US equities remain in minor chop mode, if mostly leaning a little higher. Meanwhile, WTIC is currently -1.7% in the $76s. The energy sector ETF of XLE is currently net lower for the week by -1.0% at $83.37.

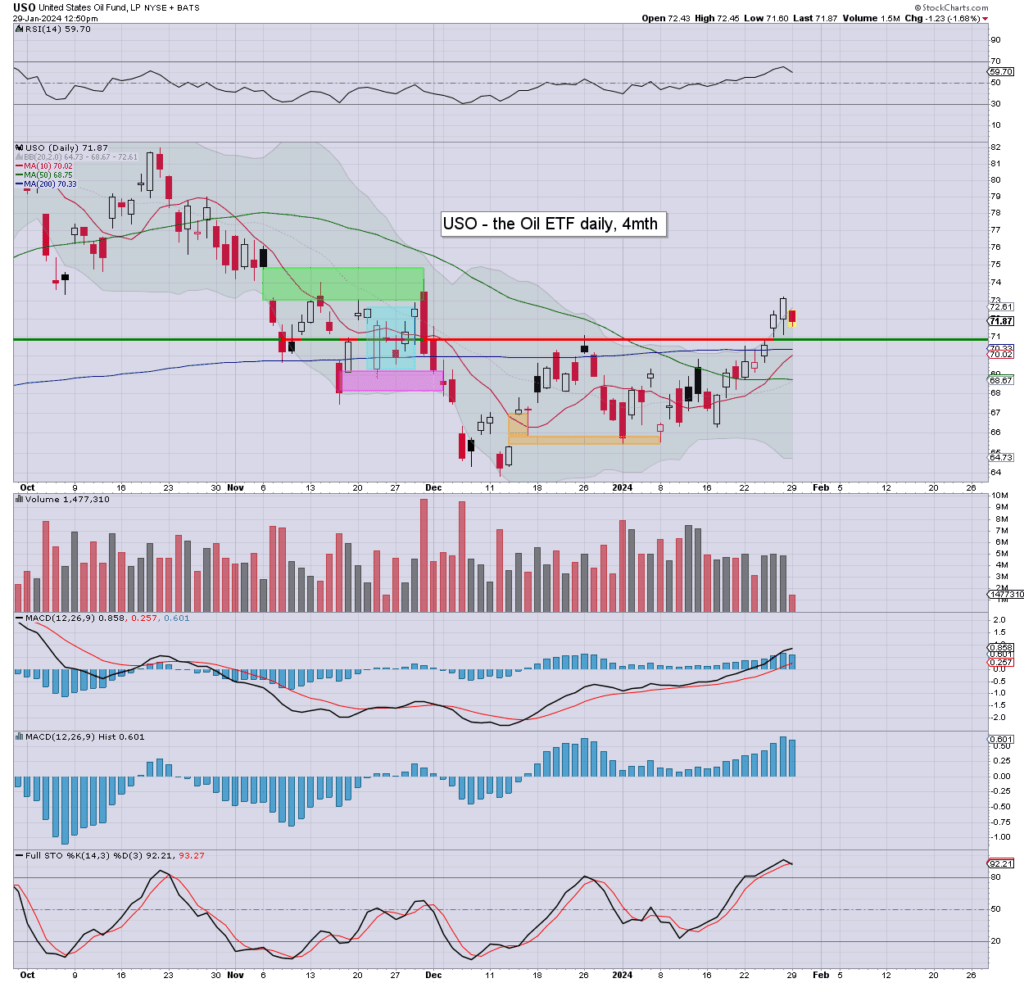

USO daily

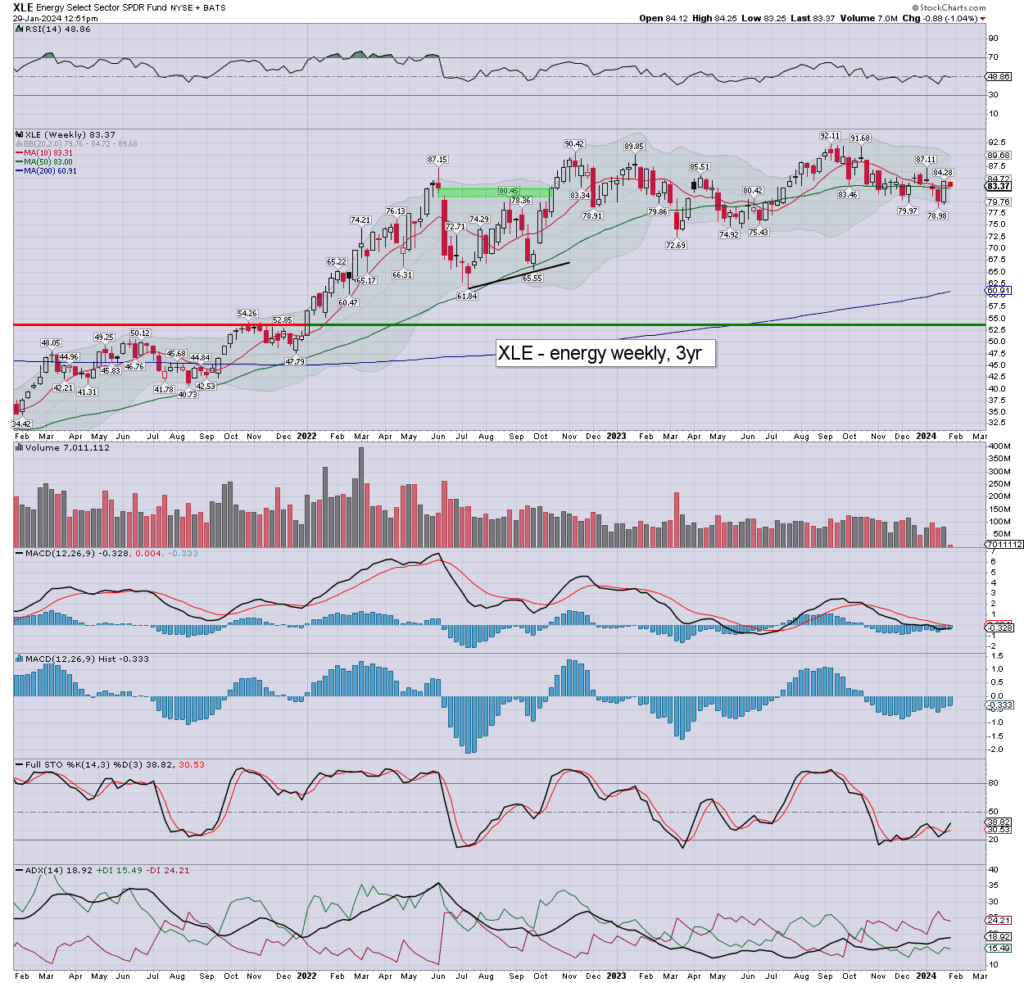

XLE weekly

Summary

WTIC/USO: oil printed an overnight high of $79.29, on the attack on US troops, but then cooled to $76.54… for no good reason, if partly pressured by the moderately stronger dollar. We’ve seen a recovery to the $77s. Oil bulls should be seeking a monthly close >$78, which would offer $85 or so in Feb’.

XLE: energy stocks are sig’ lower, not helped by WTIC $76s. Momentum prone to turning positive w/c Feb’12th.

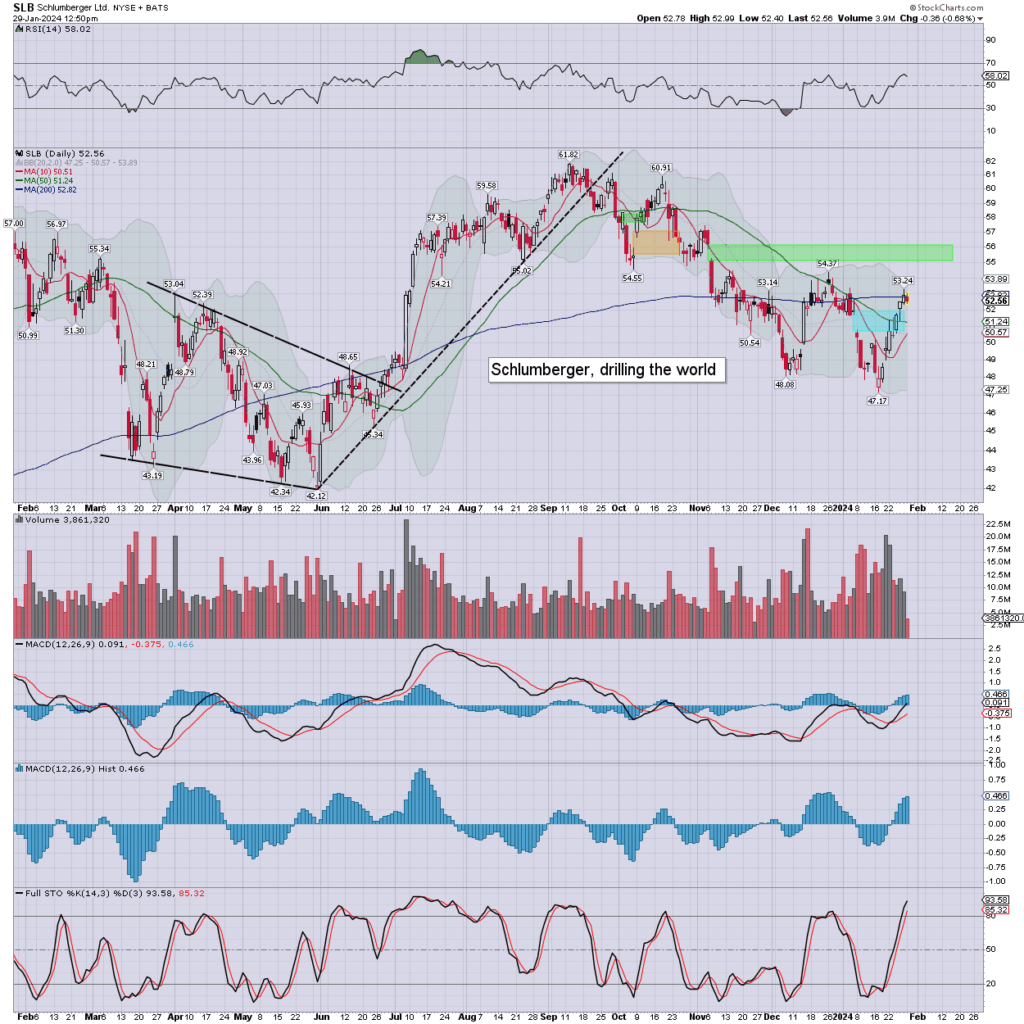

*I picked up SLB from $52.57, and I’d like the $54s this Wed’ afternoon.

notable stock: SLB

Right now, its my favourite energy stock, although I’d favour ET and KMI for a yield. I should own all three.

–

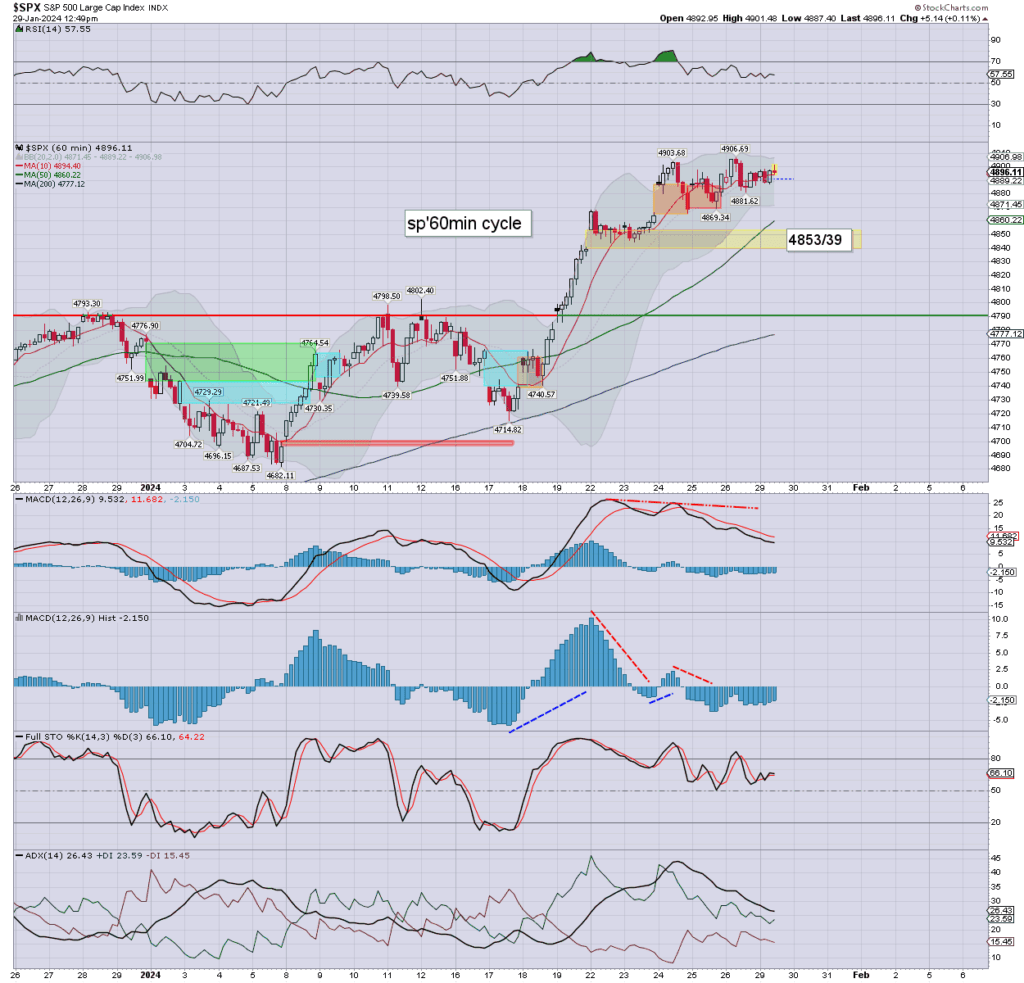

Equities: sp’60min

A new hist’ high is clearly viable this afternoon.

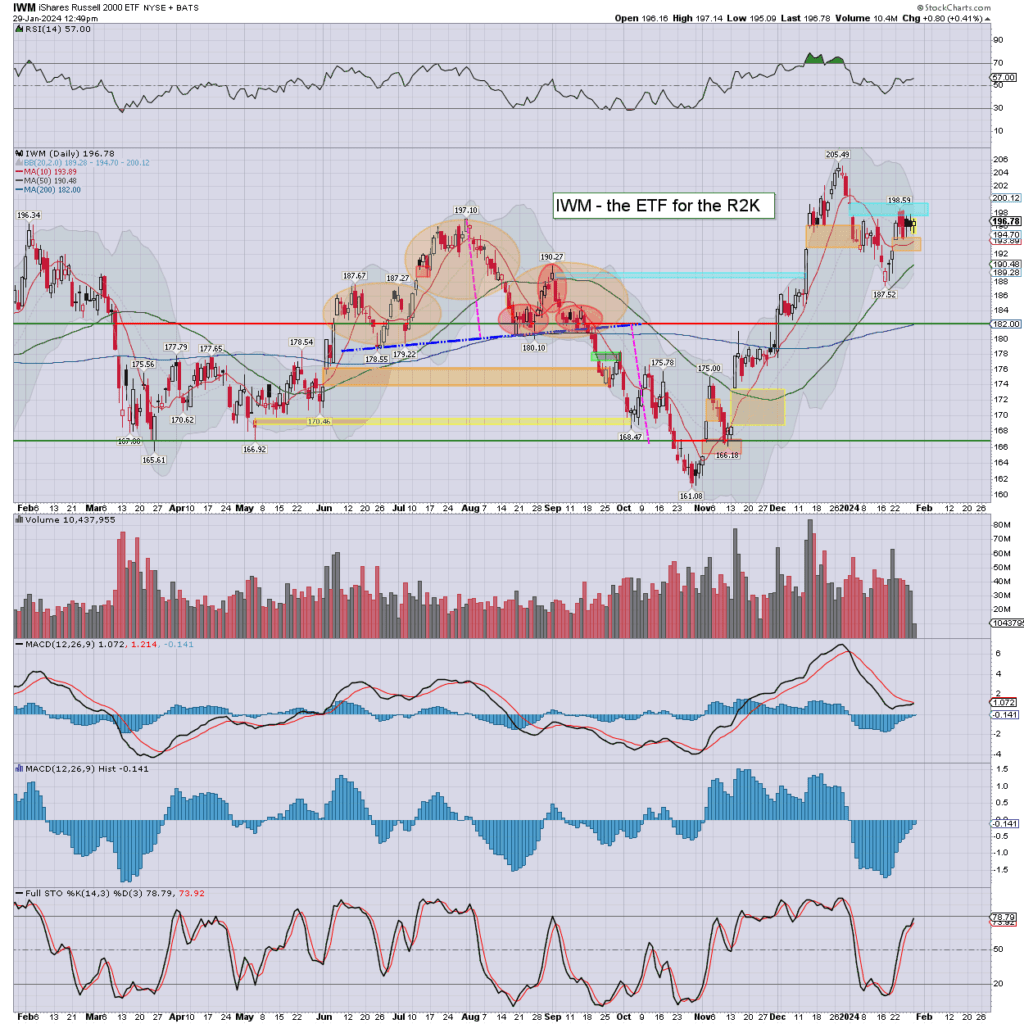

Special note… IWM, daily

The current candle is rather bullish. Structure is a bullish pennant.

Momentum due to turn positive, bodes positive for some days.