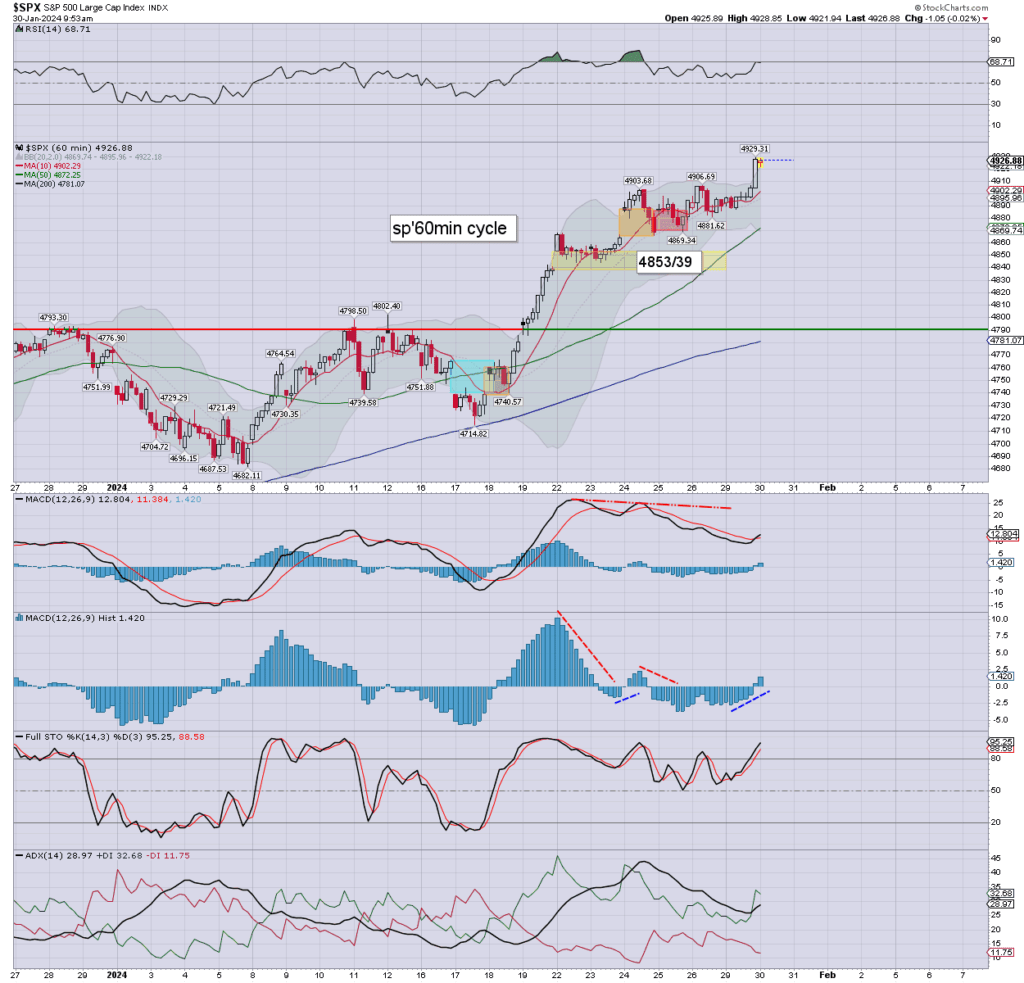

US equities open a little weak… but its more chop than anything. The market will remain inclined to favour the bulls into Wednesday’s FOMC announcement. WTIC $77s. Gold $2067 (if mostly highly due to futures being rolled)

sp’60min

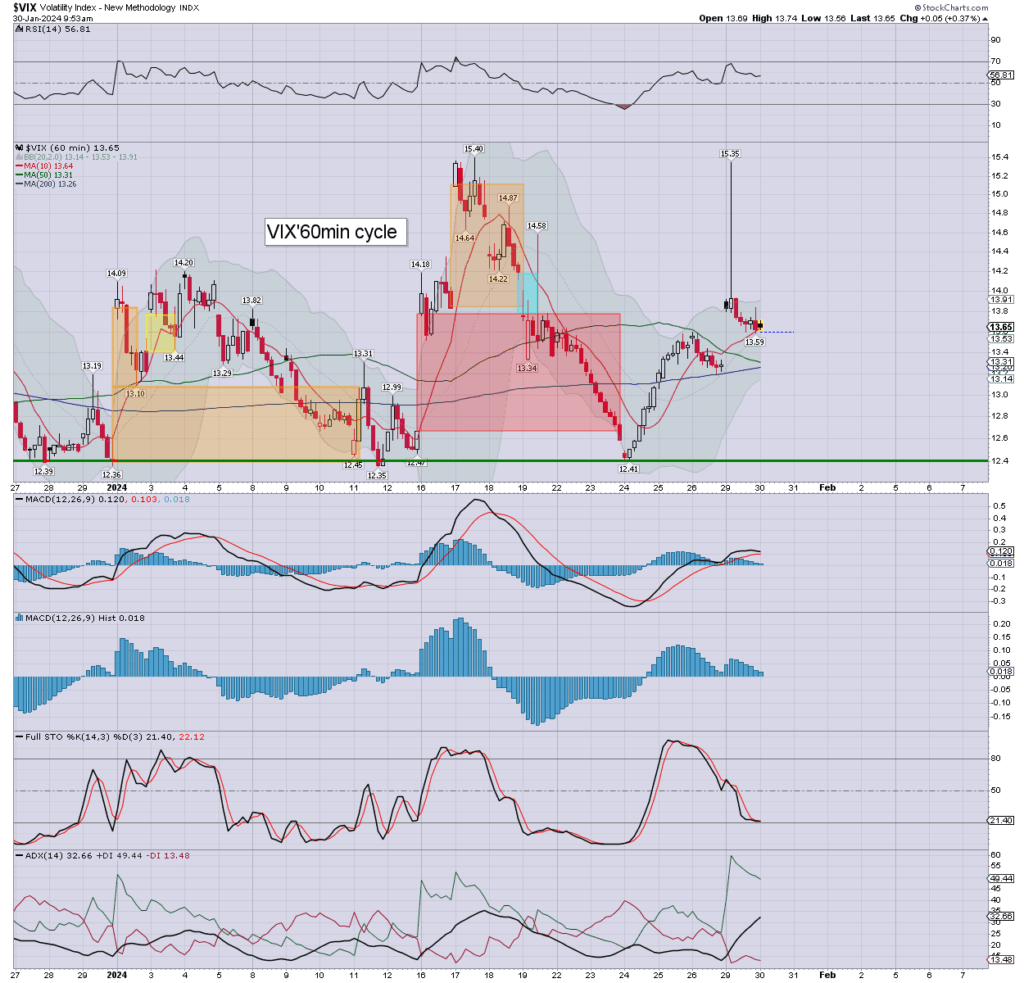

VIX’60min

Summary

There remains no downside power, with the SPX already turning positive.

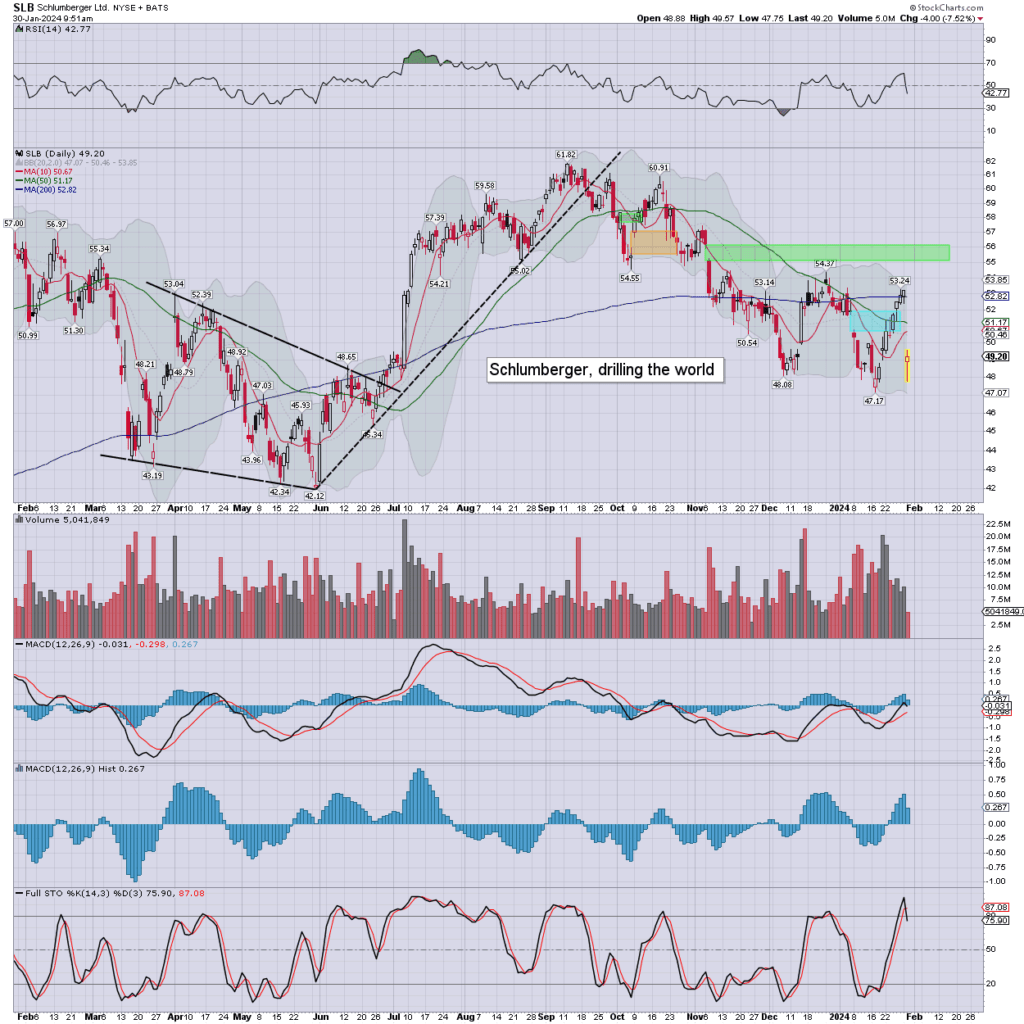

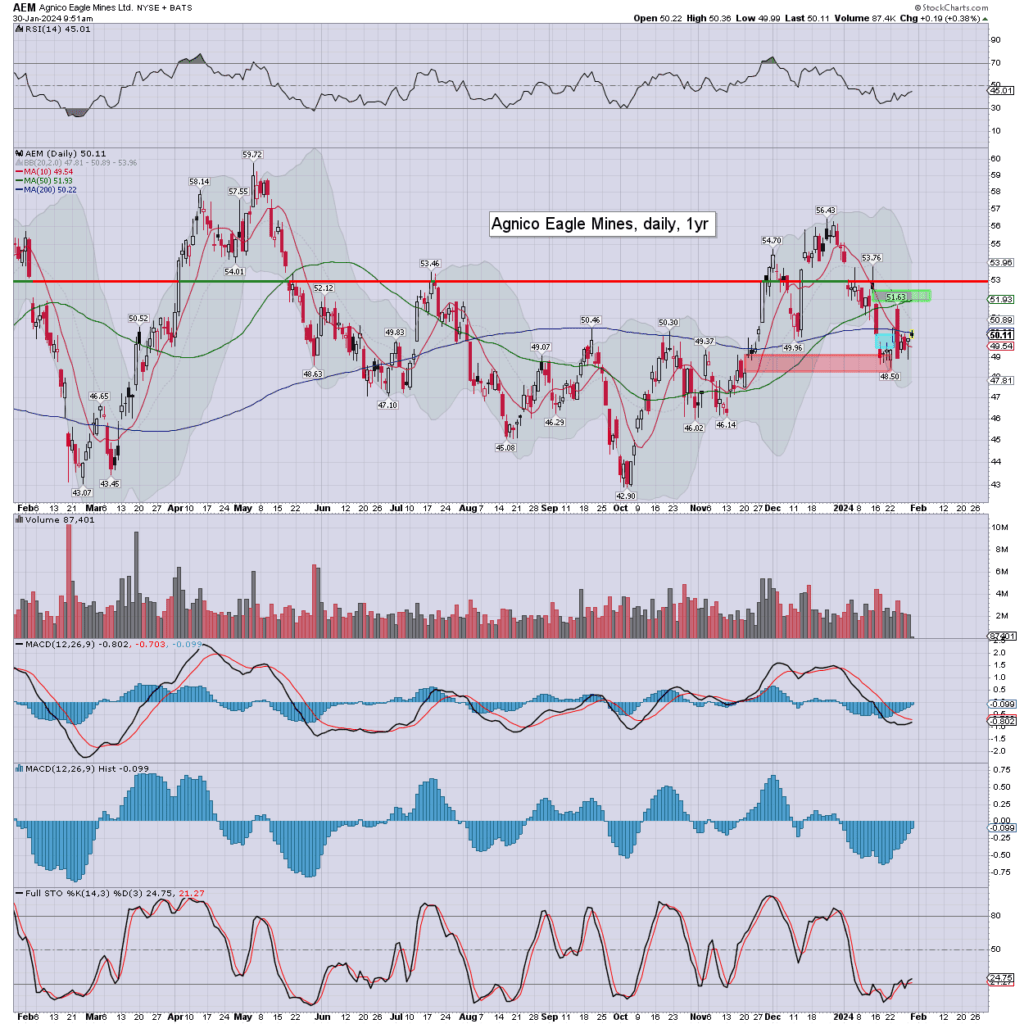

*Yours truly has bailed on AEM… in 49.11… out 50.12. I can’t really complain, and I’ll look to add to SLB, but I’ll have to wait for the funds to settle.

–

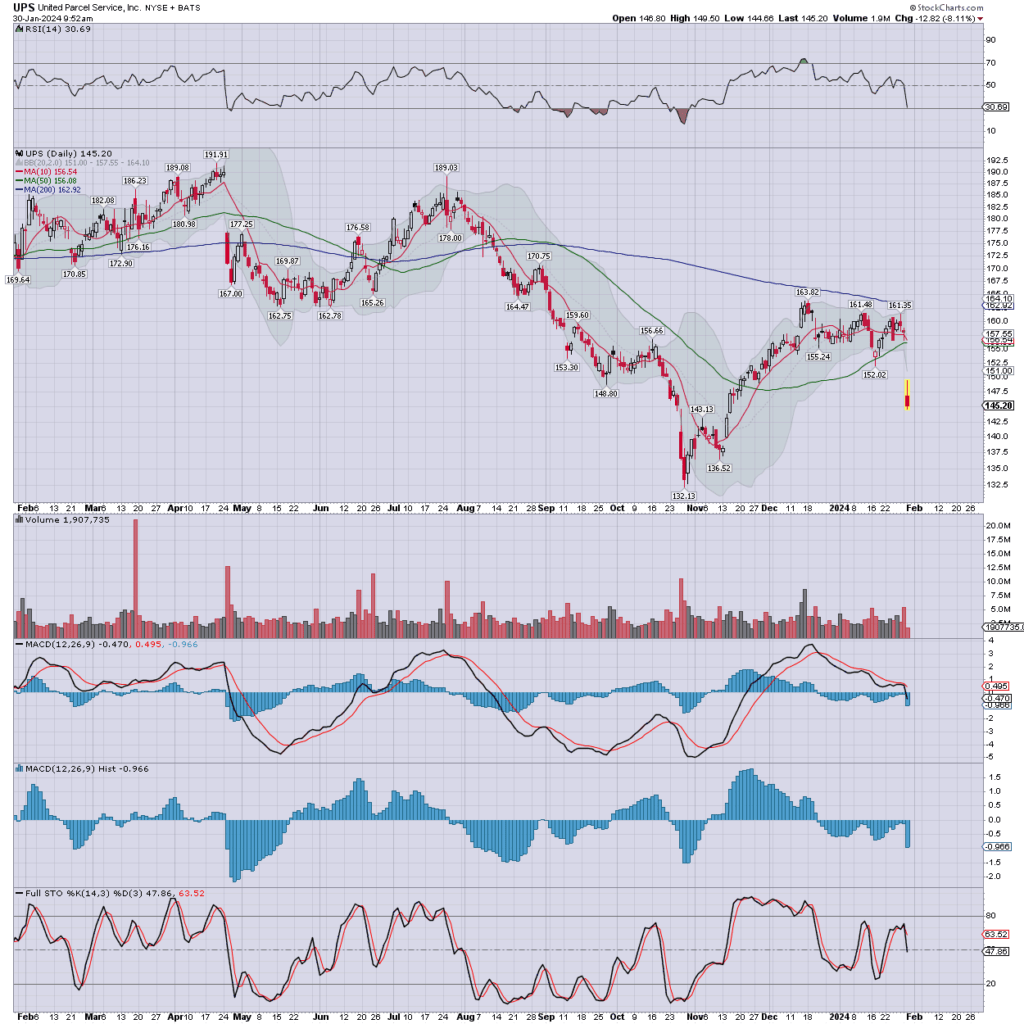

notable stock: UPS

Headline earnings were mixed… EPS $2.47 vs 2.46est. Rev’ y/y -7.8% to $24.9bn vs 25.4est. Weak guidance. Divi’ increase to $1.63. Sister FDX is lower in sympathy.

–

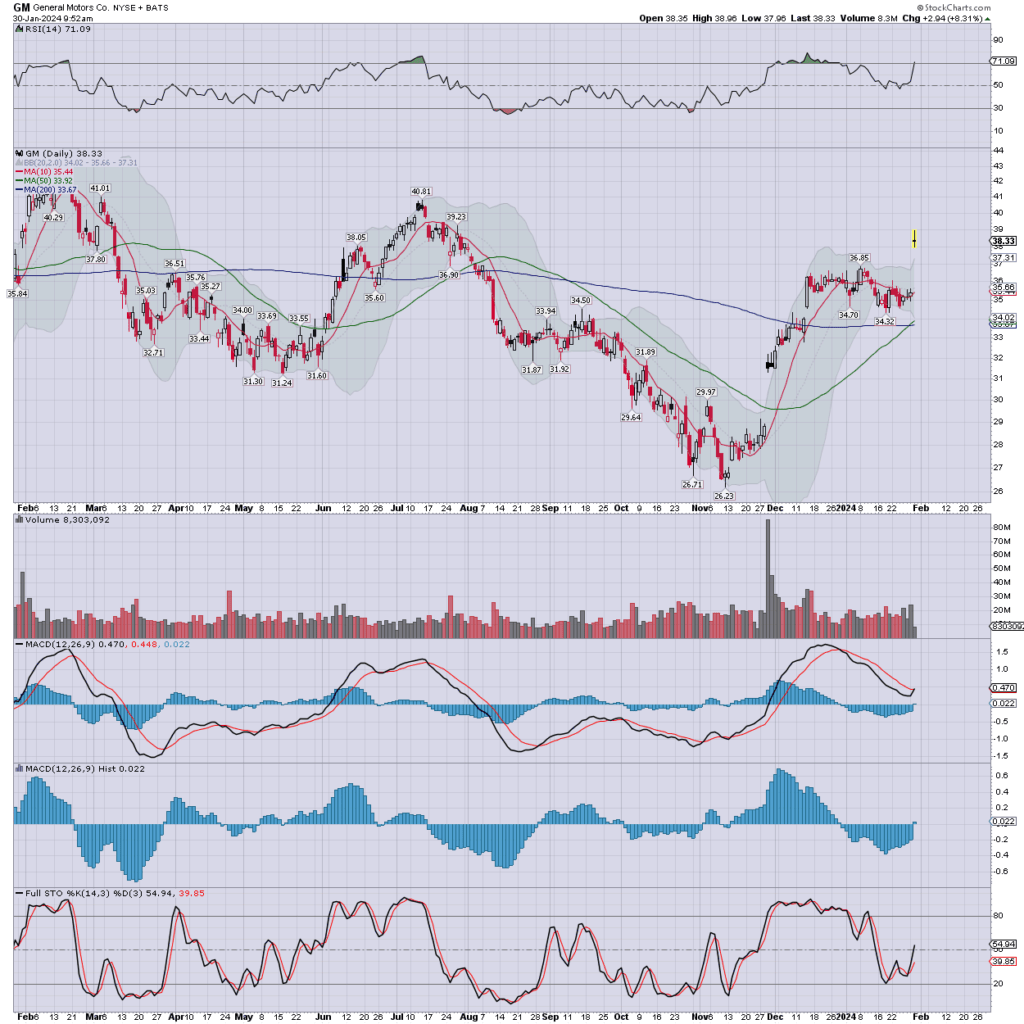

notable car: GM

Earnings were broadly fine… EPS $1.24 vs 1.16est. Rev’ y/y -0.3% to $43.0bn vs 38.8est. Positive guidance and its helping TSLA, F

—

notable energy: SLB

Oil/gas drillers lower on Aramco saying it has no intention to expand operations/capacity. The reaction onto SLB is pretty stupid.

—

notable miner: AEM

The micro cycles are very overbought, and I’m out.

If it just keeps going up… well, I’ve still a quartet of gold/silver miners.