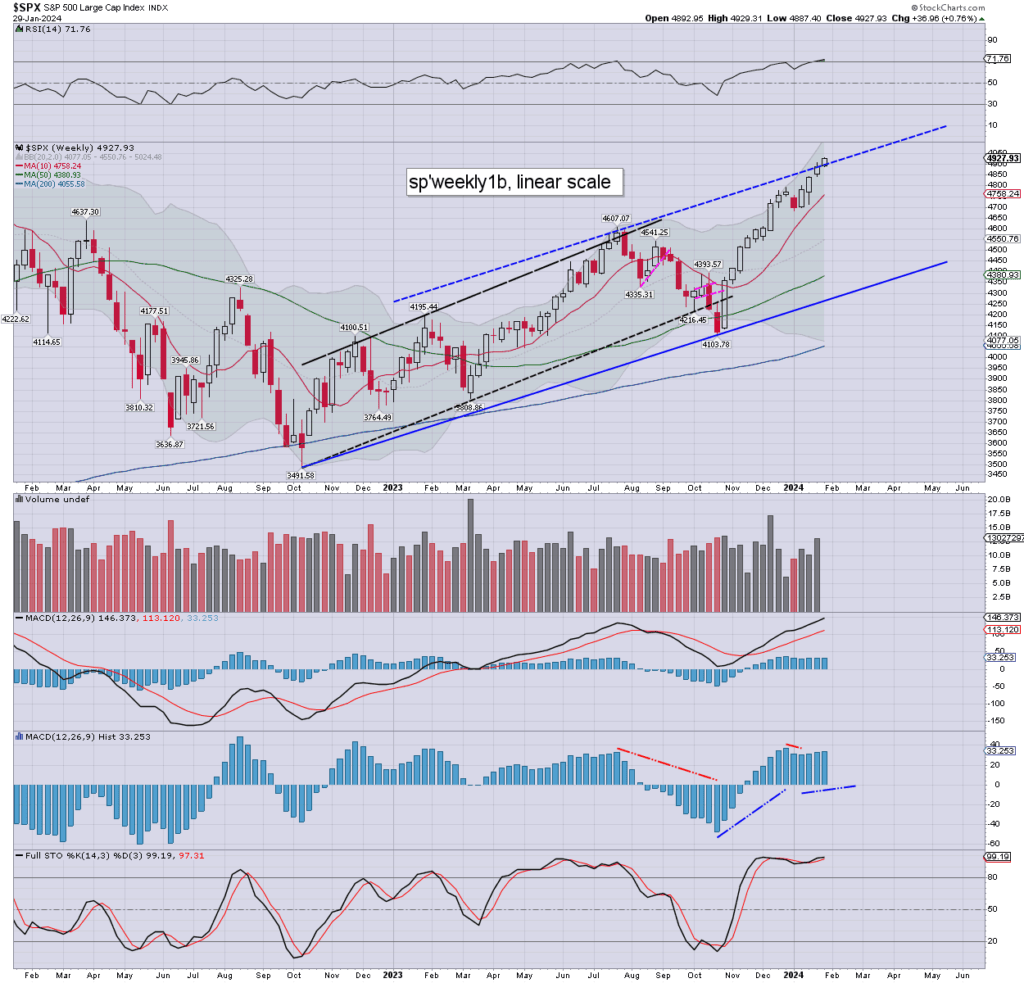

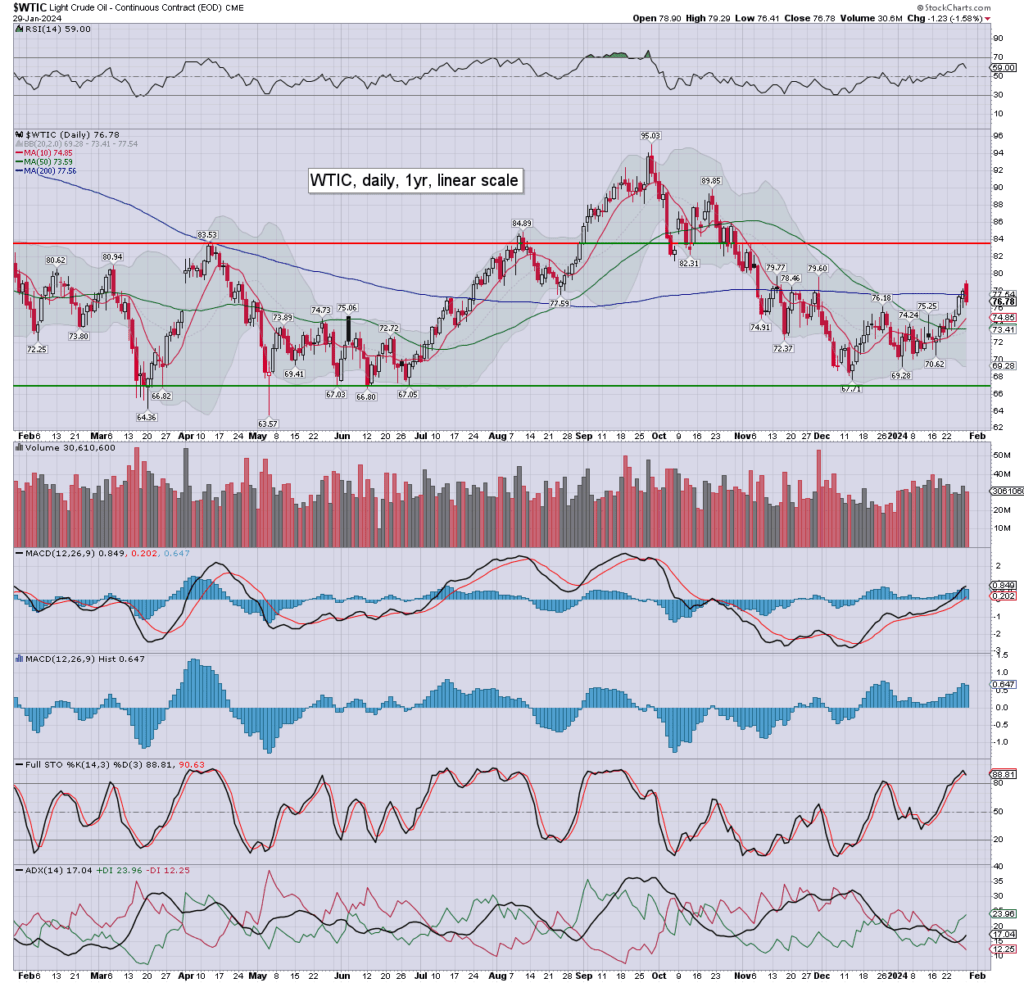

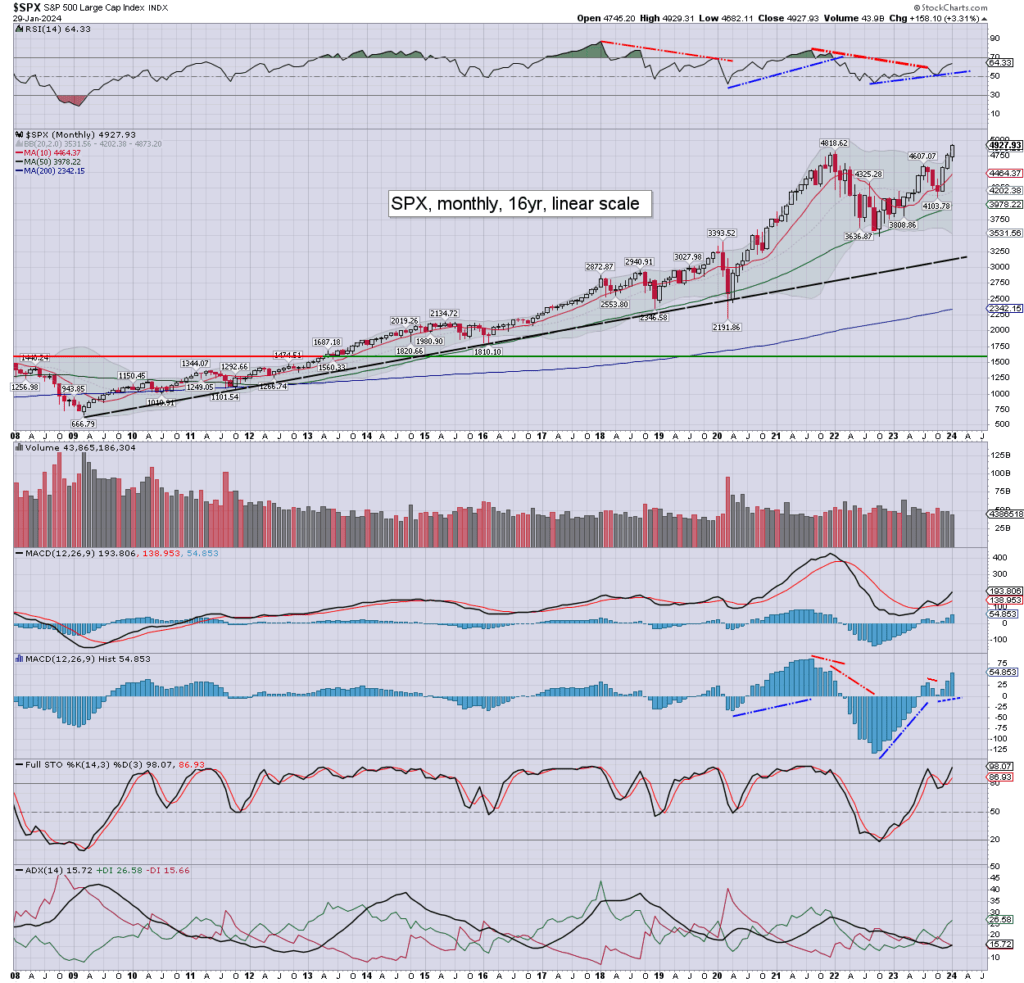

The equity week began on the most bullish note possible, the SPX printing a new hist’ high of 4929, and settling +0.8% to 4927. Meanwhile, WTIC settled -$1.23 (1.6%) to $76.78.

sp’weekly1b

WTIC daily

Summary

SPX: I would especially note we have a break above upper trend. I’d accept you could argue it depends on how you draw it, but I’m pretty sure the algos would agree with me. Upper weekly bollinger has now climbed to 5024, as giant psy’ 5K appears viable as early as this Wednesday afternoon. From there… the 5400s.

WTIC: an overnight high of $79.29, but settling at $76.78. Monday’s candle is bearish engulfing, but I don’t see anything more than early Tues’ weakness.

The middle east appears increasingly prone to something major, and it remains a wonder oil isn’t already around $100. I’d partly accept Celente’s notion that oil is weaker than it otherwise might, due to underlying slowing global growth.

For now, I am very much bullish oil. A January settlement >$78.00 would be decisive, and offer the $85s.

–

Looking ahead

Tuesday will see Case-Shiller HPI, JOLTS, Consumer con’

Earnings: PFE, GM, UPS, JBLU, AOS, MPC, MSCI, GLW, HCA, PHM, MSFT, AMD, GOOGL, SBUX, SKWS, JNPR, MTCH, LC, EA, CP

–

Final note

*I’ve not watched this yet.

‘The most important’… sounds rather mainstream’ish.

When isn’t the next Fed meeting the most important ?

–

I'm well aware some of you are blood thirsty for war with Iran. Blow back is a bitch. https://t.co/C0WZlgHuaB

— Philip Calrissian (@Trading_Sunset) January 29, 2024

I will call it as I see it, especially if it annoys some of the more blood thirsty out there.

–

QRA is out and it’s another reason for the market to rally

Treasury cuts 1Q borrowing estimate to $760B from $816B.

Expects to borrow $202B in Q2. pic.twitter.com/LNuChzjnmZ

— Disruptor ⚡️ (@DisruptorStocks) January 29, 2024

$760bn remains a horrific number for a single quarter.

–

Right now, most assume the Fed will cut rates May 1st.

> https://t.co/lgAMgdHr8k pic.twitter.com/Jz0Z1J2EGg

— Philip Calrissian (@Trading_Sunset) January 29, 2024

I agree, as rate cut’1 appears due at the THIRD FOMC of this year… May 1st.

–

Two days

Net higher for January by +158pts (3.3%) at 4927. 5K looks a given, and the 5400s – yours truly and Yardeni, look considerably less crazy than a few weeks ago.

–

I do like seeing such hypocrisy outed.

–

I reference the SECOND video…

They are still sour over this one. They want you to forget it happened. 😁 pic.twitter.com/2YAOE3DvPm

— Rapidsloth (@Rapidsloth_) January 28, 2024

Back in Nov’2015 the SNL crew thought nothing of bringing on Trump. It is the case they want such videos forgotten. A few in the comments have suggested Trump use it as a campaign ad.

Regardless… we’re another day closer to the election.

I hope we get one.

A fair one.

Goodnight from London