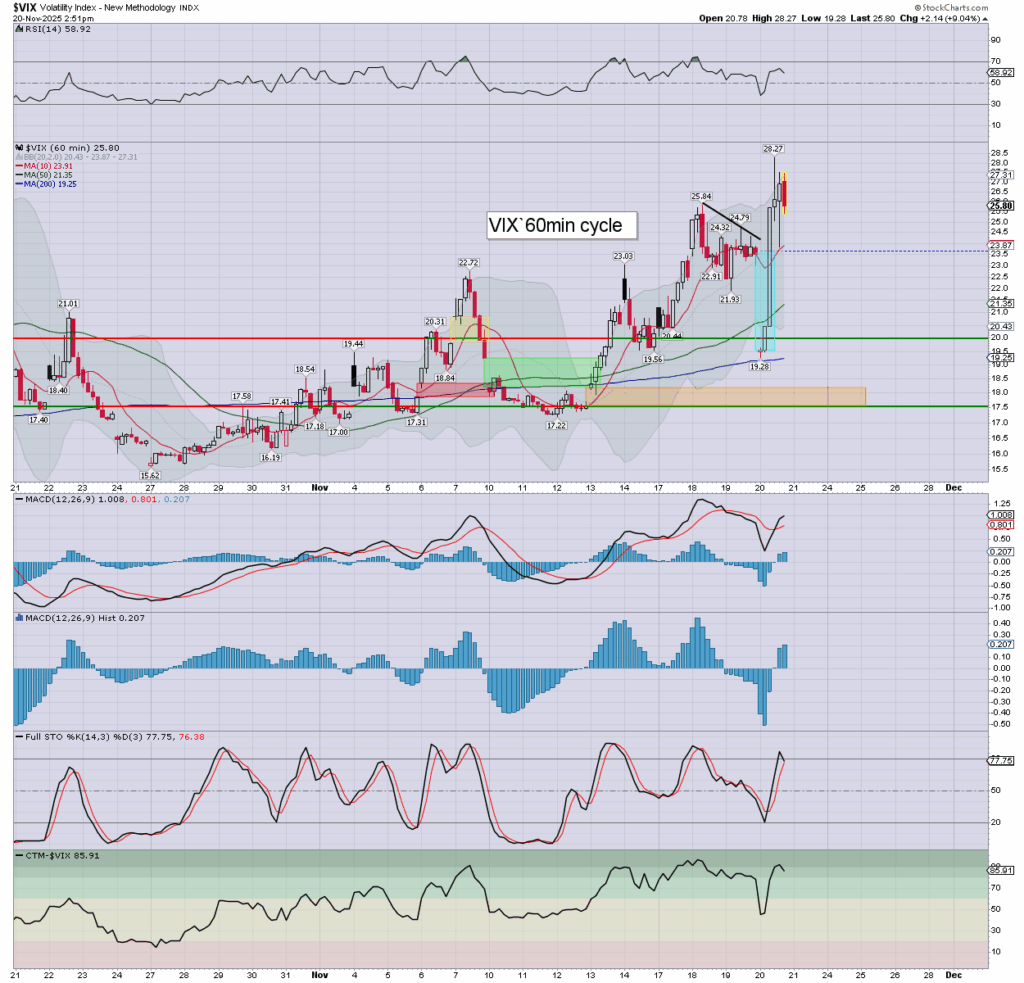

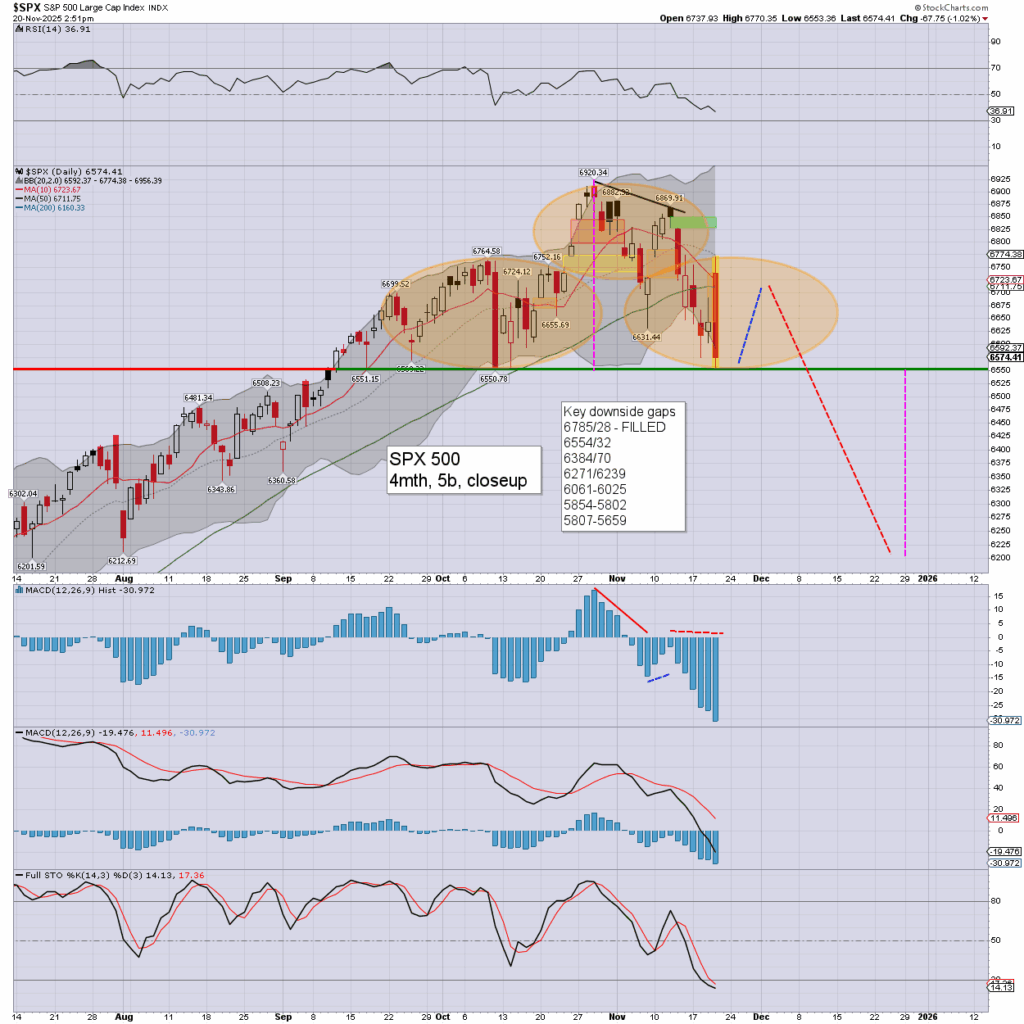

US equities are set for sig’ declines… an ugly downside reversal of 217pts. VIX 19>28s, if due to cool back toward the key 20 threshold.

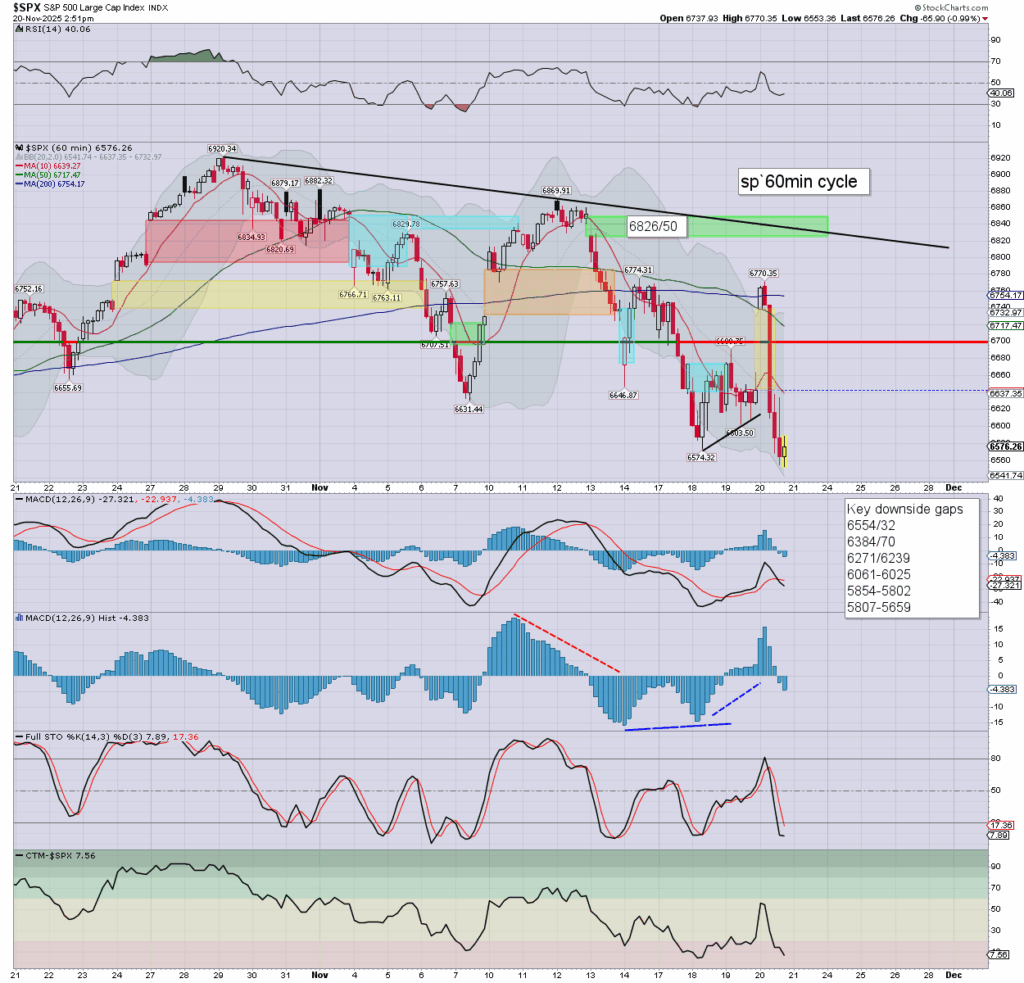

sp’60min

VIX’60min

Summary

Whilst Thursdays do tend to lean to the bears, today’s reversal was a very powerful one, as reflected in the VIX.

The s/t cyclical setup favours the bulls.

Friday OPEX offers a bounce.

Best guess… a pin around 6650, decisively below multiple supports, which will give bearish clarity into year end.

—

*yours truly isn’t short… but on the plus side, neither am I getting ground down via SLV CALLS. At least I had the sense to bail on those early Tuesday.

There is a viable H/S in the SPX. If we hold 6550s… then the more cautious bears (yours truly included) could try to short on a bounce from around the 50dma (6700s) next week.

—

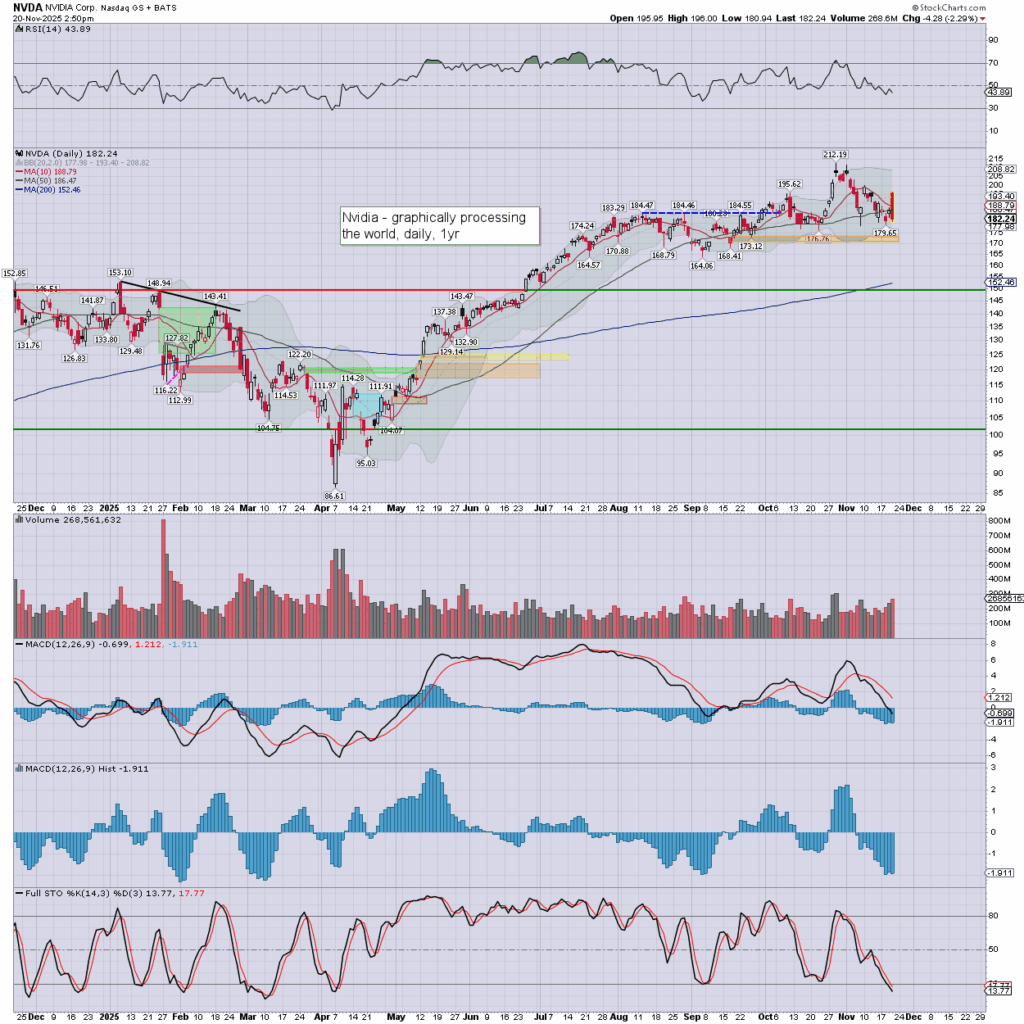

notable stock: NVDA

One thing is certain, its going to settle below the opening high.

–

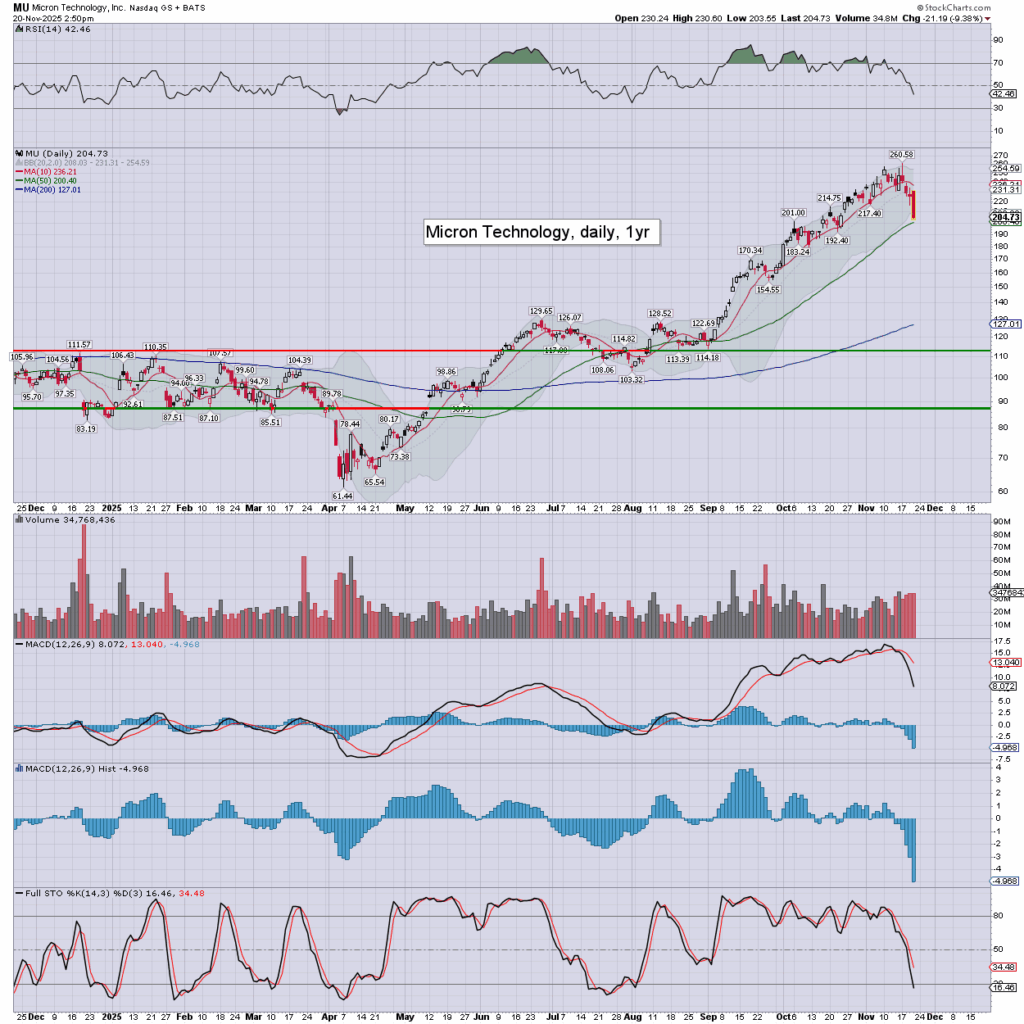

notable semicon: MU

S/t tech bulls getting washed out.

–

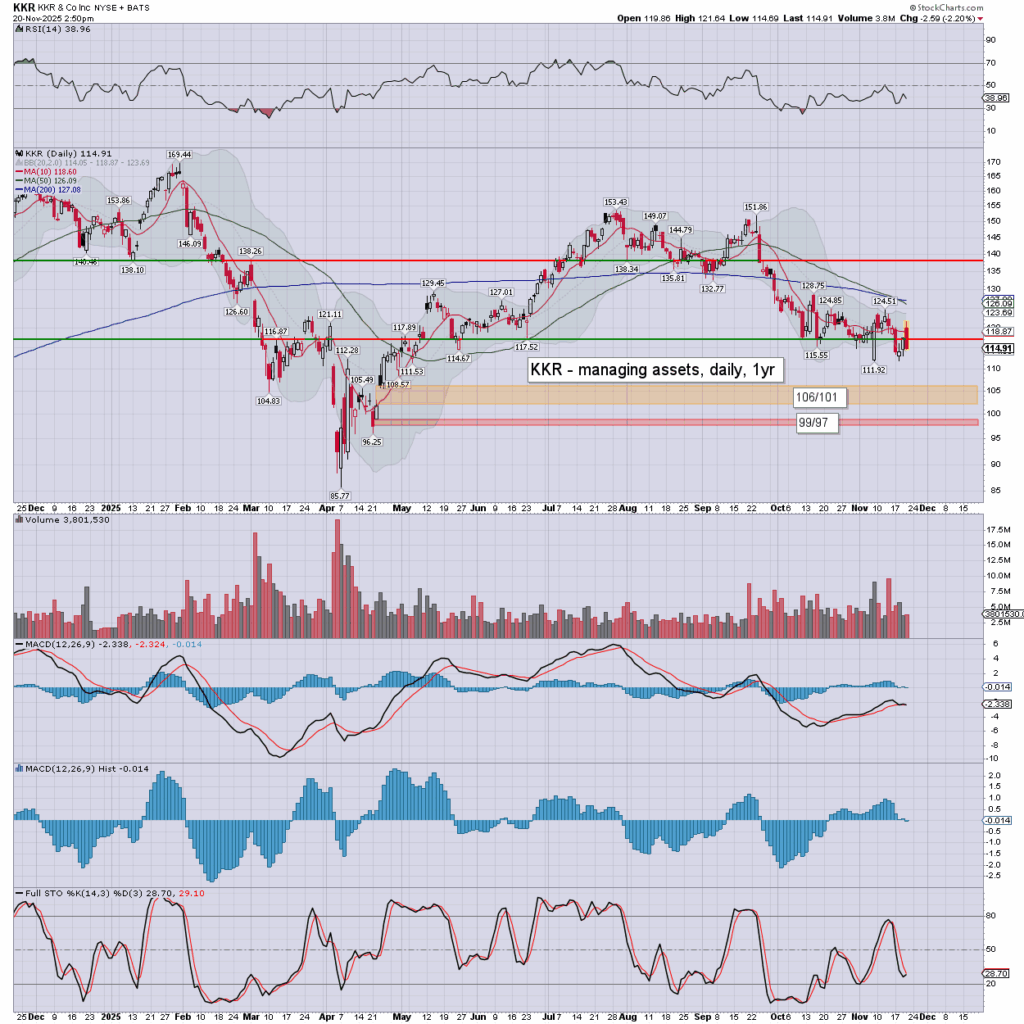

notable fin: KKR

Psy’ $100 appears an eventuality.

–

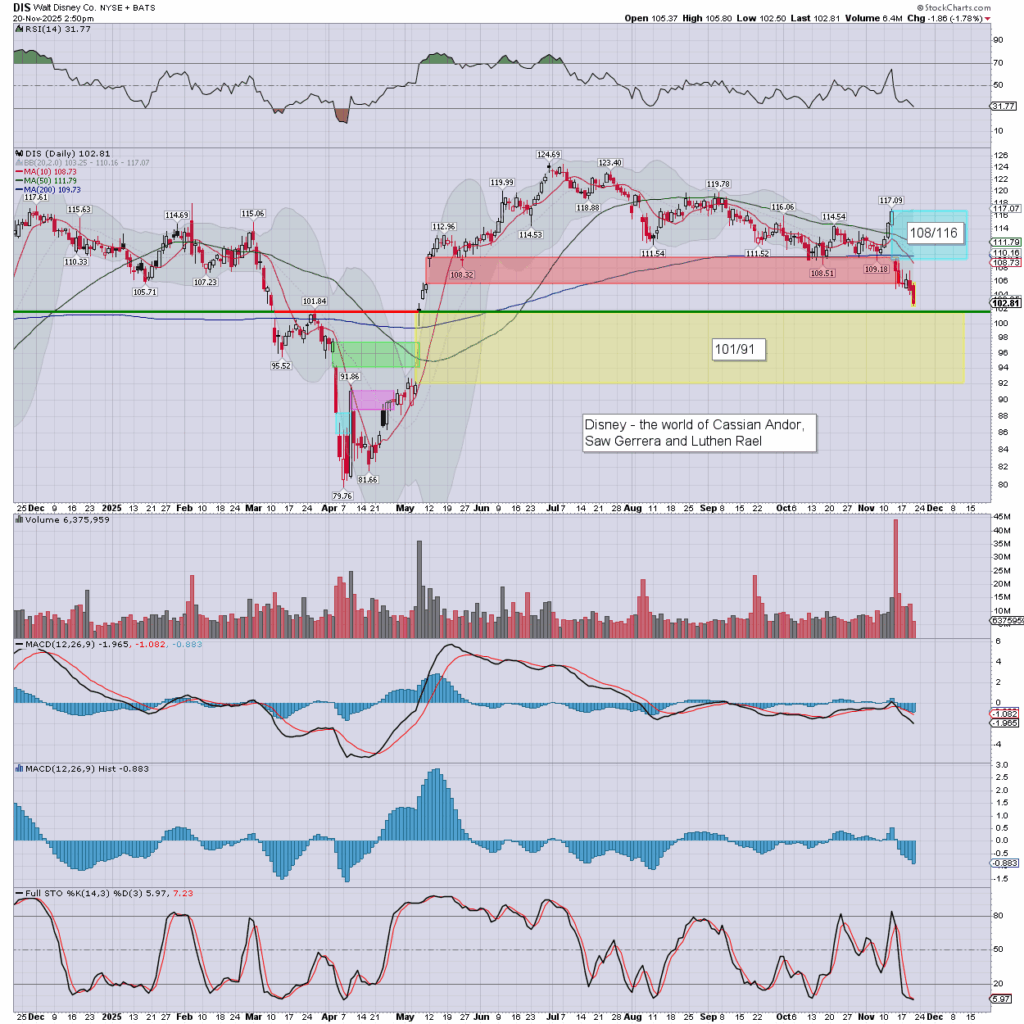

notable Dow component: DIS

New multi-month low.

Yellow gap to fully fill with SPX 6200s.

back at the close…