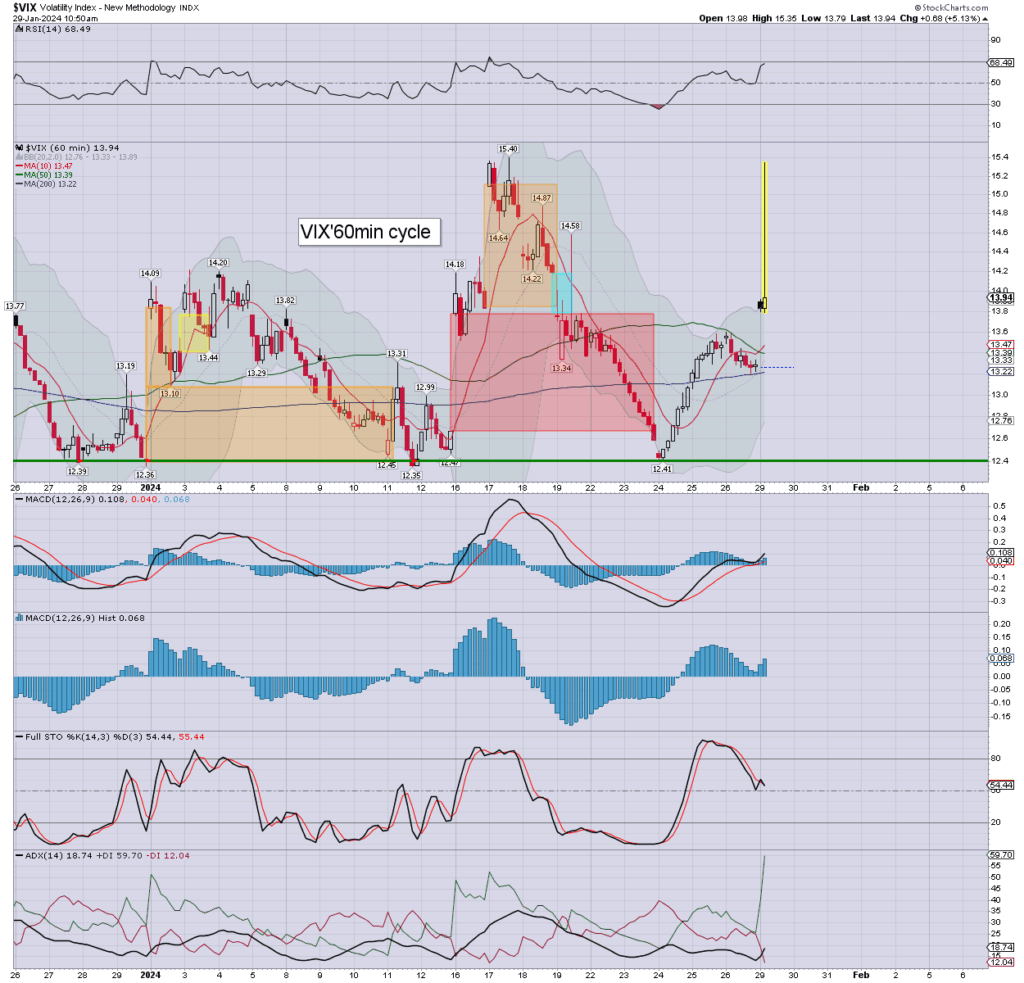

US equities remain in minor chop mode. VIX ghost printed 15.35, if reverting back to the 13s. USD is +0.4% at 103.64. WTIC $76s. Gold $2021.

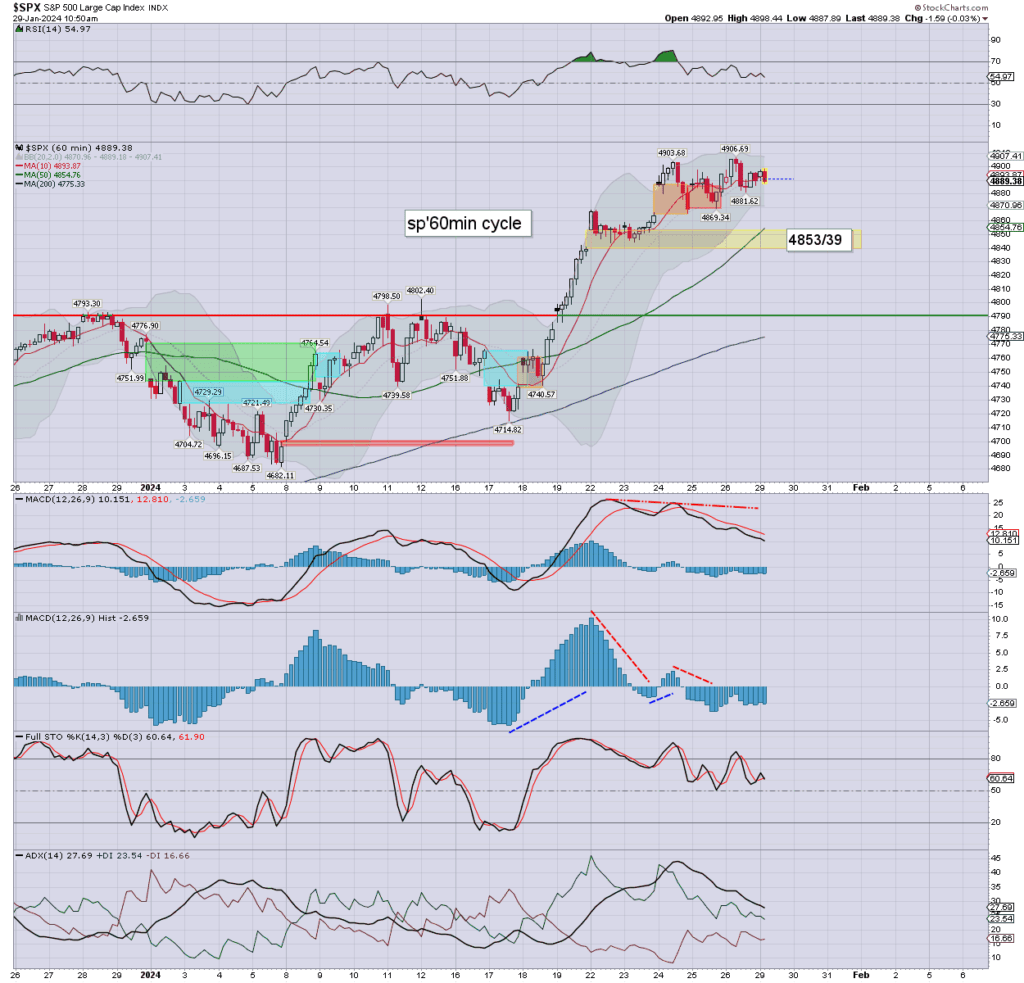

sp’60min

VIX’60min

Summary

*We’re seeing an increased number of ‘ghost prints’ in recent weeks. I’d see it as a sign of underlying instability. For now, I still see the VIX-long trade as currently dead.

—

It should be clear, there is near ZERO downside power.

The market will be inclined for considerable (if positive leaning) chop into Wed’ afternoon, when a spike to 4940/50s will be technically viable.

*I’ll look to hold the two new additions of AEM and SLB for at least a few days.

–

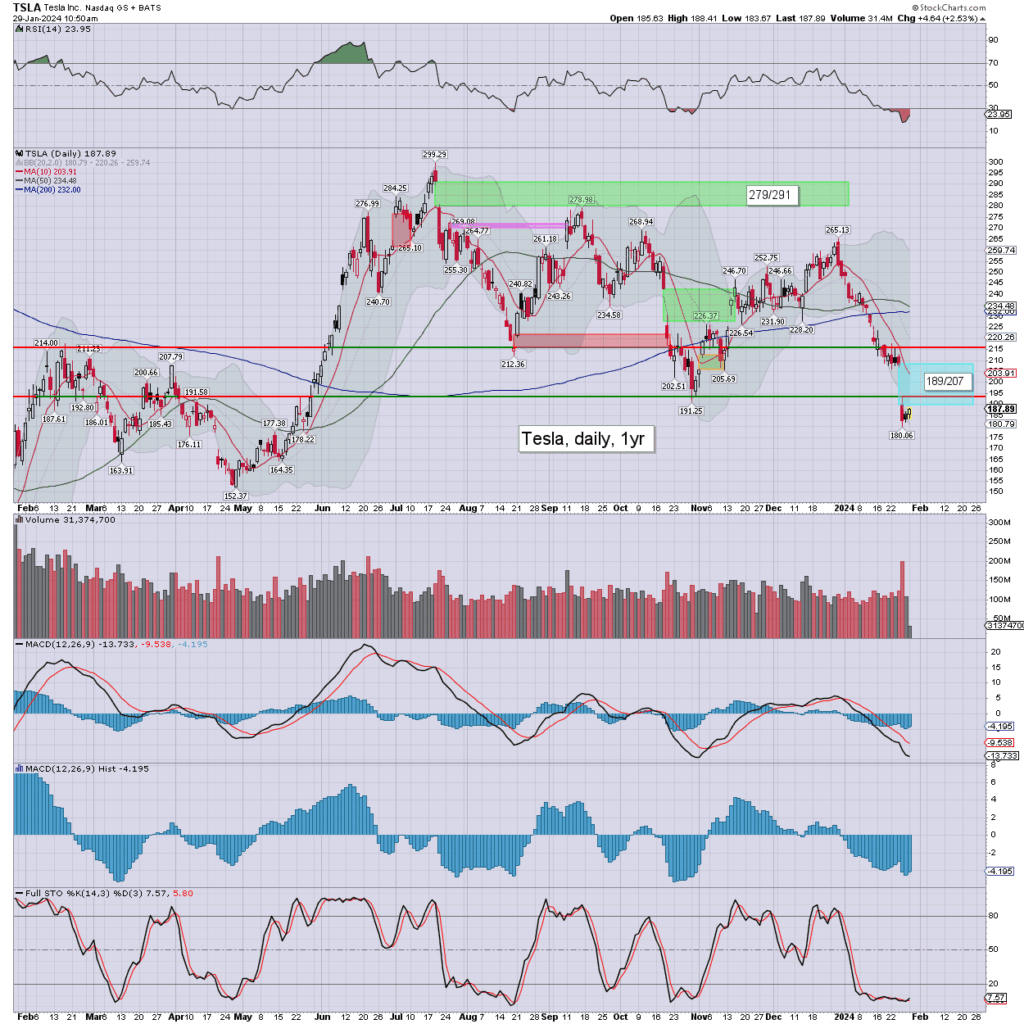

notable stock: TSLA

Tesla still battling to find and build a floor. Such things can typically take 2-3 weeks.

–

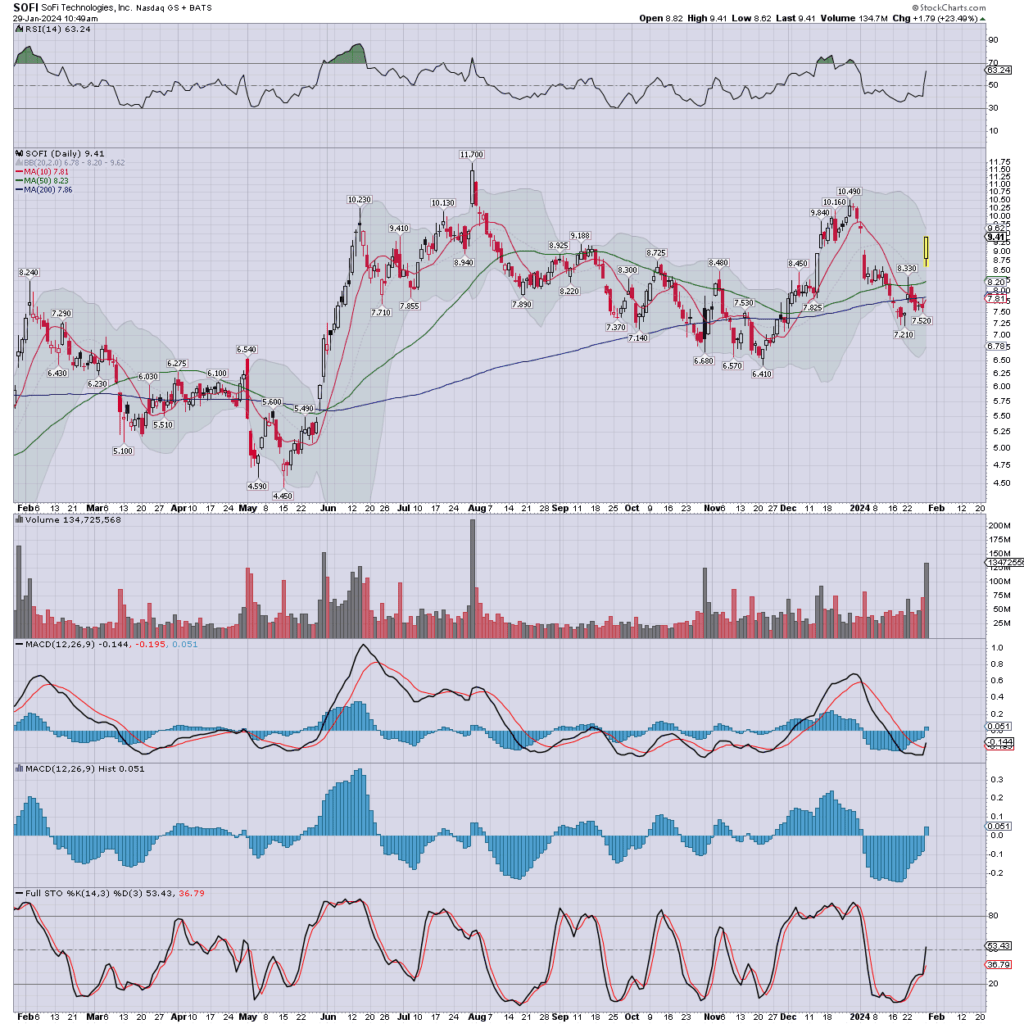

notable stock: SOFI

EPS of 2cents doesn’t merit hysteria, but its at least profitable. Momentum has turned positive, as its gap filling. I still don’t like it though.

—

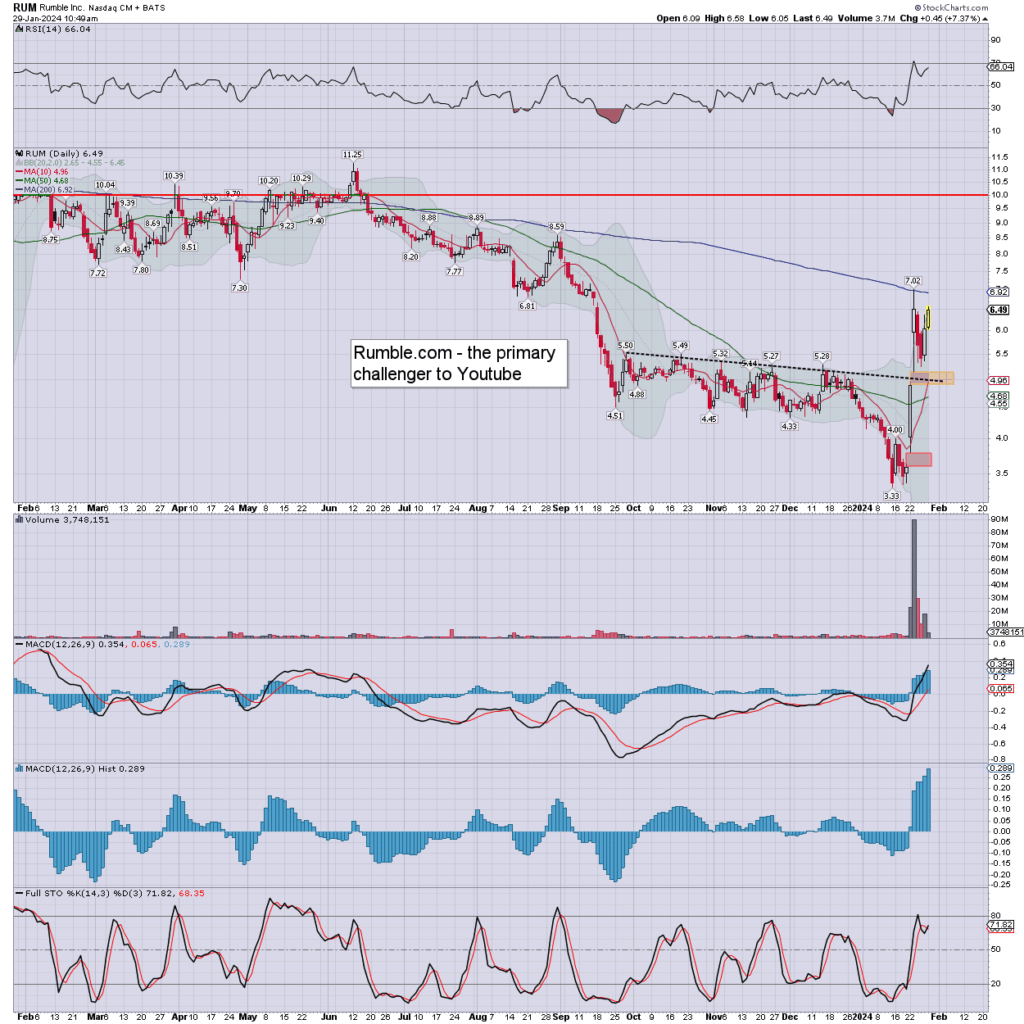

notable strength: RUM

I like Rumble, but I will NOT chase this one higher.

—

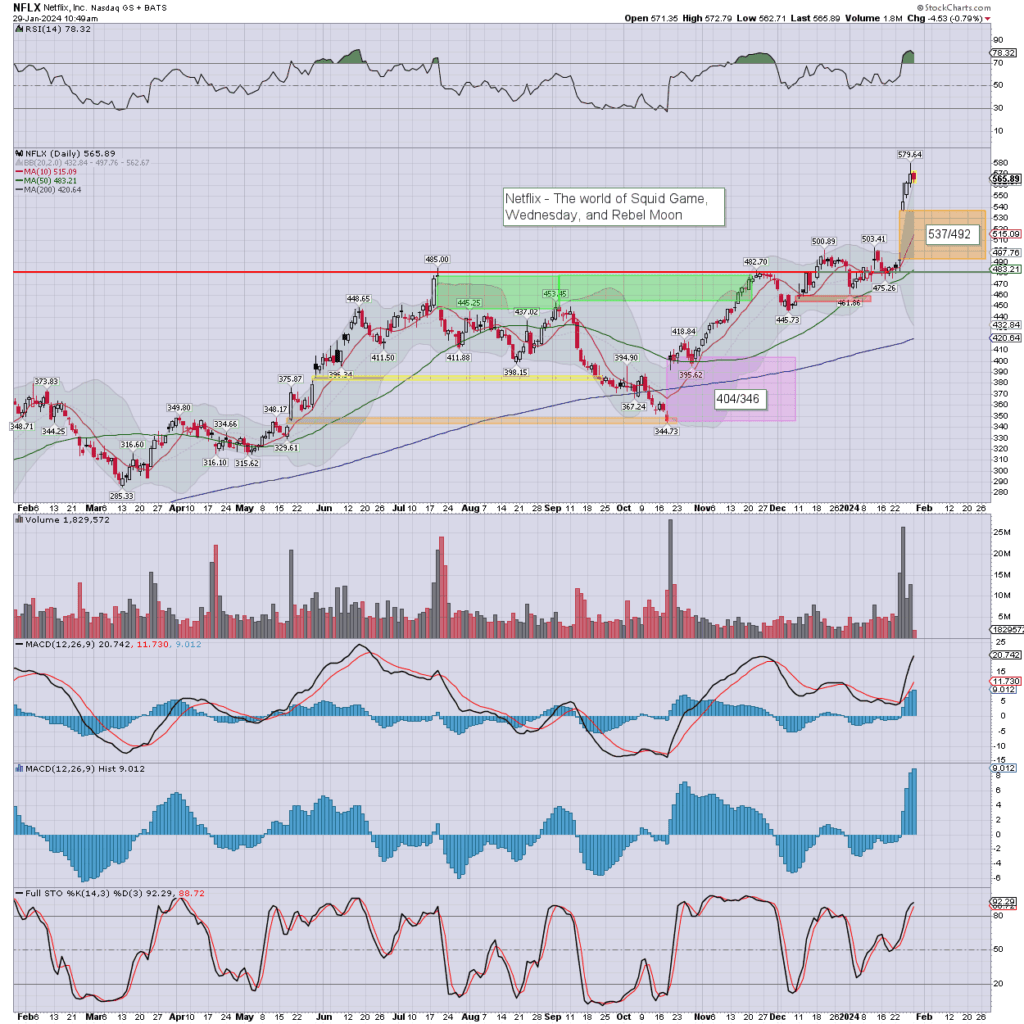

notable stock: NFLX

Even Netflix can’t go up every day. On balance, orange gap should at least be tagged, but it sure doesn’t have to fully fill, as purple gap shows.

Watching True Detective (HBO, Warner Bros’ Discovery) last night, interesting to see a character ask if someone ‘stayed in and watched Netflix’, as the streamer name has become the generic reference for cable.

Time for lunch…