Good morning. US equity futures are fractionally higher, SPX +6pts, we’re set to open at 4710. USD is -0.1% at DXY 102.08. The precious metals are a little mixed, Gold +$4 (printing $2058), with Silver -0.1%. WTIC is +0.6% in the $73s (printing $74.00).

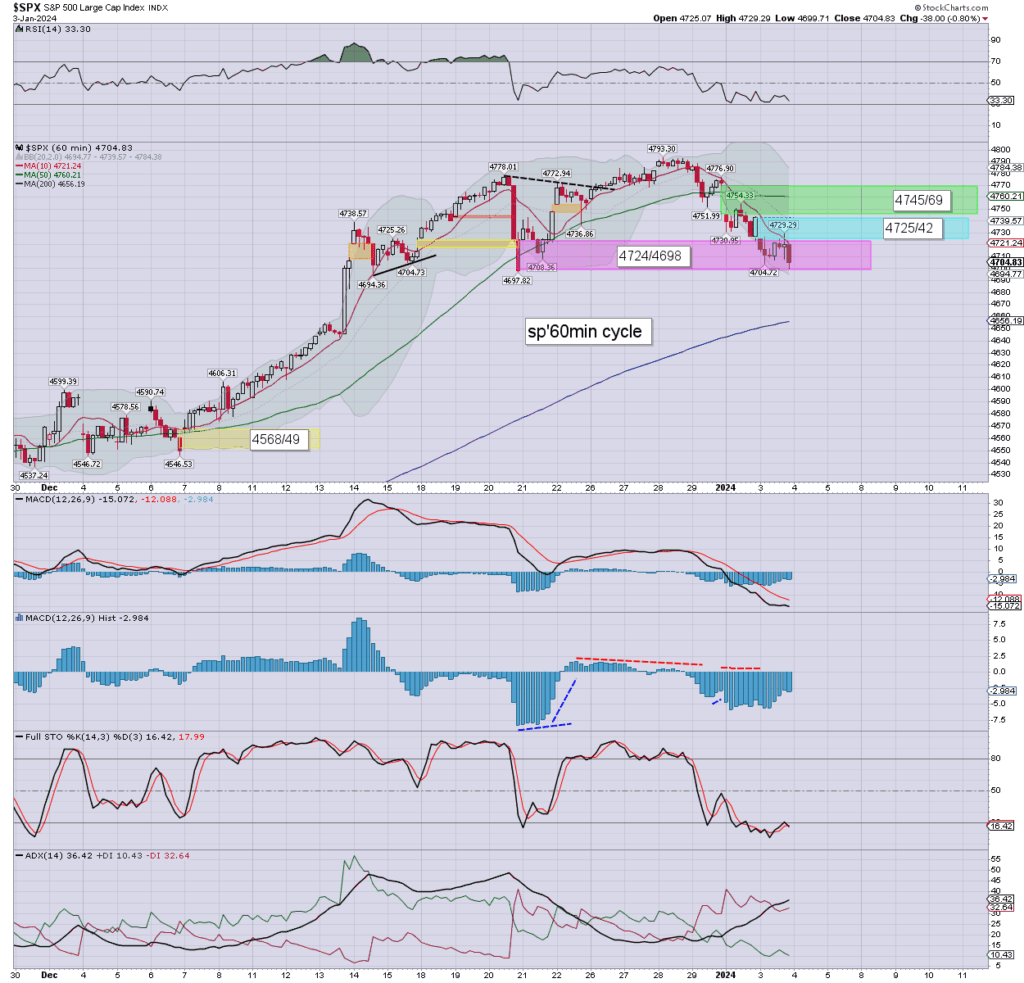

sp’60min

Summary

Yesterday saw broad weakness, if rather choppy. S/t momentum settled on the moderately low side.

Overnight futures have been subdued, if leaning fractionally higher.

I’d keep in mind the ADP jobs data is due 8.15am, and its likely that the market would see a lousy print as good news. The same can be expected on Friday with the BLS data.

Yours truly shall continue to find sanctuary in gold and the related miners. I see little reason why that will change this side of the spring equinox.

—

Early movers

AAPL -0.7%, Piper Sandler, overweight>neutral, 220>205

ADI -2.9%, Bernstein, outperform>market-perform

AFRM +1.7%

–

AG +0.7%

ALB +0.8%

AMD -0.3%, Bernstein 100>120, Piper Sandler 150>165

–

APA -4.4%, APA buying Callon Petroleum (CPE) for $4.5bn (all stock deal), for what is an effective merger of two mid tier energy names.

–

BA +0.3%

BABA -0.7%

–

CAG -2.4%, EPS 71cents vs 68est. Rev’ y/y -3.2% to $3.2bn inline. Guidance weak. The drop in revenue is distinctly worse, relative to inflation.

–

CALM -4.5%, post earnings depression

CCL +0.9%

–

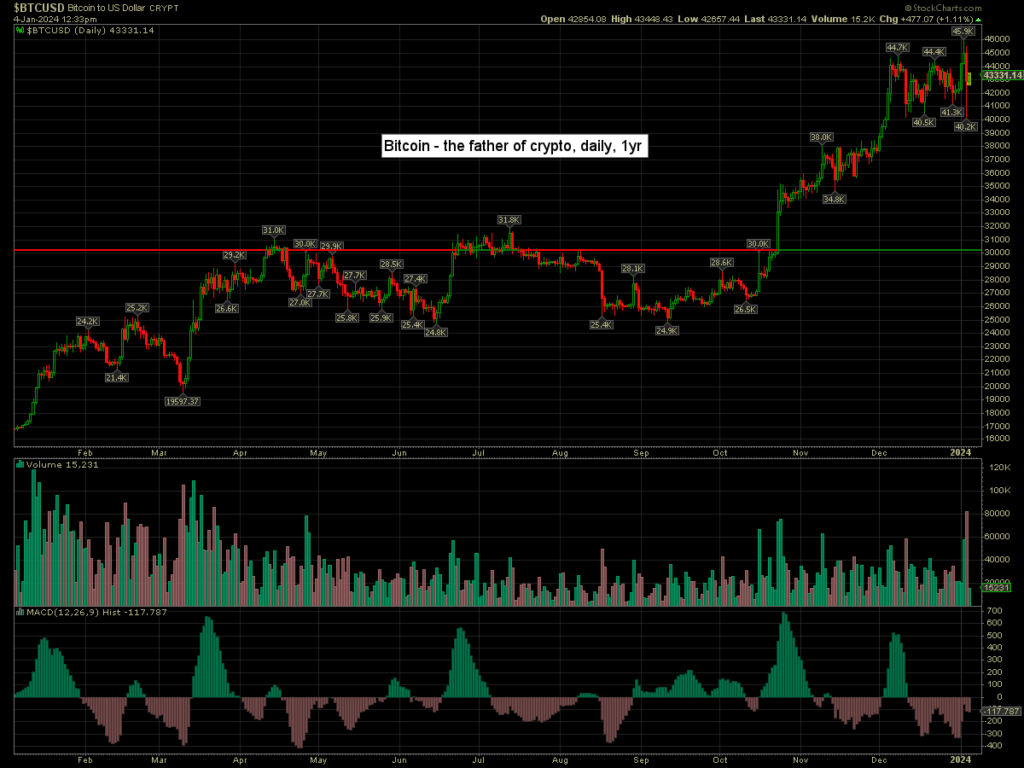

COIN +1.8%

Bitcoin is +1.1% at $43331

–

CPE +6.5%, effectively being merged into APA

DIS +0.4%

FCX -0.9%, with copper -2cents to $3.84

FL -1.5%, in sympathy with JD sports

–

GM +1.3%, CFRA, 32>34

GOLD +0.3%

HD +0.8%, Barclays, equal-weight>overweight, 325>372

–

INTC -3.0%, Mobileye guidance below estimates

LLY +1.3%

MARA +2.8%

MU +0.9%, Piper Sandler, neutral>overweight, 70>95

–

NEM +0.2%

NKE -1.0%, in sympathy with JD Sports of the UK

NVDA +0.4%

NXPI -4.7%, news?

ON -5.2%, news?

–

OXY +0.4%

PFE -0.4%, Cowen, outperform>market-perform, $32

SLB +0.5%

SOFI +1.3%

SWKS -1.7%, Piper Sandler, overweight>neutral, $90

TGT +0.5%

–

TLT -0.8%

TSLA +0.5%

TXN -2.0%, Bernstein, 130>140

–

UNG +4.0%, with Natgas $2.77

–

VIX +0.4% at 14.09

–

VZ +1.1%, Wolfe, peer-perform>outperform, $46

–

WBA +3.4%, EPS 66cents vs 63est. Rev’ y/y +9.9% to $36.7bn vs 34.9est. Guidance held. Dividend cut 48% to 25cents.

–

XOM +0.7%

ZIM +3.7%

—

Overnight markets

Asian markets were moderately lower, whilst European markets are fractionally mixed…

Japan: -0.5% to 33288

China: -0.4% to 2954

Germany: currently u/c at 16538

UK: currently +0.2% at 7695

—

Have a good Thursday