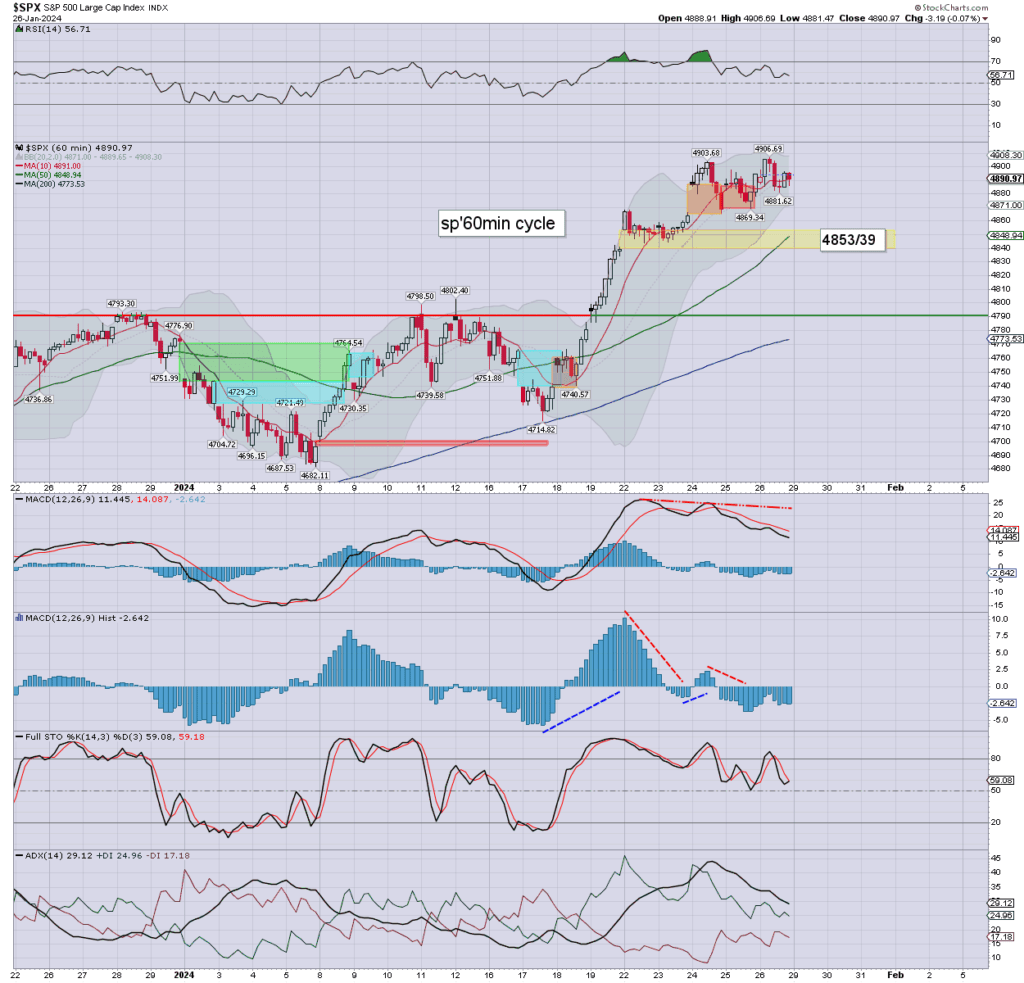

US equity indexes closed a little mixed, SPX -3pts (0.1%) at 4890. Nasdaq comp’ -0.4%. Dow +0.2%. The Transports settled -0.3%. R2K +0.01%

sp’60min

Summary

closing hour action: micro chop, leaning a touch weak. S/t momentum settled on the moderately low side.

–

… and that concludes a Friday. With a new historic high of 4906, it was a net bullish day to a net bullish week.

Typically, the market will be inclined to lean upward ahead of an FOMC. If Monday does see early weakness (for whatever reason), it’d be a valid buying opp’.

–

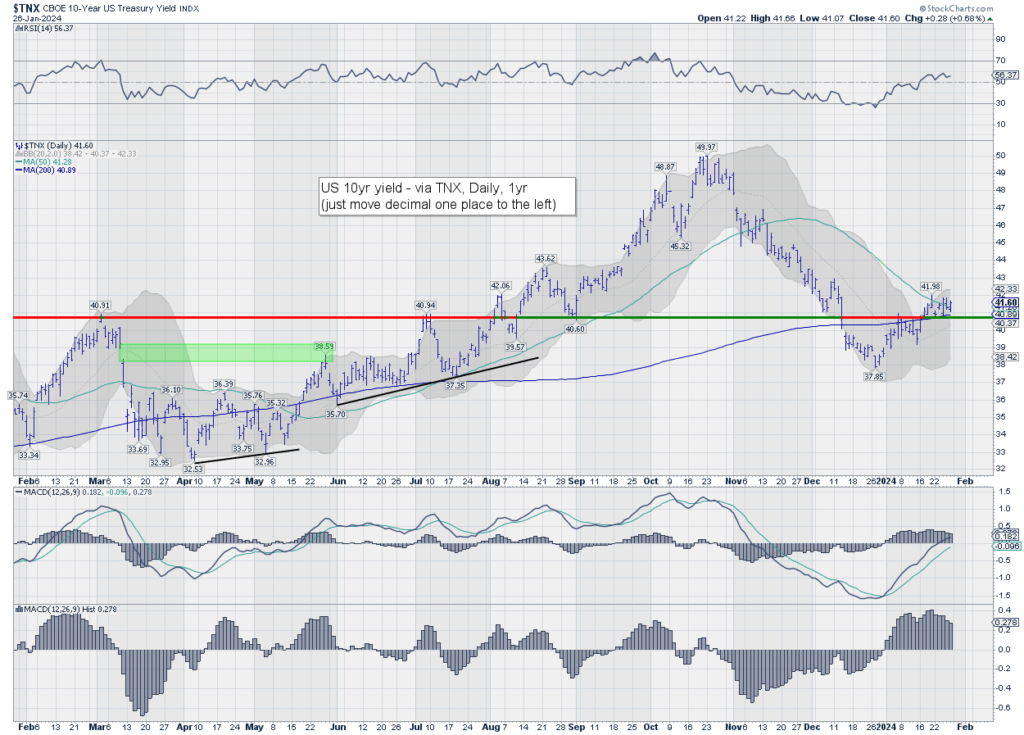

notable bond yield proxy: TNX

Yields net higher, but remaining under the recent high of 4.198%

Structure offers an ABC multi-week bounce, and still threatens another wave lower to around 3.25%. To be clear, I am VERY much open to a subsequent secondary wave higher to break a new cycle high >5.00%, as Bianco, Schiff, and a few others are suggesting.

–

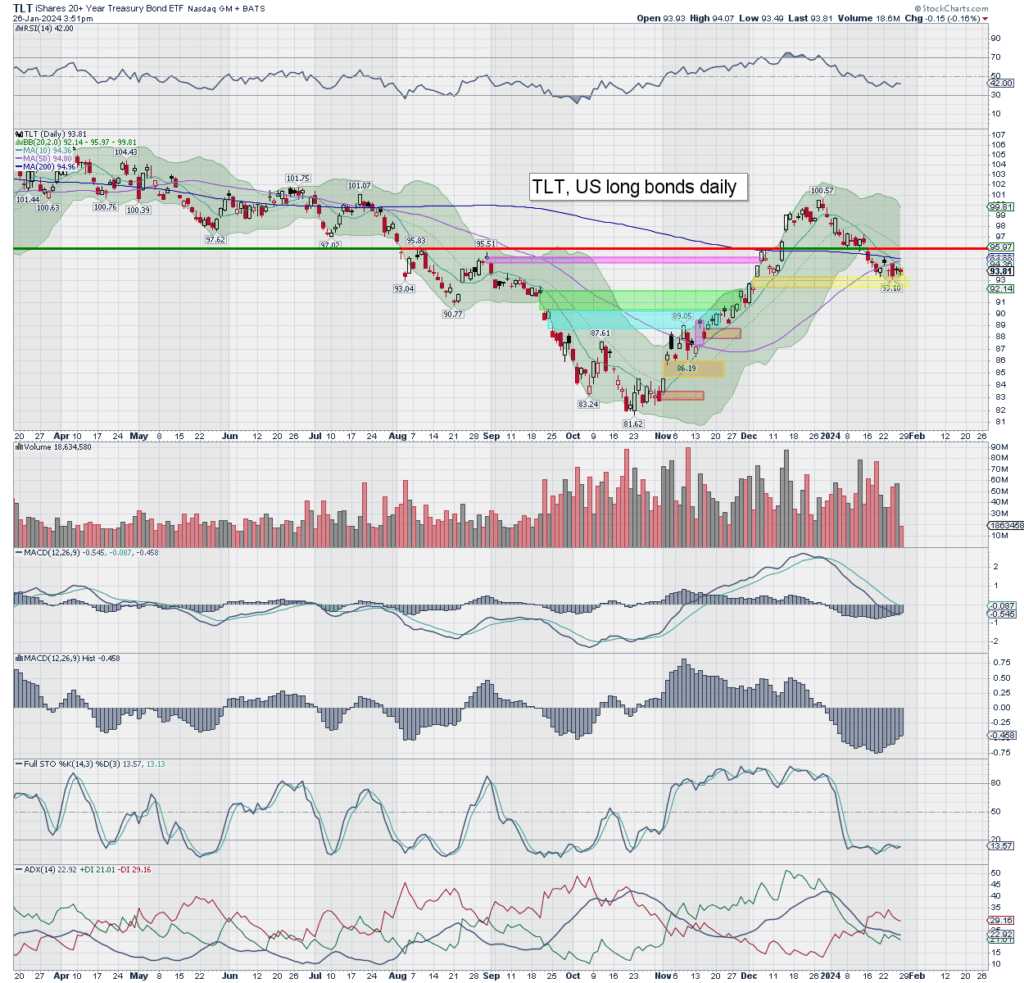

notable bond ETF: TLT

The US 10yr bond… net lower, if holding above the Wednesday low.

I would favour almost ANY US-listed stock above a Govt’ bond.

–

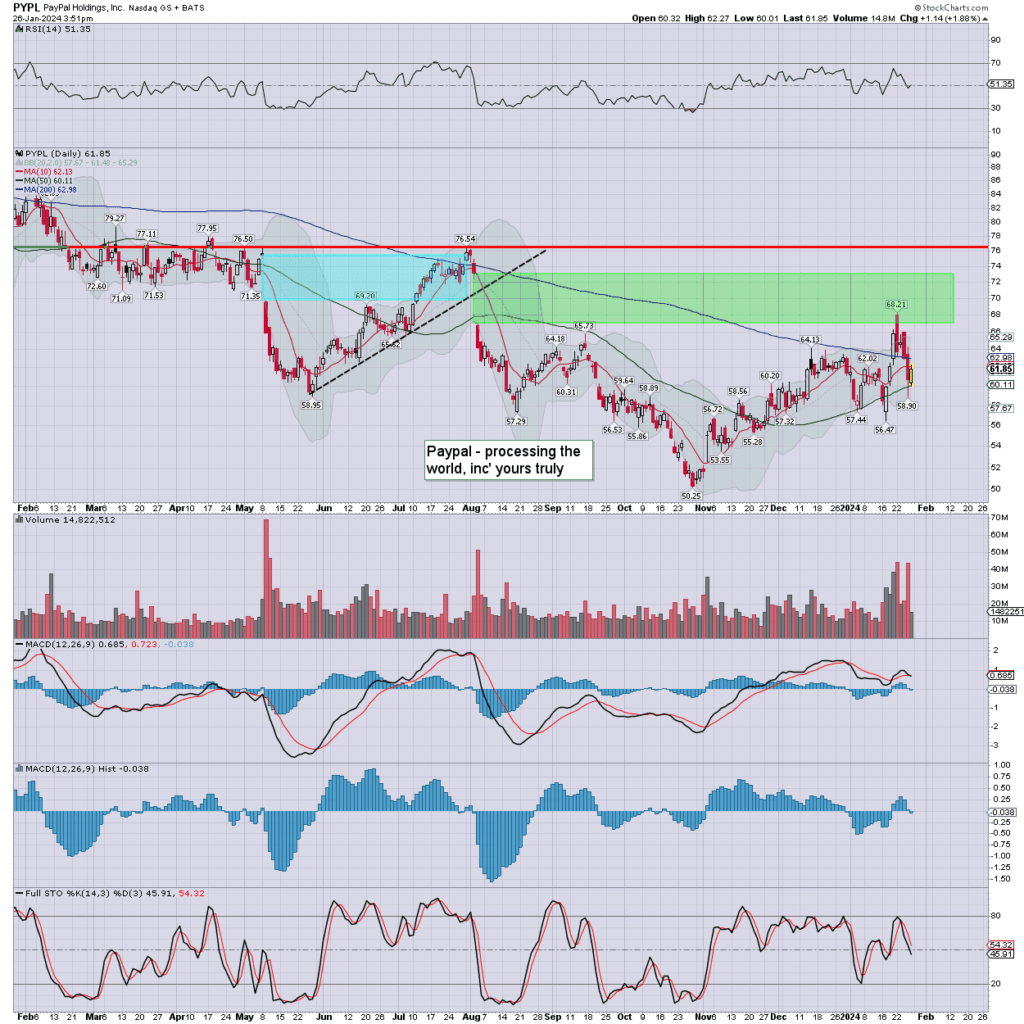

notable stock: PYPL

Some buyers from around the 50dma. I still see X Payments as a Paypal killer. For now, Mr Market doesn’t appear to be thinking about it.

–

… around 11am ET/4pm GMT. A fine winter’s day.

Have a good evening

–

more later on the VIX and Indexes by 6pm EST