Good morning. US equity futures are fractionally higher, SPX +15pts, we’re set to open at 6553. USD is +0.2% at DXY 100.28. The precious metals are broadly lower, Gold -0.4% (printing a low of $4022), with Silver -2.2% (printing a low of $48.62). WTIC is -0.6% in the low $58s (printing a low of $57.42).

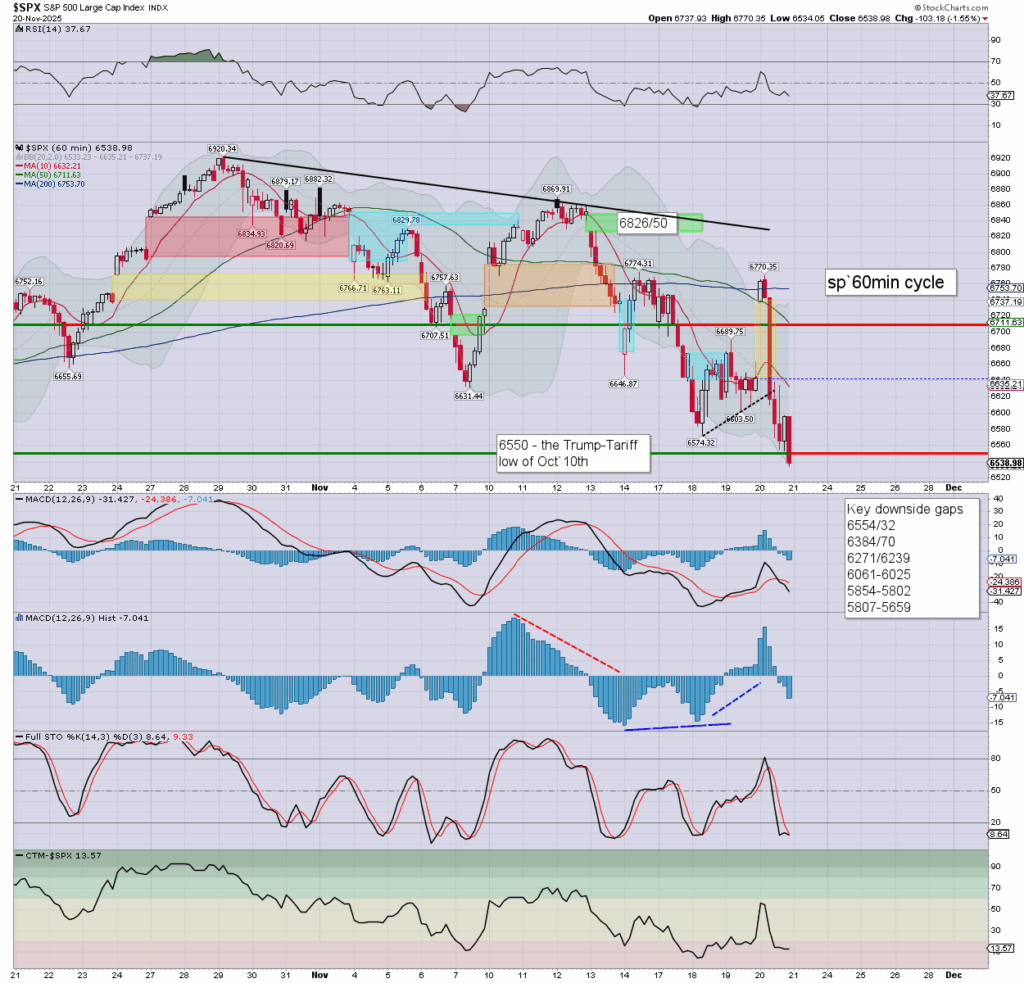

sp’60min

Summary

Yesterday saw a powerful downside reversal from 6770 to 6534, and settling at 6538. S/t momentum settled on the moderately low side.

Overnight futures have been choppy, we’re set to open +15pts or so.

Considering yesterday’s daily bearish engulfing candles, we should expect most things to be red at some point in early morning.

I equally expect an upside reversal, as we’re clearly s/t oversold, and its not bold to guess we settle positive.

Its OPEX… look for a pin around 6550 or 6600 on a stretch. A weekly close <6690 (as appears assured) would make for a decisive bearish weekly settlement, with broader bearish implications for December.

Yours truly is merely looking for an acceptable time/level to short an index. The time is not OPEX, and the 6530s are too low. So… I’ll wait until Monday.

—

Early movers

ALB -4.0%

AMD -0.6%

B -0.6%

–

BJ +1.6%, EPS $1.16 vs 1.09est. Rev’ y/y +2.4% to $5.22bn vs 5.34est. Marginally positive guidance.

–

BMNR -3.3%

–

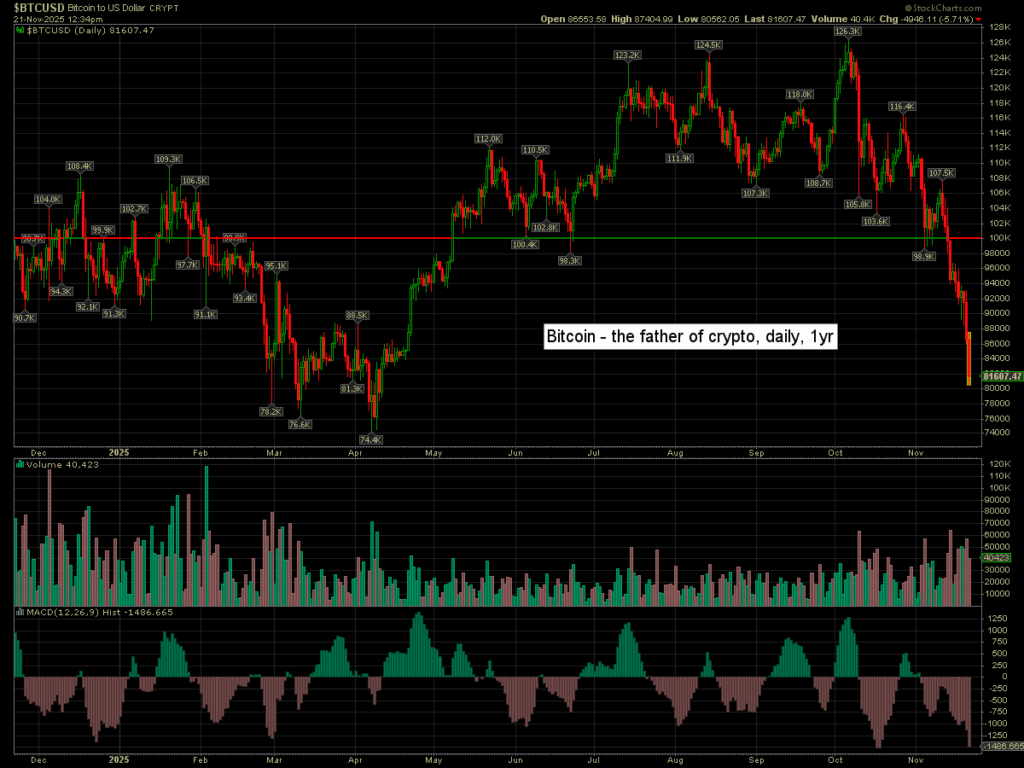

COIN -2.2%

Bitcoin is -5.7% at $81K

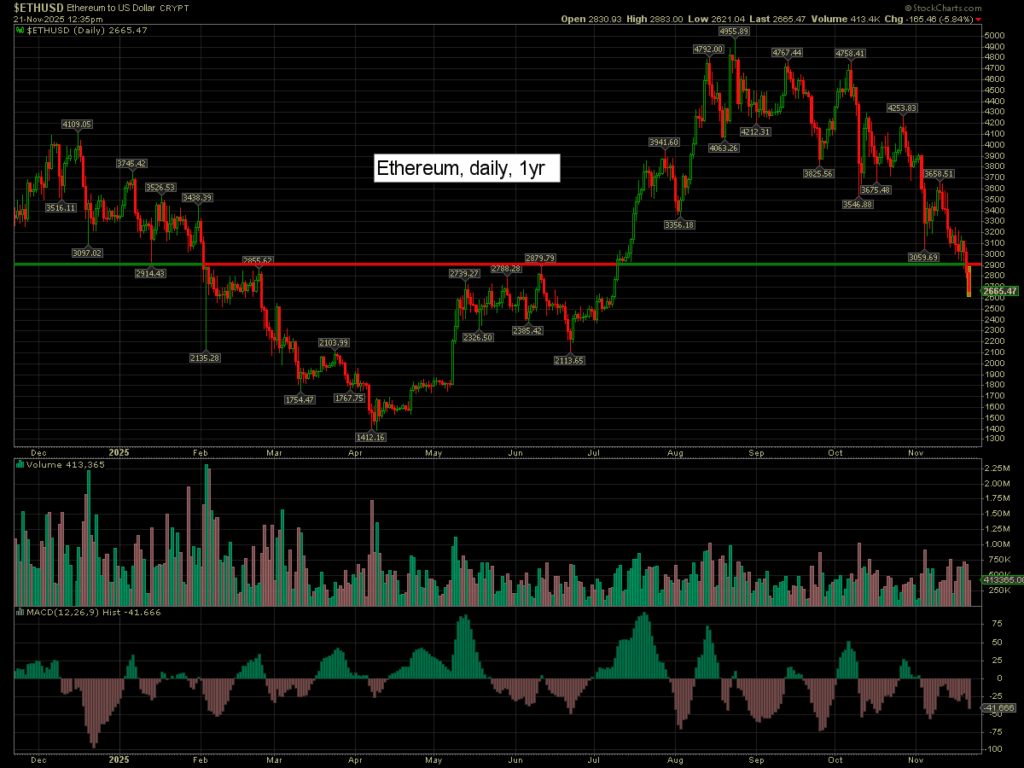

Ethereum is -5.8% at $2665

–

DEO +3.1%

–

GAP +4.6%, earnings (Thurs’ AH), EPS 62cents vs 59est. Rev’ y/y +2.9% to $3.94bn vs 3.91est. Positive guidance.

–

GOOGL +0.4%

HMY +1.9%

INTU +3.2%, post earnings gains

–

META -0.5%

MSTR -4.0%

MU -0.8%

–

NVDA -1.6%

NWG +2.3%, bouncing UK fins

OXY -0.3%

PLTR -0.9%

–

ROST +2.3%, earnings (Thurs’ AH), EPS $1.58 vs 1.41est. Rev’ y/y +10.4% to $5.60bn vs 5.41est. Positive guidance

–

TSM -1.5%

–

VIX +4.3% at 27.56… I would look for the VIX to settle red.

–

XPEV -1.9%

—

Overnight markets

Asian markets were very significantly lower, whilst European markets are broadly lower…

Japan: -2.4% to 48625

China: -2.4% to 3834

Germany: currently -0.9% at 23069

UK: currently -0.4% at 9487

—

Have a good Friday