US equities are choppy, if mostly leaning weak. Meanwhile, WTIC is currently +1.1% in the $77s. The energy sector ETF of XLE is currently net lower for the week by -0.1% at $84.17.

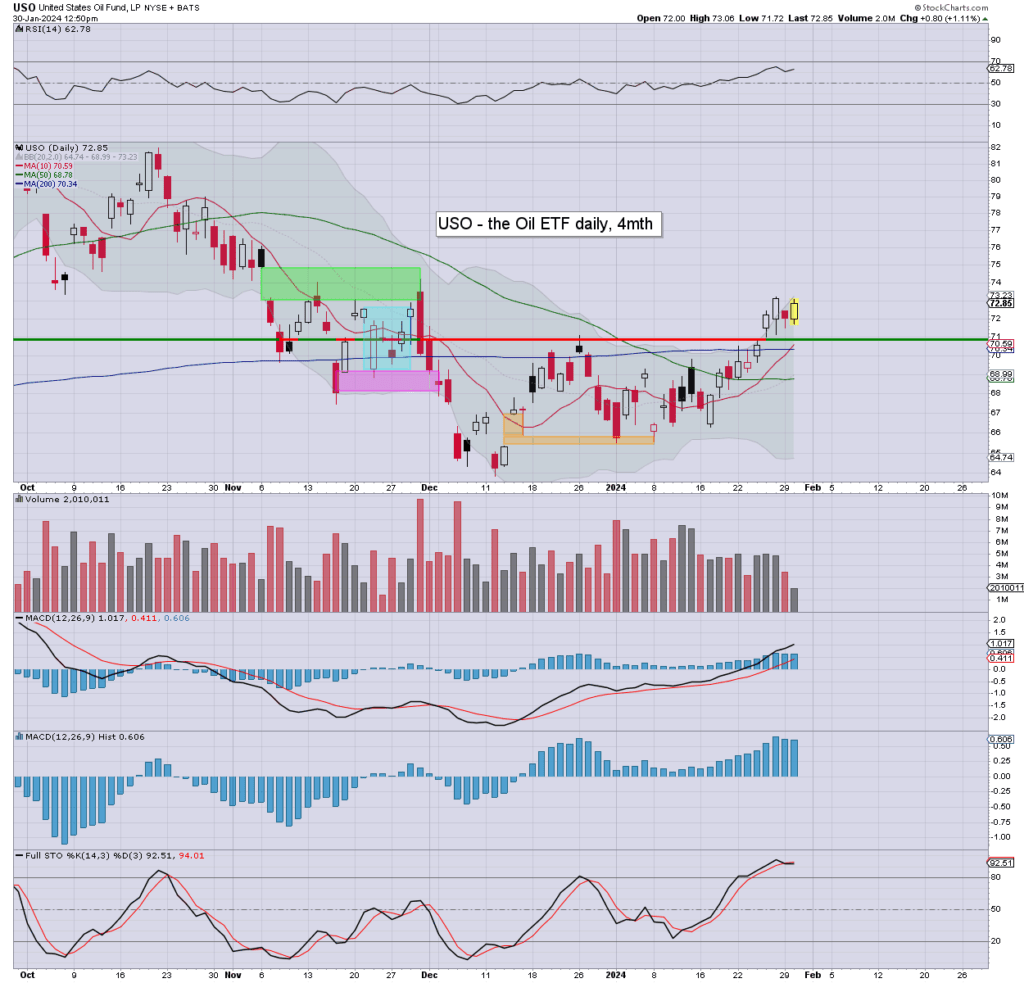

USO daily

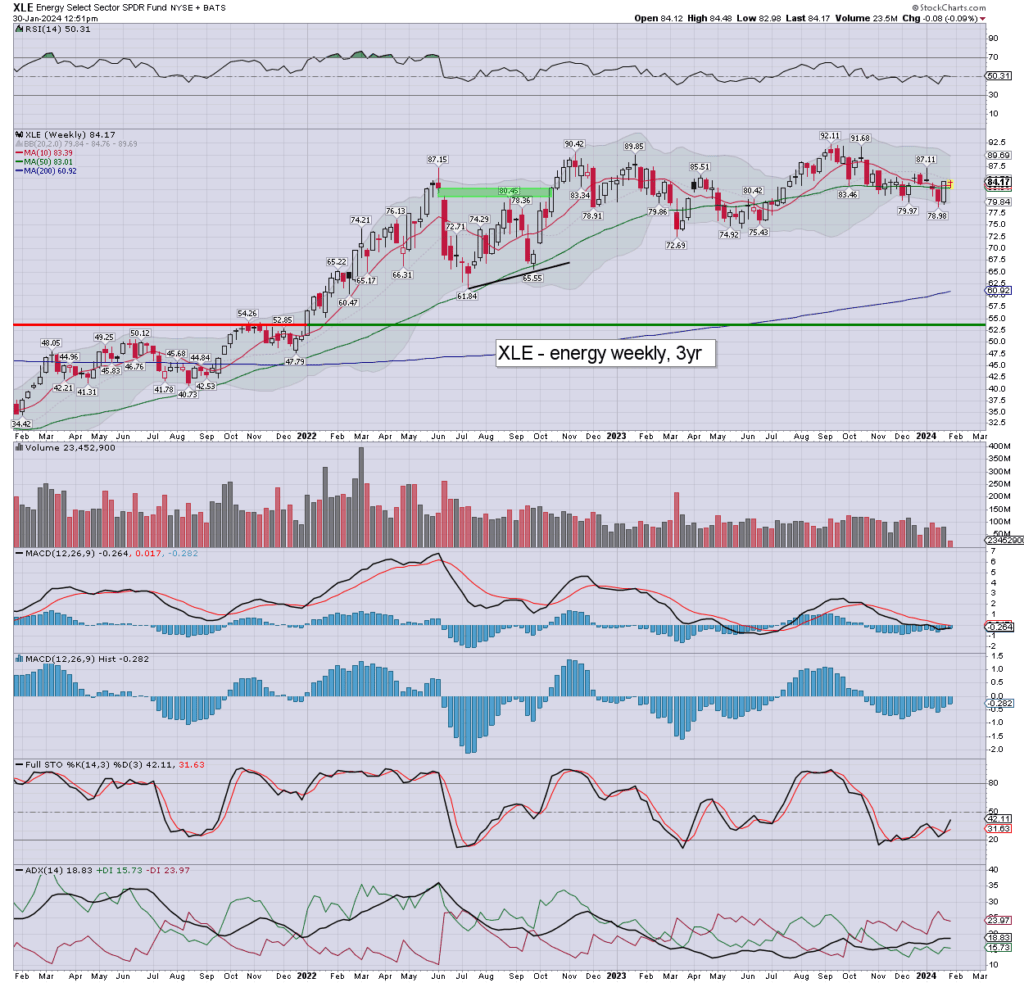

XLE weekly

Summary

WTIC/USO: oil printed $78.12… as a monthly settlement >$78 appears increasingly likely. Such a close will offer the $85s in Feb’.

XLE: energy stocks have recovered from early downside, with the sector back to broadly flat. If WTIC does power to around $85, the sector could be expected to climb by 10/15%.

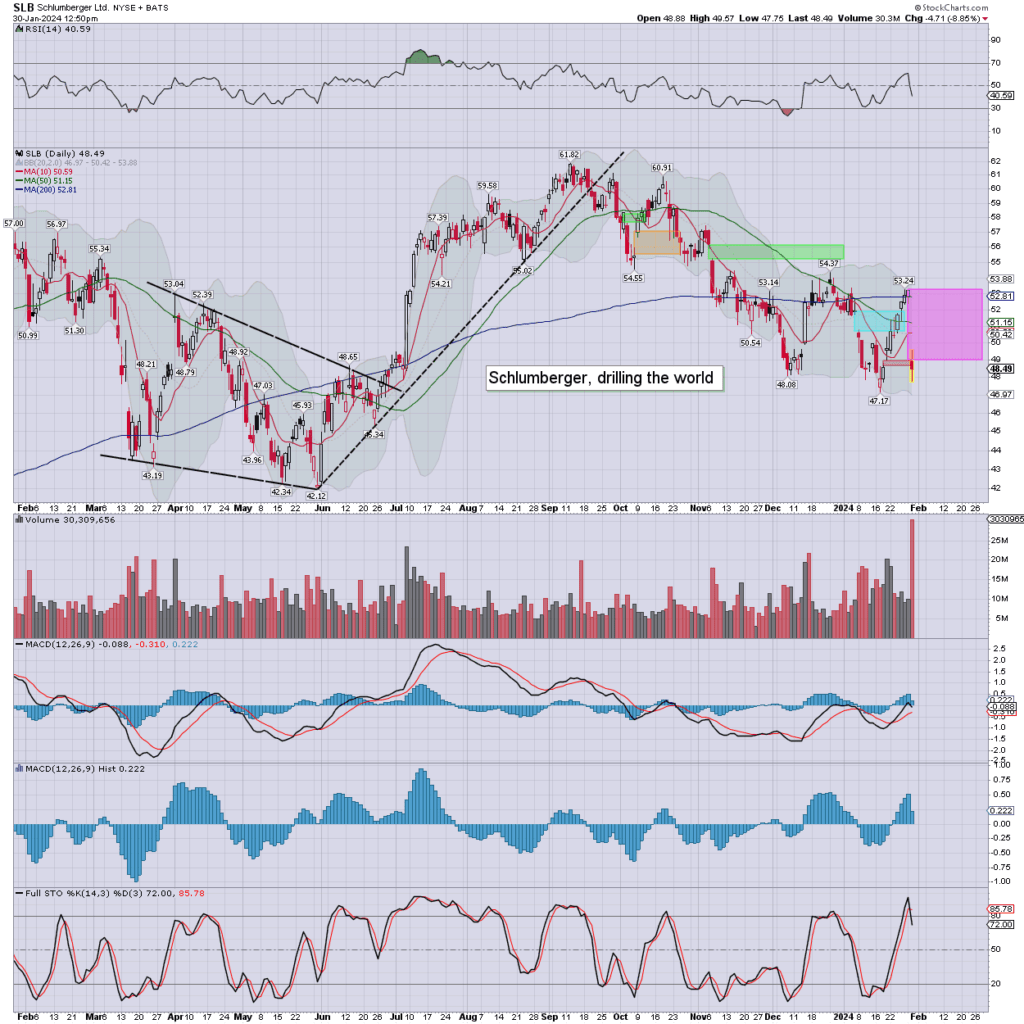

notable stock: SLB

The Aramco news wasn’t great, but it sure doesn’t justify this degree of smackdown. I picked up from $52.67 yesterday. I’ll look to add more tomorrow, as I want at least one energy stock, to balance against my quartet of gold/silver miners.

—

A subscriber kindly alerted me to…

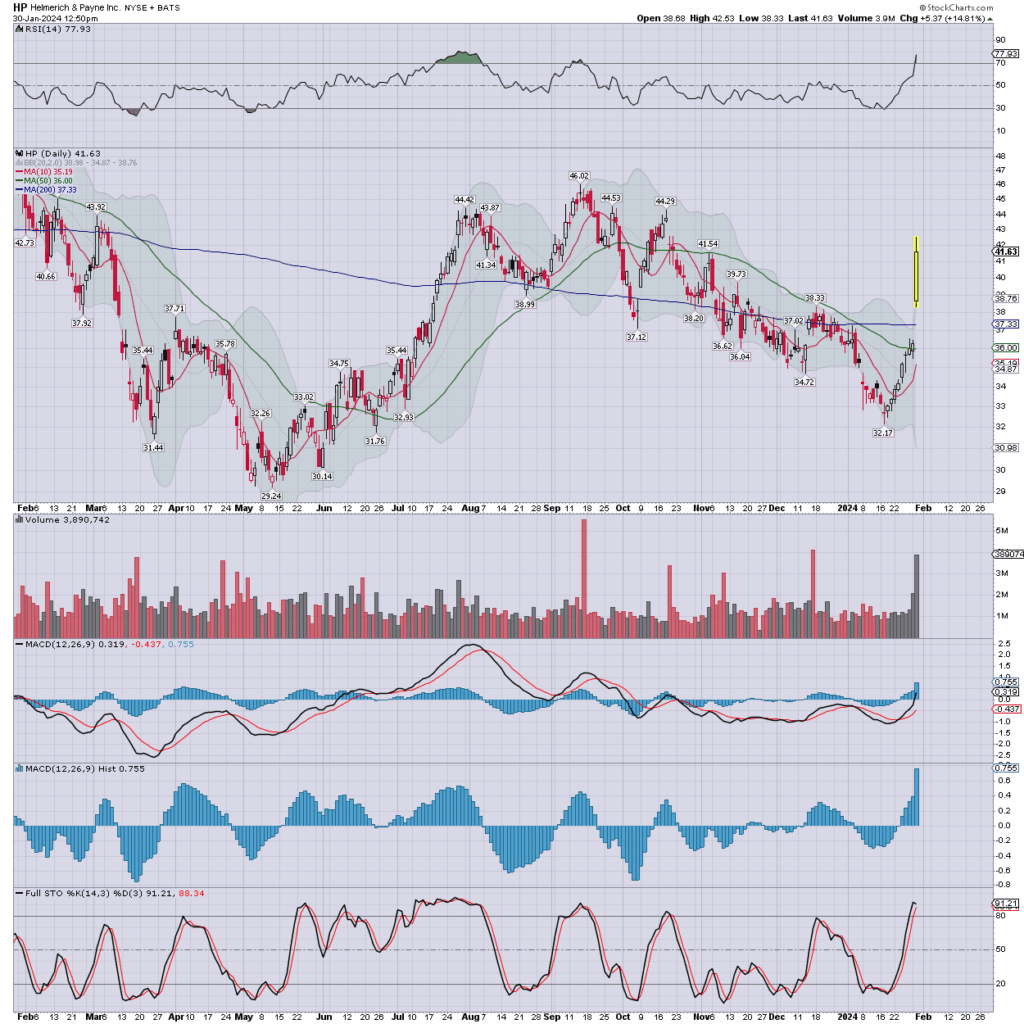

notable stock: HP

Earnings (Monday AH) were better than expected: EPS 97cents vs 73est. Rev’ y/y -6.0% to $677M vs 662est.

–

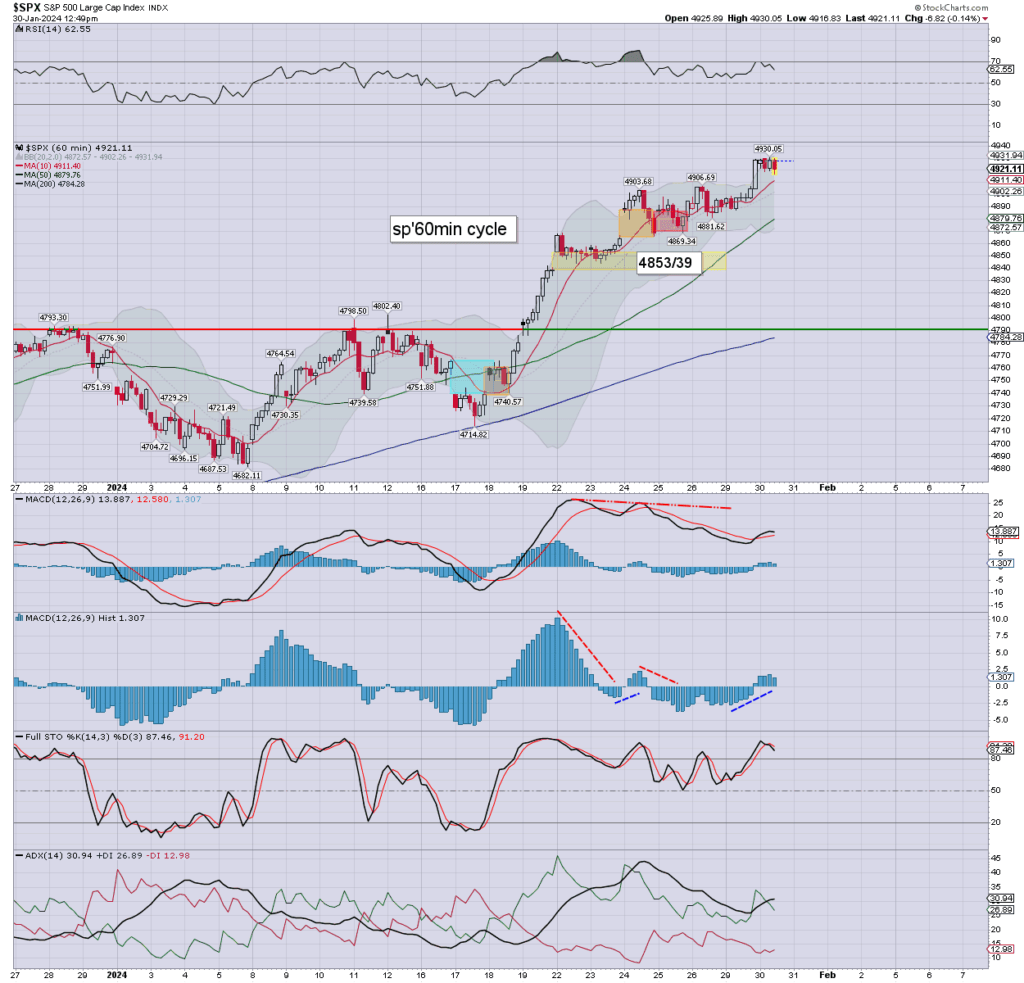

Equities: sp’60min

New hist’ high of 4930, making it a day for the bulls.

The s/t cyclical setup favours the bears… but I’d kinda expect a burst to the 4940/50s on the Wed’ 2pm press release. I just wonder if psy’ 5K is even viable tomorrow on ‘Goldilocks Powell’.