US equities open significantly higher… with the collective of the US market pulled upward by Nvidia. USD is -0.2% at DXY 100.00

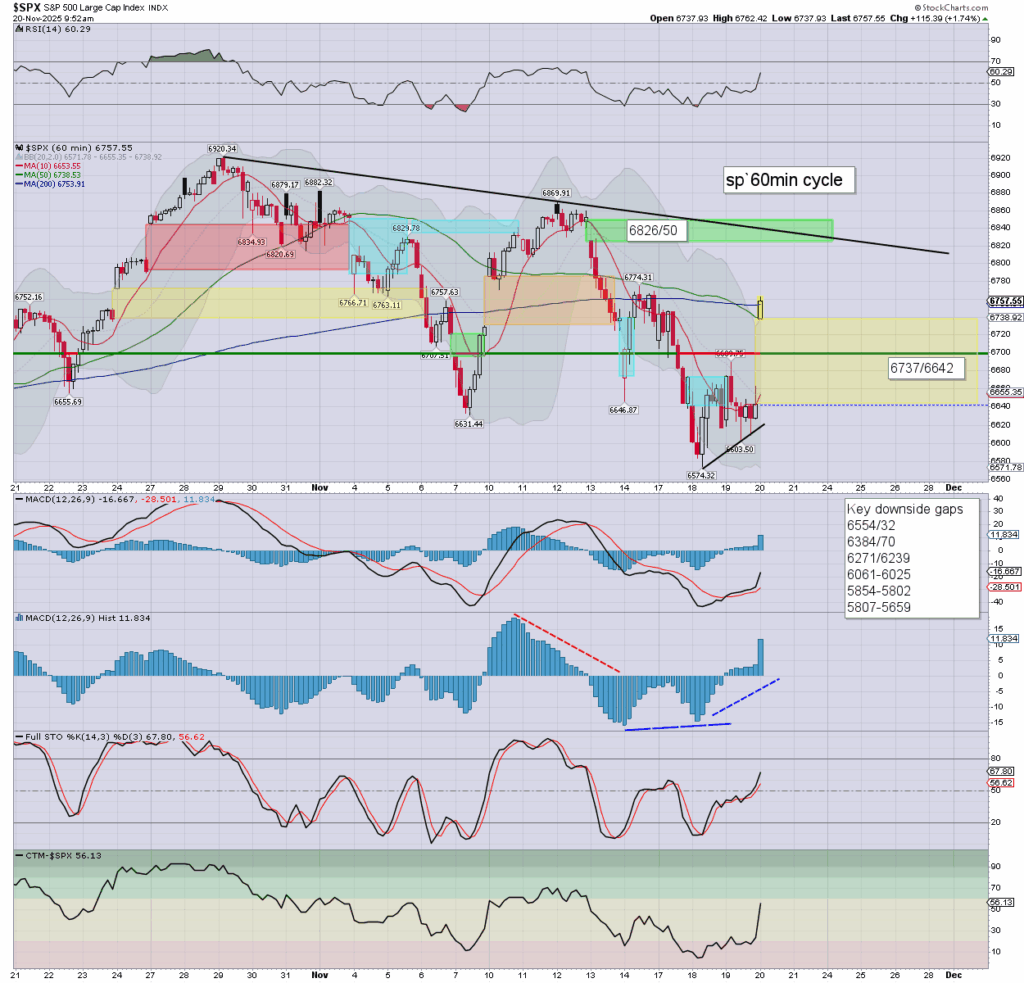

sp’60min

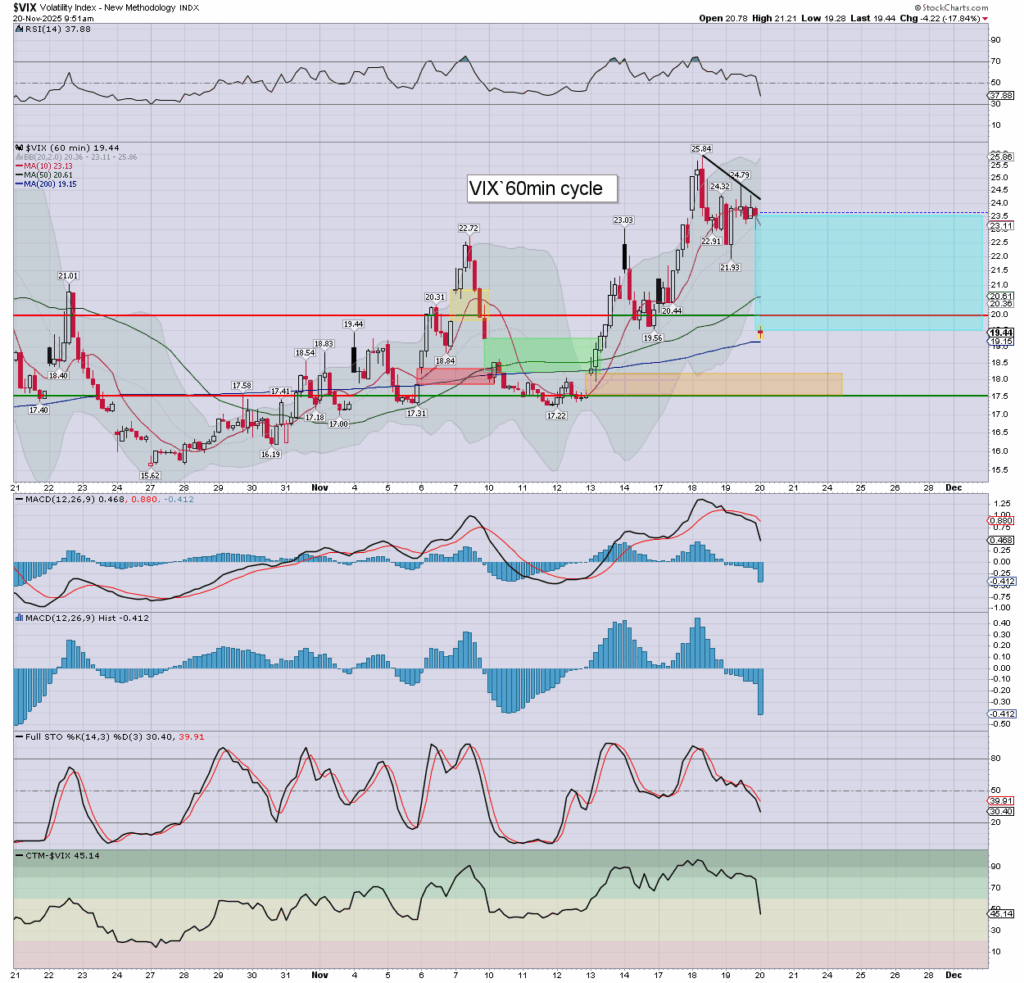

VIX’60min

Summary

*BLS monthly jobs report… originally due Oct’3rd

September net gains: 119K vs 50K est.

Headline jobless rate: 4.4% vs 4.3% est.

As for equities, its merely case of how we settle OPEX.

Its possible we might even tag green gap tomorrow.

Yours truly has zero inclination to do anything this side of OPEX.

… and yes, I’m 100% cash.

–

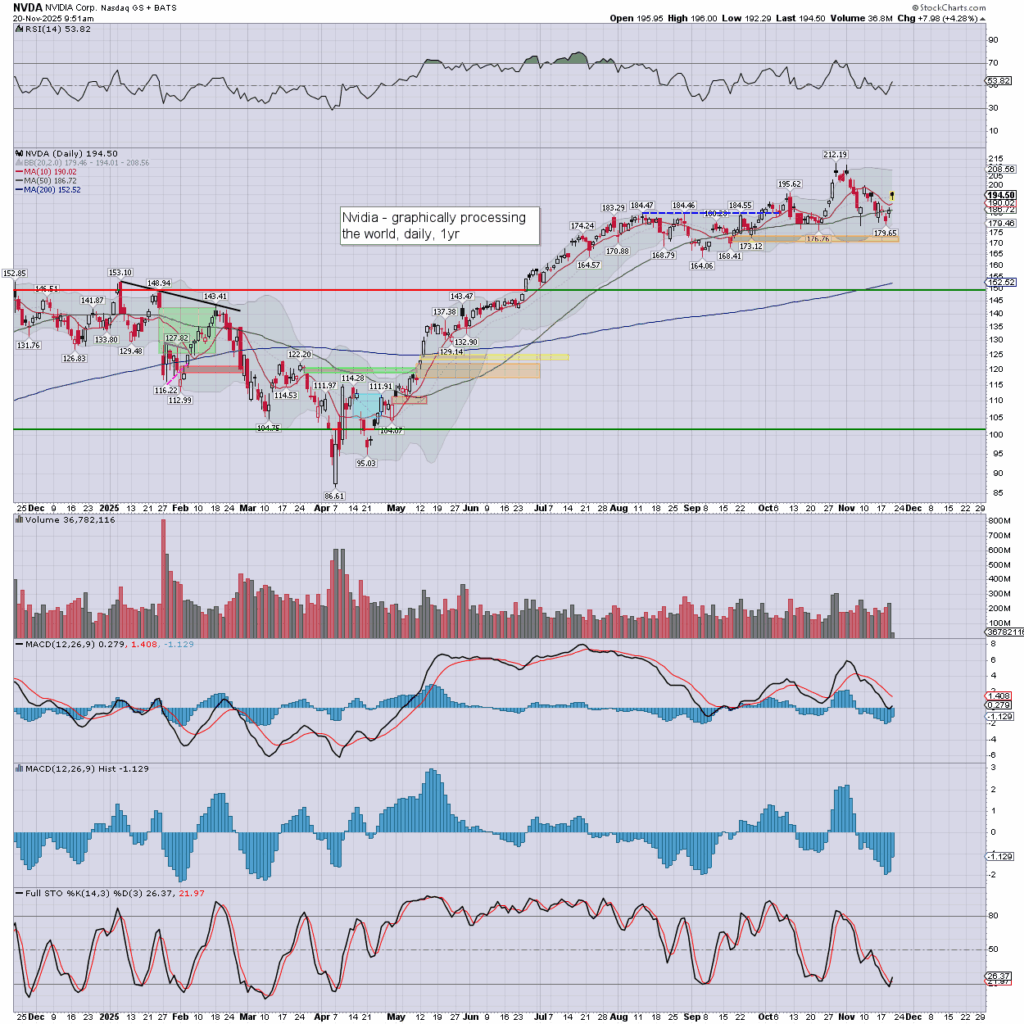

notable stock: NVDA

Earnings in AH: EPS $1.30 vs 1.25est. Rev’ y/y +62.5% to $57.0bn vs 54.9est. Divi held at 1cent. The annual growth rate is unquestionably impressive.

The stock is still below the recent hist’ high (marked by a black candle)

Today’s early price action… we’re seeing sellers.

The stock will likely settle net higher… but below the open. Black candle!

–

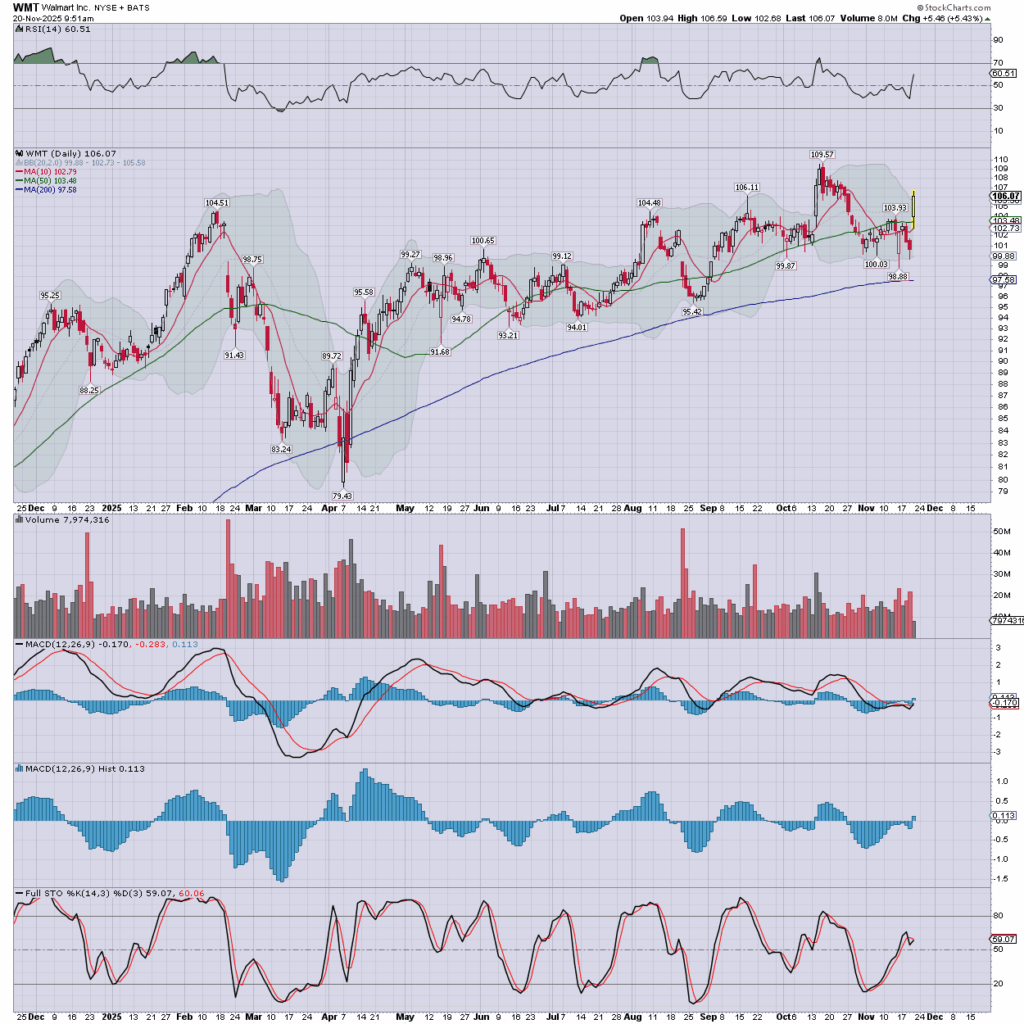

notable Dow component: WMT

Earnings were fine…

EPS 62cents vs 60est. Rev’ y/y +5.8% to $179.5bn vs 177.4est.

COMPS +1.8%. Positive guidance.

—

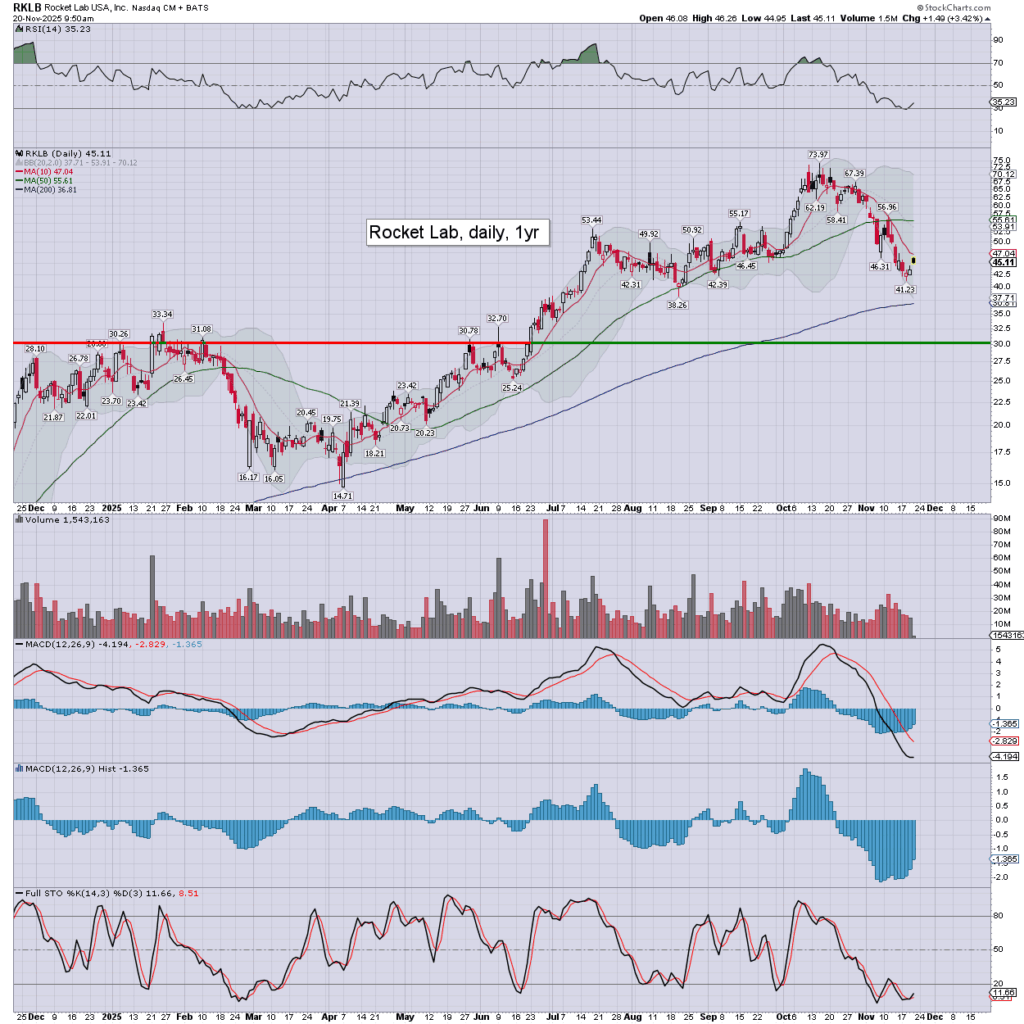

notable space: RKLB

Partly main market, partly another successful launch.

—

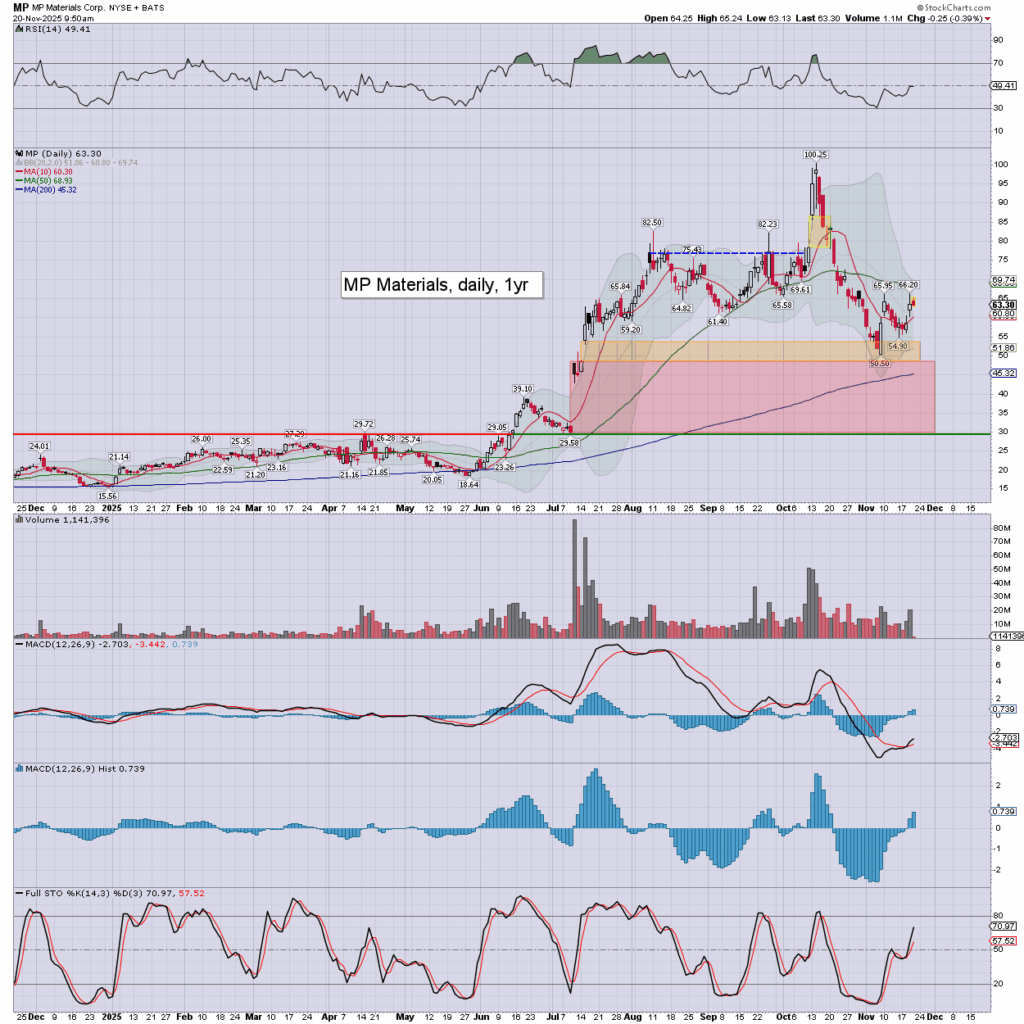

notable miner: MP

Early gains fading, stuck under the 50dma.

–

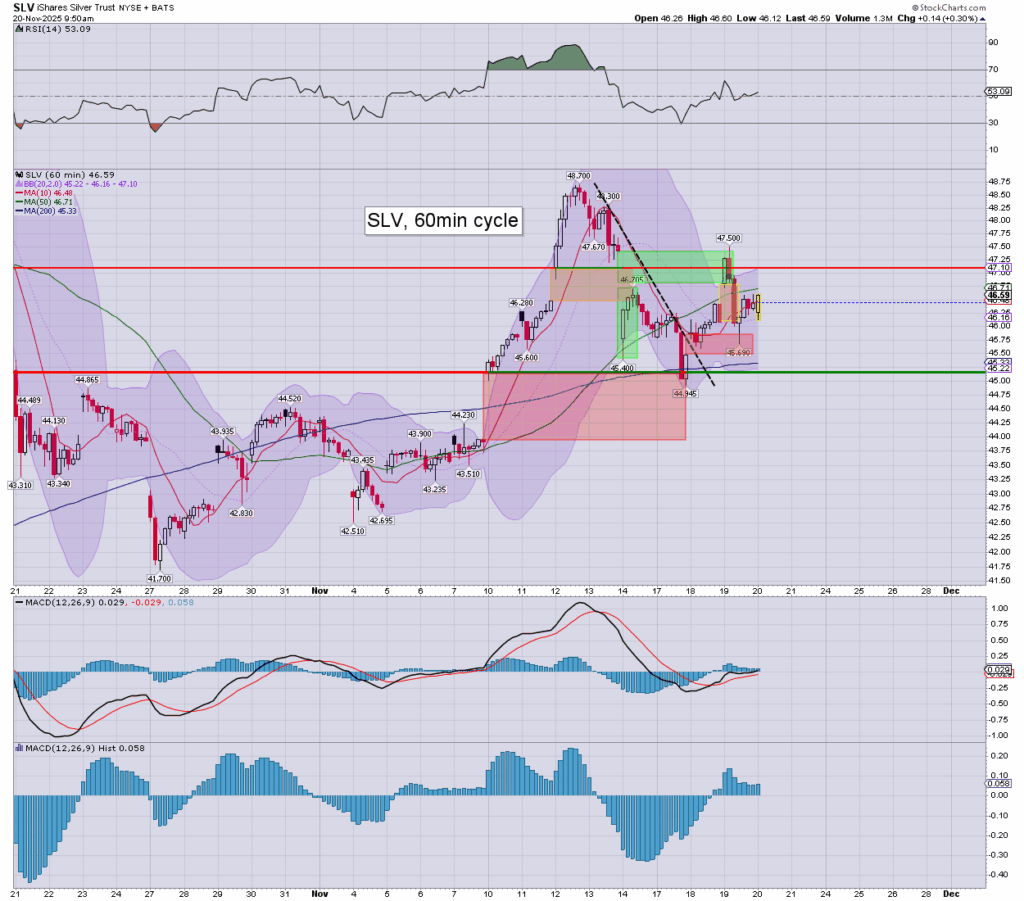

notable silver ETF: SLV, 60min

First, I’d note yesterday’s reversal, after a fill of green gap.

This morning… silver wasn’t invited to the main market party.

The USD holding around DXY 100 isn’t helping.

S/t bulls need to see silver >$52, with SLV >$48 to have renewed confidence. I hold to the notion that if you’re bearish equities, you can’t be bullish silver.