US equities are sig’ lower. Meanwhile, the precious metals are broadly lower, Gold -$18 (0.5%), with Silver -74cents (1.6%). The miner ETF of GDX is currently -4.0% at $73.31.

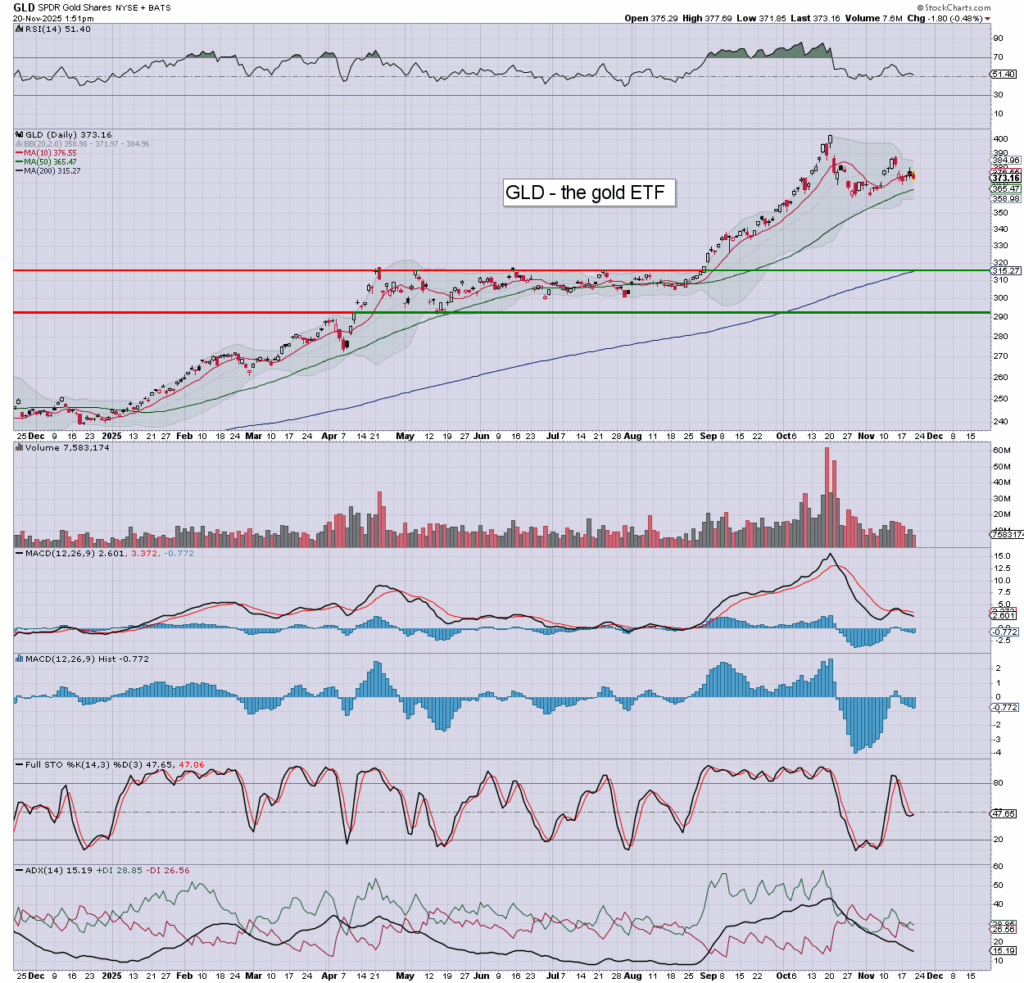

GLD daily

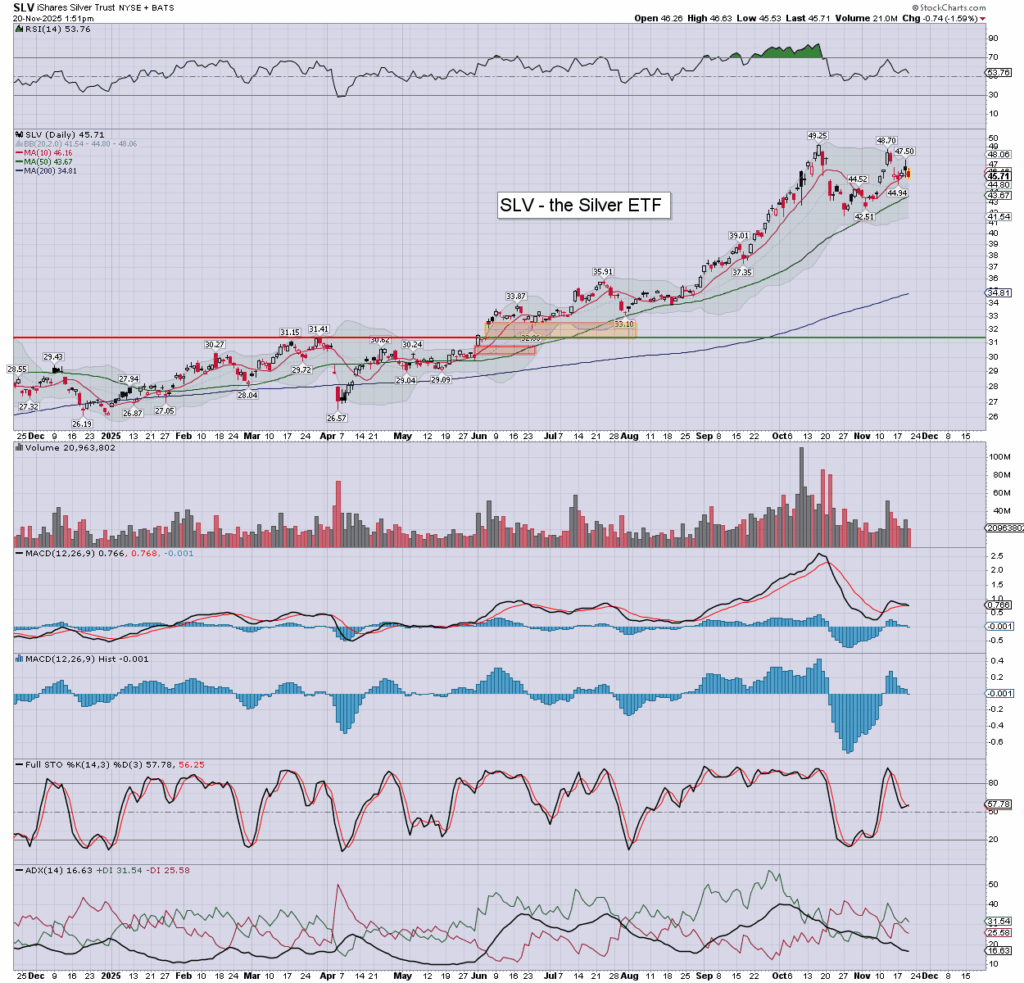

SLV daily

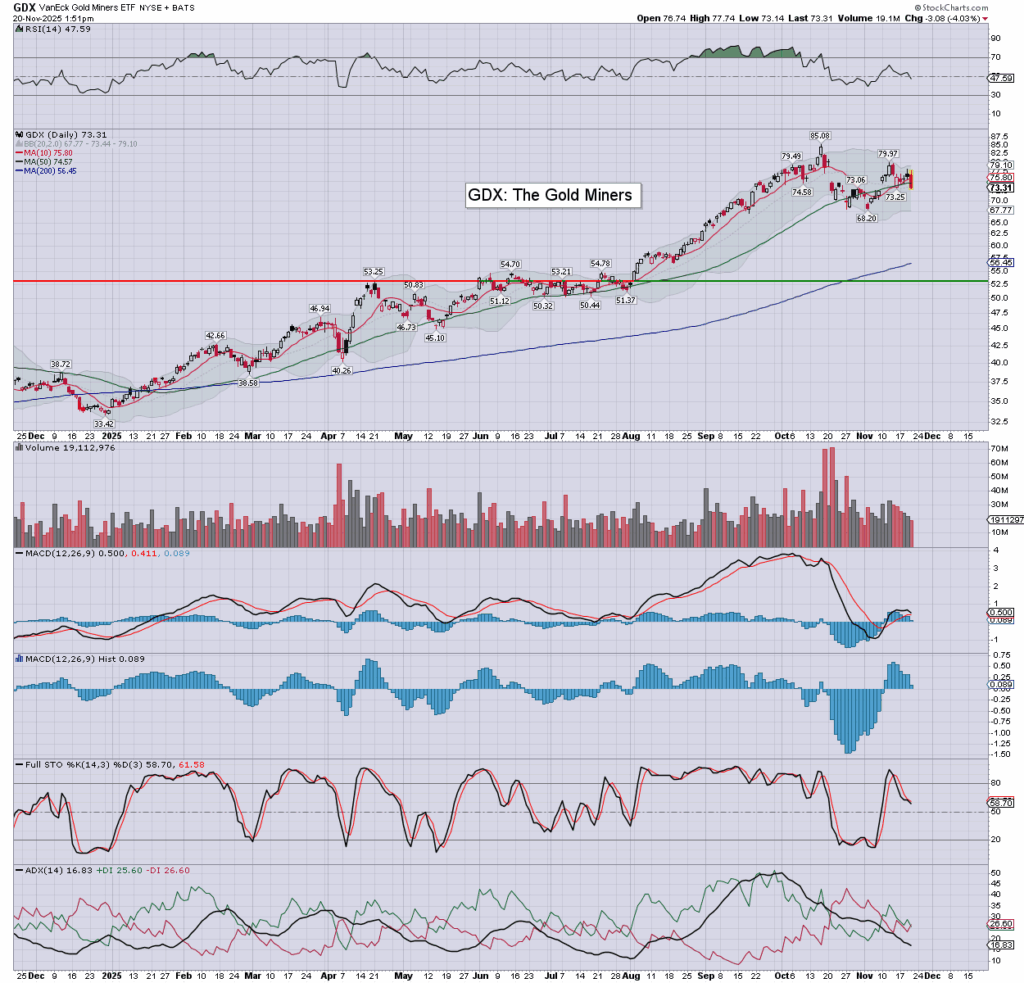

GDX daily

Summary

*it remains the case, if you’re bearish equities, you can’t be bullish silver, the miners, and to a lesser extent… gold. If SPX 6200, then silver 40/39, and gold $3500s ?

—

Gold/GLD: moderately lower, currently around $4058. Yesterday’s black candle played out.

Silver/SLV: sig’ lower, currently around $50.39. Yesterday’s black candle played out.

GDX: miners are powerfully lower, dragged down by gold/silver, and especially the main market. Yesterday’s black candle played out.

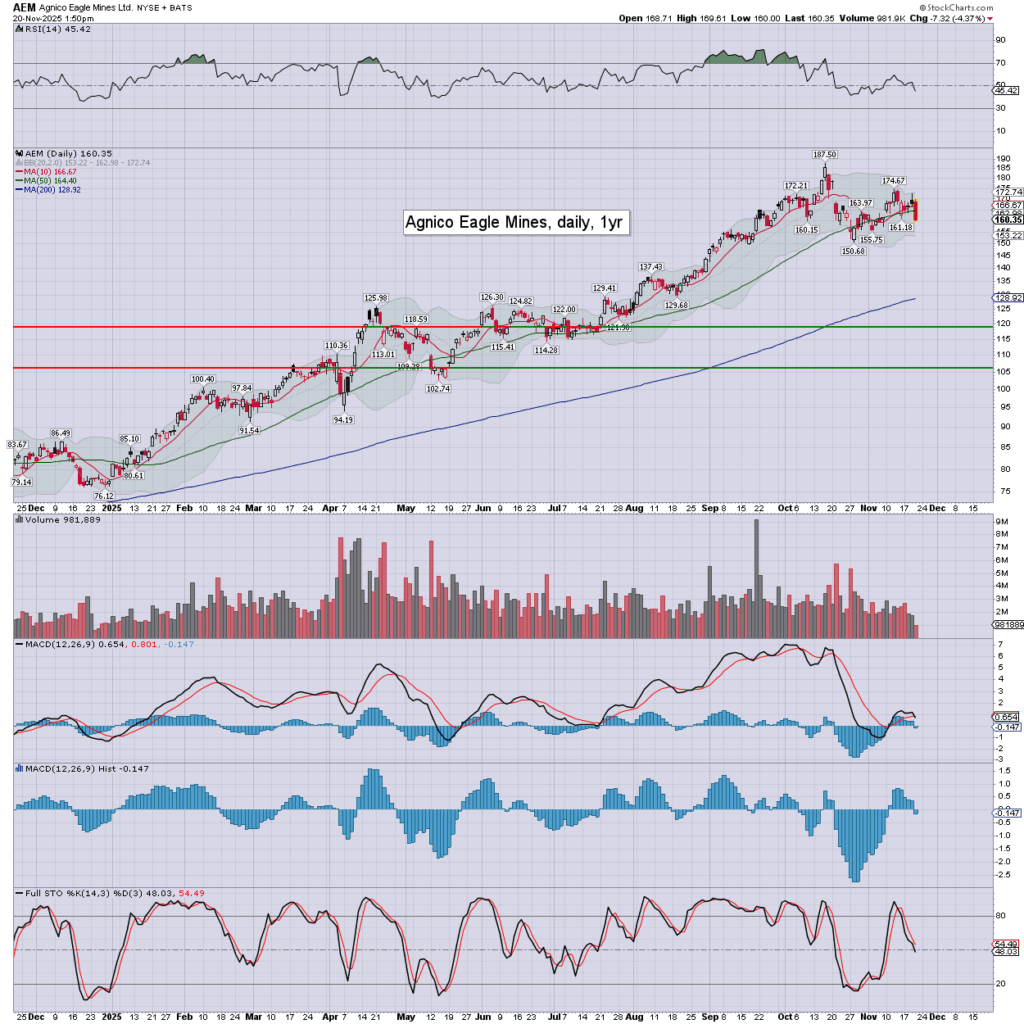

notable gold miner: AEM

Reflective of the sector. Daily momo has turned negative.

–

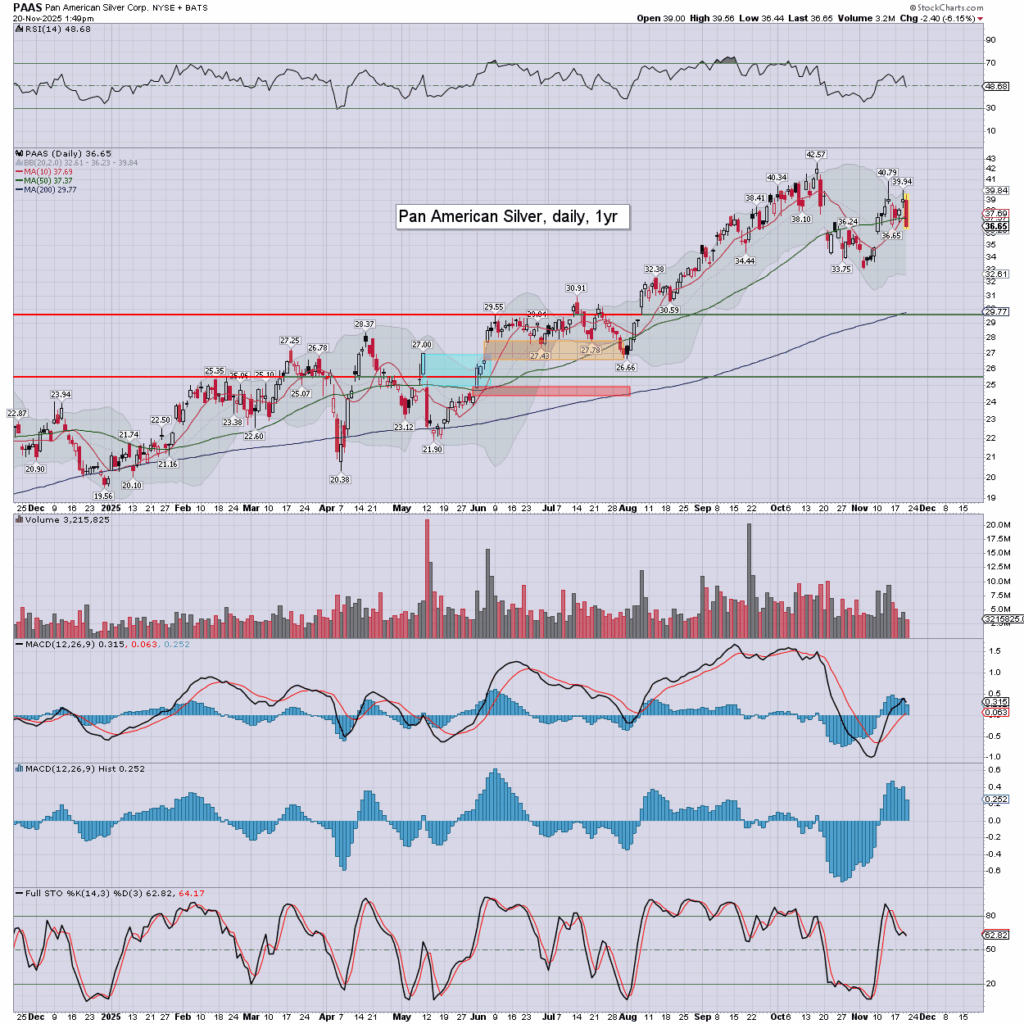

notable silver miner: PAAS

Leading the silver miners lower.

–

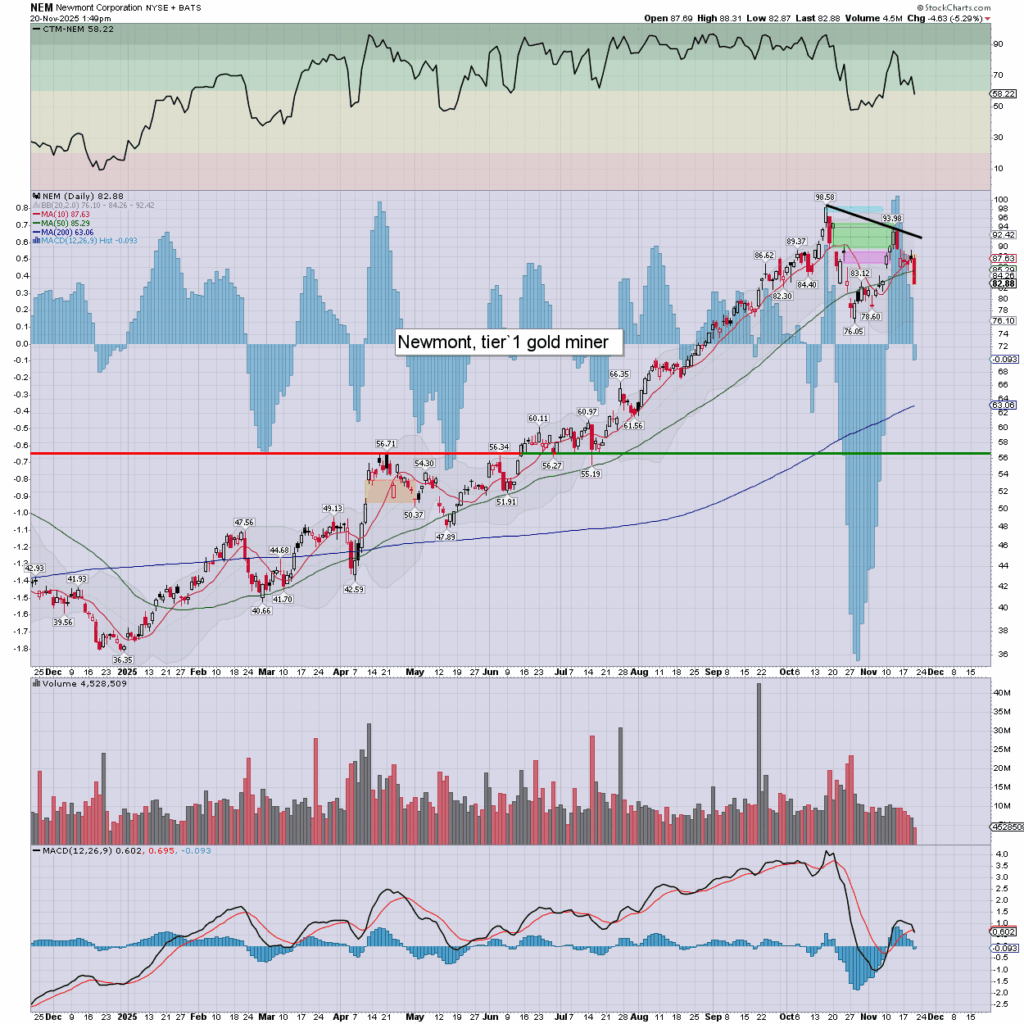

notable miner: NEM

Yesterday’s black candle played out.

Daily momentum has turned negative.

–

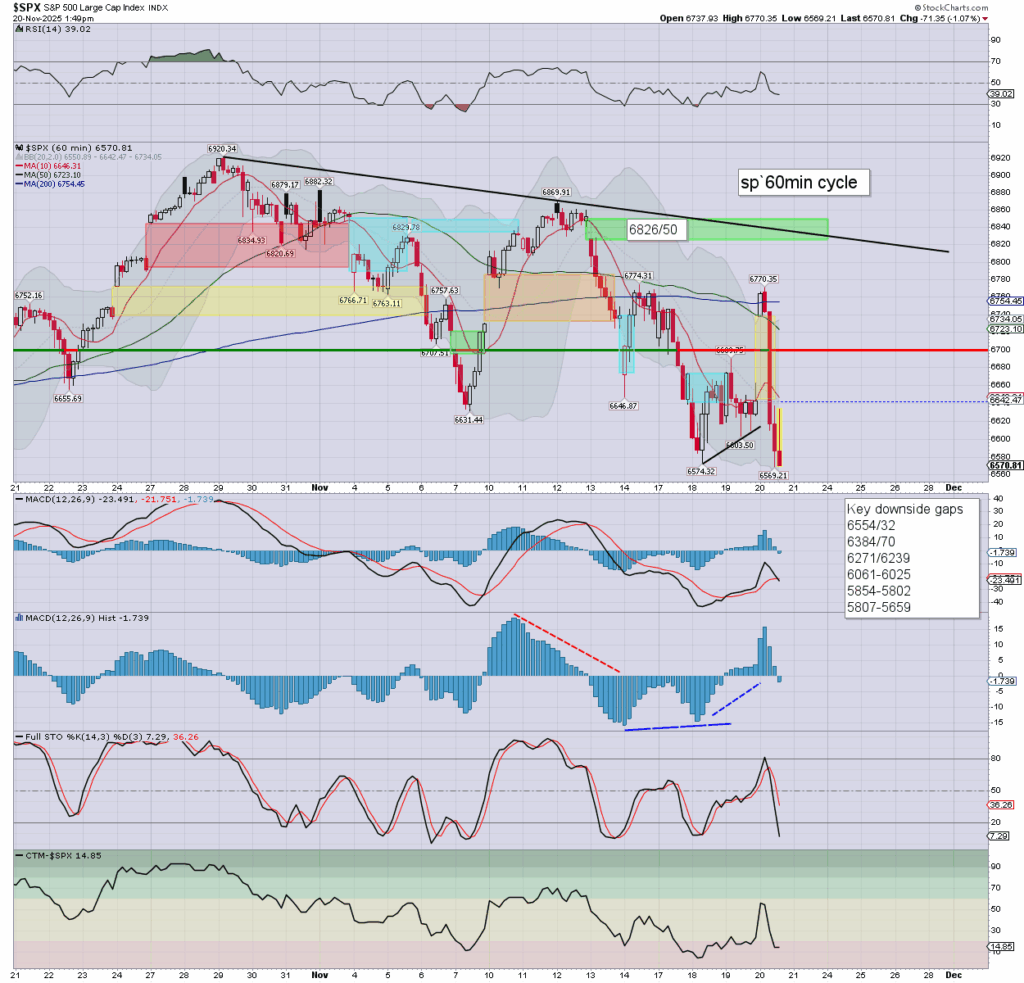

Equities: sp’60min

A bounce attempt… but failing, as s/t momentum has turned negative.

Regardless of the exact close, the powerful downside reversal makes it a net bearish day.