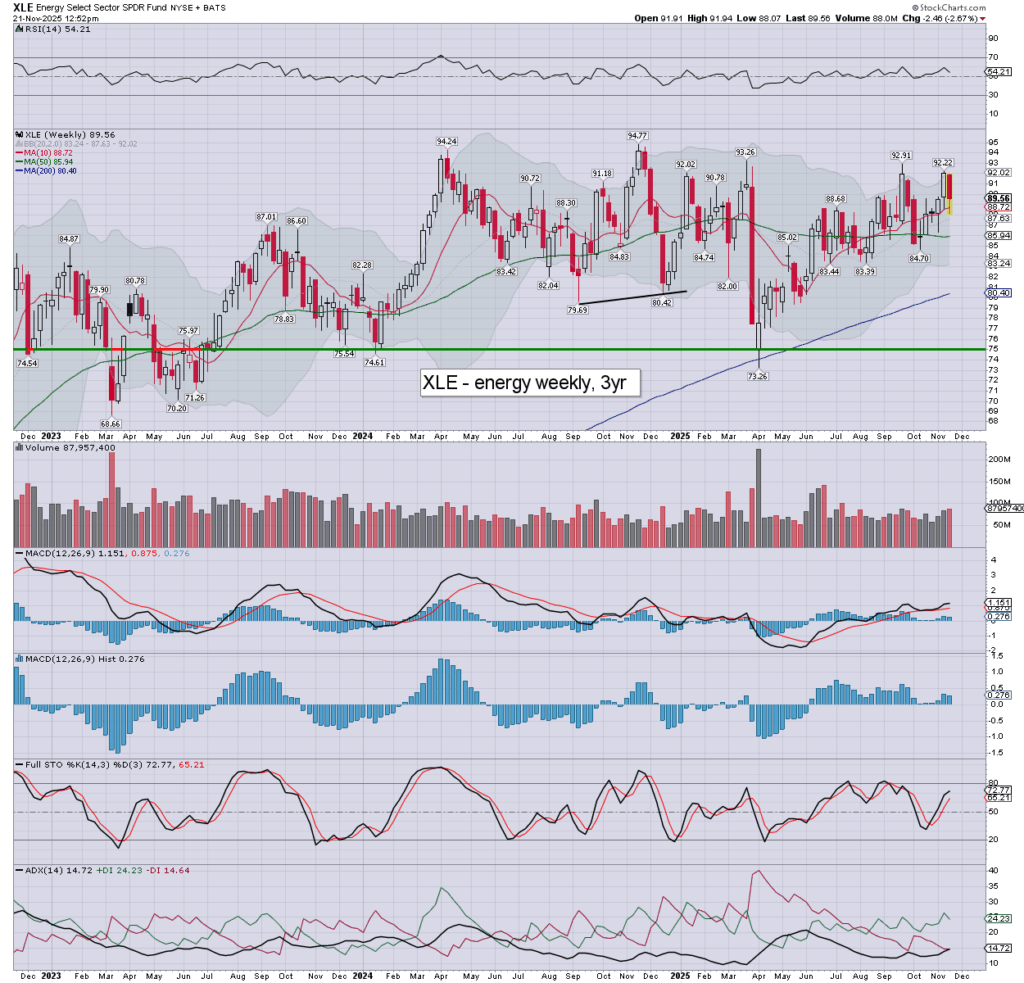

US equities are choppy, if broadly higher. Meanwhile, WTIC is currently -1.4% in the upper $57s. The energy sector ETF of XLE is currently net lower for the week by -2.7% at $89.56.

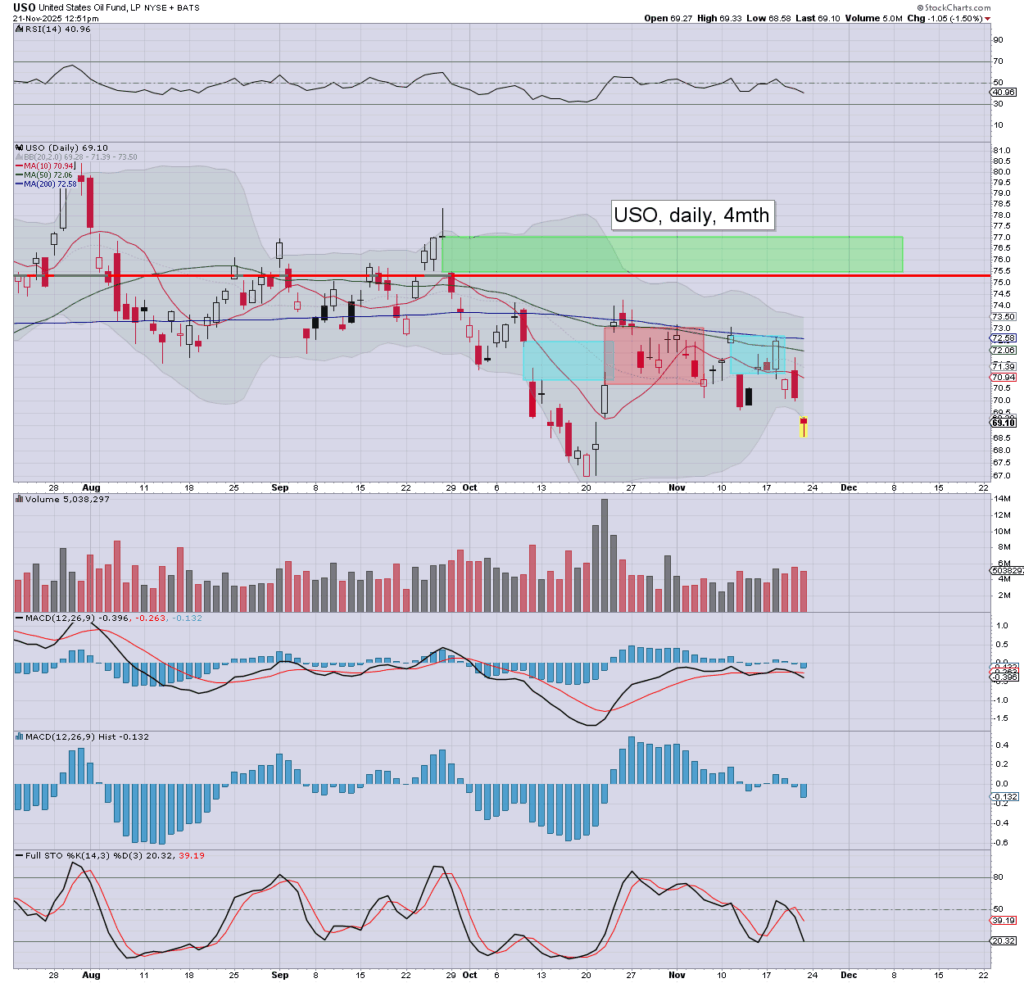

USO daily

XLE weekly

Summary

WTIC/USO: oil printed a low of $57.38, pressured by the shaky equity market, and the marginally stronger dollar. The $56s look set to fail… offering psy’ $50. On one level, El Presidente should be delighted… his friends in the energy companies… not so much.

XLE: energy stocks have rebounded with the main market, set for net gains of some degree.

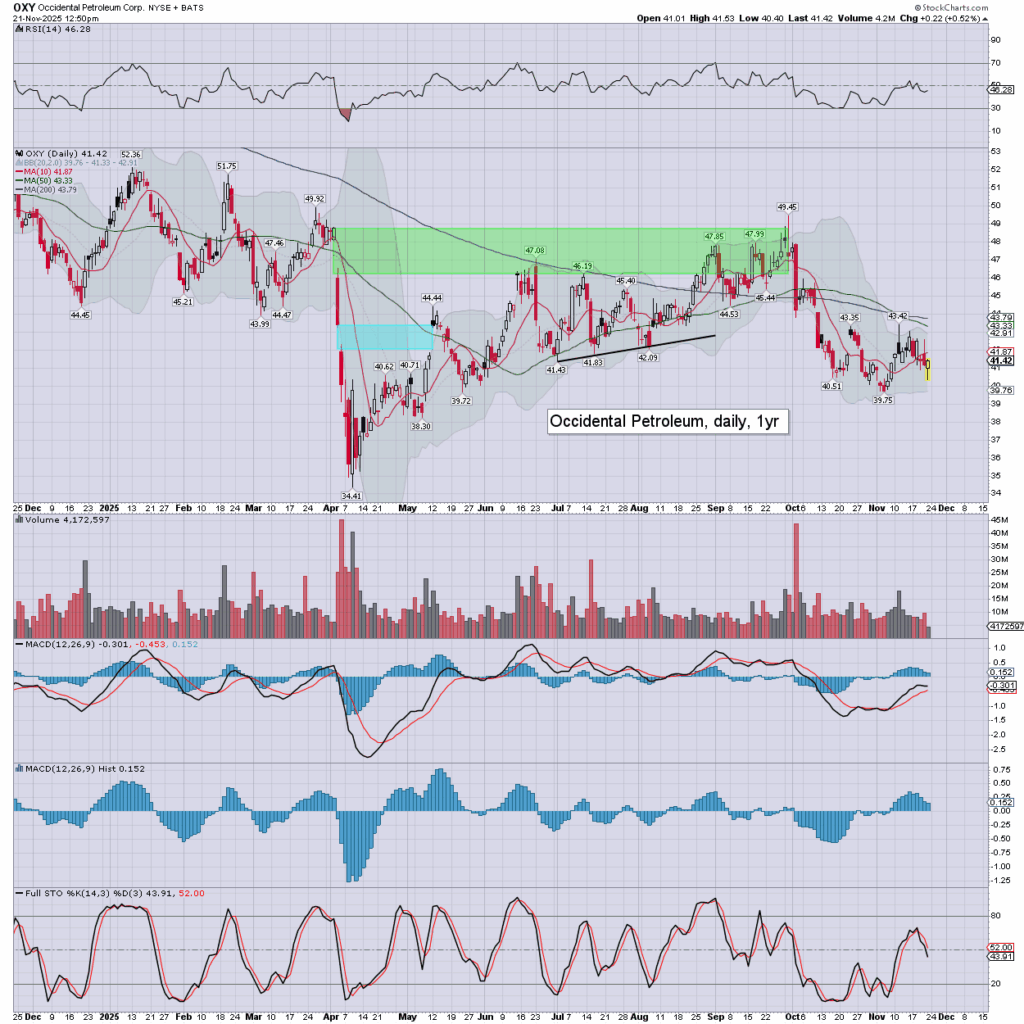

notable stock: OXY

Reflective of the sector.

–

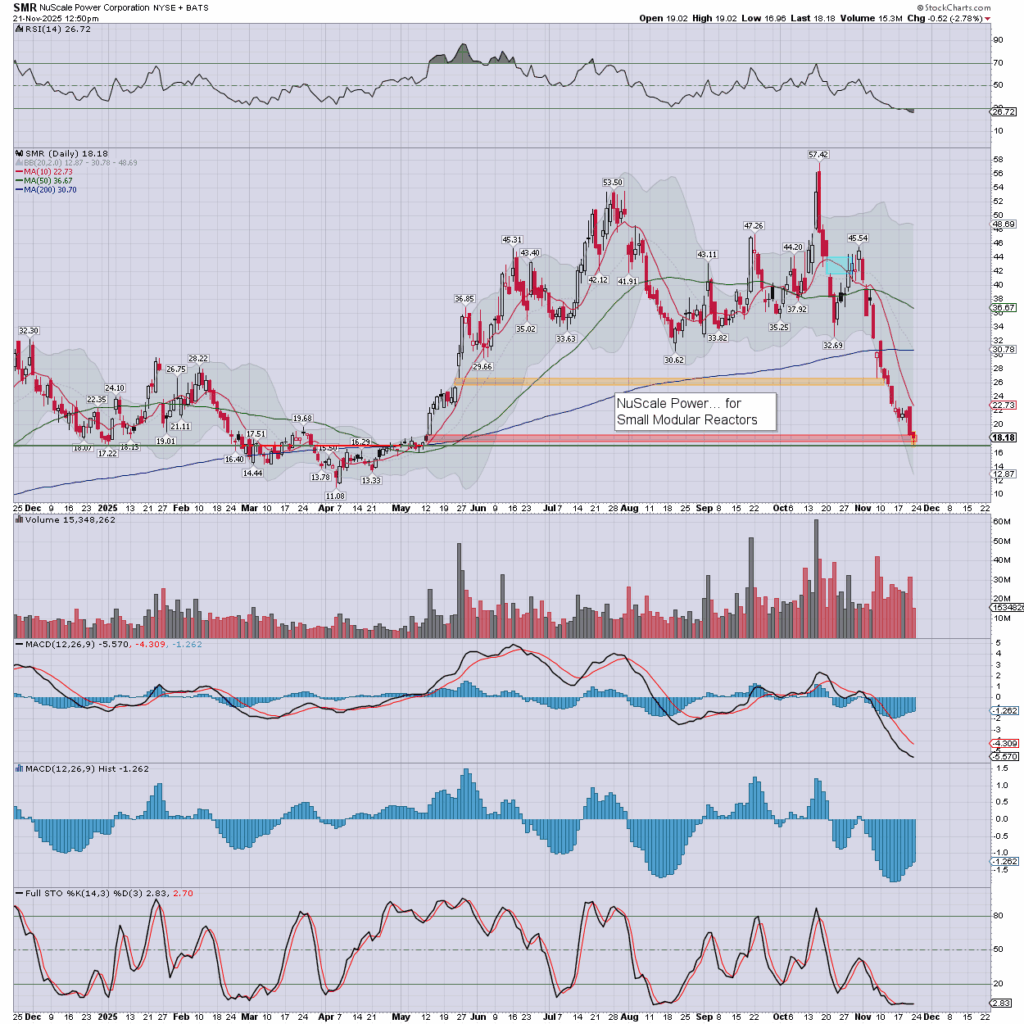

notable nuclear stock: SMR

A multi-month low of $16.96 ! Minor red gap filled… and that didn’t even need the SPX 6200s. I think a full retrace to the April $11s are coming.

—

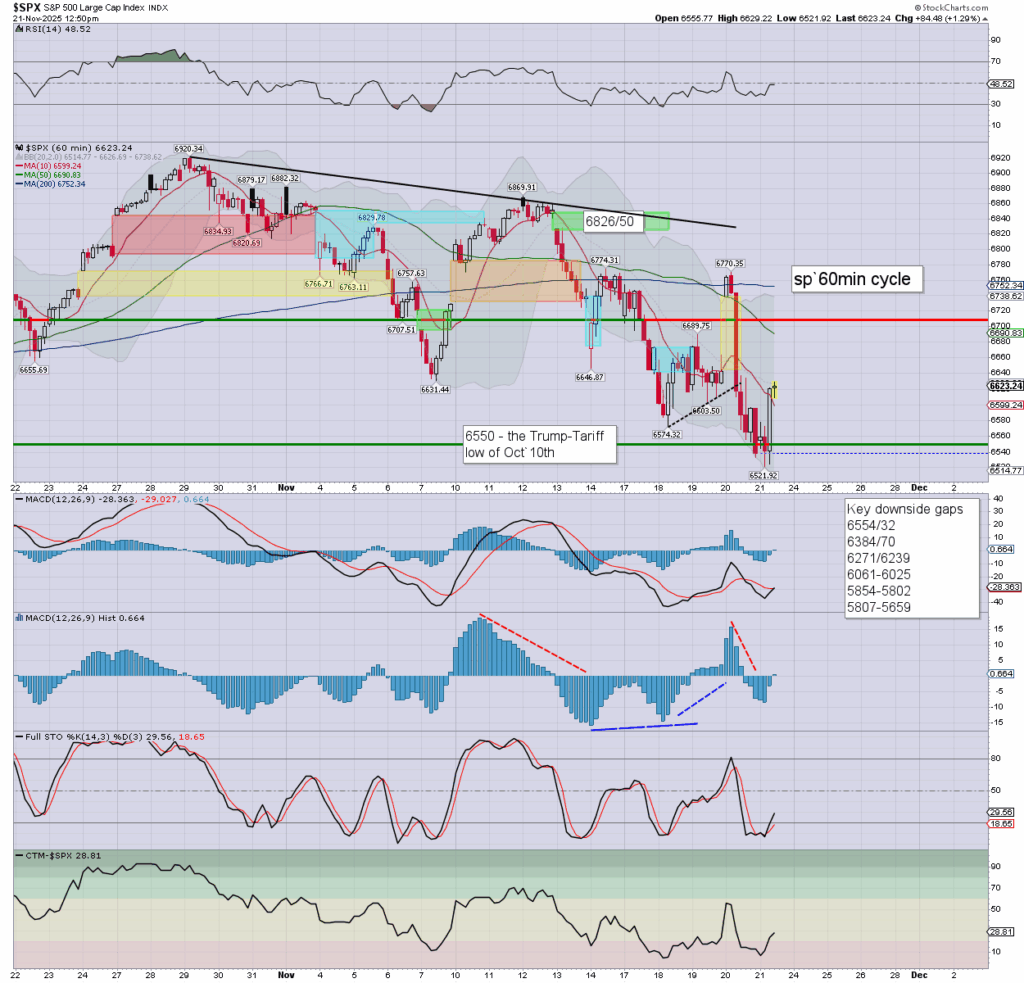

Equities: sp’60min

S/t momentum has turned positive.

Best guess… an OPEX pin around 6650.

6700 looks out of range, not least if we see some sellers into the weekend.