It was a mixed day in equity land, the SPX printing 6689, cooling to 6603, and settling +24pts (0.8%) to 6642.

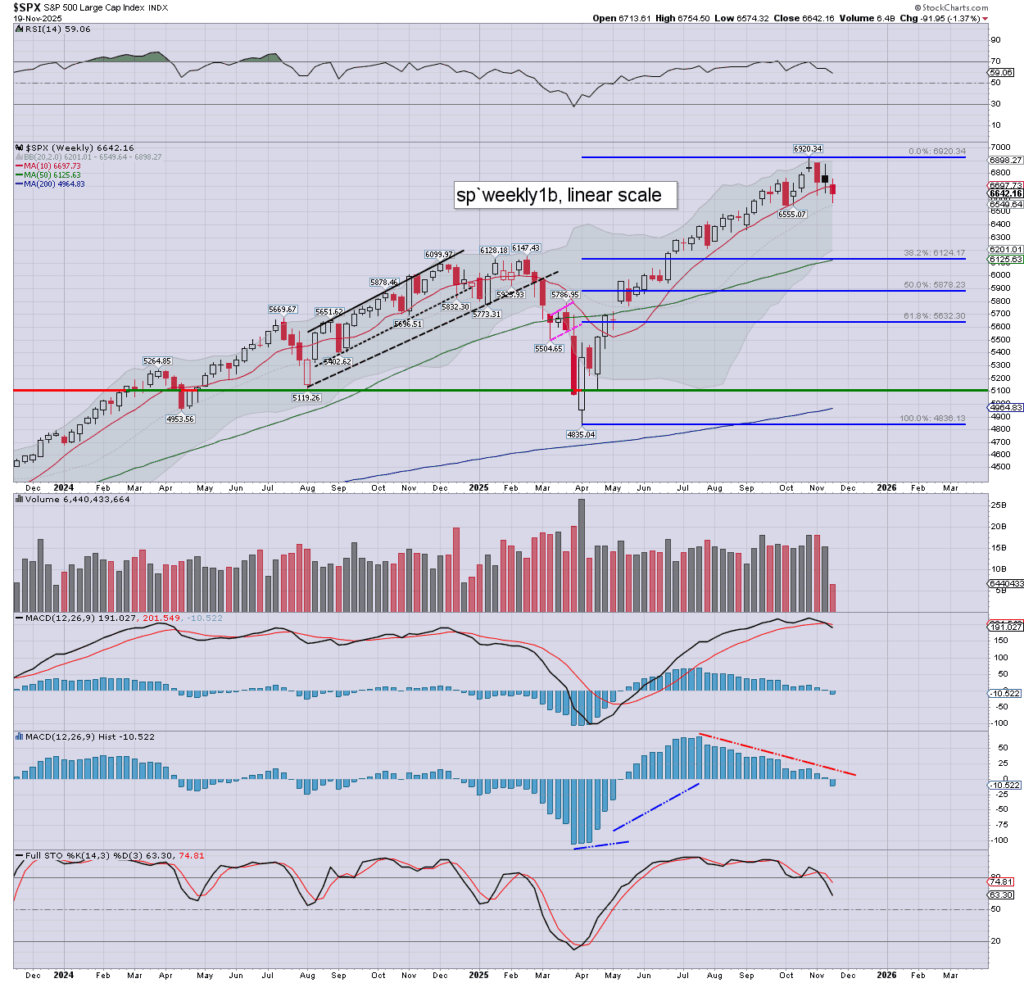

sp’weekly1b

Summary

SPX: as things are, we’re net lower for the week by -91pts (1.4%). Weekly momentum is sustainably negative, and bodes red into December.

Bears should be seeking a weekly close <6690, which would be under the the daily 50MA and the weekly 10MA. Big target 6200/6100s.

–

Stock of the day

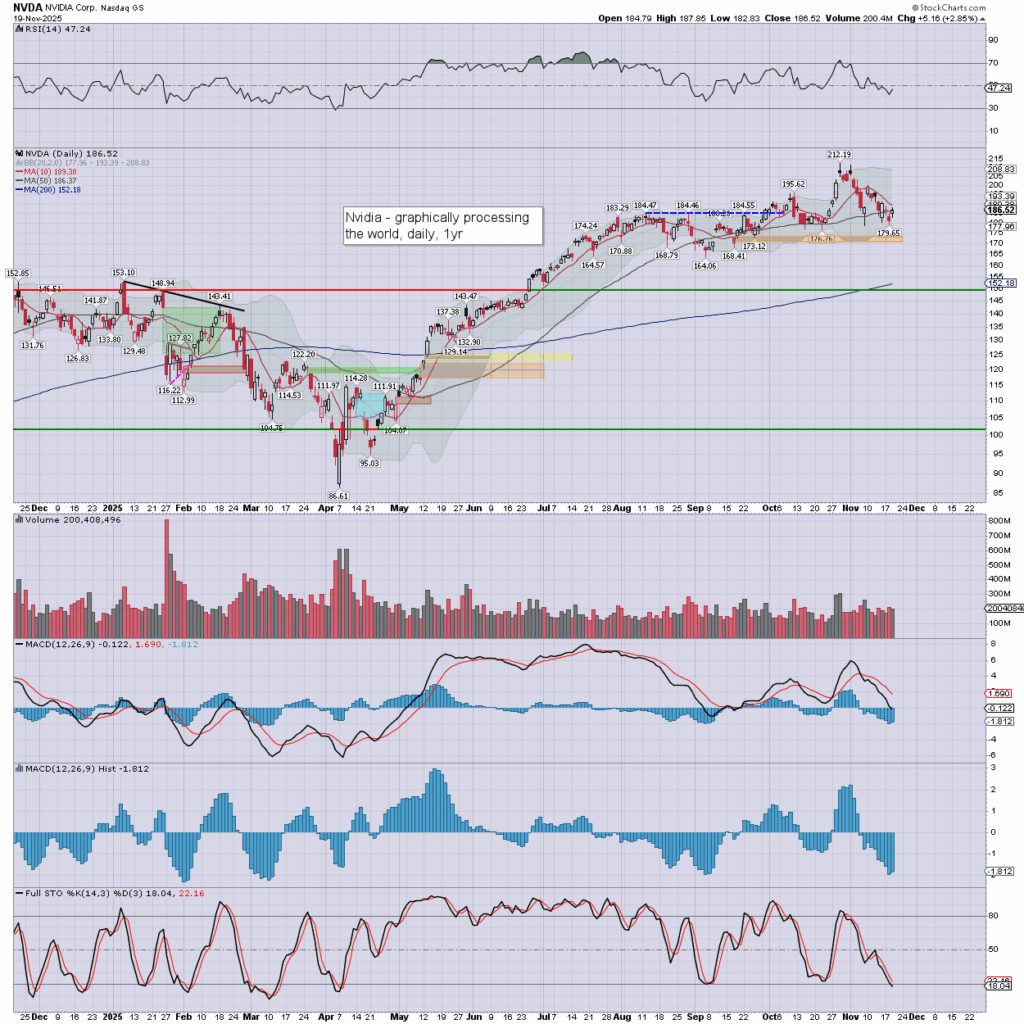

NVDA, daily

Nvidia settled +2.8% to $186.52.

Earnings in AH: EPS $1.30 vs 1.25est. Rev’ y/y +62.5% to $57.0bn vs 54.9est. Divi held at 1cent.

*As at 4.27pm EST, +$5 in the $191s.

–

Looking ahead

Thursday will see Weekly jobs, existing home sales, leading indicators

Earnings: $WMT $ZIM $SCVL $ROAD $NNOX $ALLT $WMG $RERE $VIPS $VNET $BULL $VEEV $CPRT $GAP $ESTC $UGI $INTU $TEN $POST $ROST

–

Final note

‘Recently I’ve started to see “news” circulating that CDS (credit default swaps) are being written on some of the AI-related stuff.’ – Denniger

https://market-ticker.org/akcs-www?post=254441

I also smell smoke, although whether its going to turn into a minor house fire, or take out a few city blocks… I don’t know.

–

Private credit is indeed getting worse.

–

The Insurers and off-balance sheet items

A subscriber kindly forwarded this to me…

‘Life insurers’ exposure to below-investment-grade firm debt has boomed and now exceeds the industry’s exposure to subprime residential mortgage-backed securities in late 2007.’ – the Fed, March, 2025

Even the Fed is already admitting the setup is worse than 2007.

Related chatter from Nangle of the FT…

FT > https://www.ft.com/content/6ef2d803-0117-44e0-8f99-947459b55c62?shareType=nongift

‘Market prices suggest that there is little prospect of an economic downturn sufficient to impede debtors’ timely payment of principal and capital any time in the foreseeable future.’ – Nangle

… who doesn’t appear concerned, but then… he is mainstream, and they are always cheerleading.

–

*I’ve not watched

–

Independent chatter…

–

Another using the W word. Its almost like my touted notion of ‘Today was worse than yesterday. Tomorrow will be worse than today’, has indeed spread into the global psyche.

–

Geo-political chatter.

–

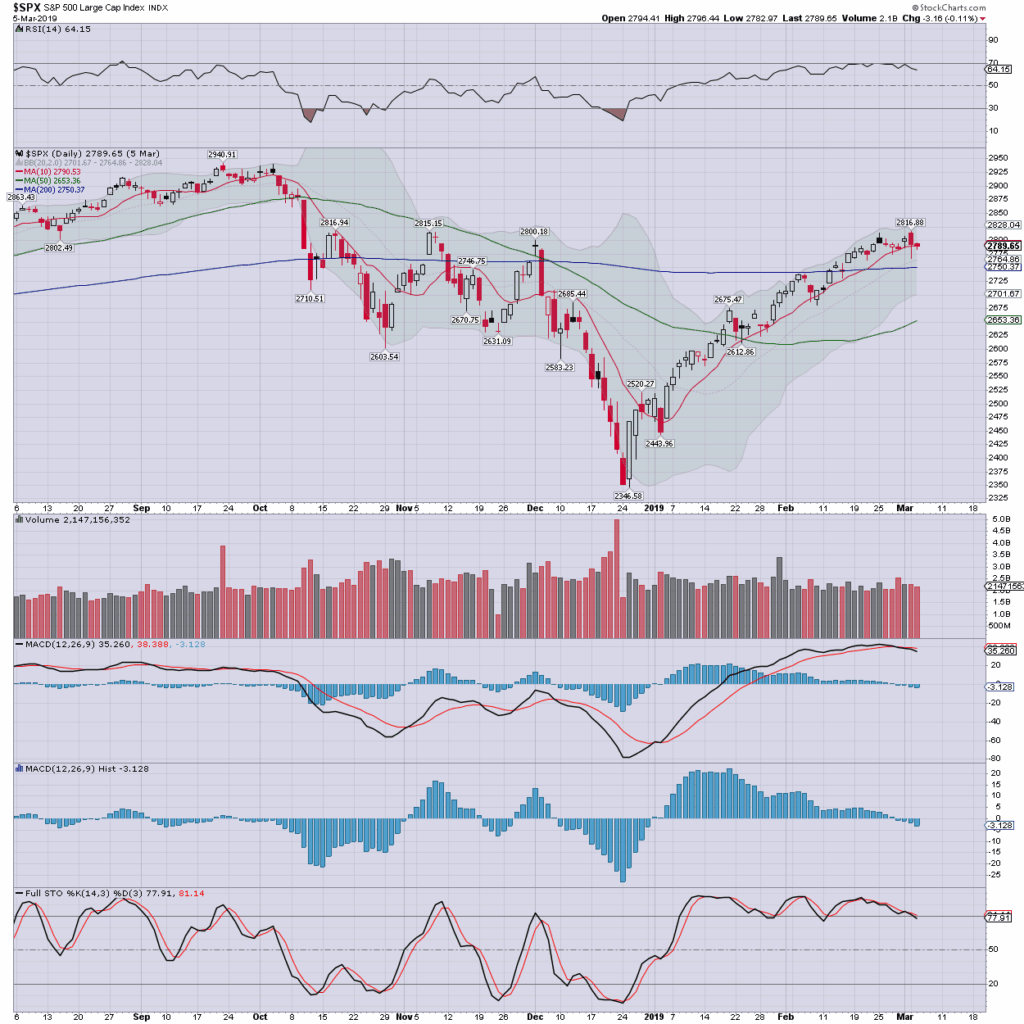

The Celente citing the decline of late 2018…

I’d note the first warning was the break of the 50dma.

The second… the 200dma

In today’s market… we’ve sustainably taken out the 50dma.

The 200dma currently stands at 6157

–

EXTREMELY recommended.

Ms. Cambone noting how ‘Capitalism’ is now seen as a dirty word. Its a profound point, as the dumb younger generation voted for Mamdani.

Its clear where this is headed…

Total dystopian surveillance and control…

Price controls.

Capital controls.

CBDCs.

Social credit scores.

Travel allowances.

Total surveillance… with everyone and everything RFID tagged.

On one level, for what this wretched society/species did to me, its pleasing to know the amount of suffering there is to come. Don’t ever try to convince me the bulk are anything but unworthy sheep.

Goodnight from London

Yours… almost ready for winter