US equities remain moderately lower. Meanwhile, the precious metals are sig’ lower, Gold -$20 (1.1%), with Silver -2.9%. The miner ETF of GDX is currently -2.4% at $29.82.

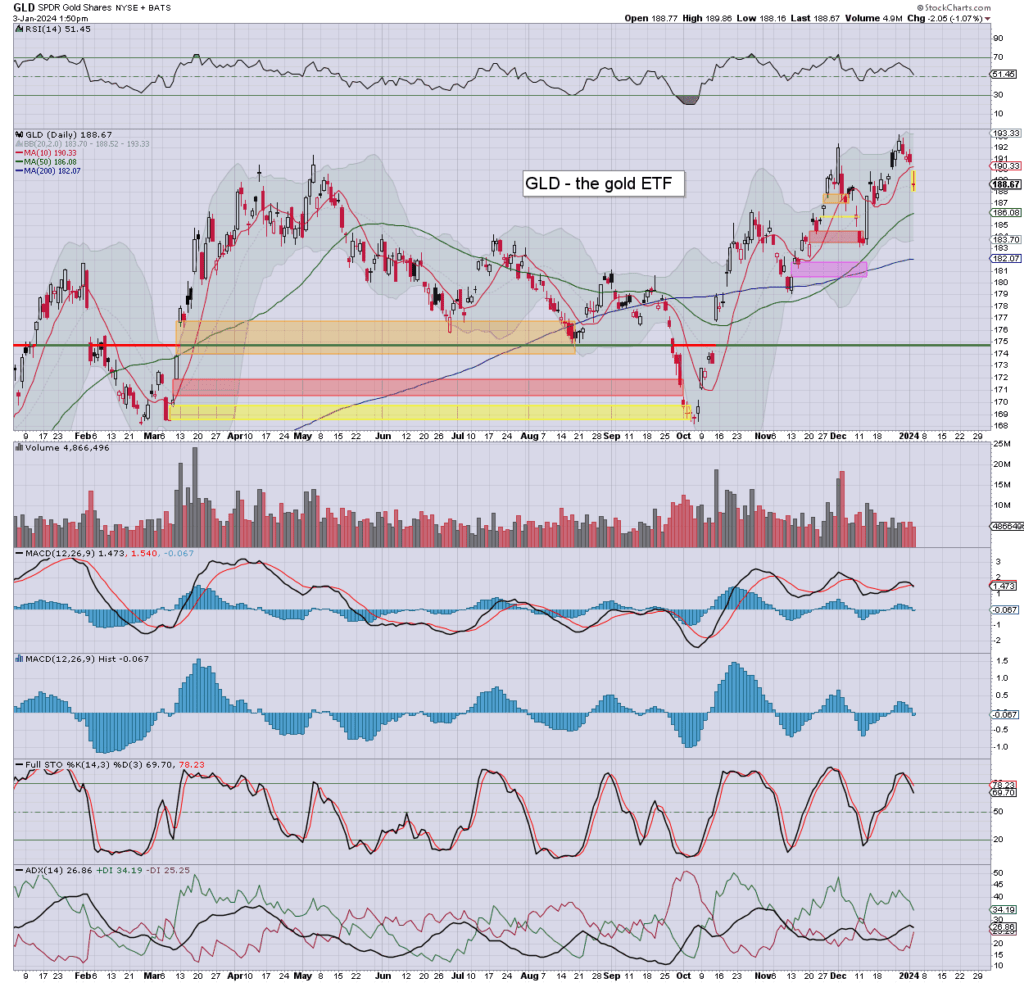

GLD daily

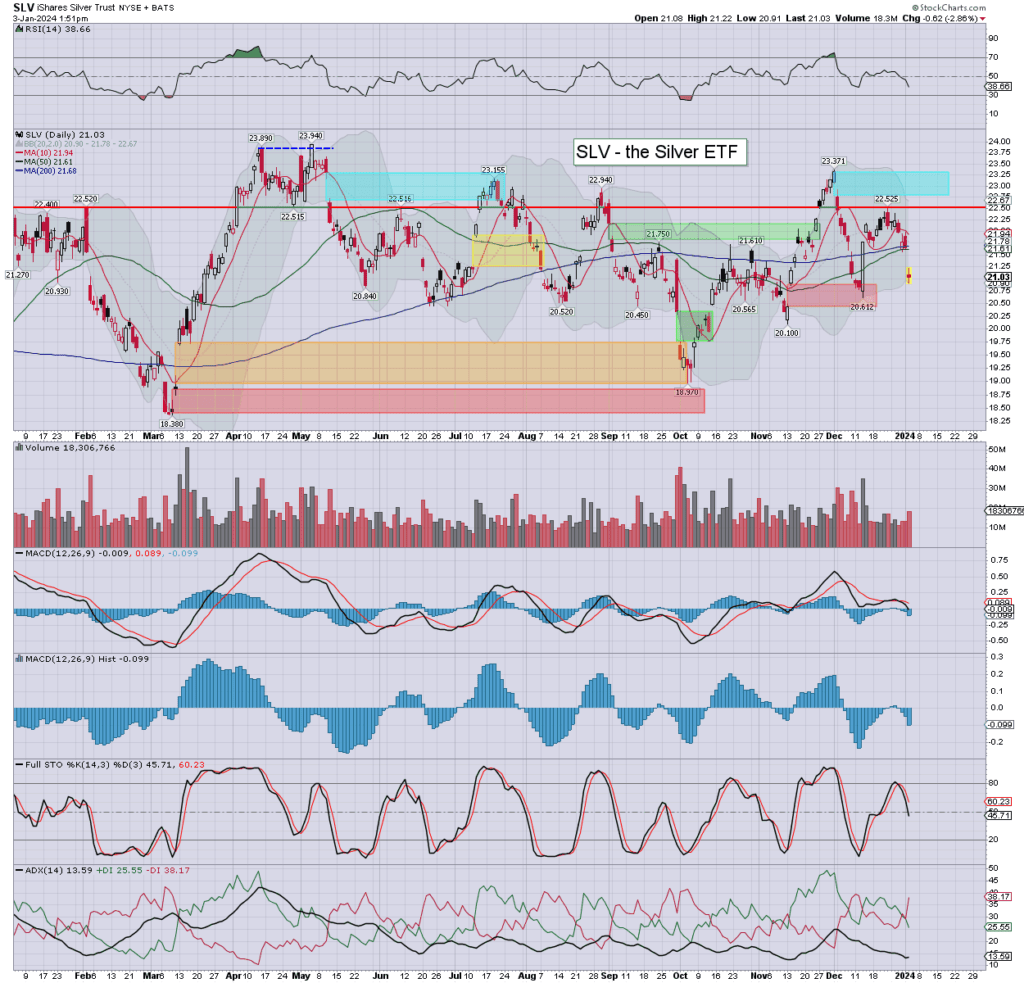

SLV daily

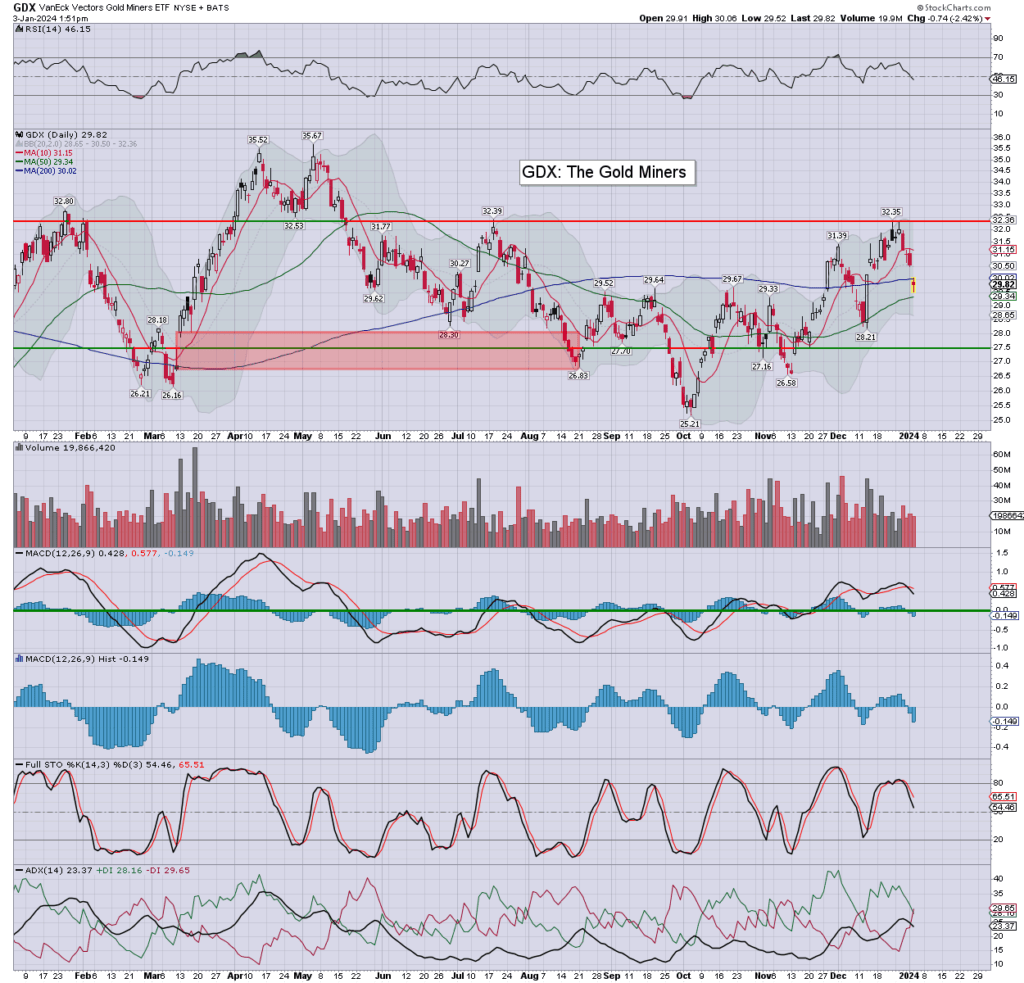

GDX daily

Summary

Gold/GLD: gold printed $2038, pressured by higher bond yields and the moderately stronger dollar. Giant psy’ $2K should hold. I’d accept a burst into the 2100s looks out of range this side of the weekend.

Silver/SLV: silver printed $23.05, pressured by the main market, and the dollar. An eventual push >$30 looks feasible this year, and the cautious will wait to chase until that is printed.

GDX: miners lower with gold/silver, and further not helped by the main market.

*I hold NEM, and am looking to pick up GOLD & AG – perhaps forming the ‘holy trinity’, of gold/silver miners.

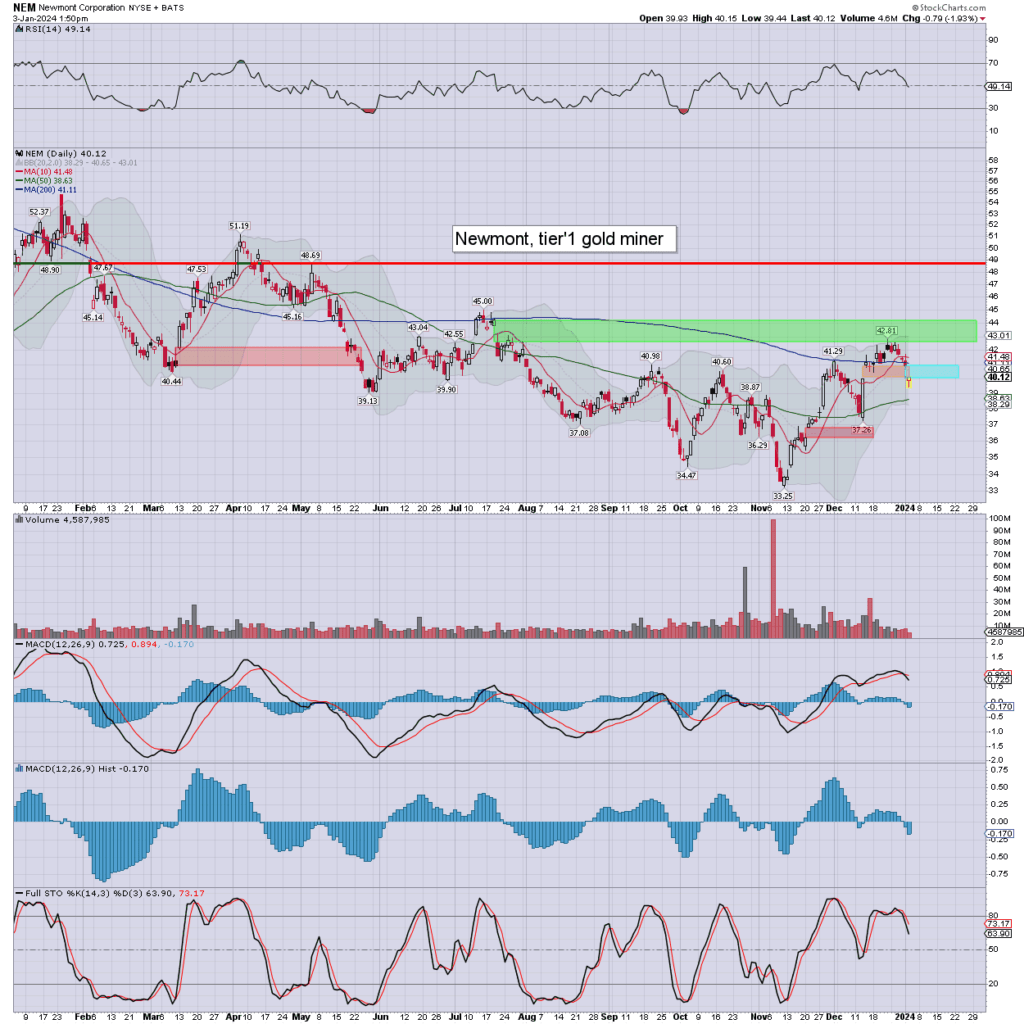

notable gold miner: NEM

Lower with the sector. The current candle is a hollow red reversal, and leans s/t bullish.

–

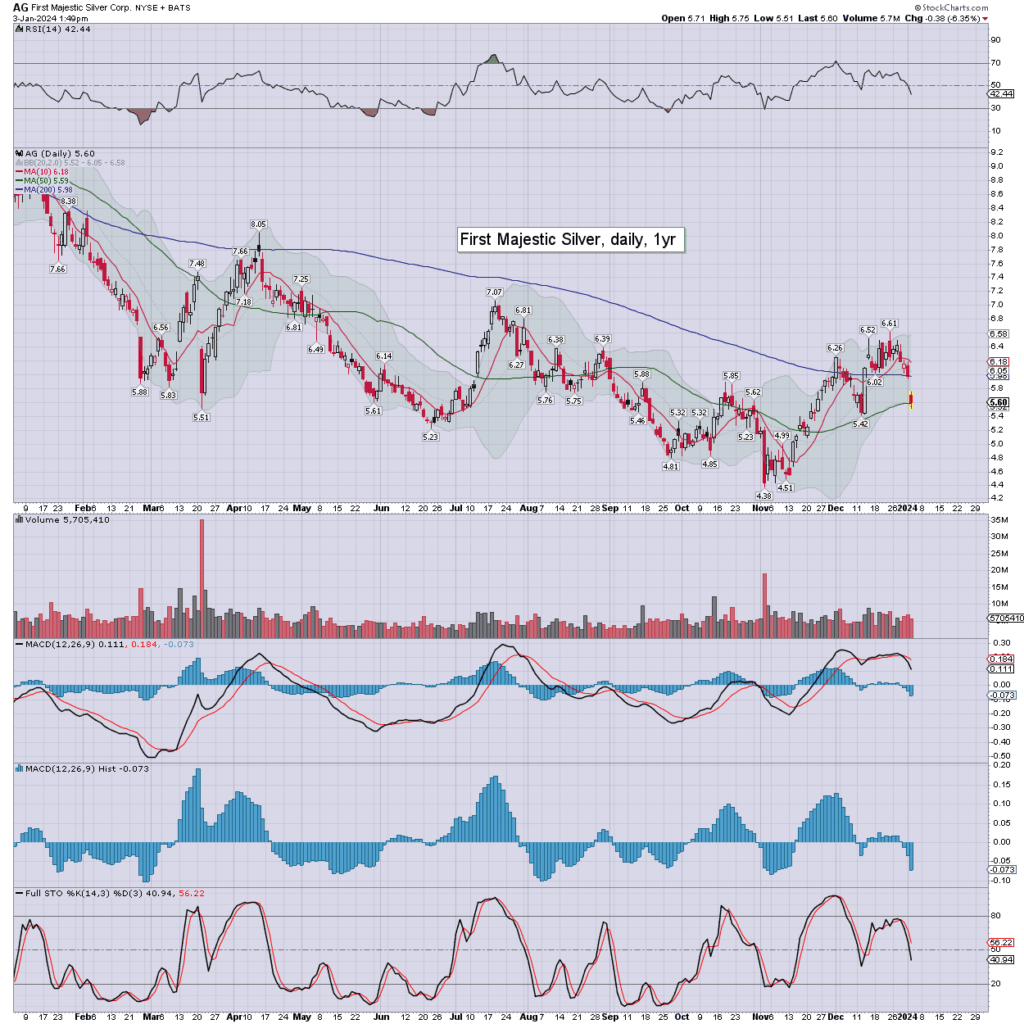

notable silver miner: AG

Reflective of the sector.

It’d be useful to hold the recent low.

–

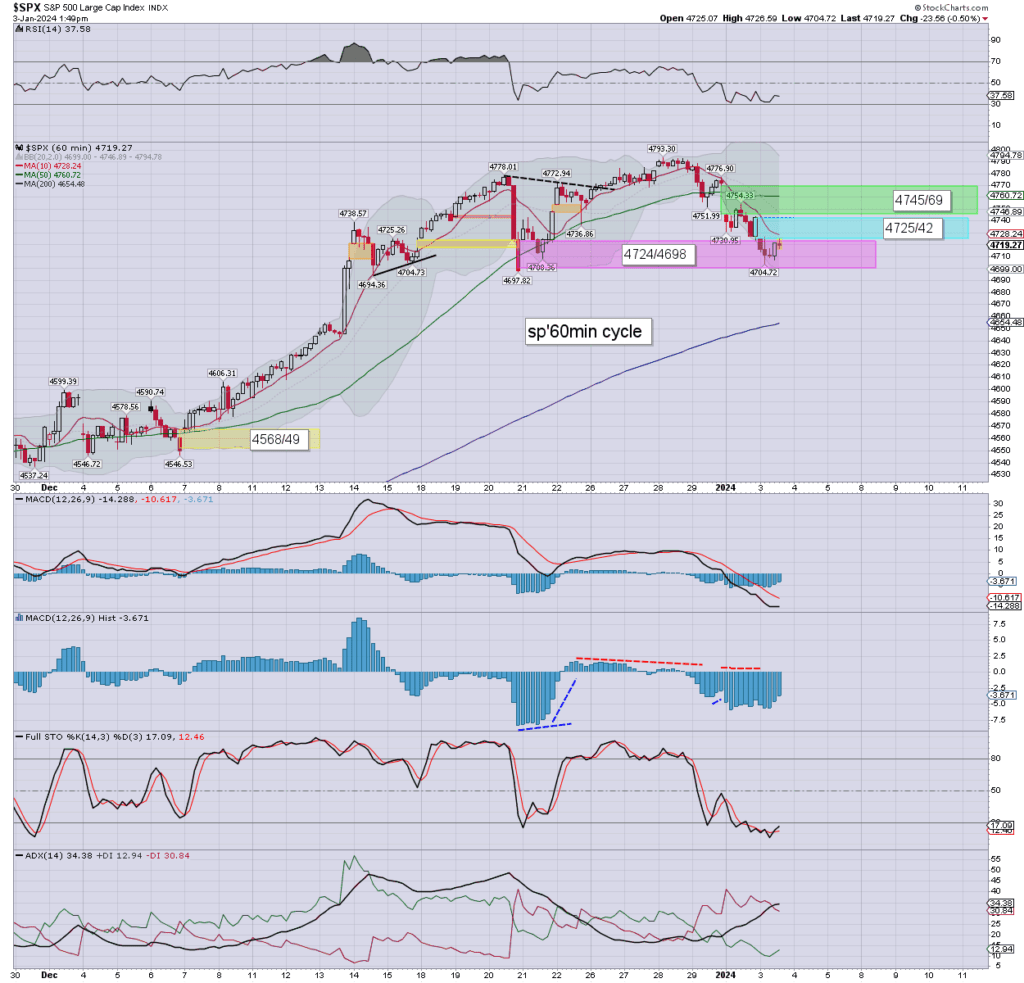

Equities: sp’60min

Choppy, if holding the morning floor of 4704.