US equities begin the week in minor chop mode. WTIC has cooled to $76.62, for no particularly good reason. USD is +0.3% at 103.60.

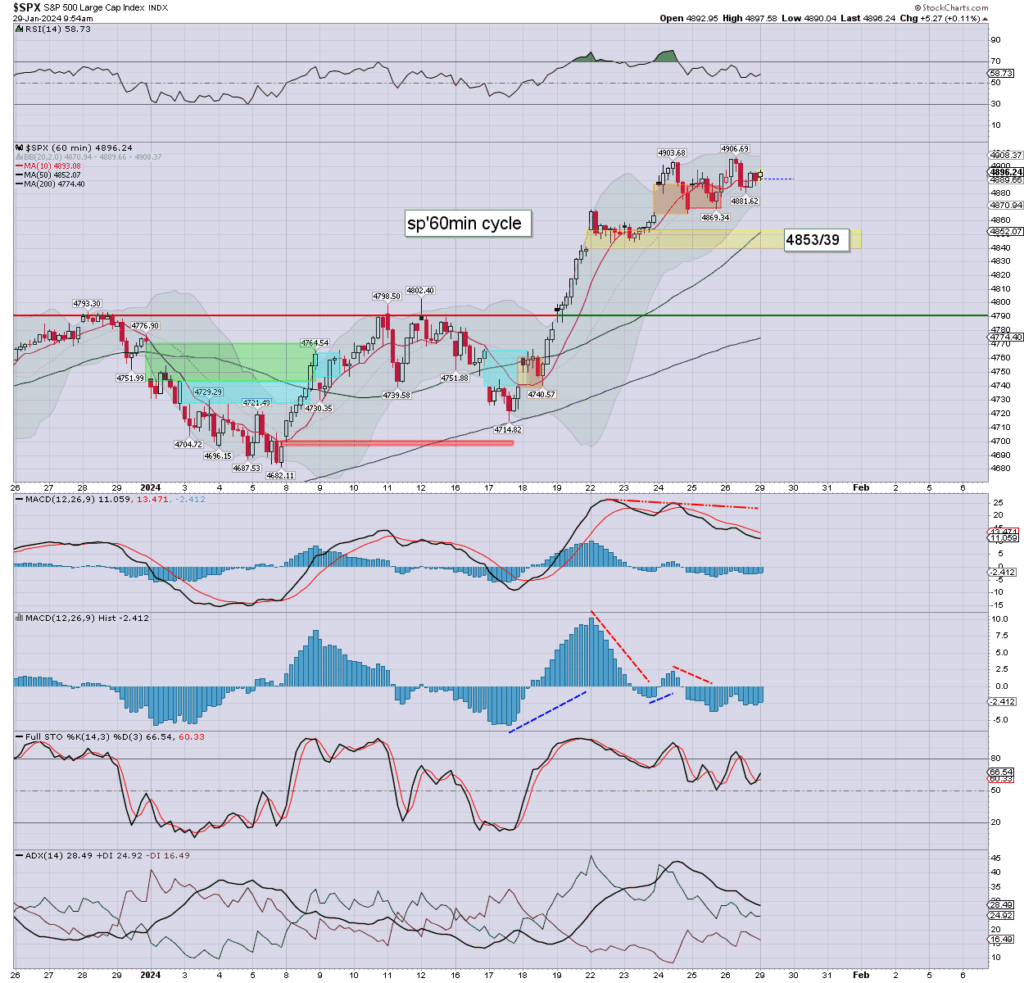

sp’60min

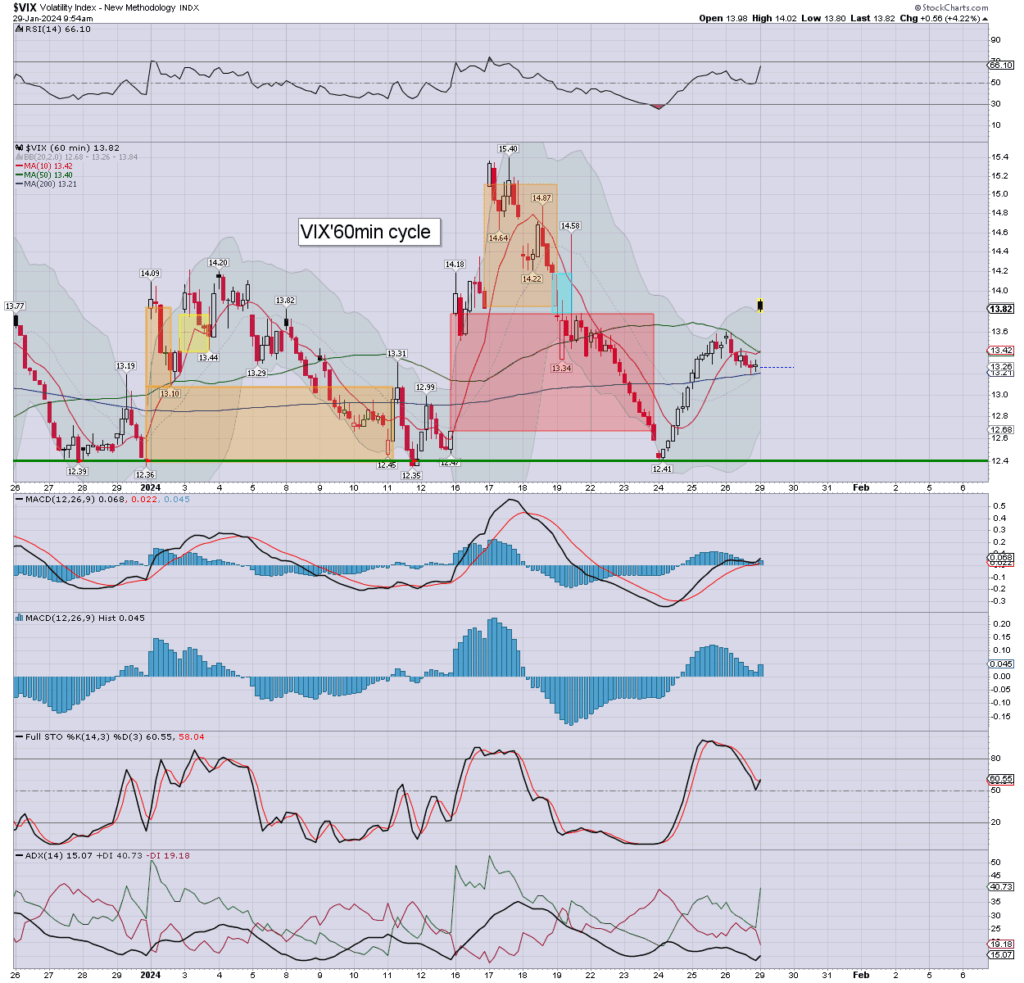

VIX’60min

Summary

The s/t cyclical setup favours the bulls, with the market inherently inclined to claw upward into Wed’ afternoon. I’d be open to the 4940/50s. Thursday. will offer ‘new money to work’, and so long as AAPL, AMZN, and META have ‘broadly fine’ earnings, the market should end the week net higher.

*yours truly has bought back AEM, and picked up SLB

–

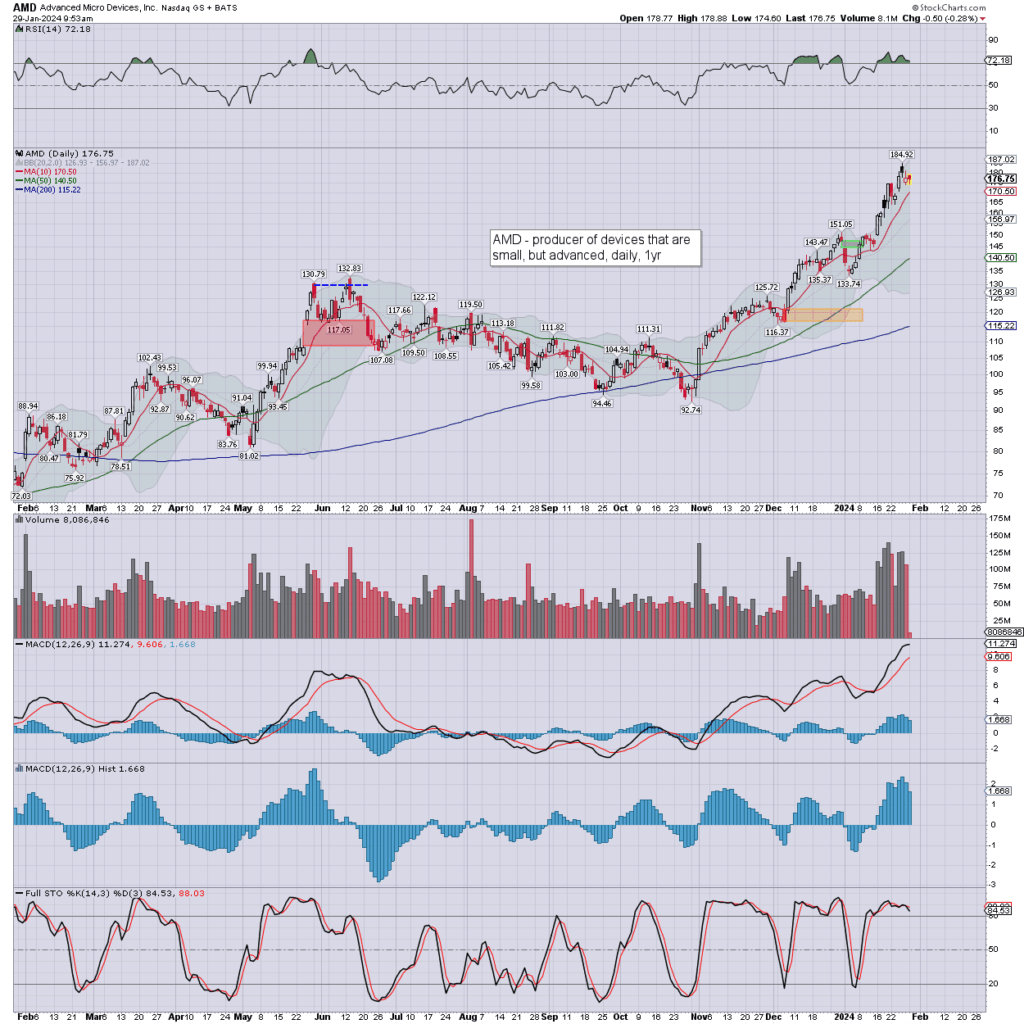

notable stock: AMD

Susquehanna 170>210, as an increasing number are resigned to >psy’$200.

–

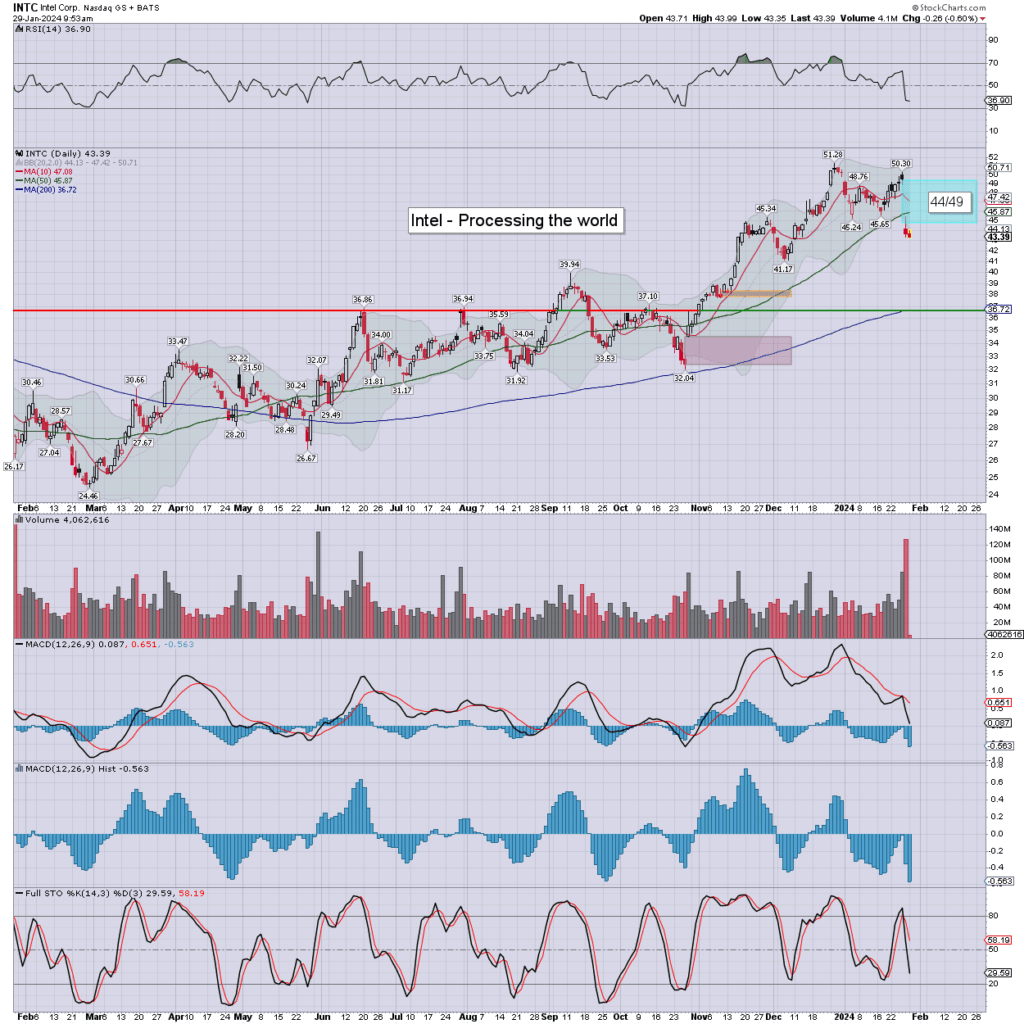

notable semicon: INTC

Vain attempt to dead cat bounce.

—

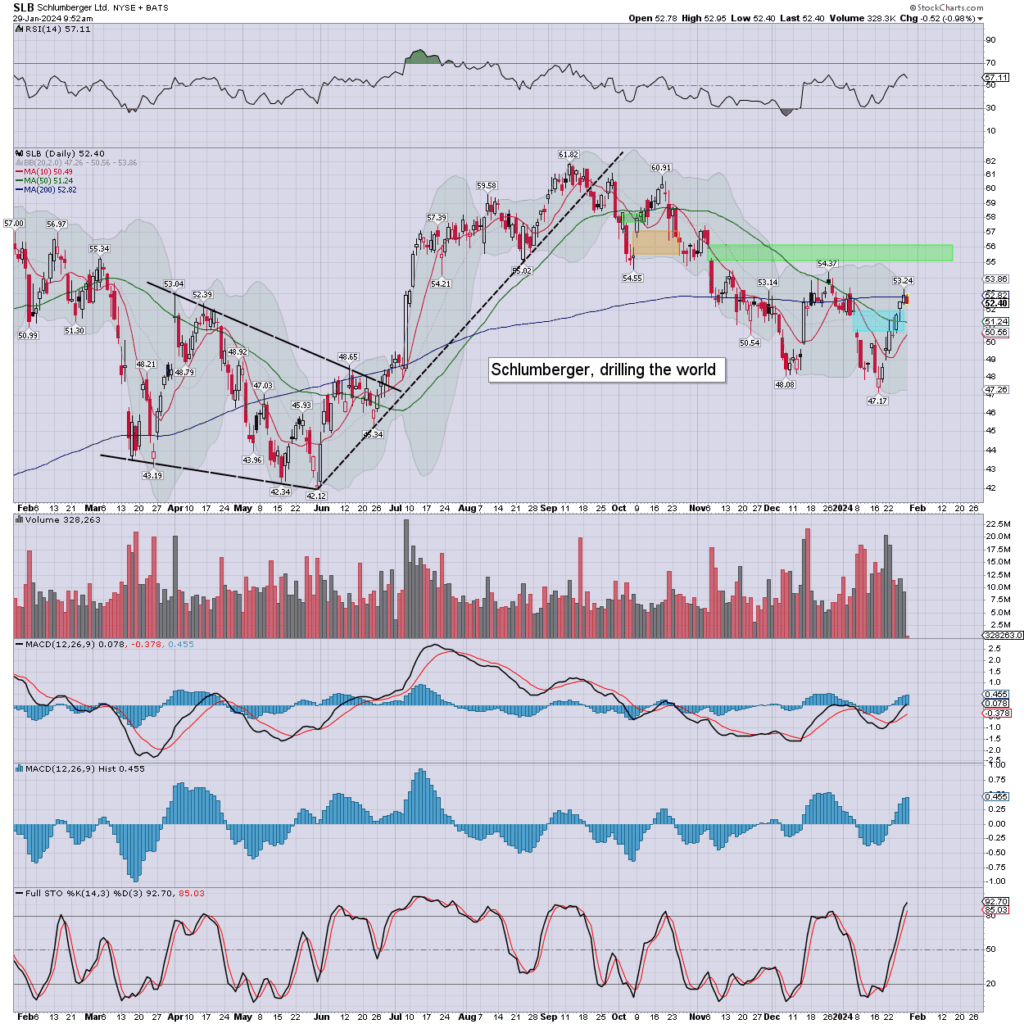

notable energy: SLB

I continue to see Schlumberger as a prime energy stock, which is outperforming sister OXY. I just bought from $52.57, and I’ll sleep fine with this leading oil/gas driller.

—

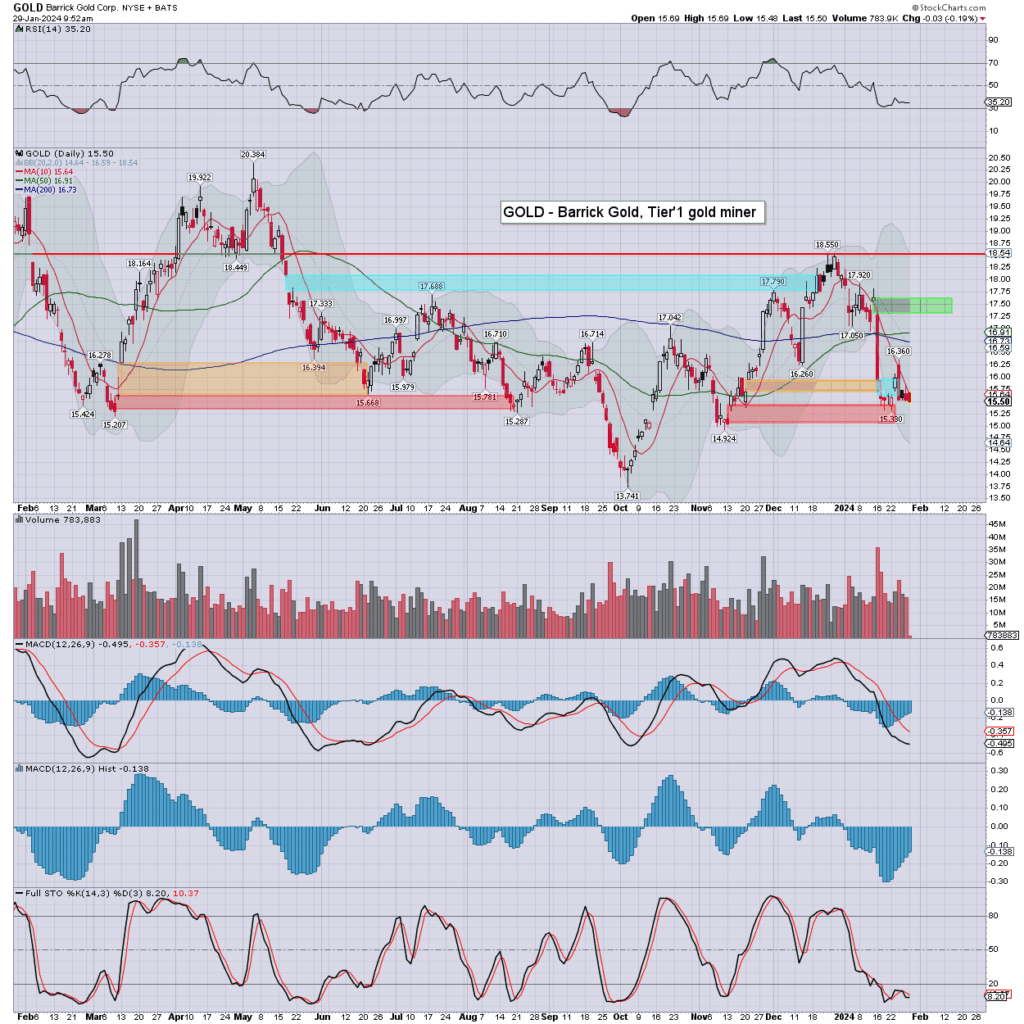

notable miner: GOLD

Barrick seeing early gains fade, with gold cooling from $2037 to $2018.

Cyclically low, and the bold will be buying/adding. I already hold, and instead picked up sister AEM.