It was a choppy end to the week, the SPX setting +3pts (0.05%) to 6836, which made for a net weekly decline of -96pts (1.4%).

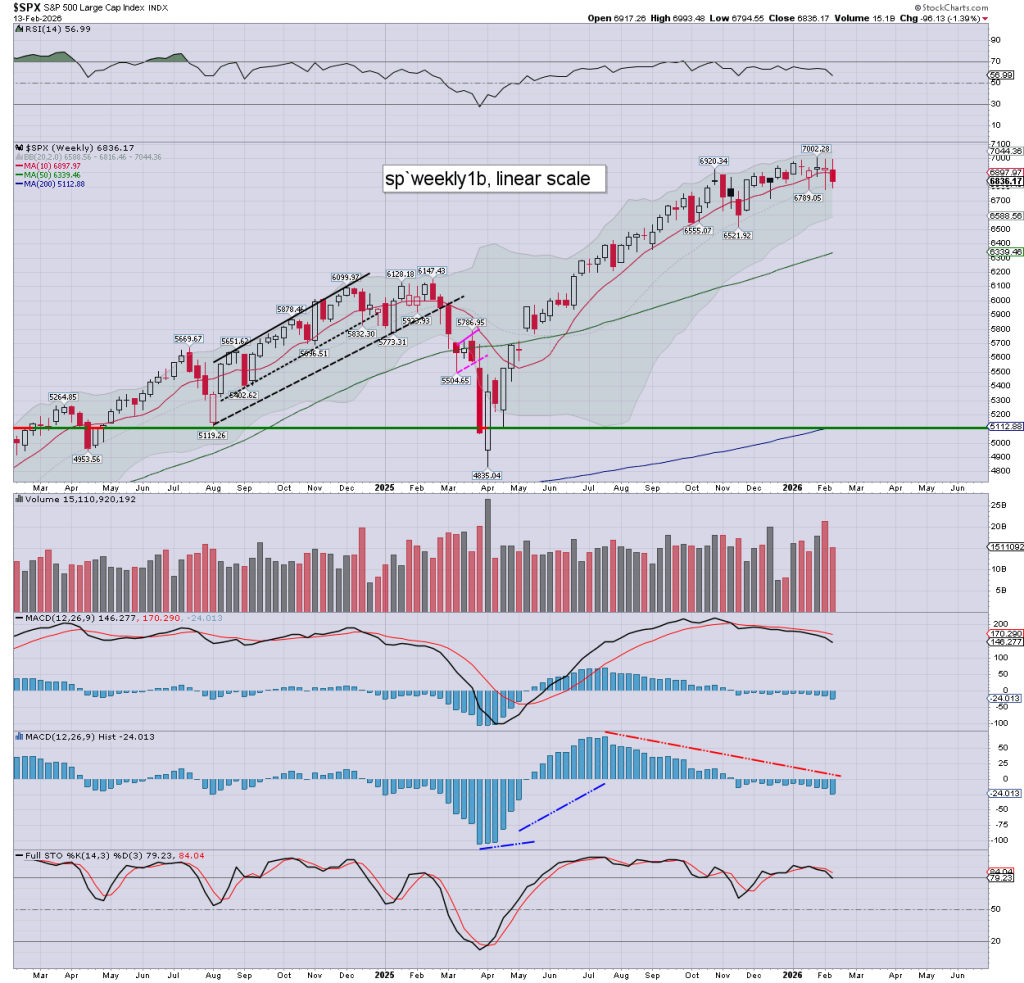

sp’weekly1b

Summary

SPX: not a great end to the week, settling under the weekly 10MA, with momentum increasingly negative. Next support is the recent low of 6789, then a gap to 6721, with the lower bollinger threatening 6588.

—

A note on Gold/Silver

Gold, weekly

Gold saw a net weekly gain of +$73 (1.5%) to $5041.

The highest ever weekly settlement.

Weekly momentum ticked a little higher, and is on the very high side.

–

Silver, weekly

Silver saw a net weekly decline of -$0.78 (1.0%) to $77.19

Weekly momentum weakened for a third consecutive week, and might turn negative next week.

*special note… Friday’s daily candle was black, which bodes bearish for Tuesday.

–

Miscell’ things

*I will be inclined to add some extra things (as they appear) late Friday/Sat’, so check back at least once this weekend.

–

A superb overview of the early days of the net, the Pirate Bay, and how it ironically lead to streaming services such as Disney+, Netflix, and Spotify.

–

I liked this YT comment… ‘When customers call a product slop, it’s not the customer that’s the problem.‘

–

Broad conversation on the AI bubble.

The ultimate question… where is the path to profitability?

–

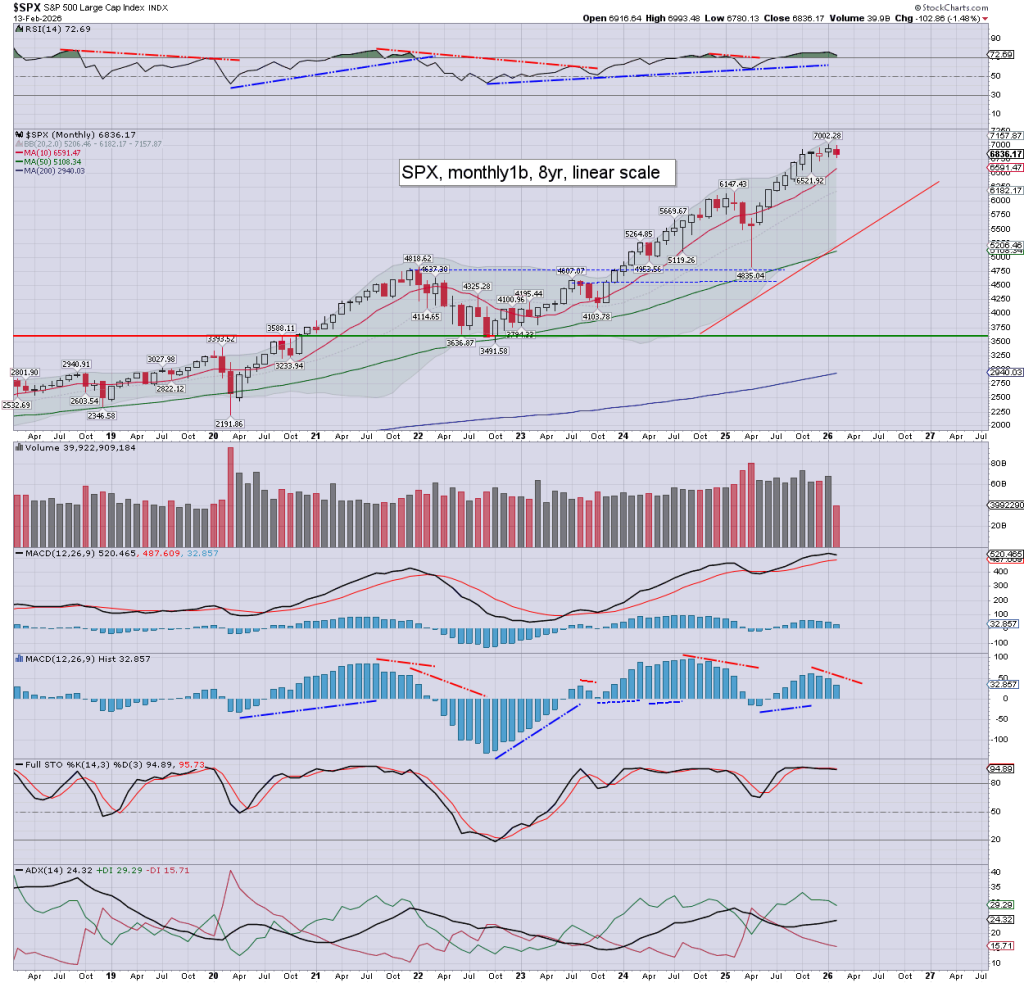

Lin with guest Feneck, who is calling for a 20% main market drop… something that Tom Lee has also been alluding to.

My concern is monthly momentum continues to weaken, prone to turning negative in March, or early April. Whenever monthly momentum turns negative… we can see big drops.

The most realistic bearish case would be 5500.

… and if you’re bearish equities, you have to be bearish silver and the miners. There is no way silver will hold current levels, if the SPX is somewhere south of 6K.

I’ve managed to avoid three silver smackdowns in recent weeks. Are we looking at silver to back test the $50 breakout threshold, before resuming higher, after a main market drop?

–

Ms. Cambone with Morgan.

–

*I’ve not watched (yet), but from what I gather in the YT comments, Vermeuelen is suggesting silver might fall to $28. That is arguably Krazy talk, unless the equity market falls at least 20%.

–

The weekly wrap on geo-politics is always recommended.

–

The Celente… remains understandably furious!

–

Carlson on privacy… a dying notion for most, especially within the failed state of the UK and mainland Europe.

–

Rogan with Dr Malone, as the C19 story is far from over.

–

The weekend

Two days to rest/recover, and work a little. I’ve sideline entertainment from Gold Rush, and I should get around to season three of Squid Game.

As ever, feel free to message me via X, Disqus or email.

Sincerely, enjoy the long weekend, and goodnight from London

yours… Philip

—

The weekend post will appear Sat’ 12pm EST @ https://tradingsunset.blogspot.com, and will detail six of the US equity indexes (weekly candle charts).

*the next scheduled post will be the pre-market brief, 8.30am, Tuesday, Feb’17th.