US equities are a little lower. Meanwhile, the precious metals are a little lower, Gold -$3 (0.1%), with Silver -0.5%. The miner ETF of GDX is currently -0.5% at $28.11.

Weekly charts for perspective…

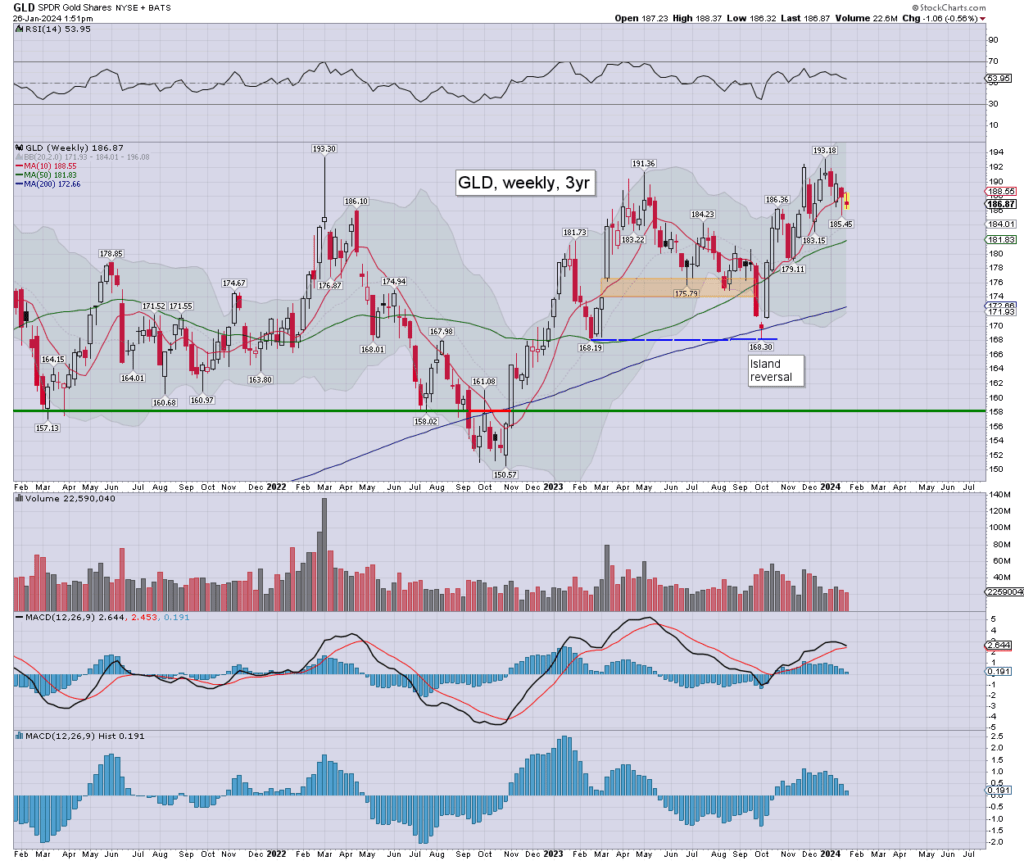

GLD

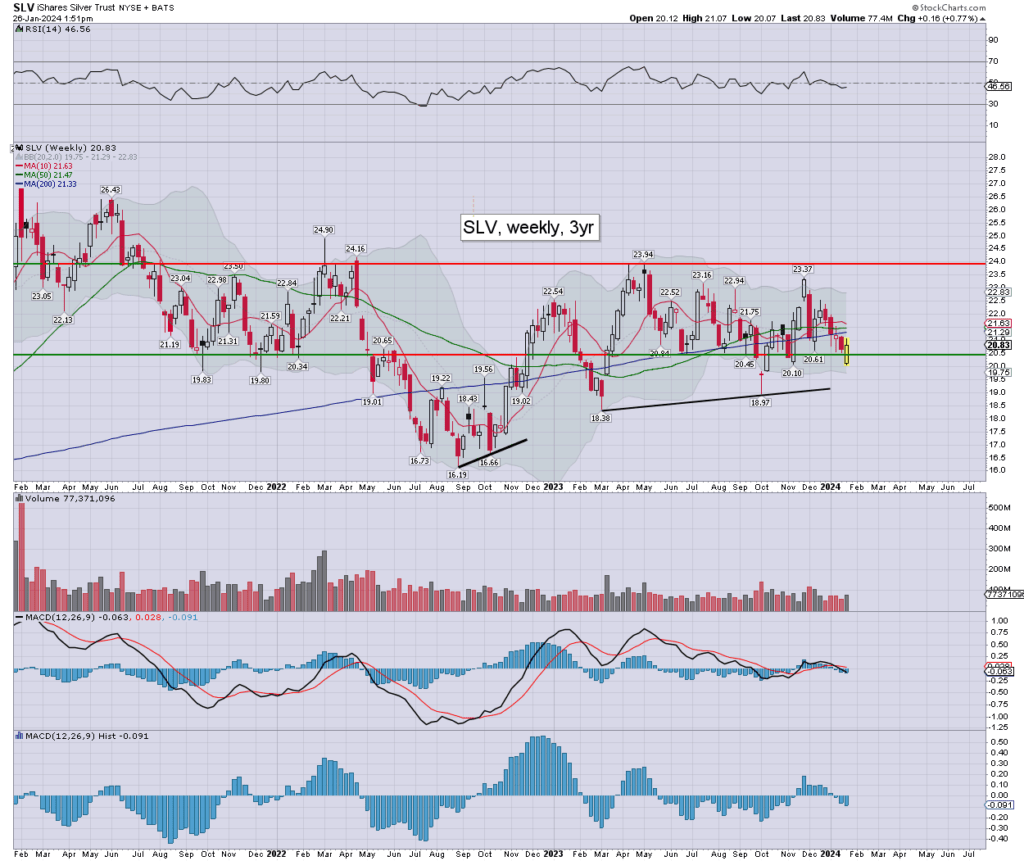

SLV

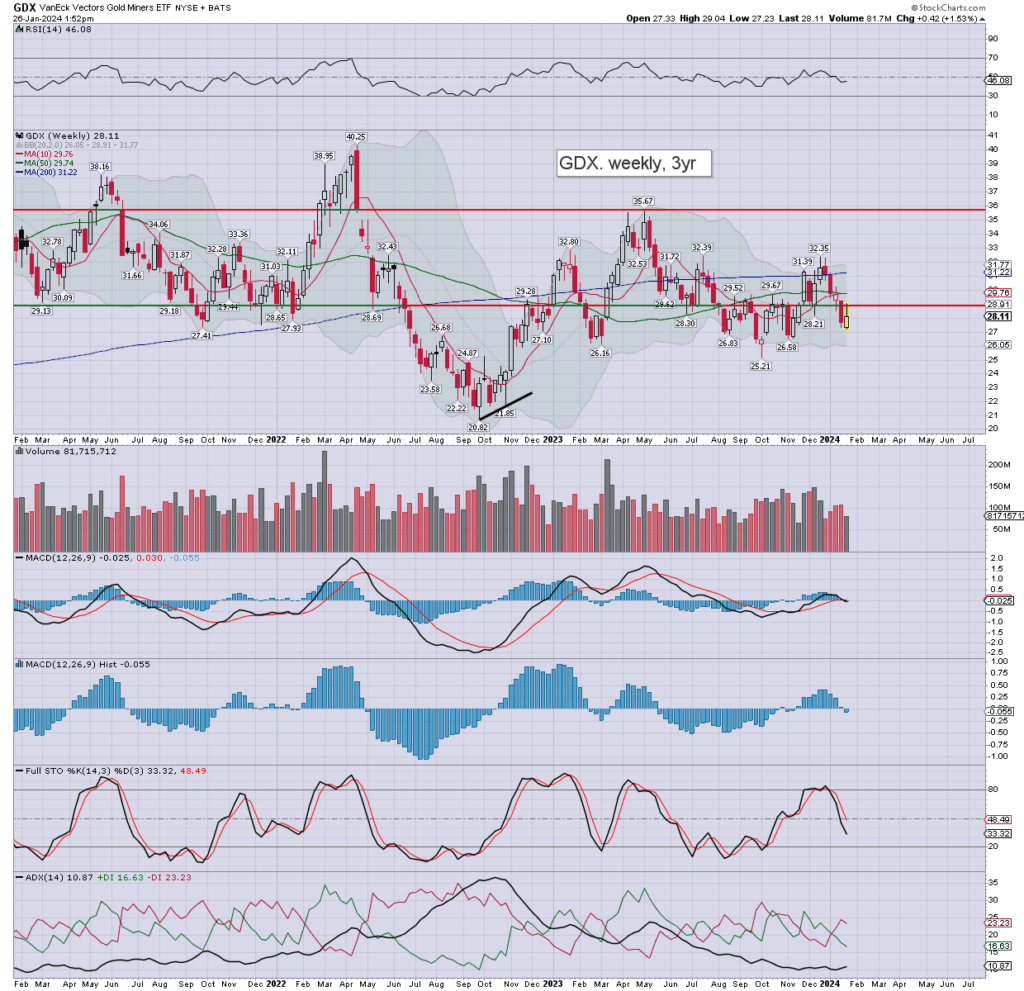

GDX

Summary

Gold/GLD: gold printed $2015… not great, but its still managing to hold above giant psy’ $2K. Set for a net weekly decline of -0.6%.

Silver/SLV: silver printed a low of $22.81. I’d still favour Gold. Set for a net weekly gain of +0.8%.

GDX: miners have seen early gains fully fade, not helped by gold/silver, and a marginally shaky main market. Set for a net weekly gain of +1.5%.

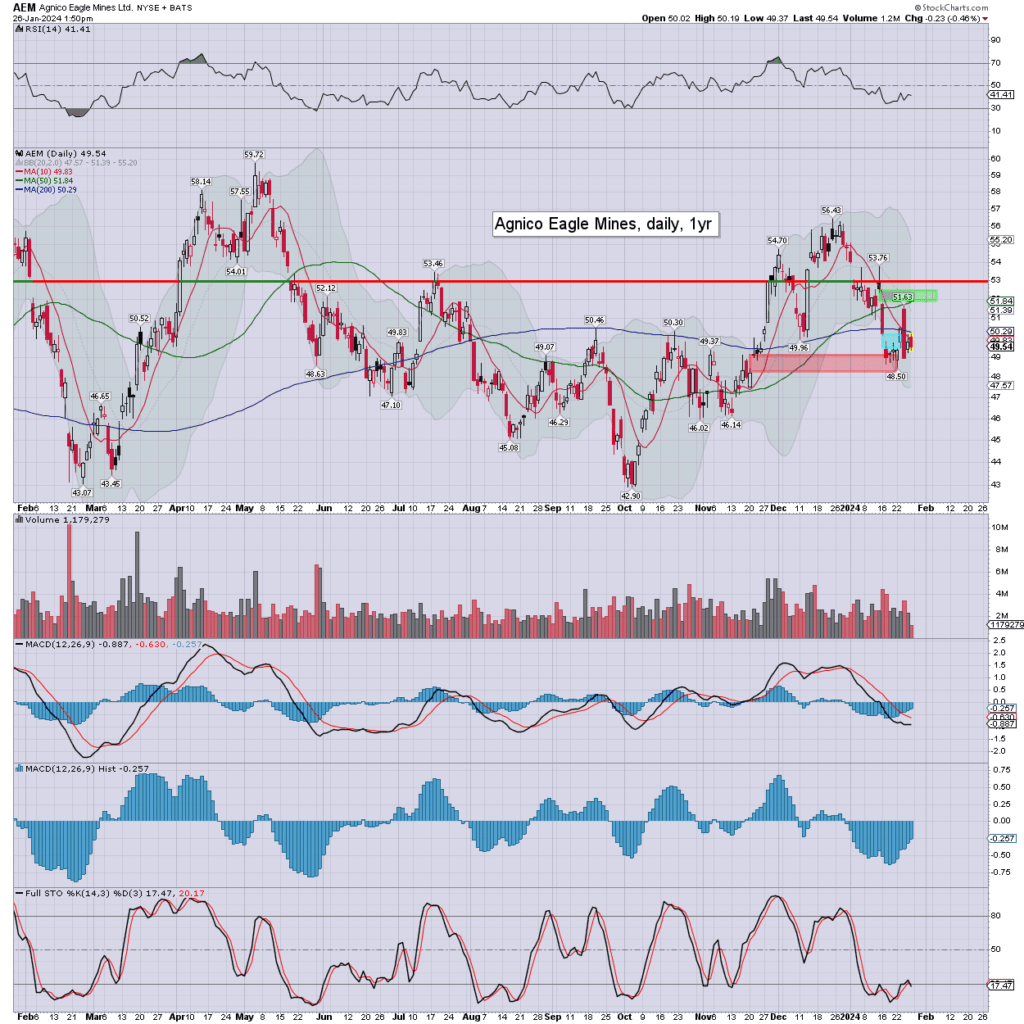

*I hold the quartet of NEM, GOLD, AG, HL. I’m tempted to buy back AEM, but not until next Monday.

notable gold miner: AEM

–

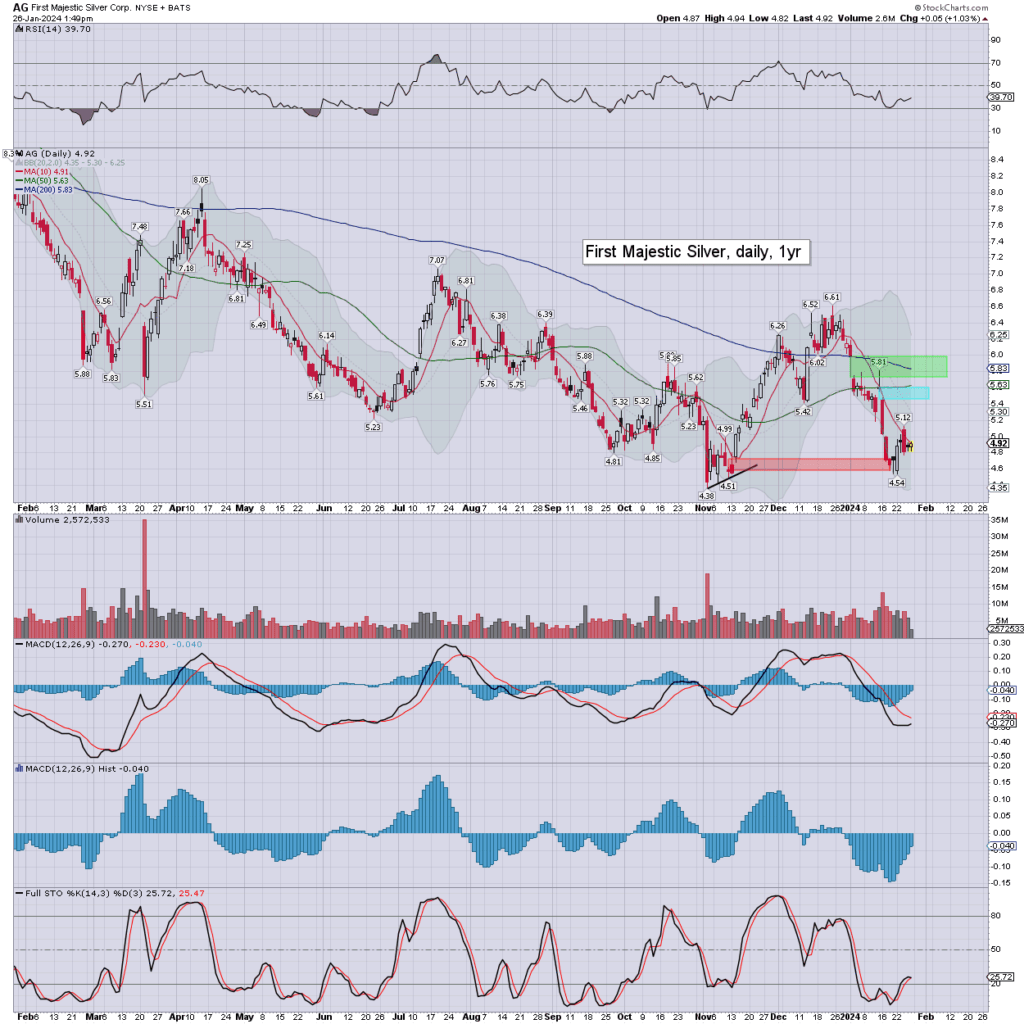

notable silver miner: AG

Silver miners fairing a little better this week.

—

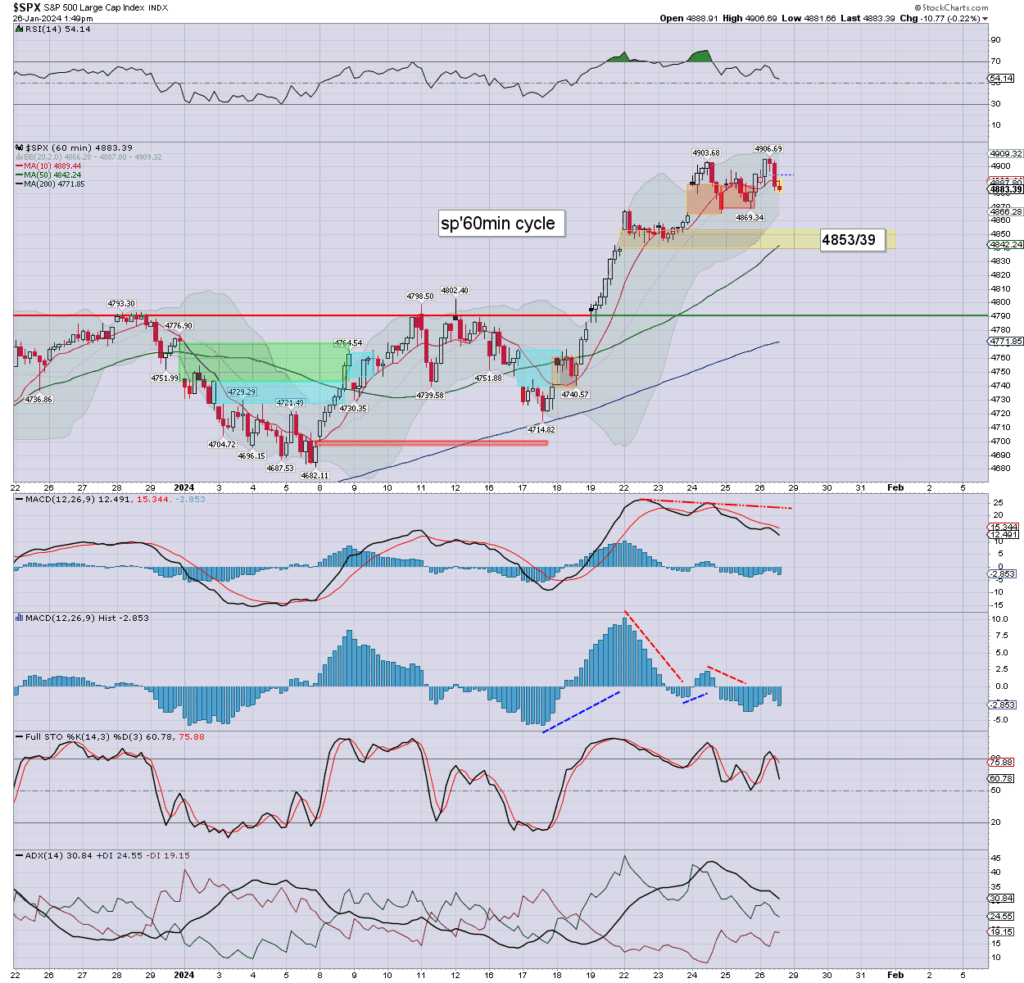

Equities: sp’60min

Just a little cooling.

The market will be inclinded to climb into end month/FOMC.