US equities remain choppy, if moderately higher. Meanwhile, WTIC is currently +0.2% in the low $63s. The energy sector ETF of XLE is currently net higher for the week by +2.2% at $54.45.

USO daily

XLE weekly

Summary

WTIC/USO: oil is churning the 63/62s. A tag of orange gap appears probable next week. I’m considering a long trade (via USO) into March, on threat of USA-Iran. Monthly momentum might turn positive before end month, and threatens a spike to the $77s.

XLE: energy stocks are net higher for an EIGHTH consecutive week. Impressive… relative to oil and the main market.

notable stock: XOM

A second day of cooling, but that is from a new hist’ high.

–

notable nuclear stock: SMR

New cycle low of $13.66. I still like this one, with basic target of the 200dma around $30

—

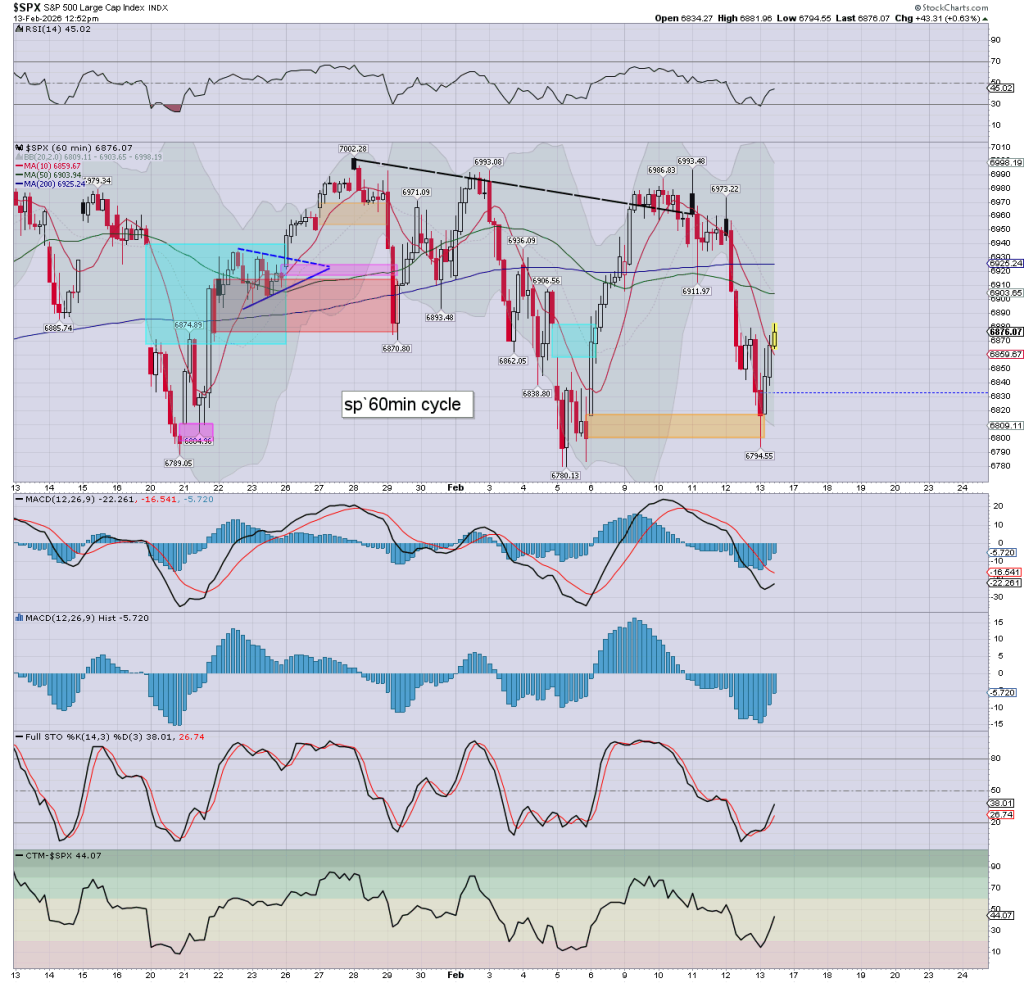

Equities: sp’60min

Hourly momentum continues to swing back toward the bulls.

Considering the long weekend, I wonder if we’ll see some late day cooling.

Yours truly remains content on the sidelines.

I’ll look to buy back silver next Tuesday.