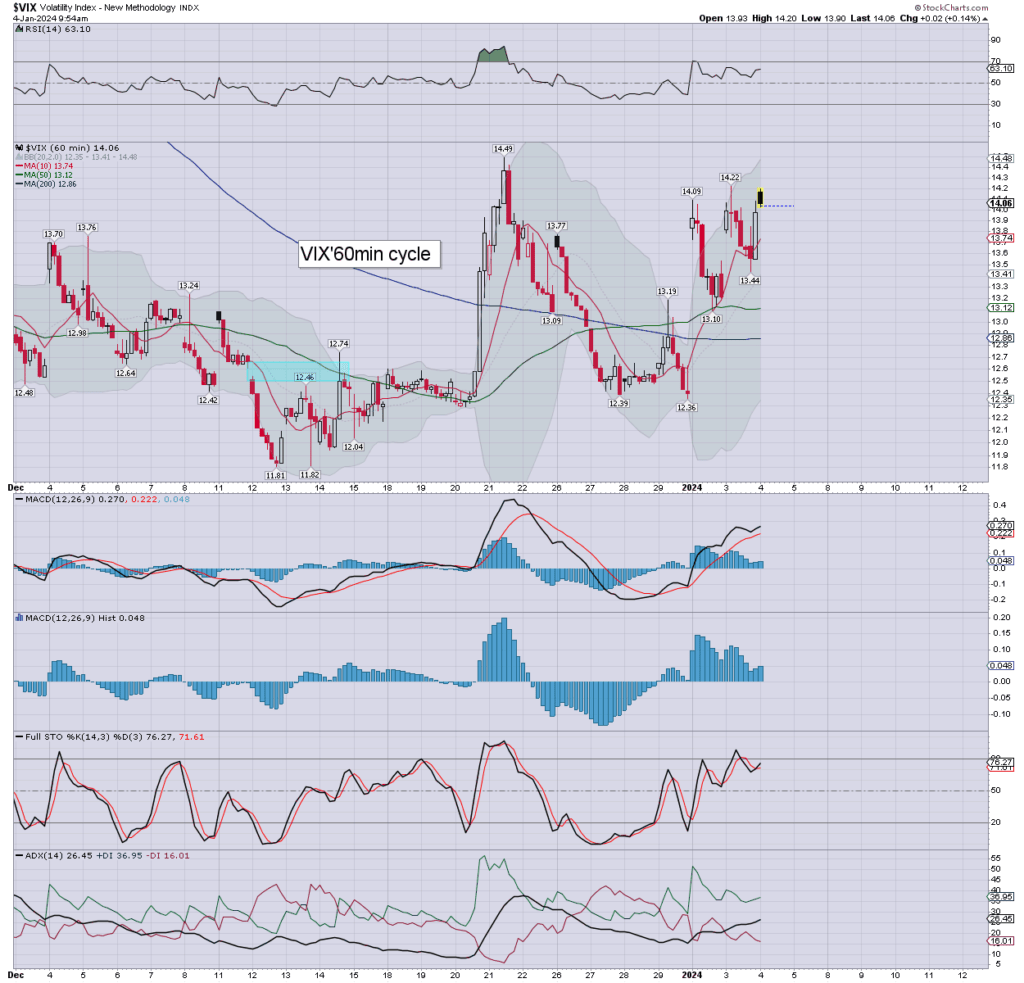

US equities open in minor chop mode. VIX is offering the equity bears nothing. USD is churning flat in the 102s. US 10yr has pushed to 4.00% again.

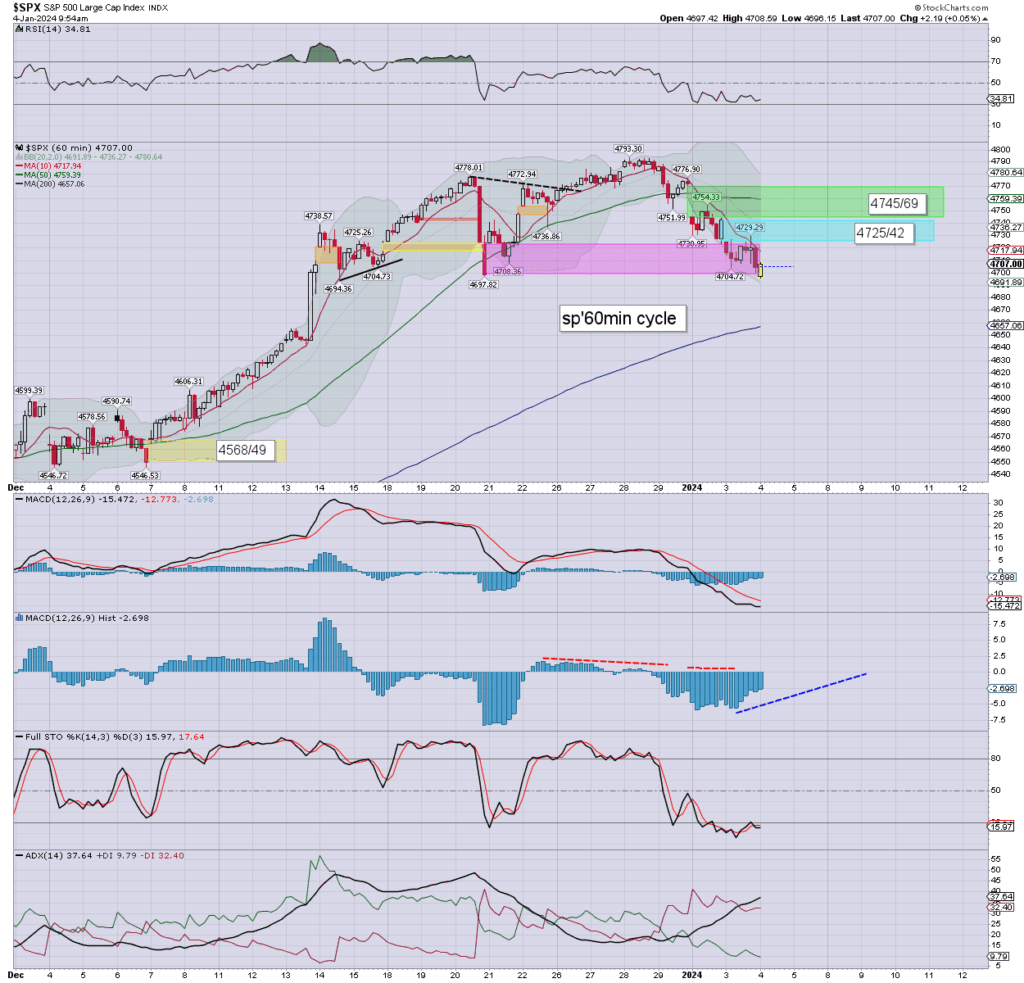

sp’60min

VIX’60min

Summary

ADP jobs: 164k vs 101k (prior revised).

Better than expected, and arguably Goldilocks for the equity bulls.

Purple gap fully filled.

The s/t cyclical setup favours the bulls.

Whilst ADP jobs hasn’t moved the market, there is always tomorrow with the BLS data.

–

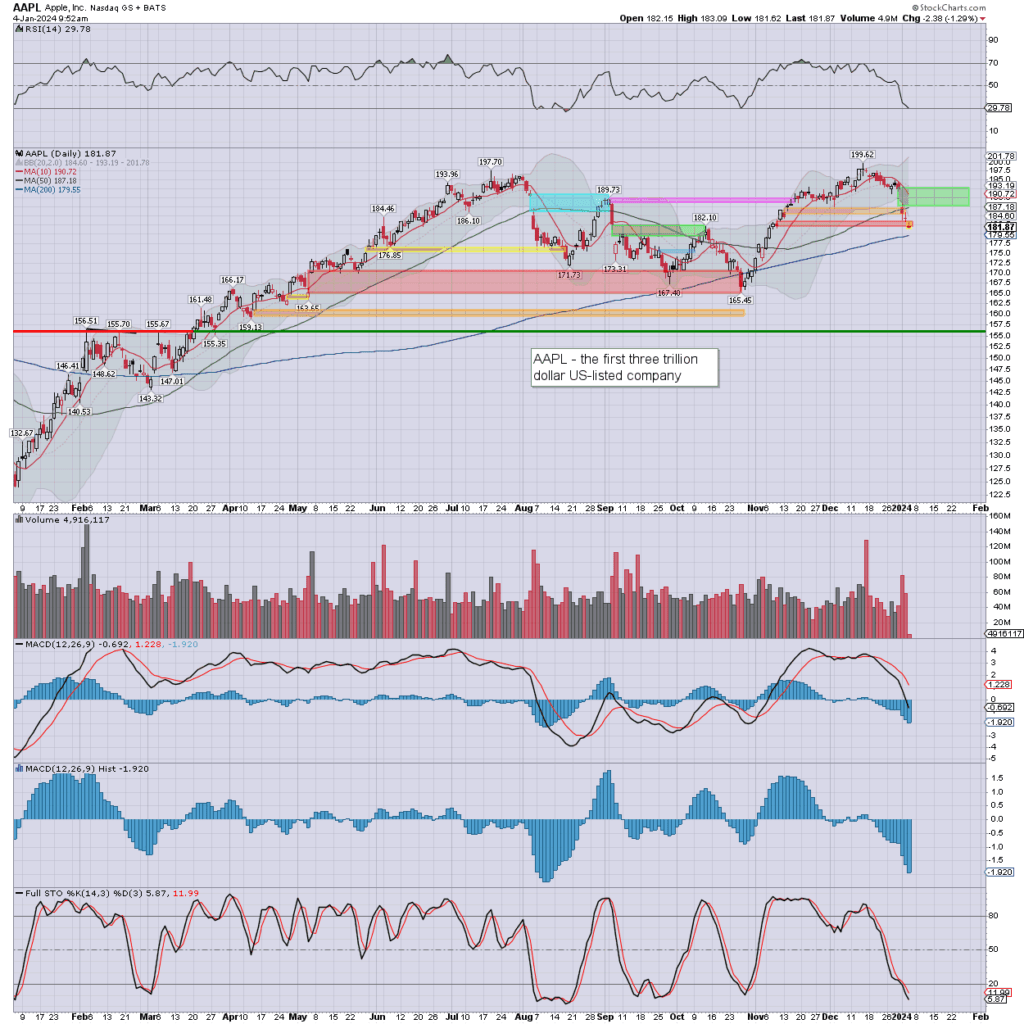

notable stock: AAPL

Piper Sandler, overweight>neutral, 220>205

Cyclically VERY low… and near the 200dma, where the buyers should appear.

–

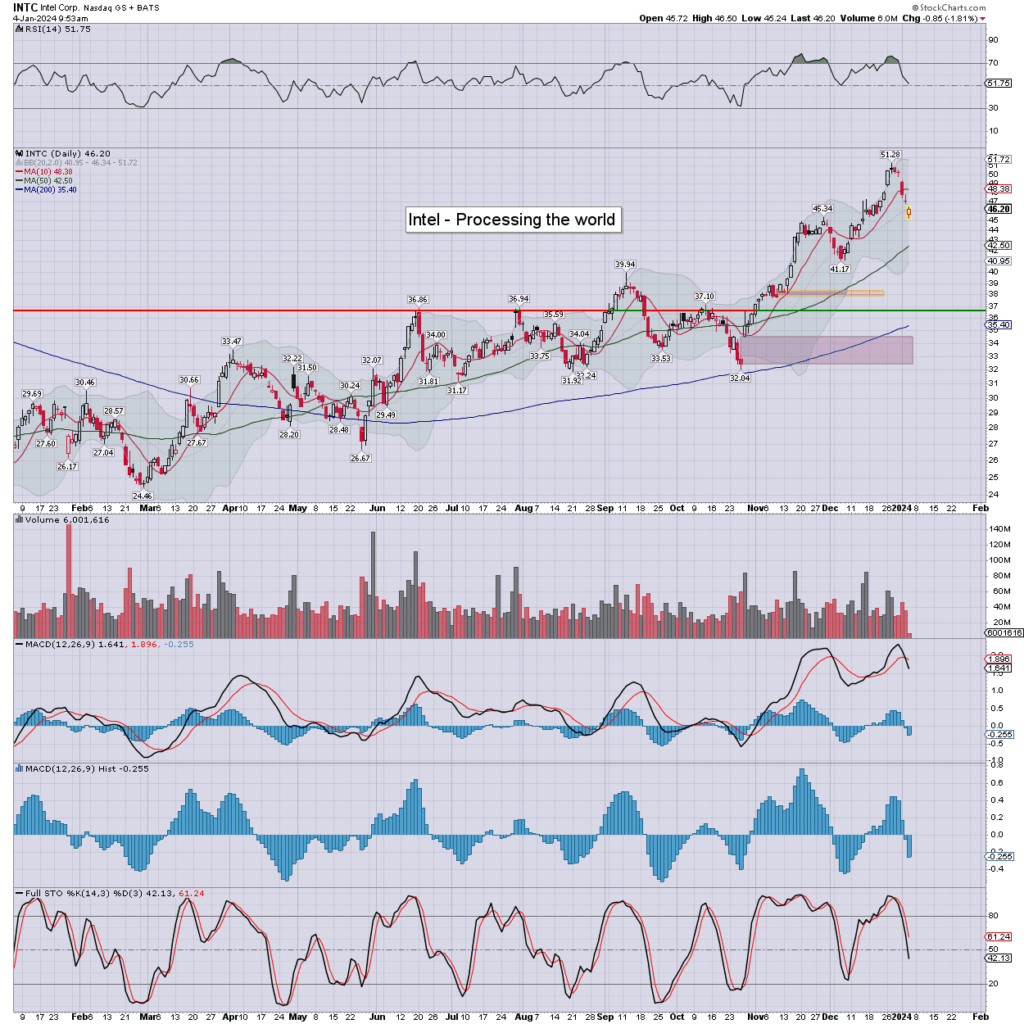

notable weakness: INTC

Market annoyed with lowered guidance from Intel’s ‘Mobileye’ division.

Opening candle is a reversal.

—

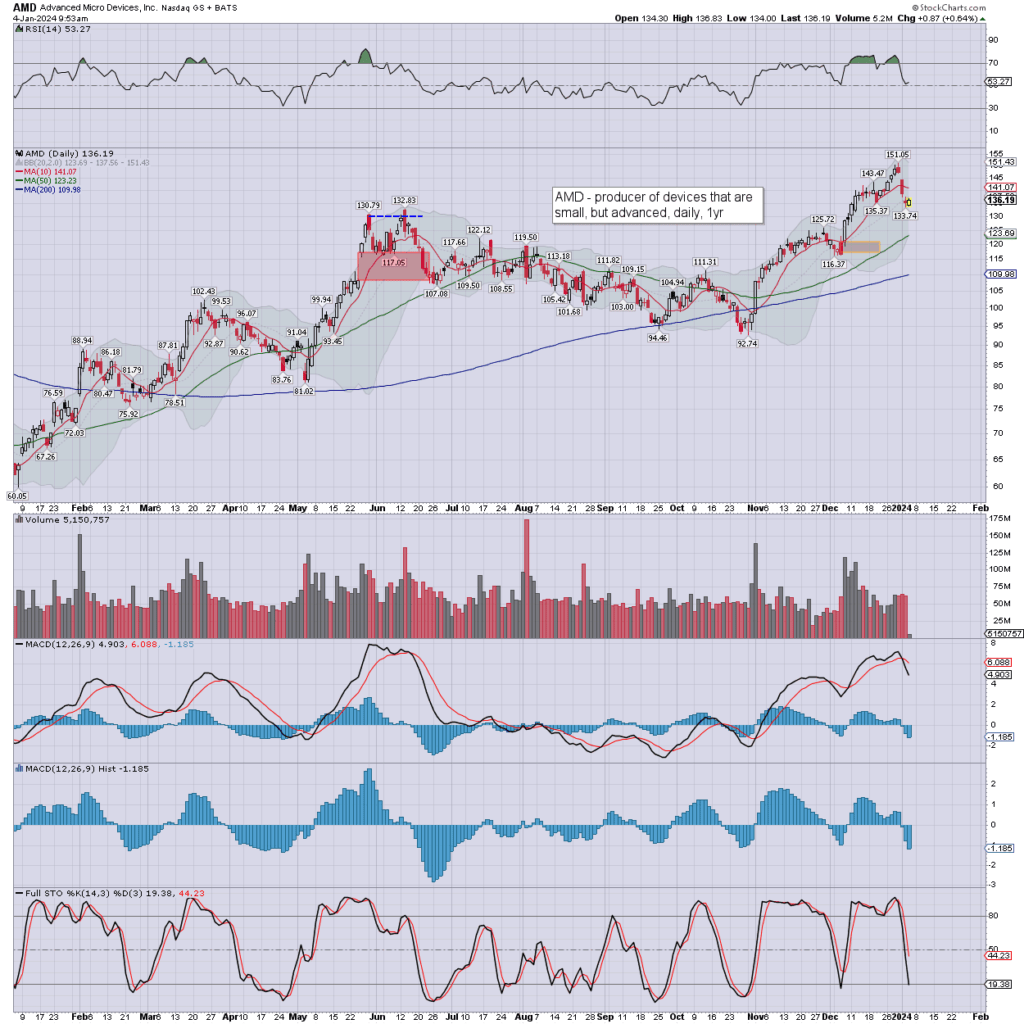

notable semicon: AMD

Early weakness (pressured by Intel), but swinging upward.

Bernstein 100>120, Piper Sandler 150>165

—

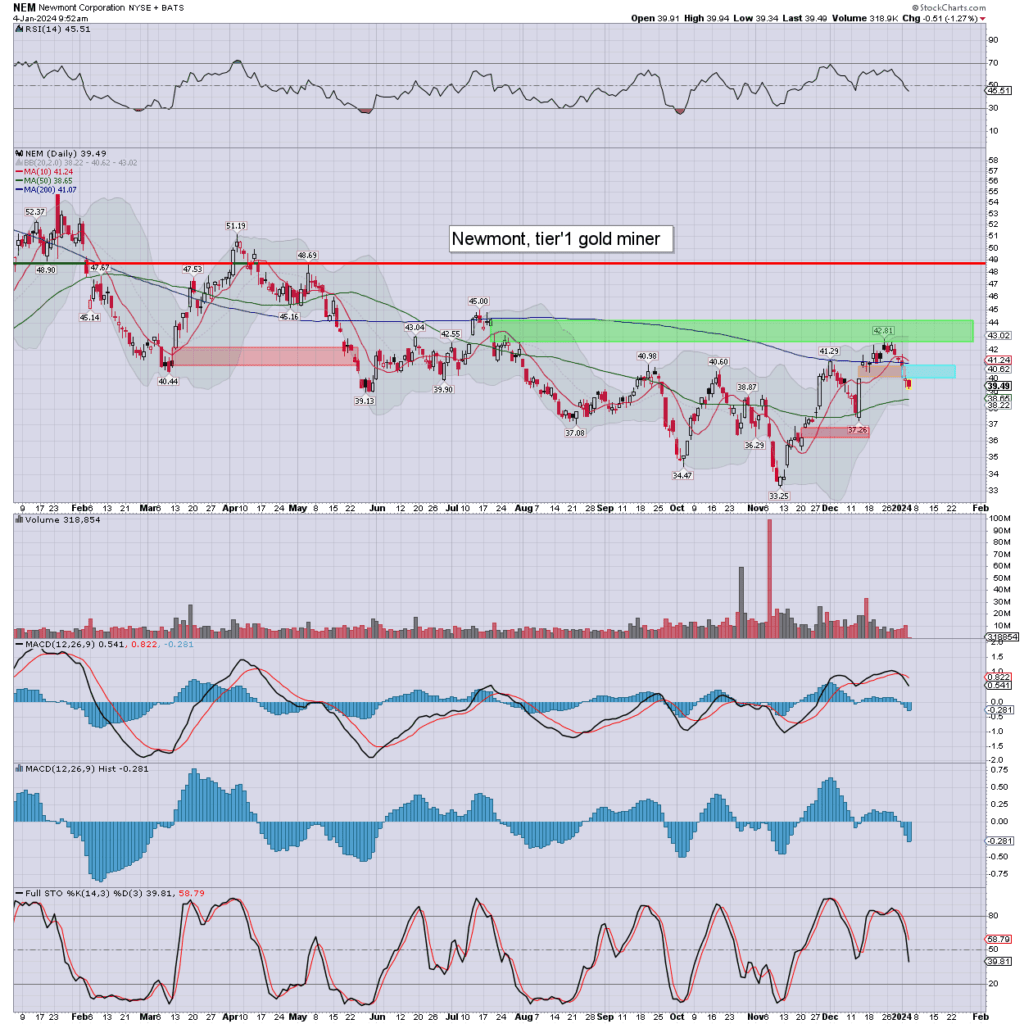

notable miner: NEM

Yesterday’s candle was a hollow red reversal, and whilst we’re currently sig’ lower, a lot can happen in six hours. More broadly, the miners need Gold to break and HOLD >$2100.