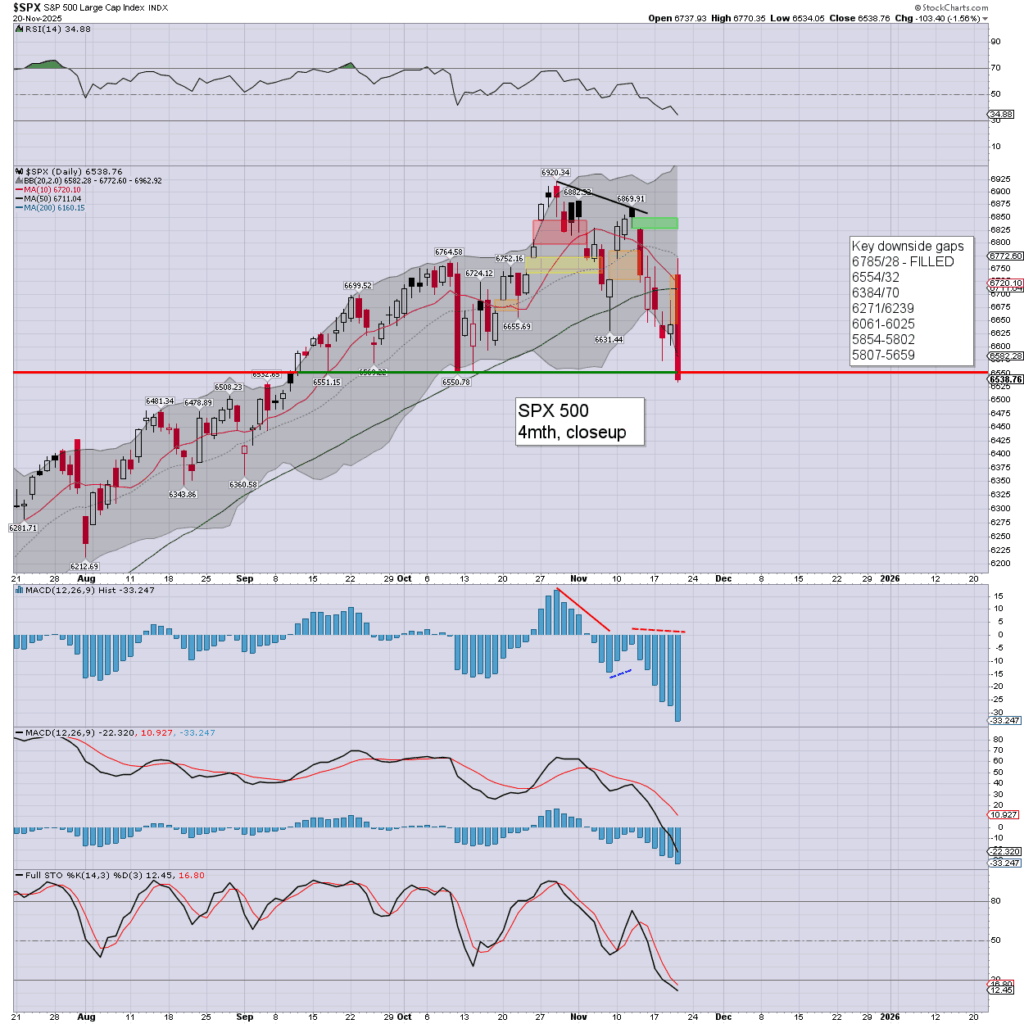

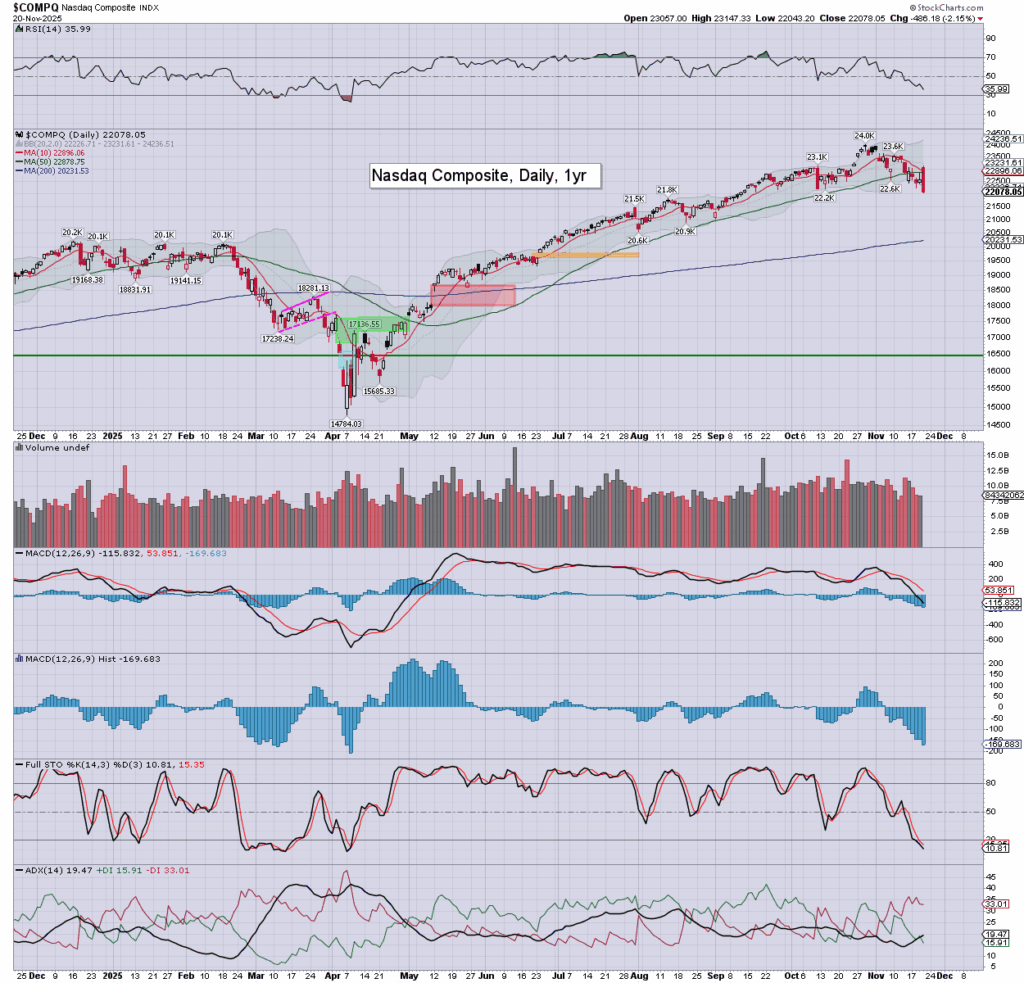

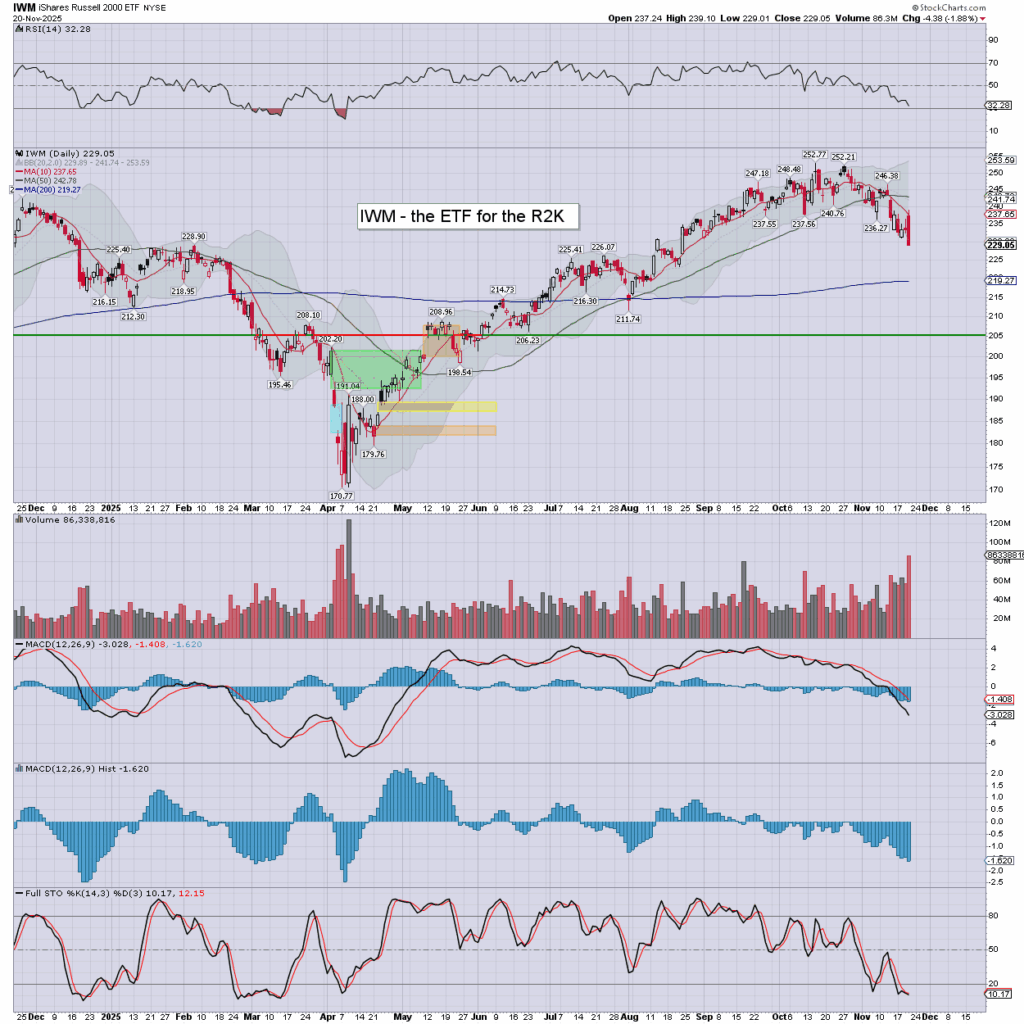

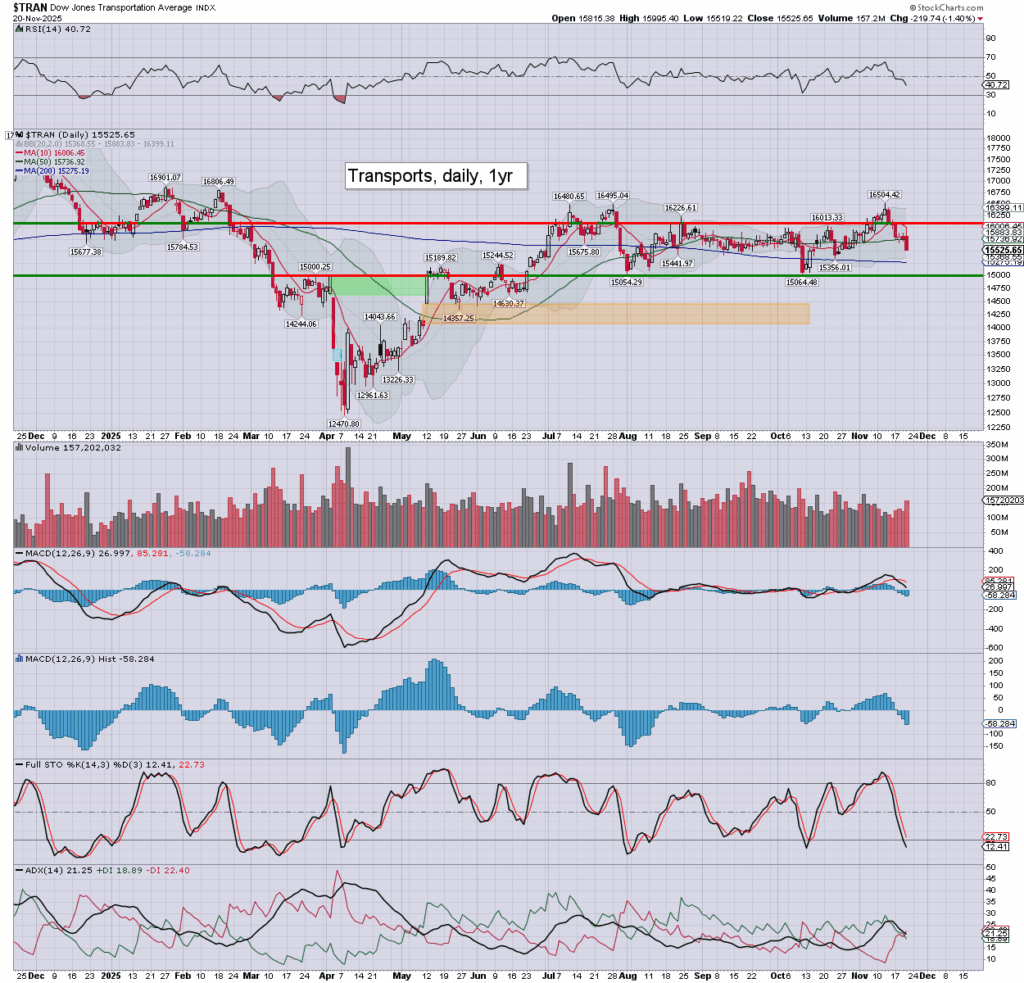

US equity indexes mostly closed significantly lower, SPX -103pts (1.6%) at 6538. Nasdaq comp’ -2.1%. Dow -0.8%. The Transports settled -1.4%. R2K -1.9%

sp’daily5

nasdaq comp’

r2k

transports

Summary

SPX: an early high of 6770, but swinging powerfully lower to 6534, and settling -1.6% to 6538. The break of the Trump-tariff low of 6550 is significant. Today’s candle is bearish engulfing, and I’d note the 200dma in the 6160s.

NAS: an early high of 23147, but swinging powerfully lower to settle -2.1% to 22078. Today’s candle is bearish engulfing, and I’d note the 200dma in the 20200s.

R2K: an early high of 239.10, but settling -1.9% to 229.05. Today’s candle is bearish engulfing, and I’d note the 200dma in the 219s.

Trans: a sixth consecutive daily decline, settling -1.4% to 15525. Today’s candle is bearish engulfing, with an upper spike from the 10MA. Soft support 15K.

–

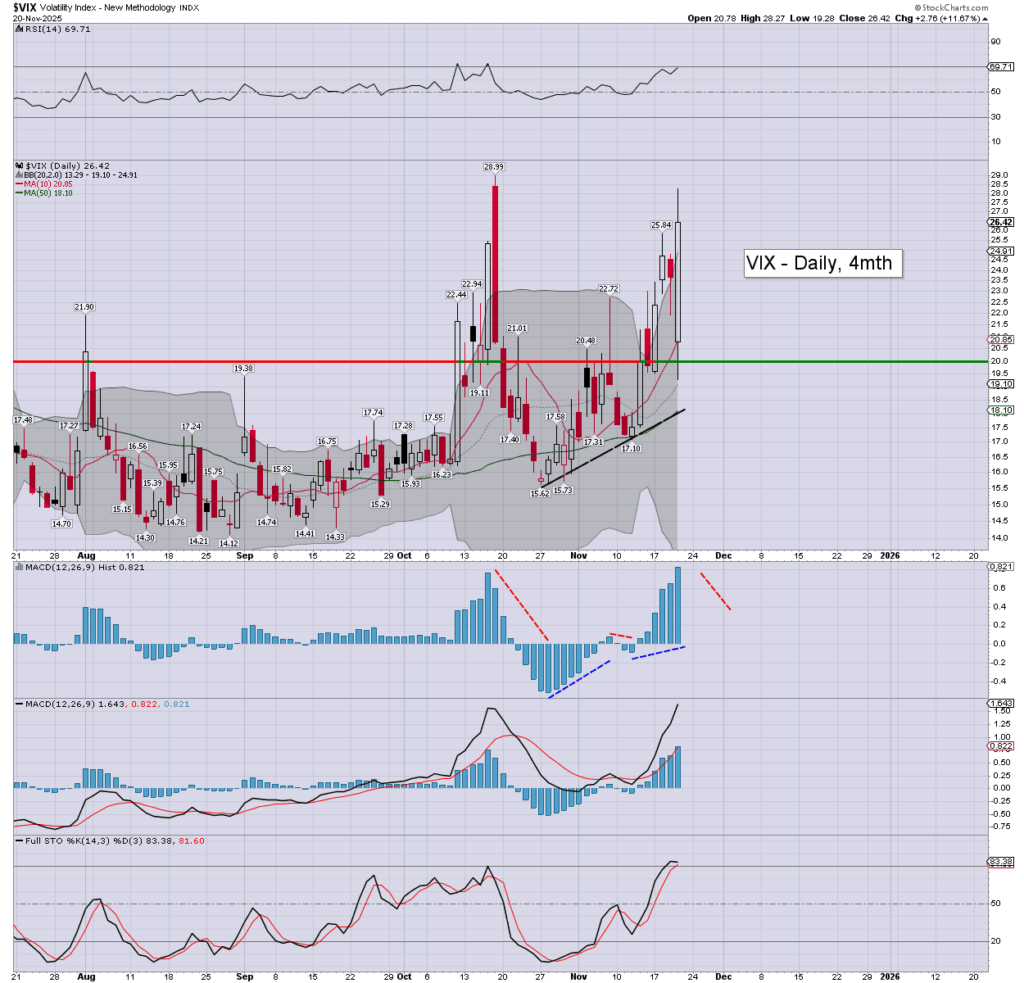

VIX’daily

Volatility saw an early low of 19.28, spiking to 28.27, and cooling back to settle +11.7% to 26.42. Daily momentum accelerated upward, and is on the high side. Today’s candle is bullish engulfing – an appropriate mirror to the bearish engulfing SPX candle.

A weekly VIX settlement above the key 20 threshold appears a given, and bodes broadly bearish equities into December. We can start to think about VIX 40/50 before Santa delivers.

–

Looking ahead by 6pm EST