US equity indexes closed broadly higher, SPX +36pts (0.8%) at 4927. Nasdaq comp’ +1.1%. Dow +0.6%. The Transports settled +0.2%. R2K +1.7%

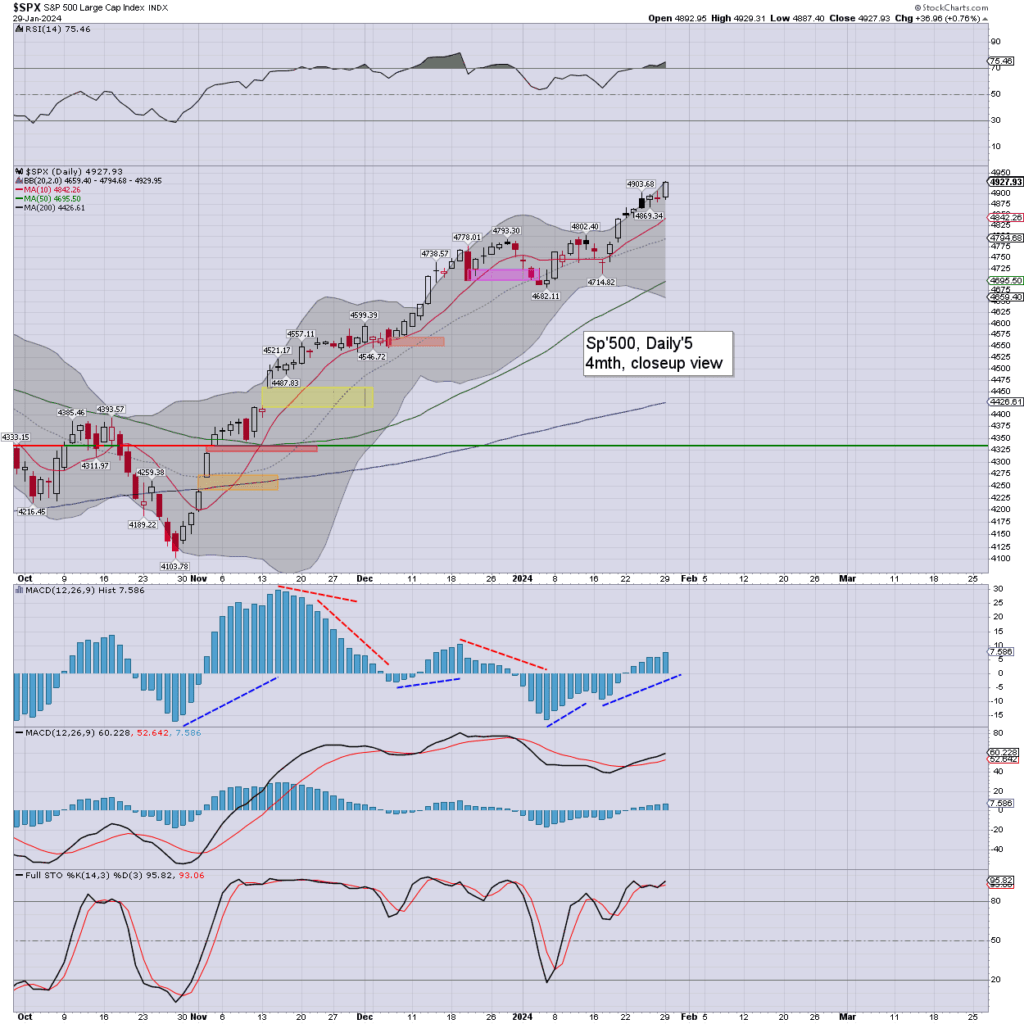

sp’daily5

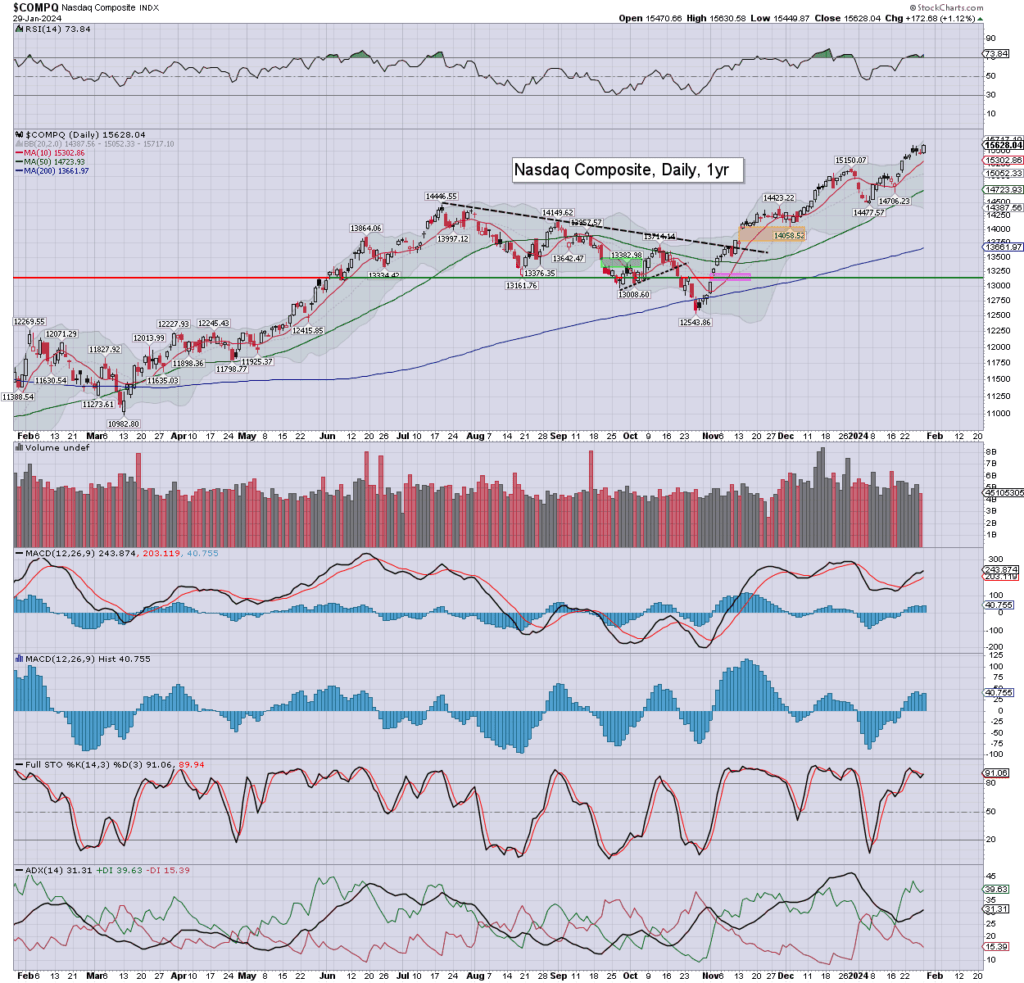

nasdaq comp’

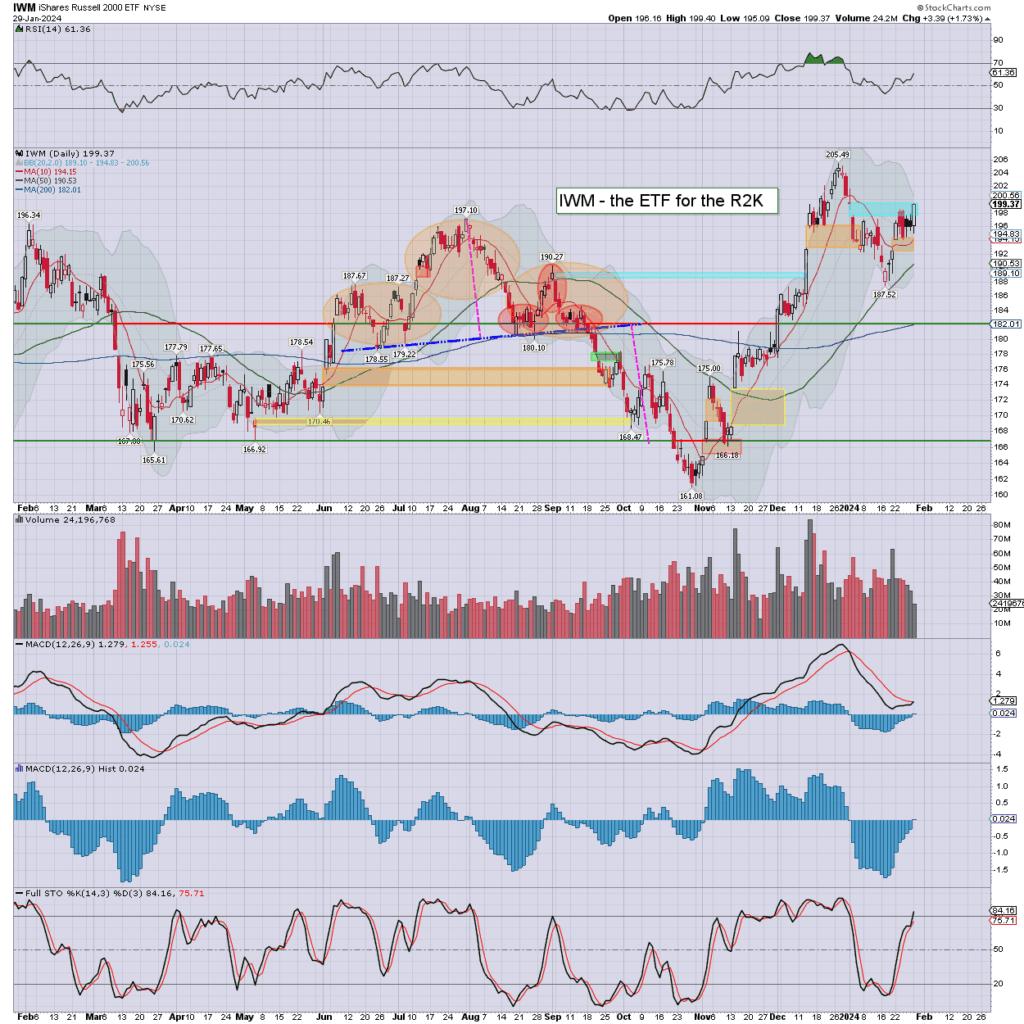

r2k

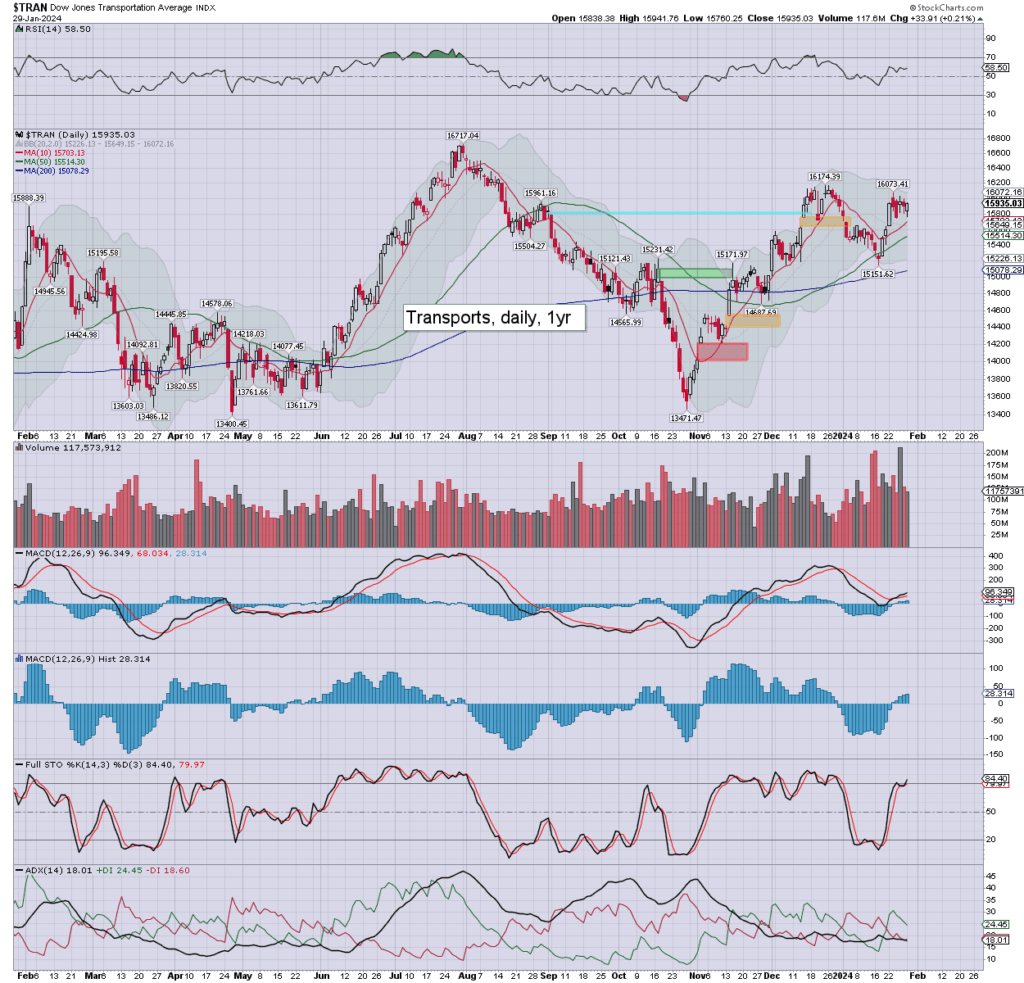

transports

Summary

SPX: a low of 4887, but swinging upward to print a new hist’ high of 4929, and settling +0.8% to 4927. Friday’s hollow red reversal candle played out. Today’s candle is bullish engulfing.

I’d note the upper bollinger at 4929… and that will climb to the 4940/50s for Fed day. I’m starting to think giant psy’ 5K is viable this Wed’ afternoon, but even if its not, it now seems even more likely within Feb’.

—

NAS: a low of 15449, but settling +1.1% to 15628. Today’s candle is bullish engulfing. We’re at (weekly) trend resistance. Any price action >15750 would be decisive, and offer a broader run to the Nov’2021 hist’ high of 16212.

R2K: a low of 195.09, but swinging rather powerfully upward to settle +1.7% to 199.37. Teal gap effectively filled. Friday’s black candle initially played out. Today’s candle is bullish engulfing, as the recent 205s look set to be cleared in February.

Trans: a low of 15760, but swinging upward to settle +0.2% to 15935. Structure is a bull flag.

–

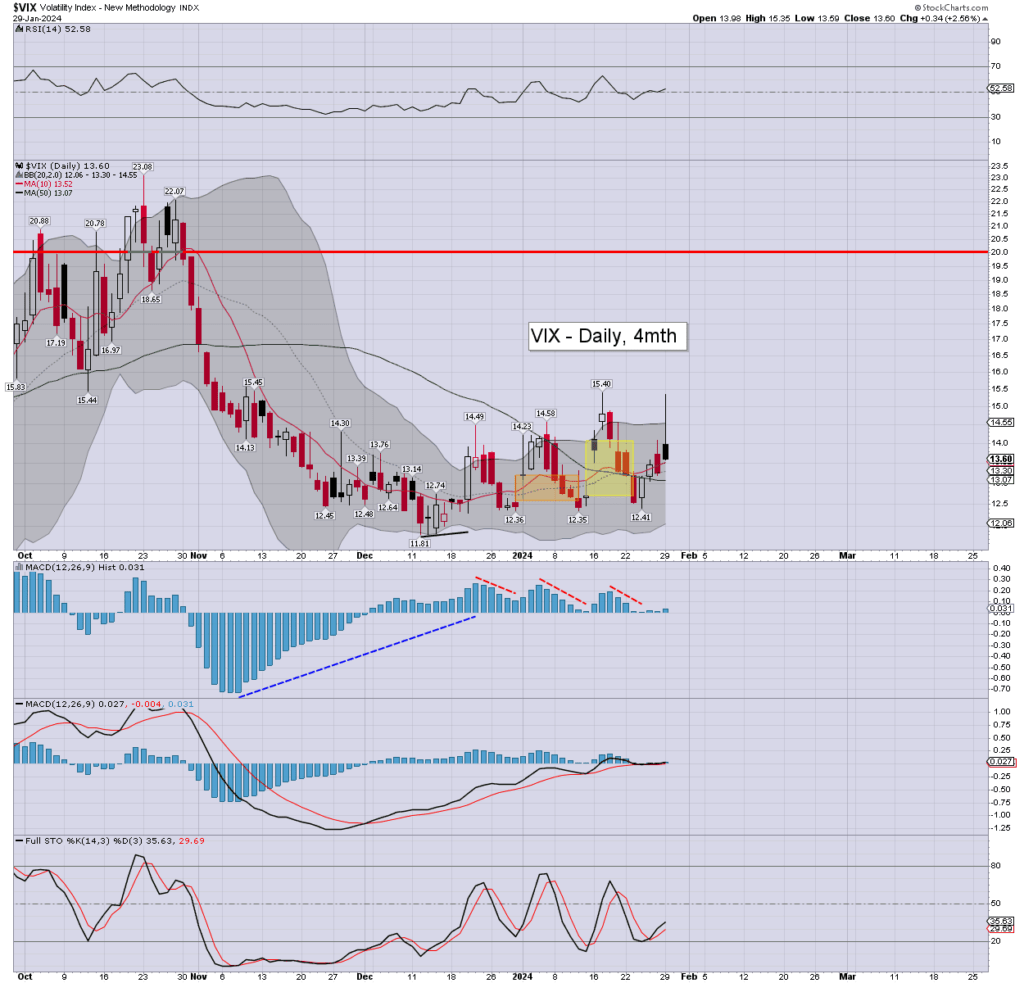

VIX’daily

Volatility was a little mixed, the VIX ghost printing 15.35, and settling +2.6% to 13.60. Momentum ticked upward, and remains fractionally positive.

Today’s candle is black, and VERY spiky on the upper side, reflective of the morning ‘ghost print’. I shall continue to see the VIX-long trade as dead into February.

–

Looking ahead by 6pm EST