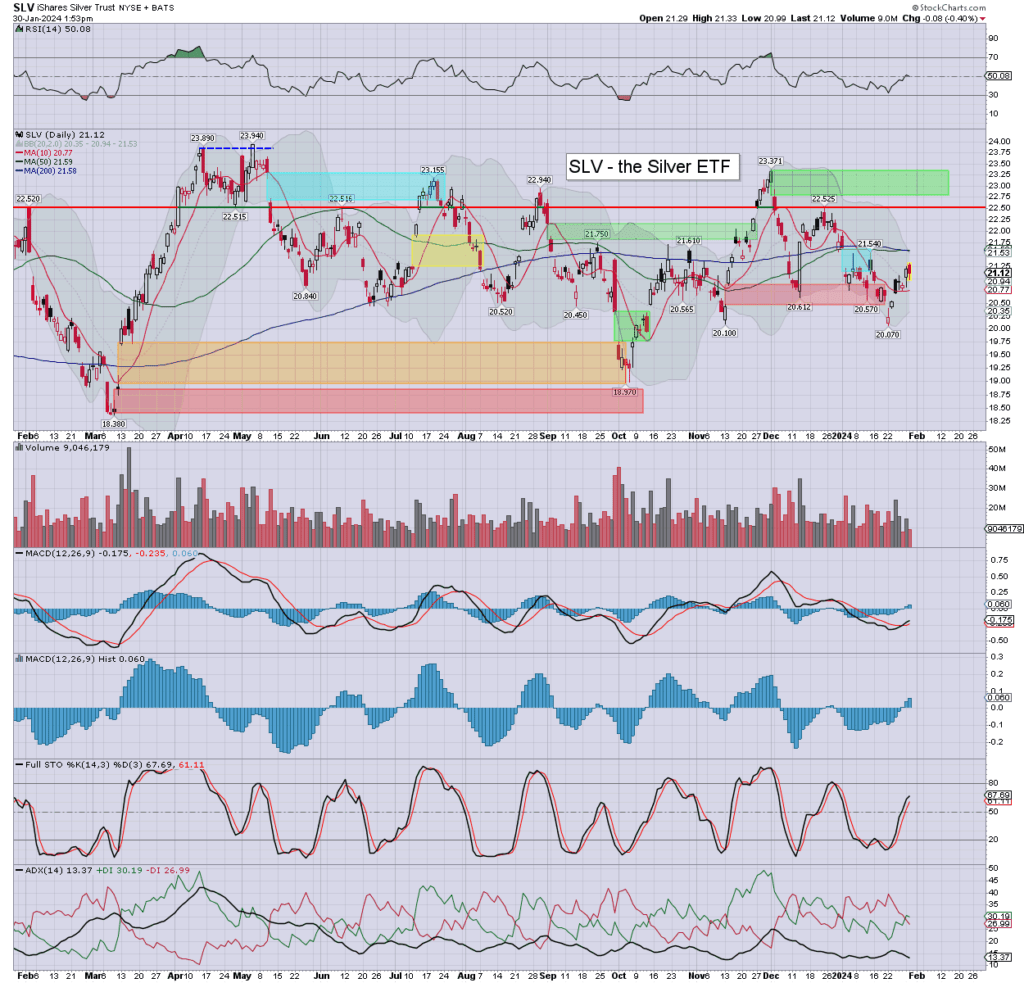

SLV daily

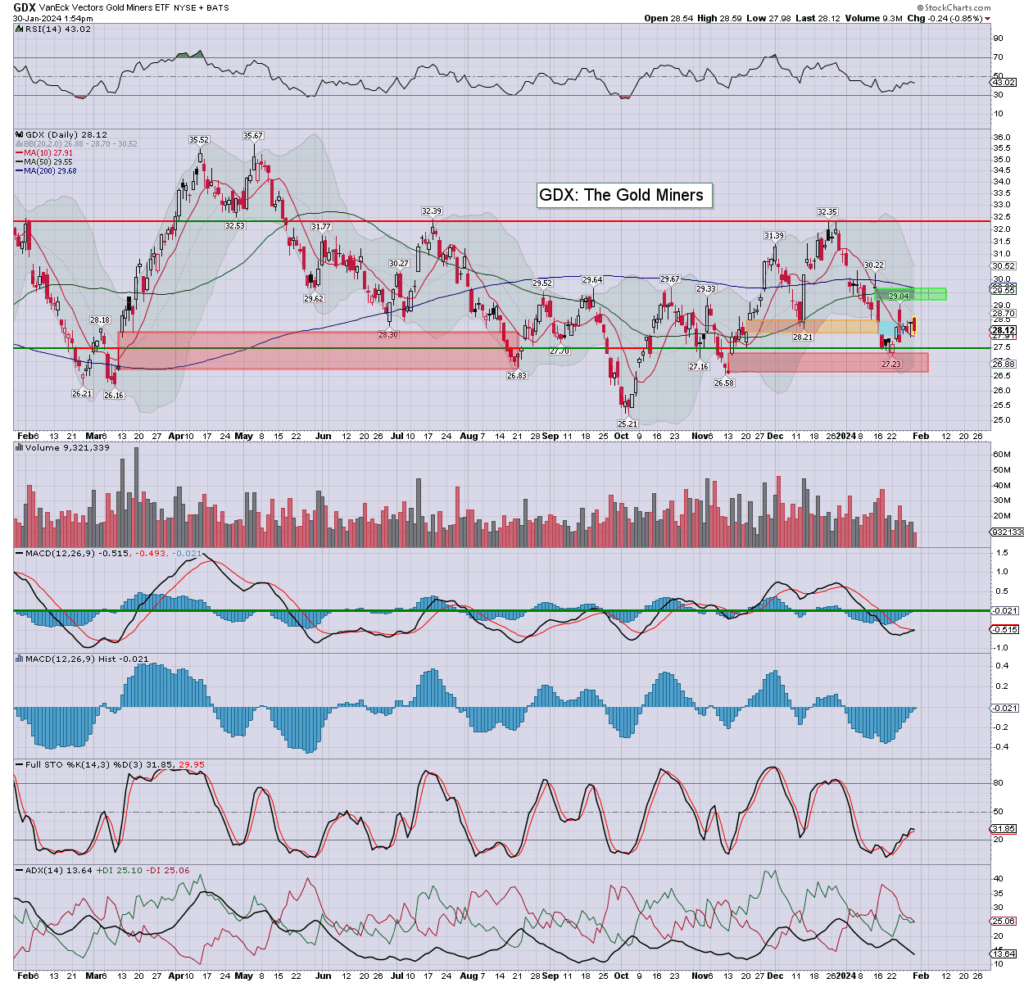

GDX daily

Summary

Gold/GLD: gold printed $2067, cooled to 47′, currently around $2051. A monthly close >$2K appears assured, not least as the January pin/fix/settlement will occur BEFORE the FOMC announcement. Gold bugs should be satisfied, but be seeking >$2100 in Feb’, if not a new hist’ high >$2152.

Silver/SLV: silver printed $23.43, if cooling back a little. I still favour Gold.

GDX: miners seeing early broad gains fully reverse to broad declines. I see all such cooling as a buying opp’.

*I hold the quartet of NEM, GOLD, AG, HL.

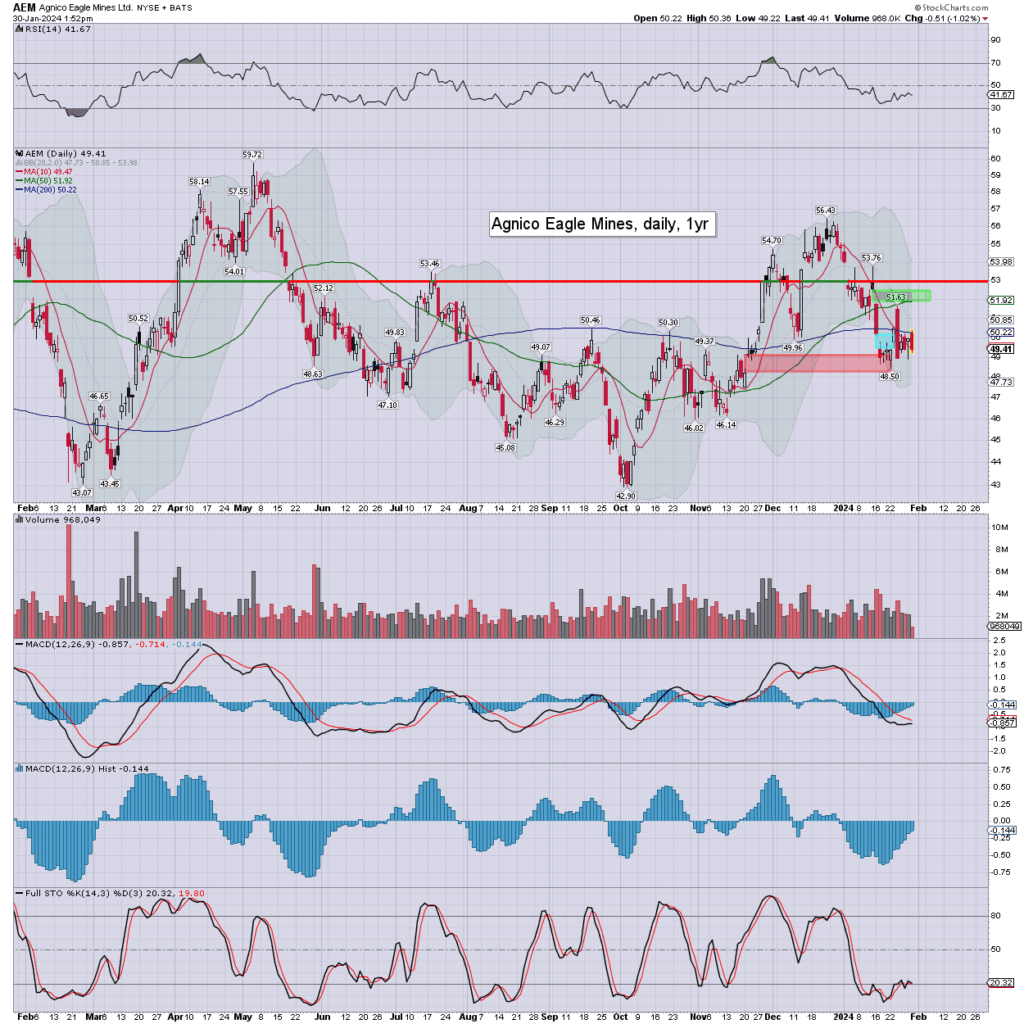

notable gold miner: AEM

I dropped in the opening minutes from $50.12. Partly as it was s/t overbought, but partly as I want to free up some funds to add to SLB.

–

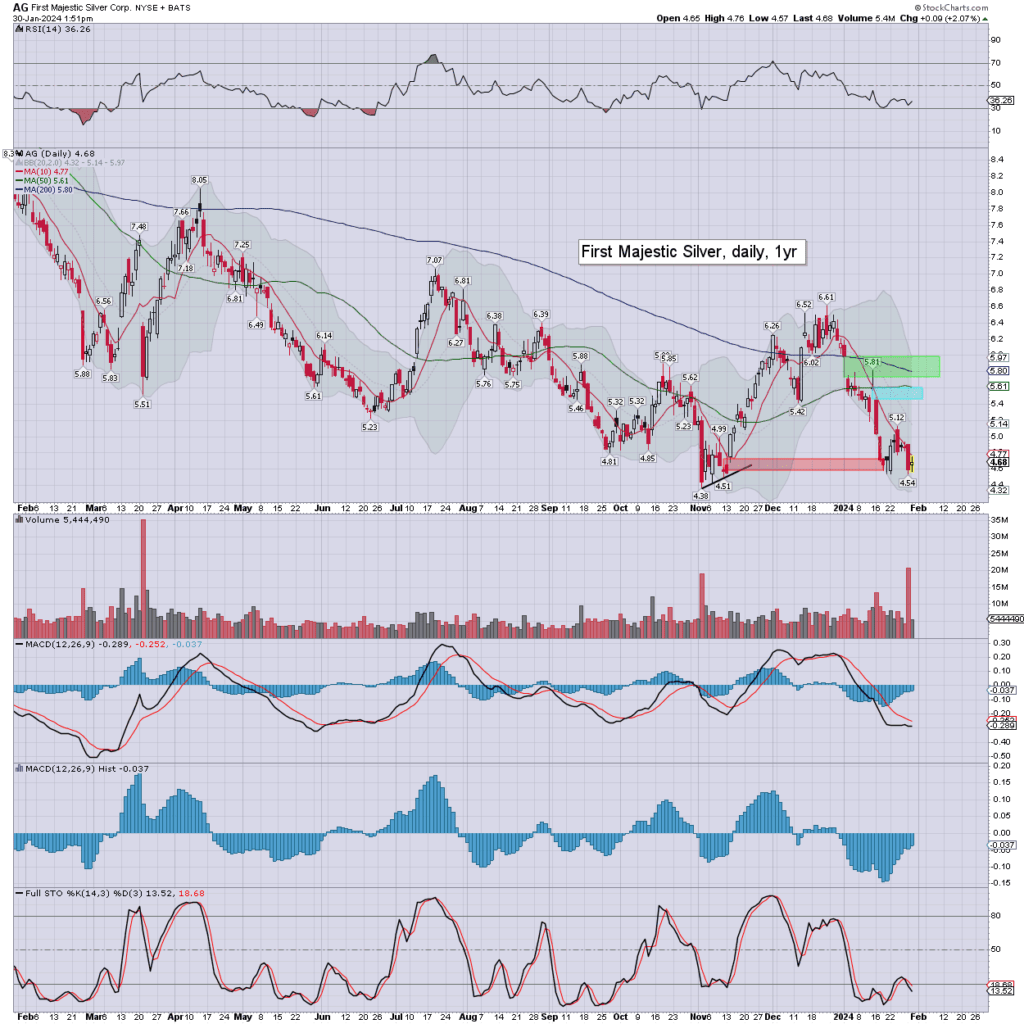

notable silver miner: AG

On any basis… cyclically very low.

—

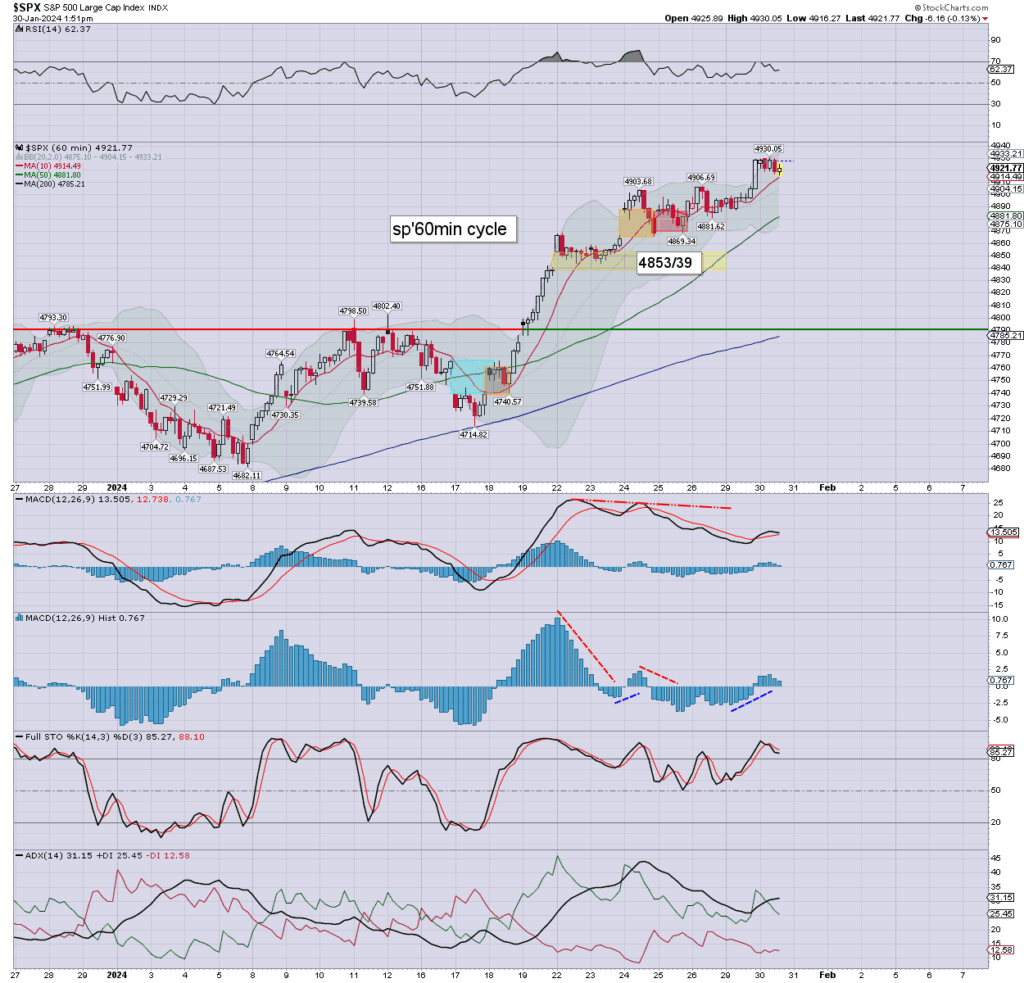

Equities: sp’60min

Micro chop. Bulls could argue structure is a baby bull flag. Certainly, the daily upper bollinger will offer the 4950/60s on FOMC-Wednesday.