Good morning. US equity futures are fractionally lower, SPX -6pts, we’re set to open at 4921. USD is -0.15% at DXY 103.27. The precious metals are a little mixed, Gold +$3, with Silver -0.2%. WTIC is -0.9% in the $76s.

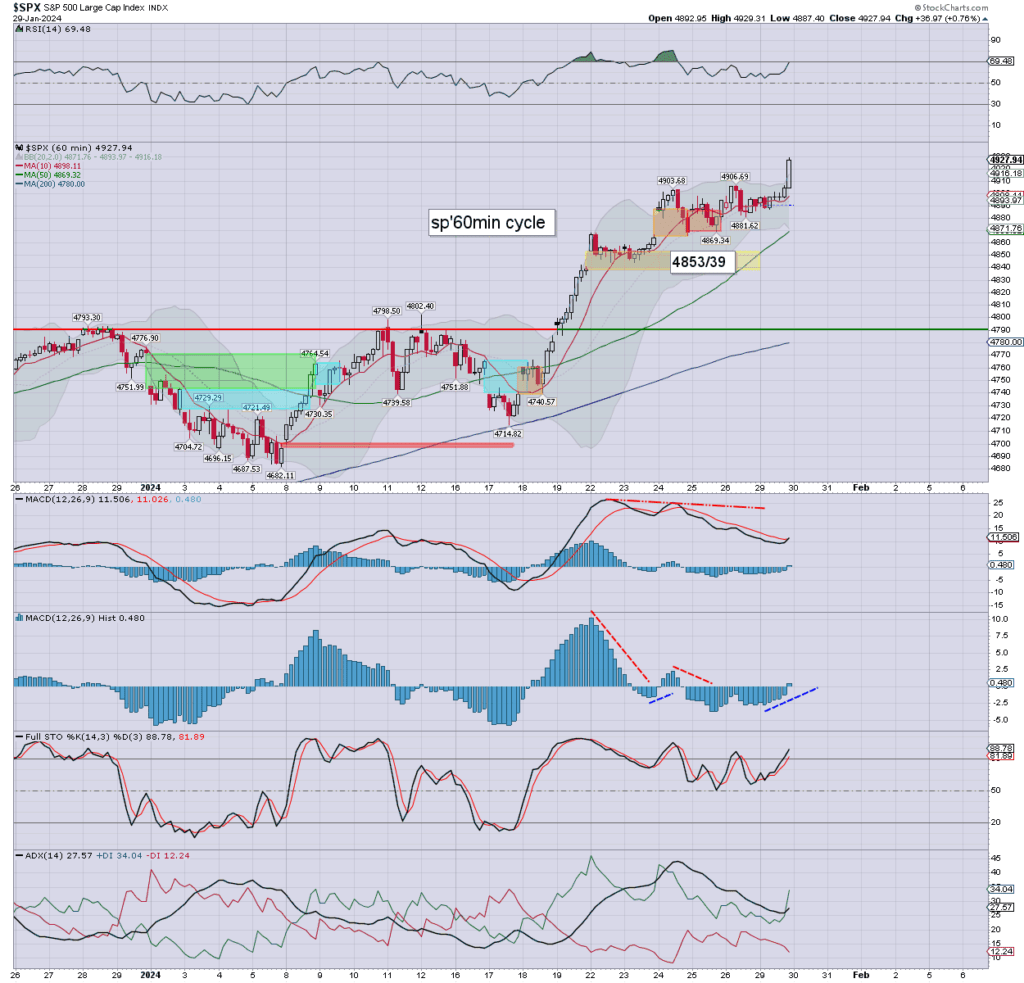

sp’60min

Summary

Yesterday saw considerable positive leaning chop, with a late day mini ramp to break a new hist’ high. S/t momentum turned positive into the close.

Overnight futures have been pretty subdued, we’re set to open fractionally lower.

Yours truly will merely look to drop AEM today, and perhaps add to SLB tomorrow.

—

Early movers

AAPL -0.6%

AG +1.1%

AMD -0.3%, earnings due in AH

–

BABA -1.2%, weak Chinese stocks

BIDU -2.4%

CLF -2.8%, post earnings depression

–

COIN +2.0%

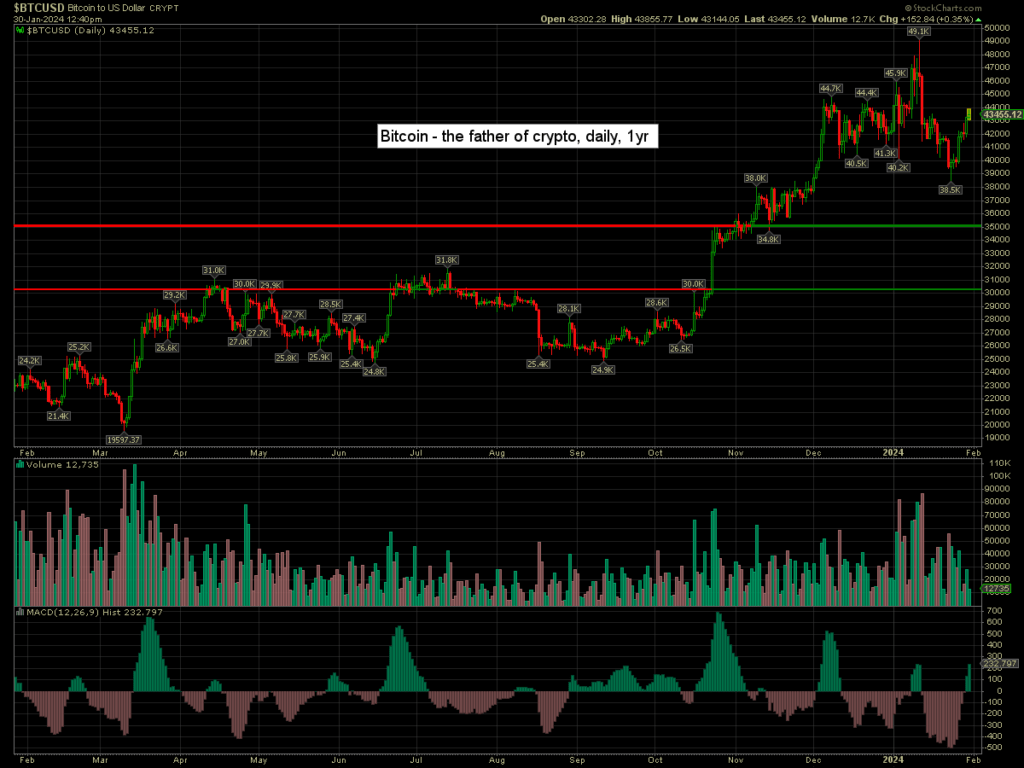

Bitcoin is +0.3% at $43455. Daily momentum is increasingly positive.

–

F +2.7%, helped by GM. Supplying EVs to Ecolab

FDX -2.0%, in sympathy with UPS

FFIV +9.5%, post earnings jump

–

GM +7.3%, EPS $1.24 vs 1.16est. Rev’ y/y -0.3% to $43.0bn vs 38.8est. Positive guidance

–

GOLD +0.1%

GS +0.9%, Morgan Stanley, equal-weight>overweight, 333>449

HAL -2.5%

–

HCA +5.8%, EPS $5.90 vs 5.05est. Rev’ y/y +11.7% to $17.3bn vs 16.5est. Positive guidance. Increases buyback >$6bn

–

JBLU -1.4%, EPS -19cents vs -27est. Rev’ y/y -3.7% to $2.3bn inline. Q1 guidance not great.

–

MPC +2.2%, EPS $3.98 vs 2.22est. Rev’ $36.8bn vs 35.3est.

–

MSFT +0.8%, earnings due in AH

NFLX -1.3%, Seaport, buy>neutral, price target of $576 removed.

NVDA +1.2%

–

PFE +0.8%, EPS 10cents vs -18est. Rev’ y/y -41.3% to $14.25bn vs 14.37est. Guidance full yr EPS $2.05/2.25. Pfizer touting cost savings of $4bn, with $3.3bn still available for stock buybacks (it never did any in 2023).

–

PHM +0.9%, EPS $3.28 vs 3.21est. Rev’ y/y -15.5% to $4.3bn vs 4.5est. Buyback of $1.5bn

–

SLB -4.7%, news? The only thing I’ve found was a note saying Aramco of Saudi Arabia will not be increasing capacity.

–

SMCI +13.0%, post earnings jump

–

SQ +2.6%, Wedbush, neutral>outperform, 70>90

TLT +0.4%

TSLA +2.3%, helped by GM

–

UPS -6.8%, EPS $2.47 vs 2.46est. Rev’ y/y -7.8% to $24.9bn vs 25.4est. Weak guidance. Divi’ increase to $1.63

–

VIX +0.7% at 13.69

–

WHR -4.3%, post earnings depression

XOM -0.5%

—

Overnight markets

Asian markets were very mixed, whilst European markets are leaning upward…

Japan: +0.1% to 36065

China: -1.8% to 2830

Germany: currently +0.25% at 16984

UK: currently +0.6% at 7675

Here in the failed state of the UK…

https://www.bbc.co.uk/news/business-68135054

Food inflation is still running >6.0%, and this is on top of last years increase of around 19%. A broken consumer, a disintegrating… blood thirsty society, whose current path is war with Russia.

—

Have a good Tuesday