US equities are choppy… and broadly flat. Meanwhile, the precious metals are fractionally mixed, Gold +$1, with Silver -0.1%. The miner ETF of GDX is currently -0.1% at $29.74.

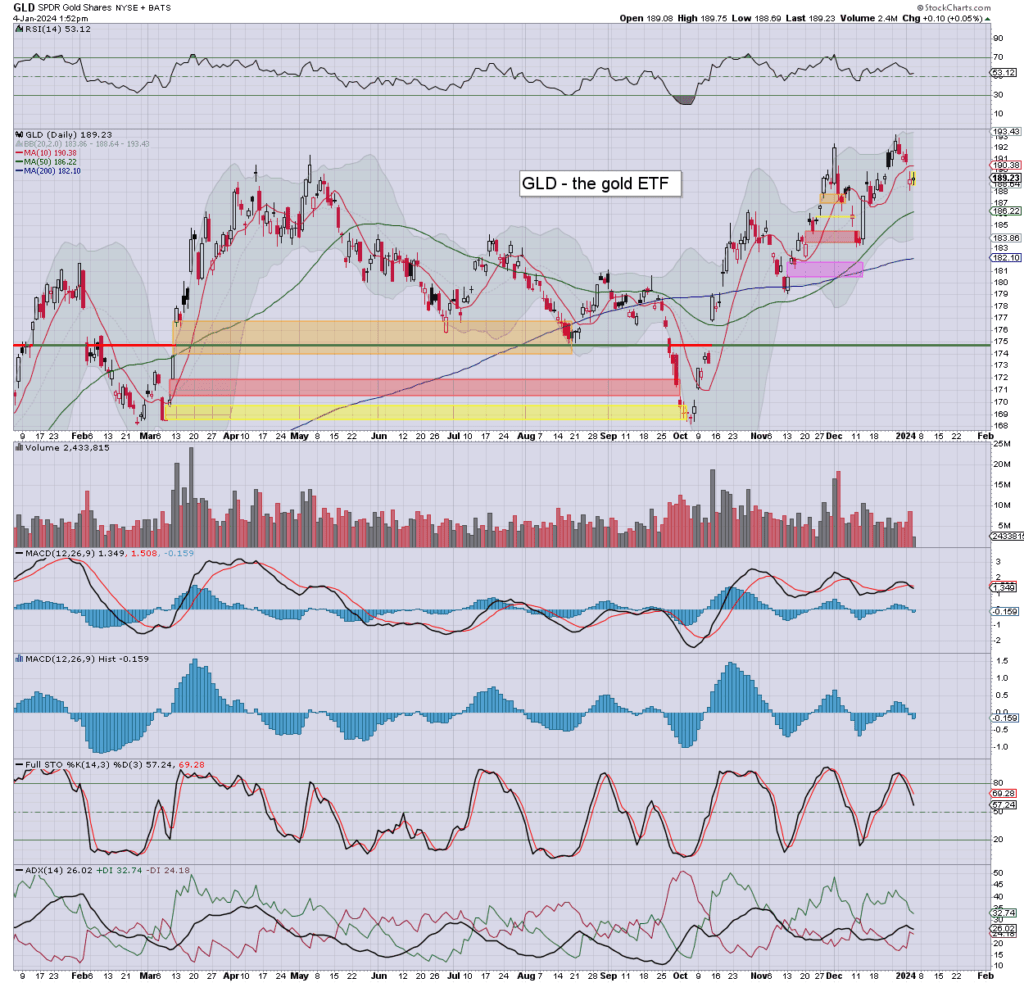

GLD daily

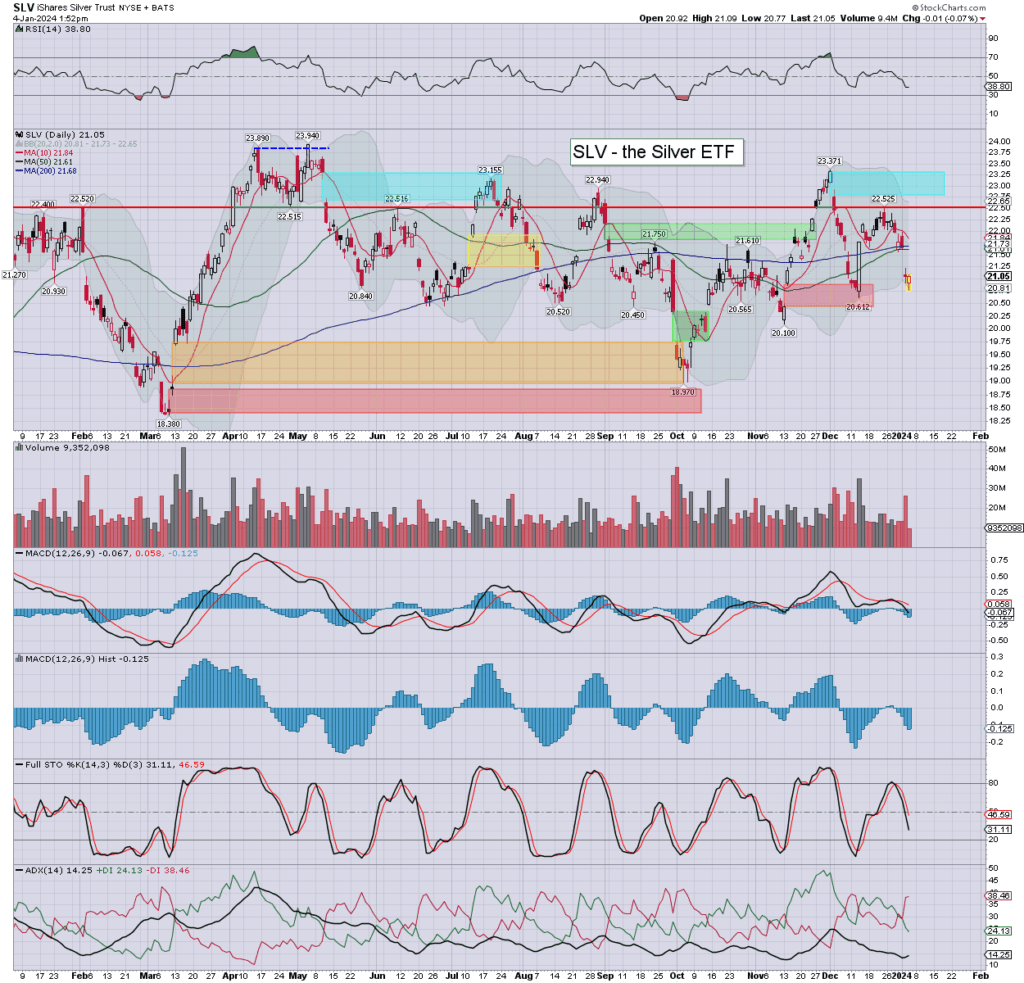

SLV daily

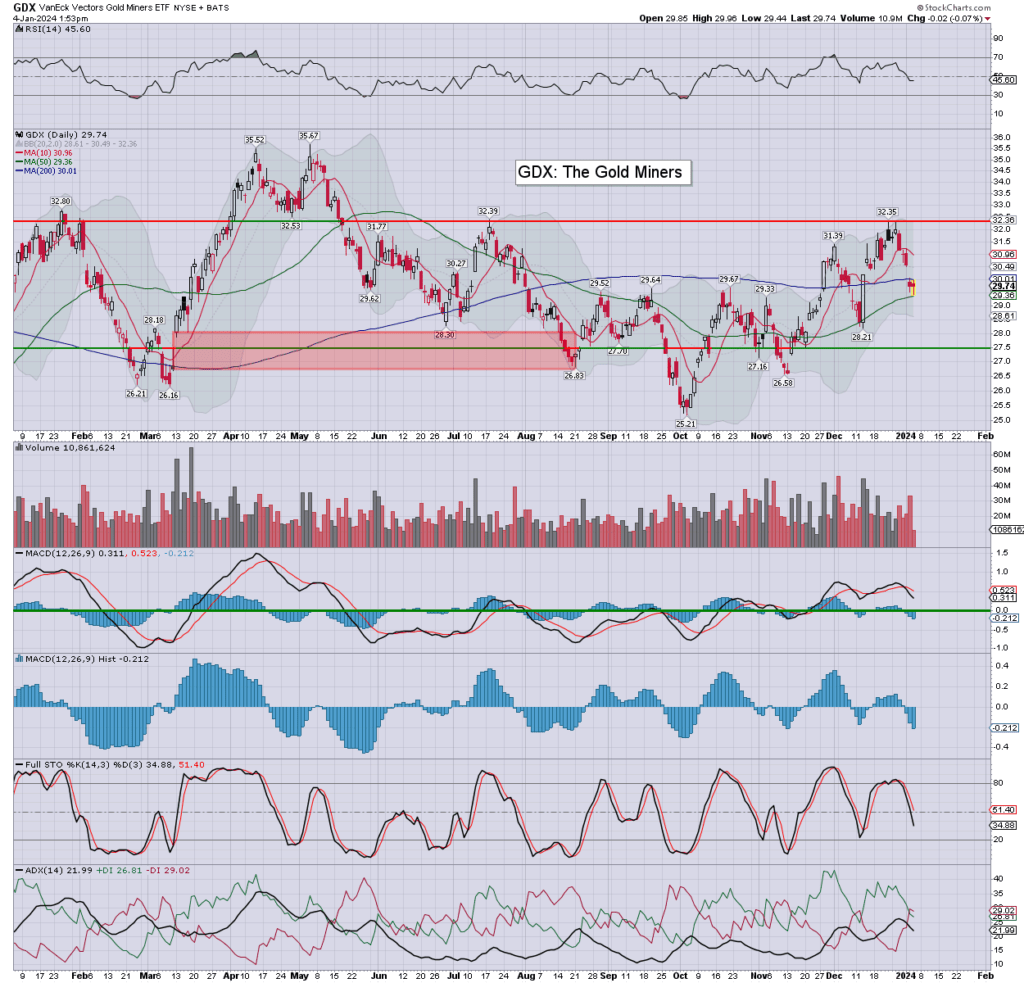

GDX daily

Summary

Gold/GLD: gold has seen a few swings… 2044, 58′, and currently around $2050. Clearly, the $2100s are out of range this side of the weekend. Maybe next week with the CPI/PPI ahead of the THIRD long weekend.

Silver/SLV: silver printed $22.88, if recovering into the low $23s. I can understand those buying physical at these prices. For the digital traders, I still see gold as superior until silver is >$30.00.

GDX: miners saw early sig’ weakness, but all saw an upside reversal, with a fair number set for a net gains.

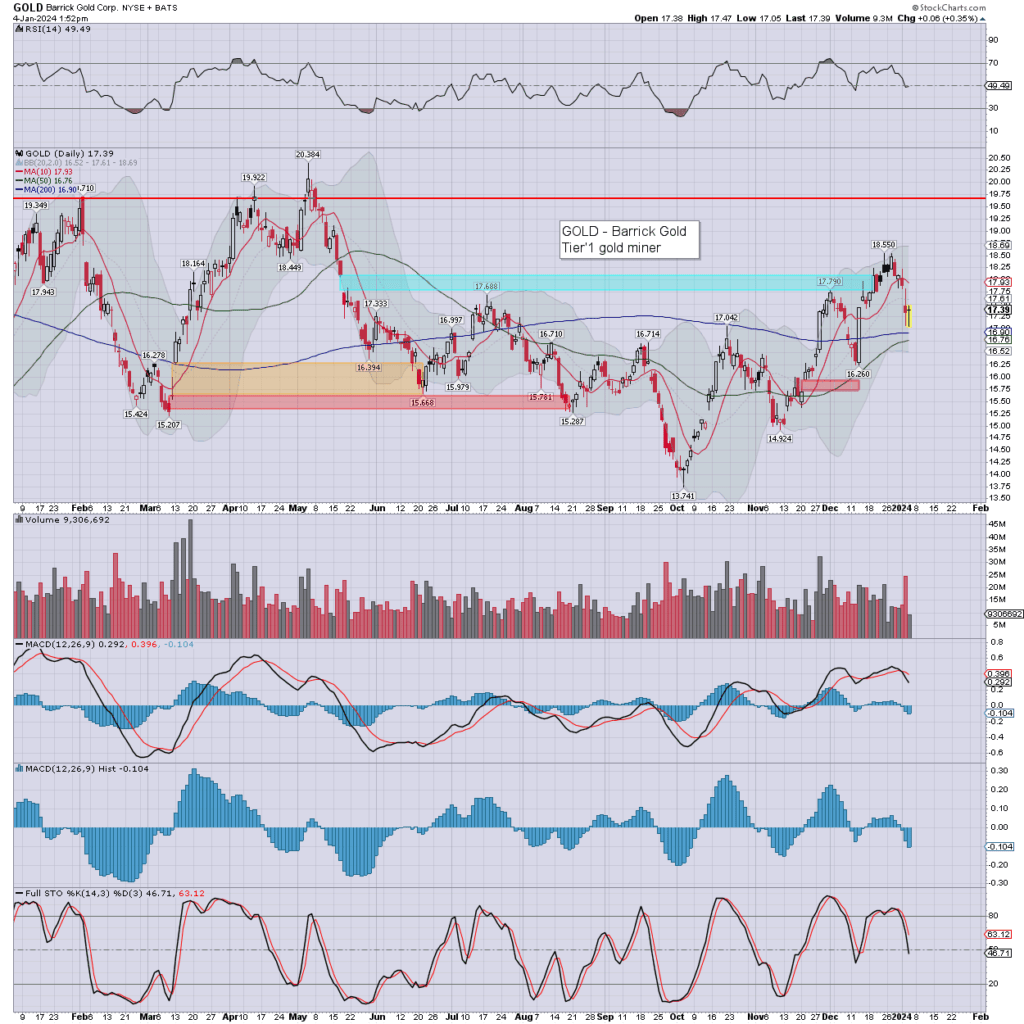

*I sleep just fine with NEM, GOLD, AG.

notable miner: GOLD

Today’s candle is spiky on the lower side, and leans s/t bullish.

–

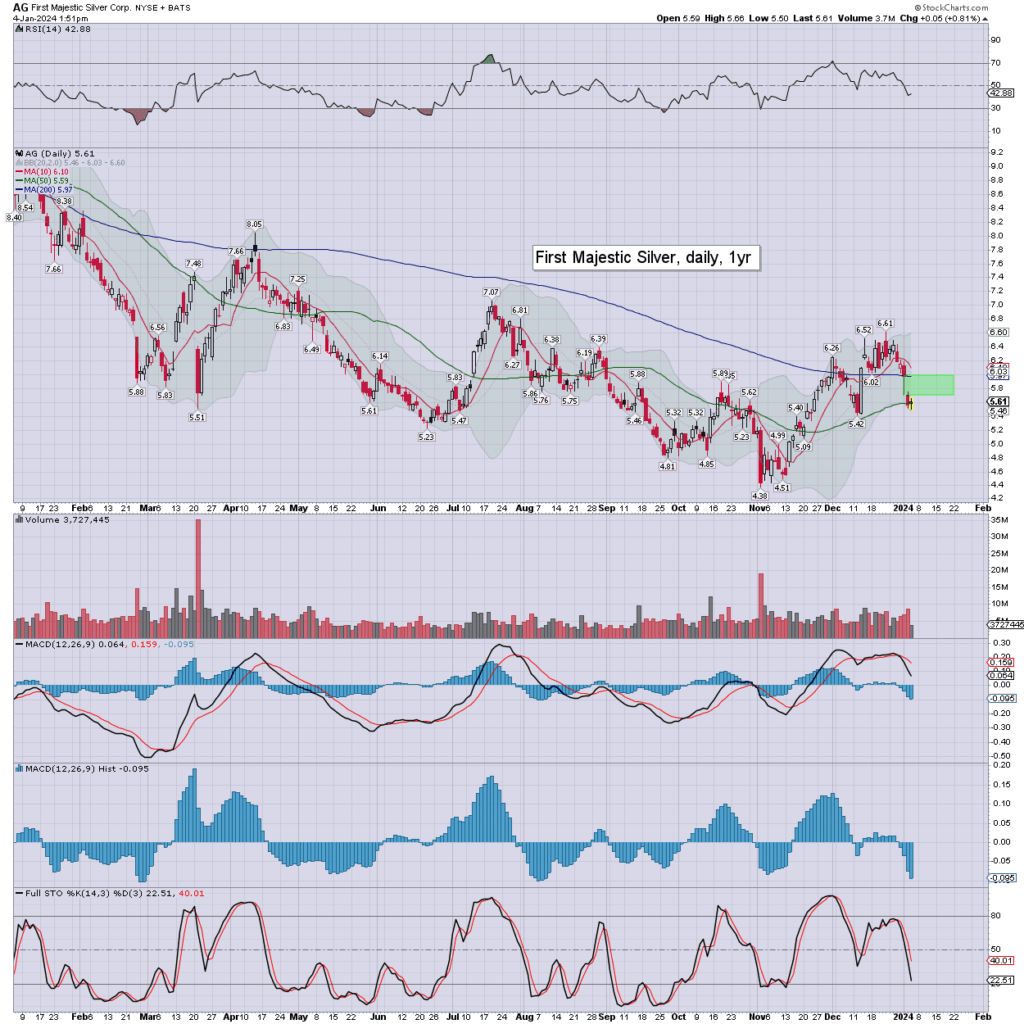

notable silver miner: AG

Trying to build a floor from around the 50dma.

The more cautious will favour the gold miners.

–

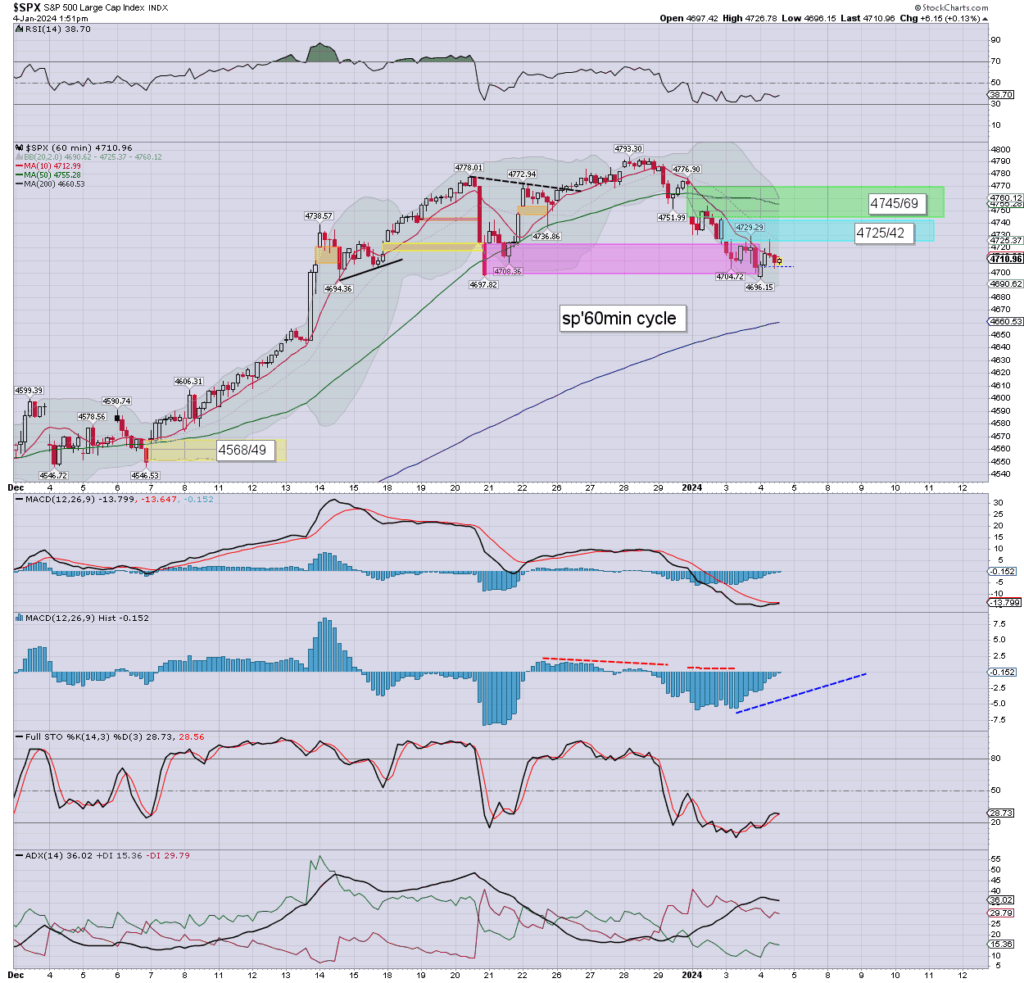

Equities: sp’60min

Chop chop… chop, as the s/t cyclical setup still favours the bulls.

Friday’s monthly jobs data should give the market the excuse to move.