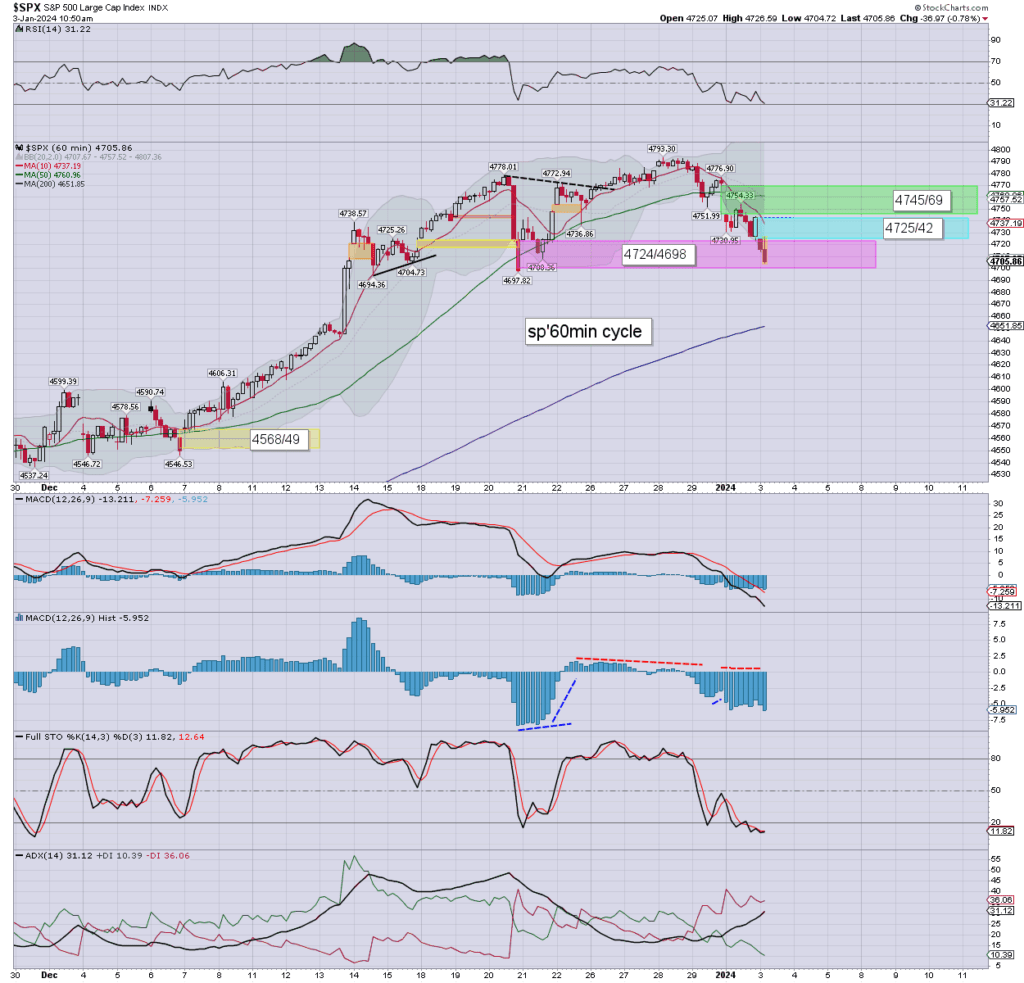

US equities are choppy, if still leaning on the weaker side. As is typically the case, the Nasdaq is leading the way down. WTIC has rebounded from the $69s to $72s. USD +0.4% at 102.28. US 10yr 3.99%

sp’60min

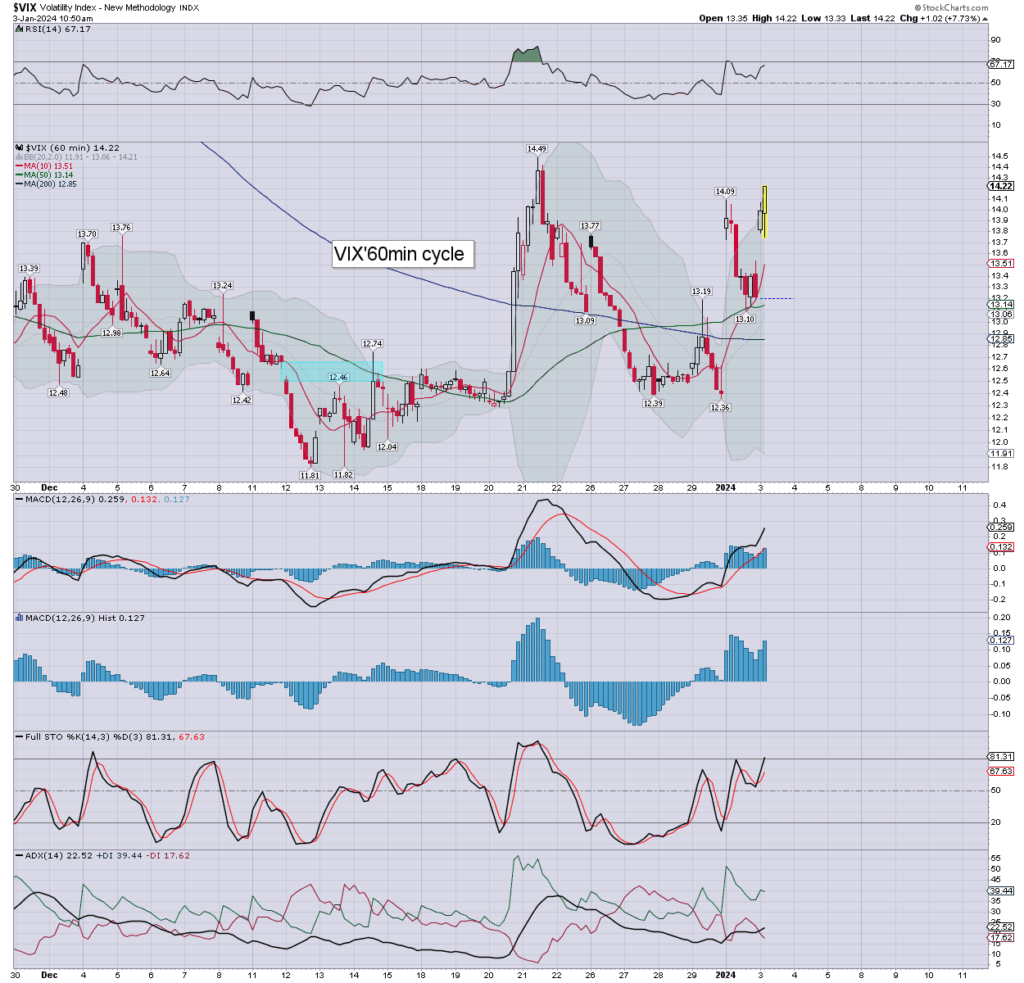

VIX’60min

Summary

It shall ironically remain the case, the ADP jobs (Thurs’), and BLS jobs (Fri’)… if they come in bad, would be the excuse to end the week on a positive note. On any basis, we’re s/t oversold.

–

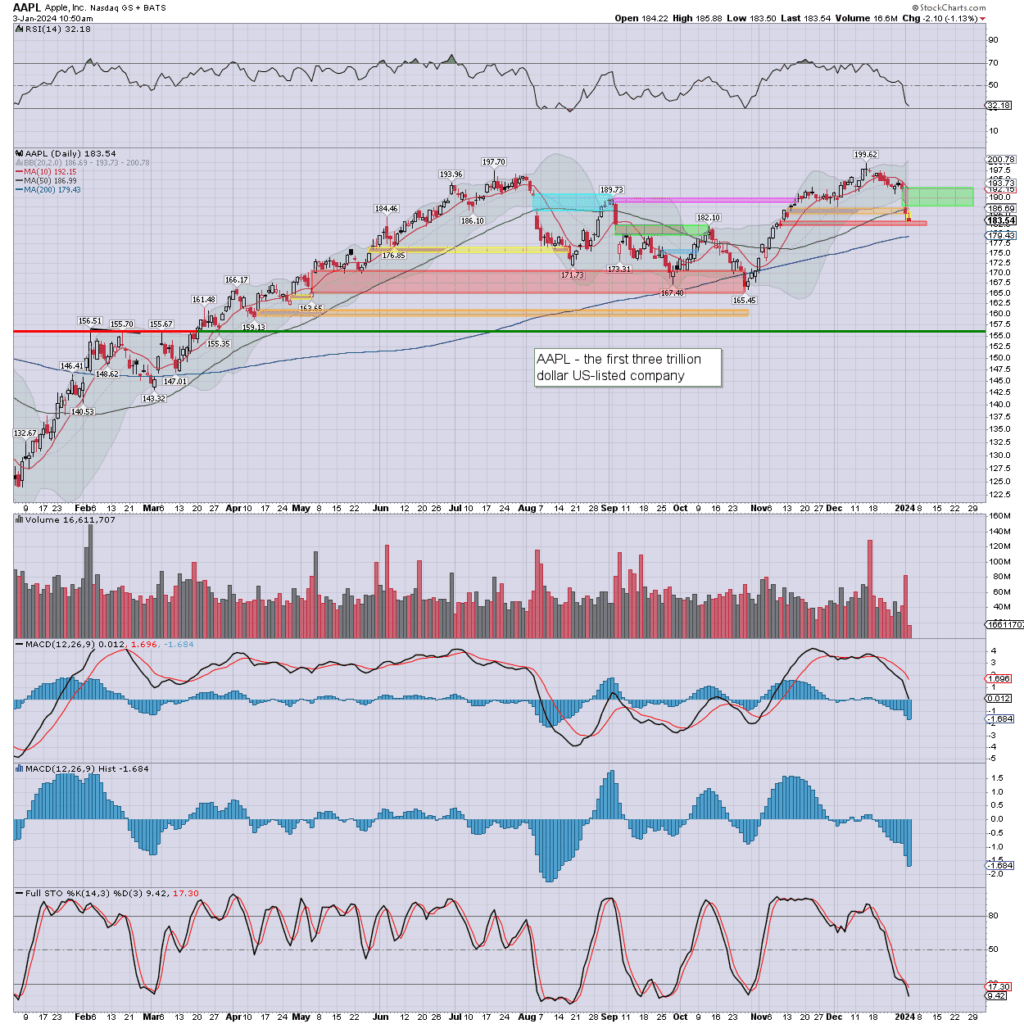

notable stock: AAPL

The 9th day lower of 12

–

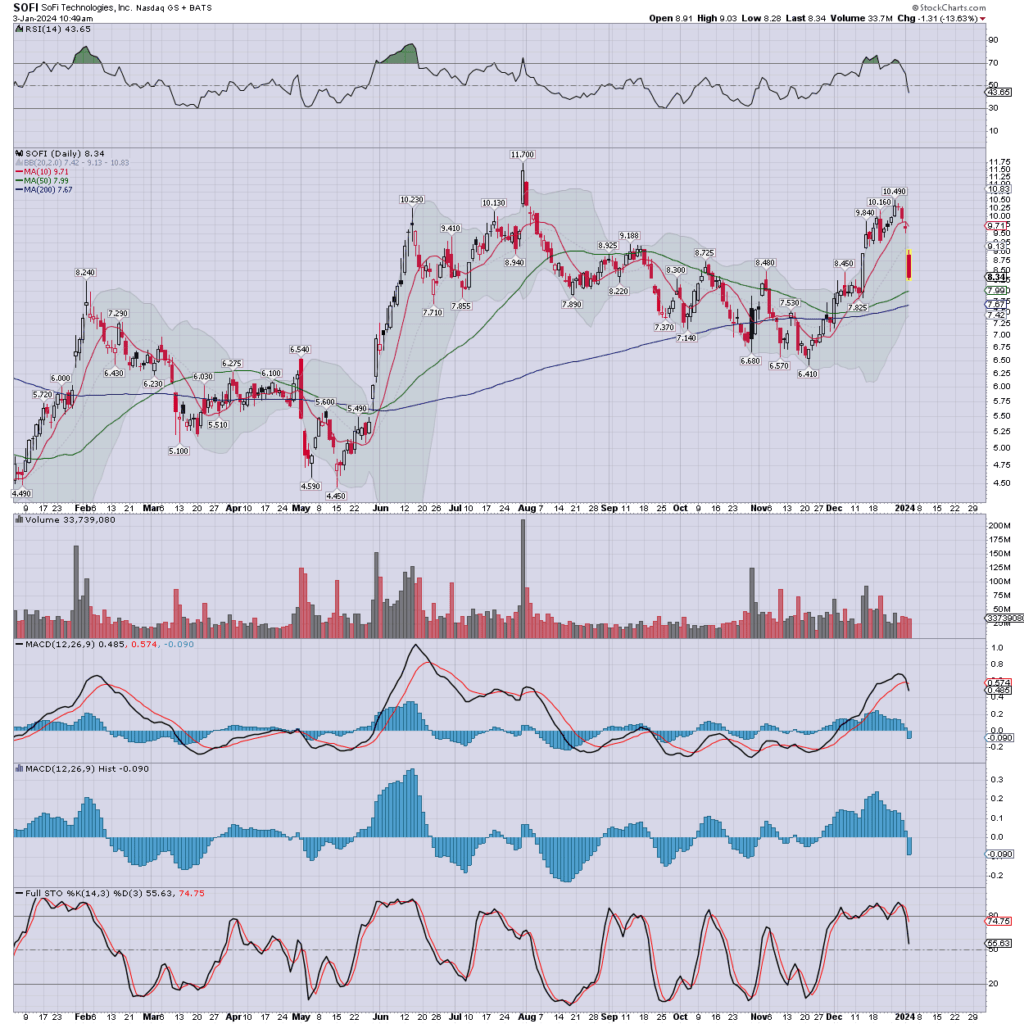

notable weakness: SOFI

KBW, market-perform>underperform, 7.50>6.50

—

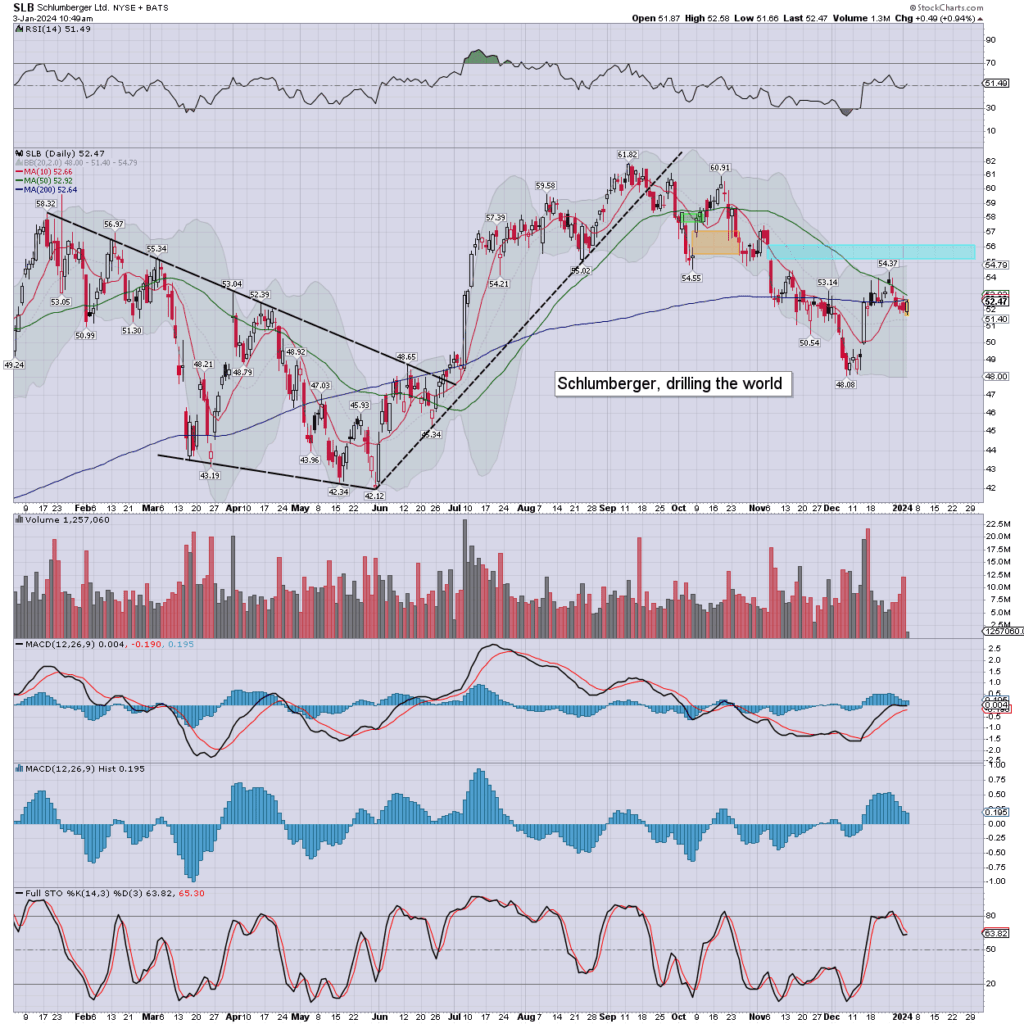

notable strength: SLB

Helped with the upside reversal in oil. Teal gap is natural target (same for OXY).

—

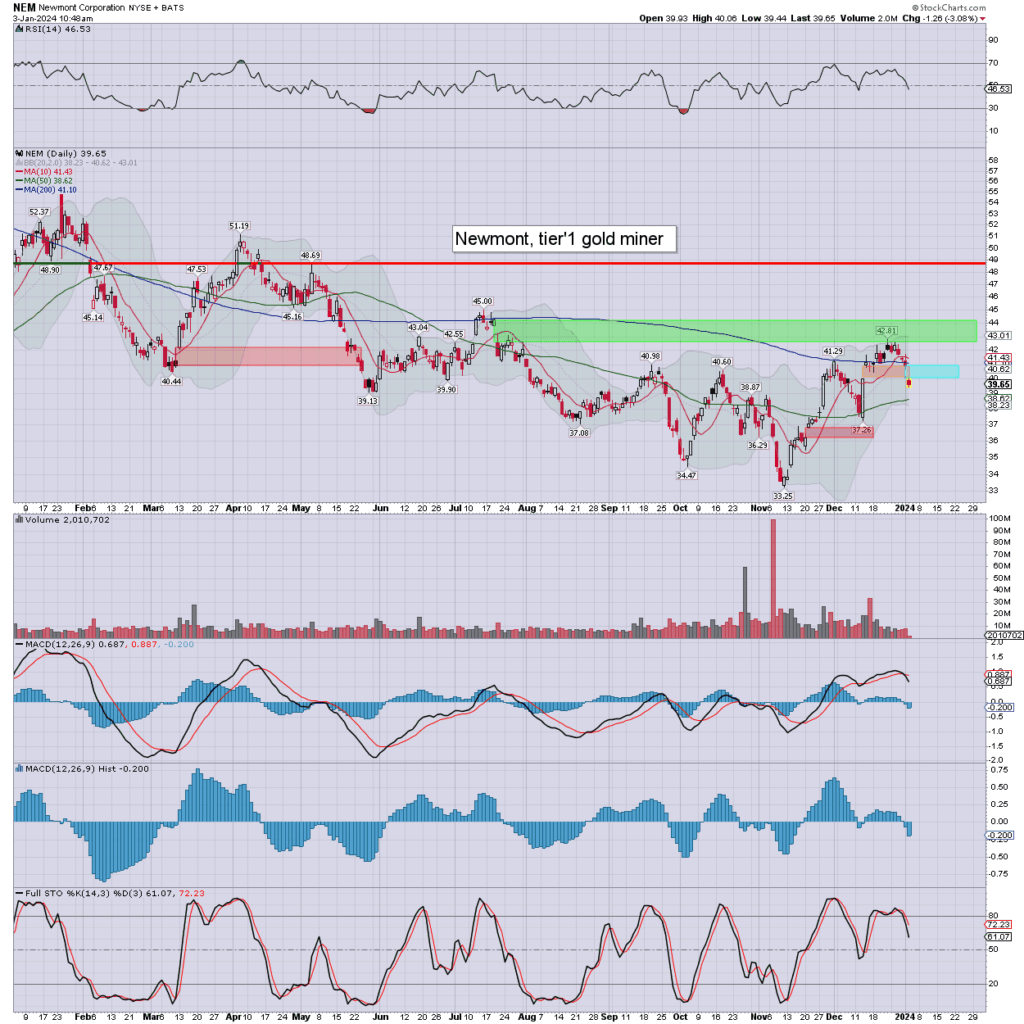

notable miner: NEM

A fourth day lower, clearly pressured by gold/silver, and the main market.

The bold will be buying, although I’d accept we have no clear cyclical floor/turn.

time for lunch…