US equity indexes closed mixed, SPX +24pts (0.4%) at 6642. Nasdaq comp’ +0.6%. Dow +0.1%. The Transports settled -0.3%. R2K -0.03%

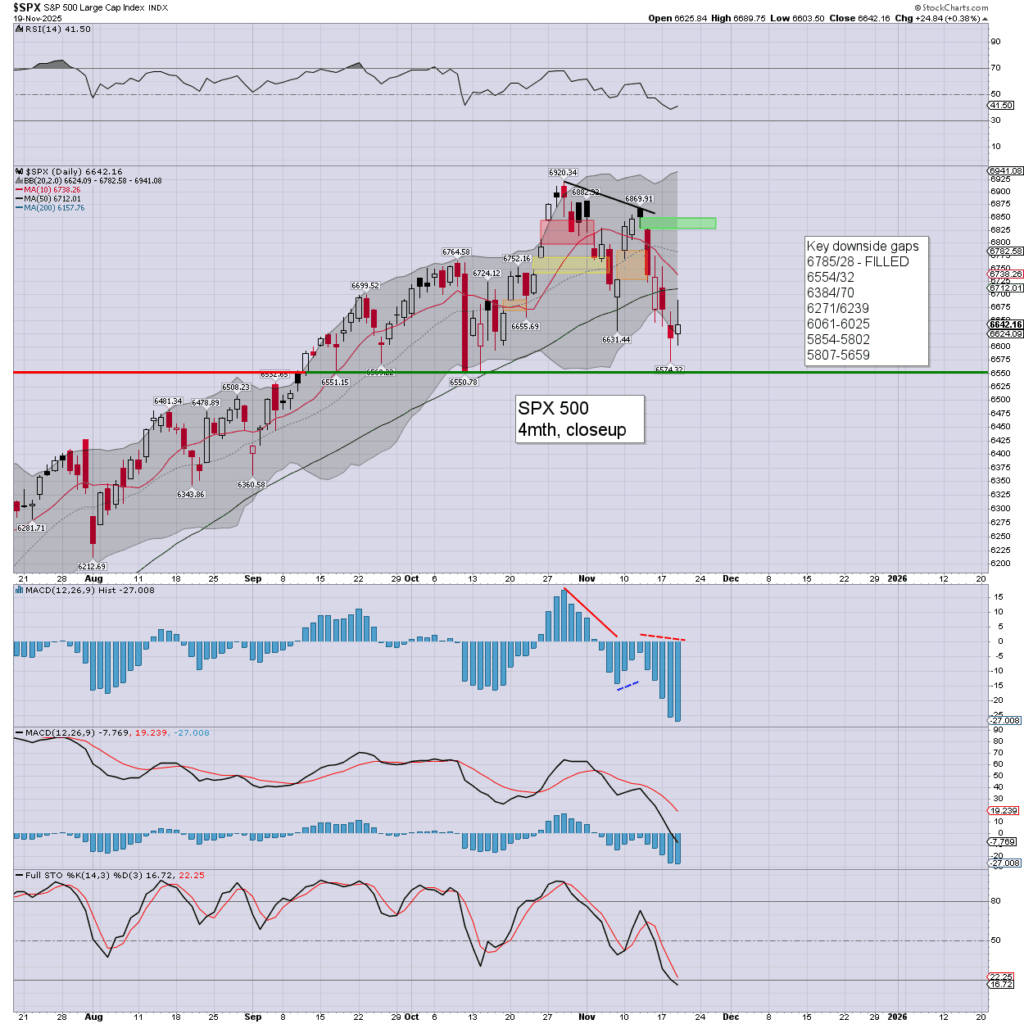

sp’daily5

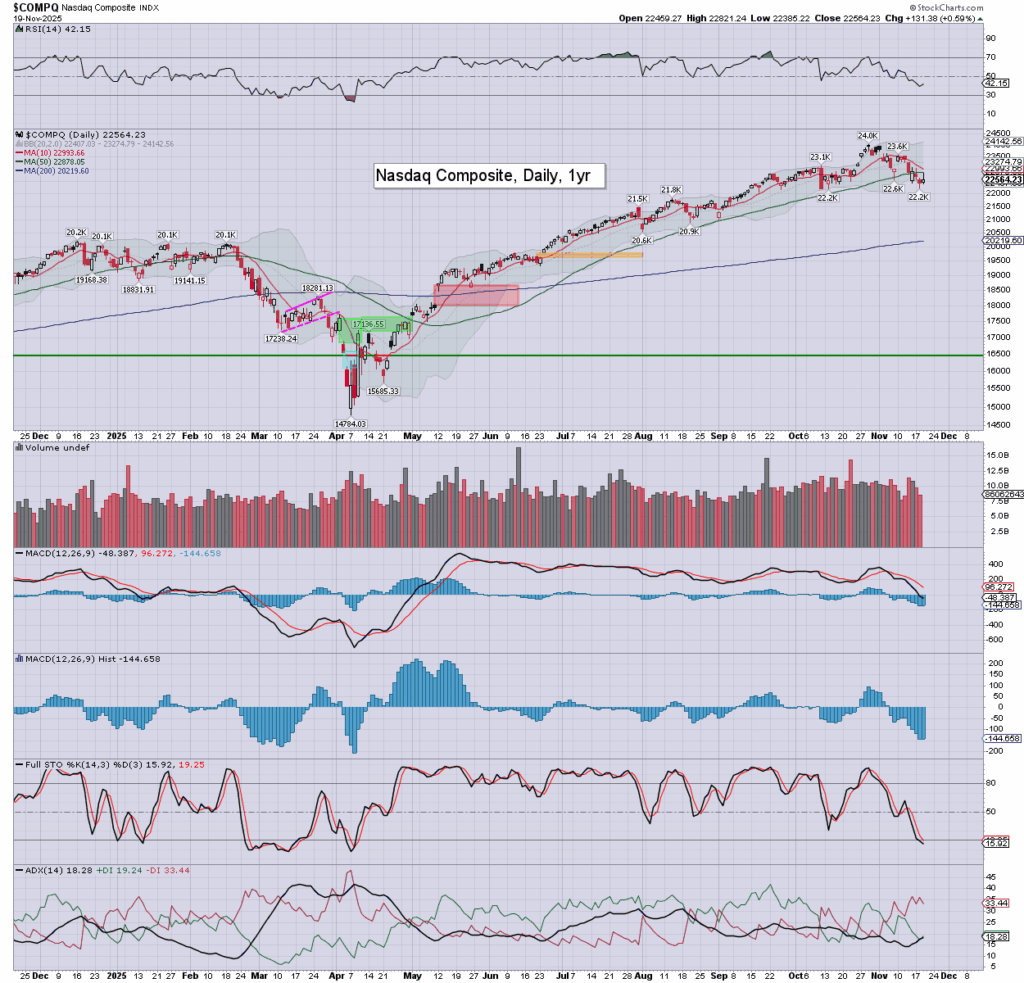

nasdaq comp’

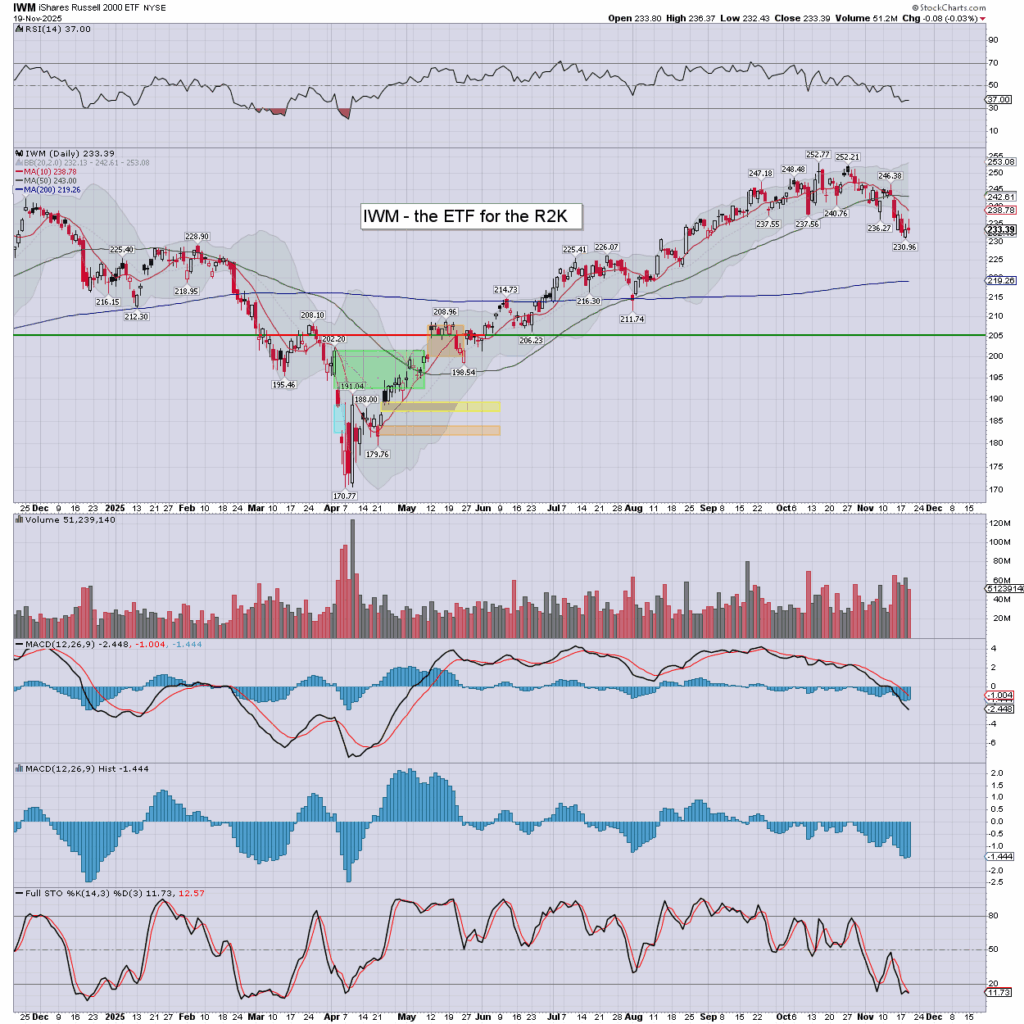

r2k

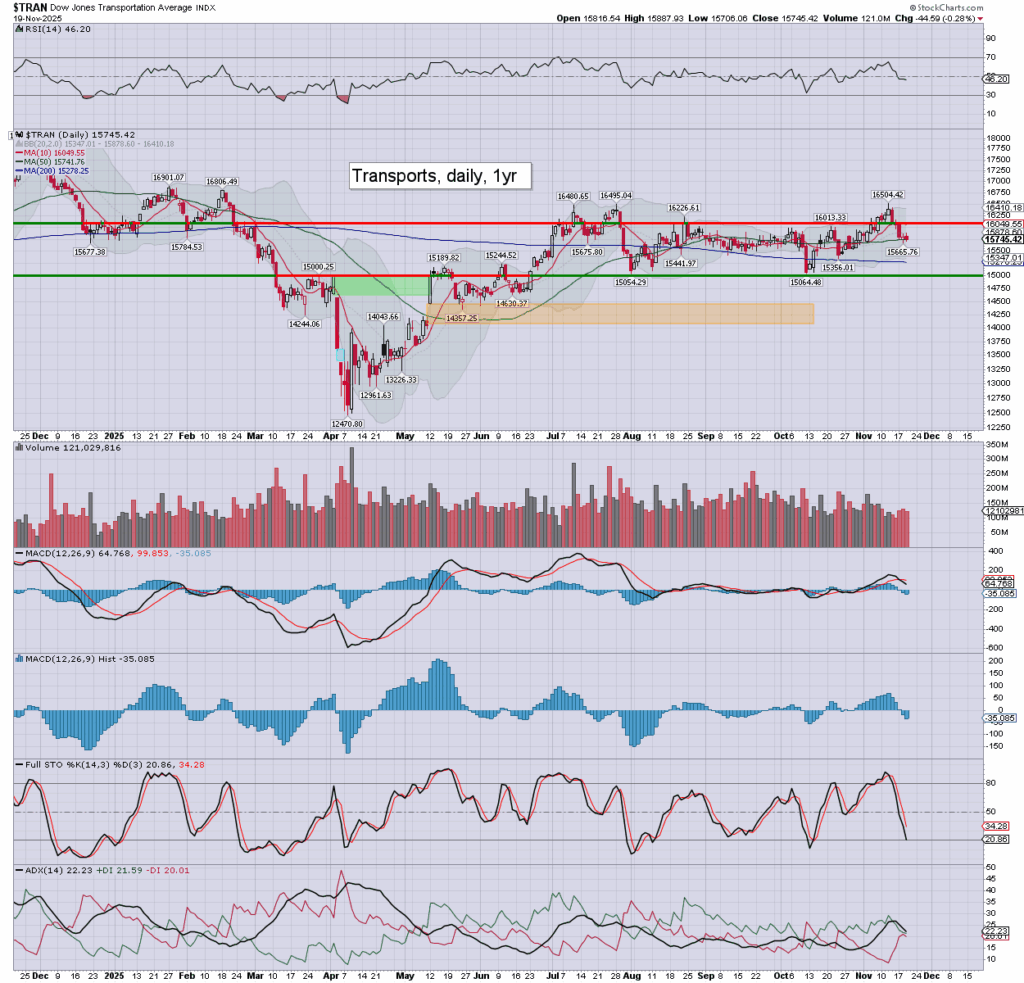

transports

Summary

SPX: early gains to 6689, a significant downside reversal though to 6603, and settling moderately higher at 6642. I’d note the intersecting 10 and 50dma… as we’ve major resistance in the low 6700s.

Daily momentum ticked a little lower, and is on the very low side. However… RSI 41s isn’t remotely oversold. The 200dma in the mid 6100s is a valid target in December.

—

NAS: settling +0.6% to 22564. Today’s candle is spiky on the upper side from around the intersecting 10 and 50dma. The 200dma in the 20200s is a valid target in December.

R2K: settling -0.03% to 233.39. I’d note the 50dma in the 243s… should which hold into end month.

Trans: a fifth day lower, settling -0.3% to 15745. Tuesday’s reversal candle initially played out. Upside resistance 16K, and then the 16200s.

–

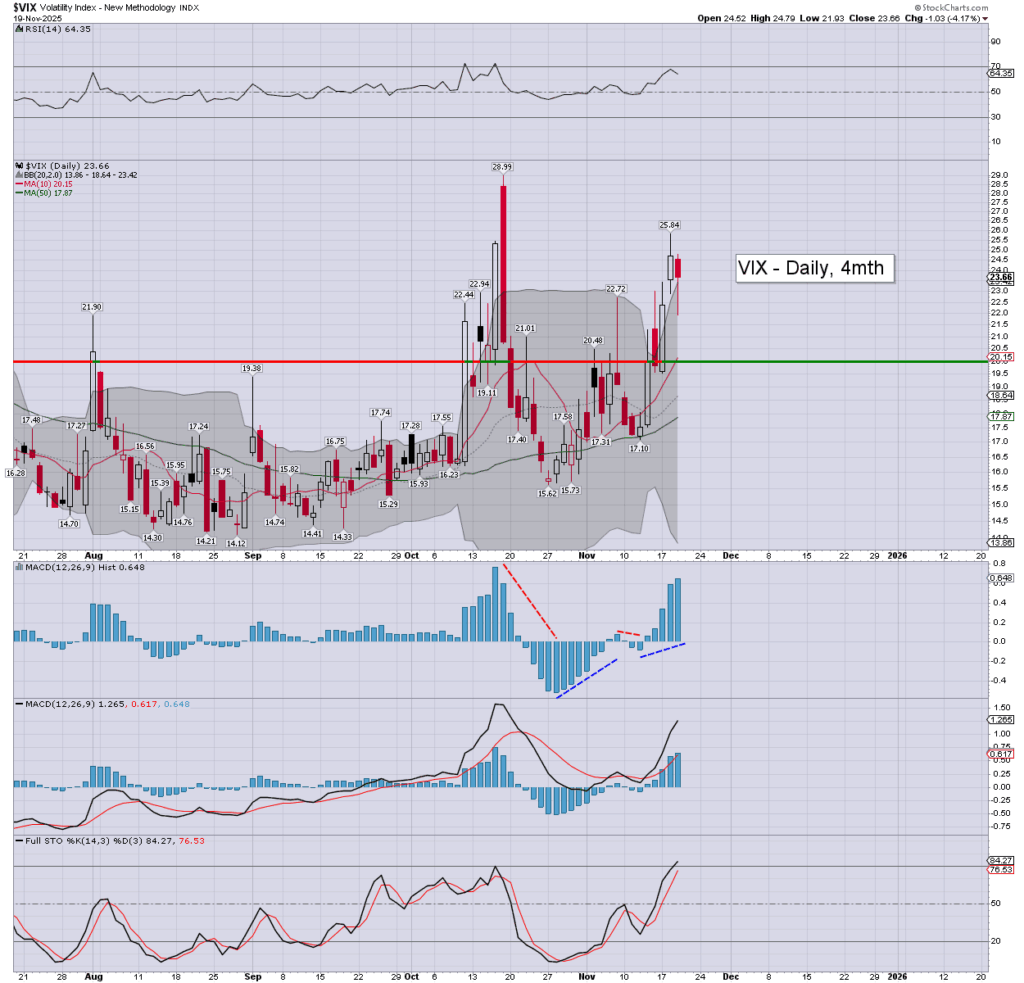

VIX’daily

Volatility was mixed, the VIX printing an early low of 21.93, spiking to 24.79, and cooling back to settle -4.2% to 23.66. Daily momentum ticked a little higher, and is on the very high side.

As things are, we appear set for a weekly settlement above the key 20 threshold.

–

Looking ahead by 6pm EST