Good morning. US equity futures are leaning weak (ahead of CPI), SPX -16pts, we’re set to open at 6816. USD is +0.1% at DXY 96.97. The precious metals are bouncing, Gold +1.2%, with Silver +3.7%. WTIC is -0.8% in the mid $62s.

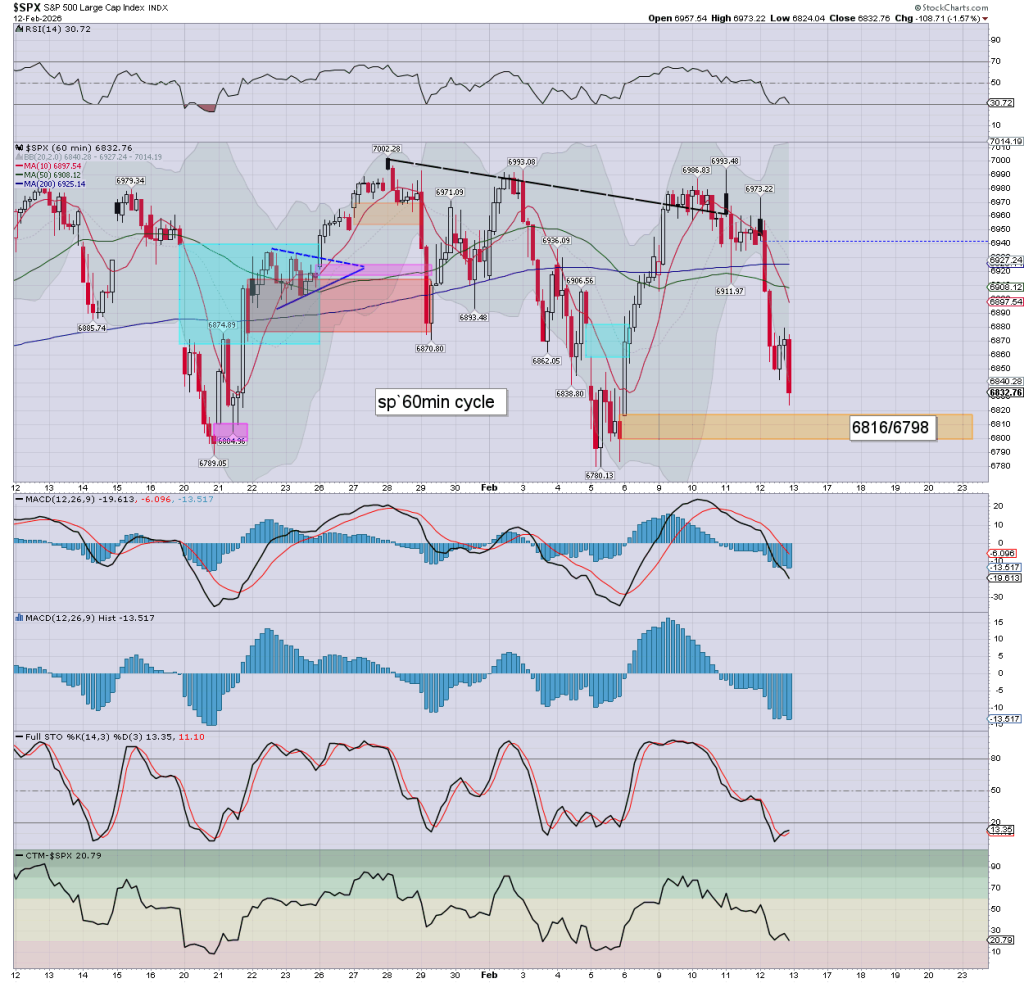

sp’60min

Summary

Yesterday opened a little higher, but there was a rather powerful downside reversal, with the SPX coming close to tagging last Friday’s gap. S/t momentum settled on the low side.

Overnight futures have been leaning on the weaker side, especially pressured by Asian markets. We’re set to open -10/15pts, but that could easily change with the CPI data.

Yours truly is looking to make a day-trade in Silver, but I’m not in the mood to chase higher. If the gains erode in early morning, I might be interested. My default is to be flat… especially into a long weekend.

—

Early movers

AA -4.2%

–

AAP +6.5%, EPS 86cents vs 42est. Rev’ y/y -1.1% to $1.97bn vs 1.95est. Profitable, but the annual decline in sales is worse relative to inflation.

–

ABNB +5.0%, earnings (Thurs’ AH), EPS 56cents vs 65est. Rev’ y/y +12.0% to $2.77bn vs 2.71est. Goldman, neutral, 140>150

–

AG +1.4%

AEM +2.3%

AMAT +10.5%, post earnings jump

–

BCS -4.1%, weak UK fins

BROS +13.6%, post earnings jump

–

CART +12.1%, earnings (Thurs’ AH), EPS 39cents vs 52est. Rev’ y/y +12.3% to $992M vs 974est.

–

CENX -9.5%

CLF -3.3%

–

COIN +5.3%

Bitcoin is +1.2% at $67K. The cyclical setup favours the bulls.

–

CRSR +30.6%, earnings (Thurs’ AH), EPS 43cents vs 27est. Rev’ y/y +5.6% to $436M vs 422est. $50M buyback. Corsair helped by soaring memory prices.

–

DB -3.8%, weak EU fins

DKNG -17.0%, post earnings horror

EXPE -4.6%, post earnings depression

FCX -1.0%, with copper -8cents at $5.70

HL +2.0%

–

MRK +1.9%, Deutsche Bank, hold>buy, 115>150

–

MRNA -0.3%, EPS -$2.11 vs -2.59est. Rev’ y/y -29.8% to $678M vs 626est. As expected… garbage.

–

MU -1.4%

NWG -3.7%, weak UK fins

PAAS +1.2%

–

PINS -20.6%, post earnings horror

PLTR -1.4%

RIVN +20.1%, post earnings leap

–

ROKU +15.3%, EPS 53cents vs 27est. Rev’ y/y +16.1% to $1.39bn vs 1.35est.

–

SMR +0.9%

TOST -1.3%, post earnings cooling

TSLA -0.8%

–

VIX +1.5% at 21.11

–

WEN -6.2%, EPS 16cents vs 14est. Rev’ y/y +5.4% to $543M vs 535est.

–

XOM -0.5%

—

Overnight markets

Asian markets were sig’ lower, whilst European markets are broadly flat…

Japan: -1.2% to 56941

China: -1.3% to 4082

Germany: currently u/c at 24854

UK: currently +0.1% at 10408

—

Special note…

It will be an Open Day, with my posts available to all. Its the best (and free) form of advertising I can get.

Have a good Friday the 13th