US equity indexes mostly closed a little weak, SPX -16pts (0.3%) at 4688. Nasdaq comp’ -0.6%. Dow +0.03%. The Transports settled -0.04%. R2K -0.2%

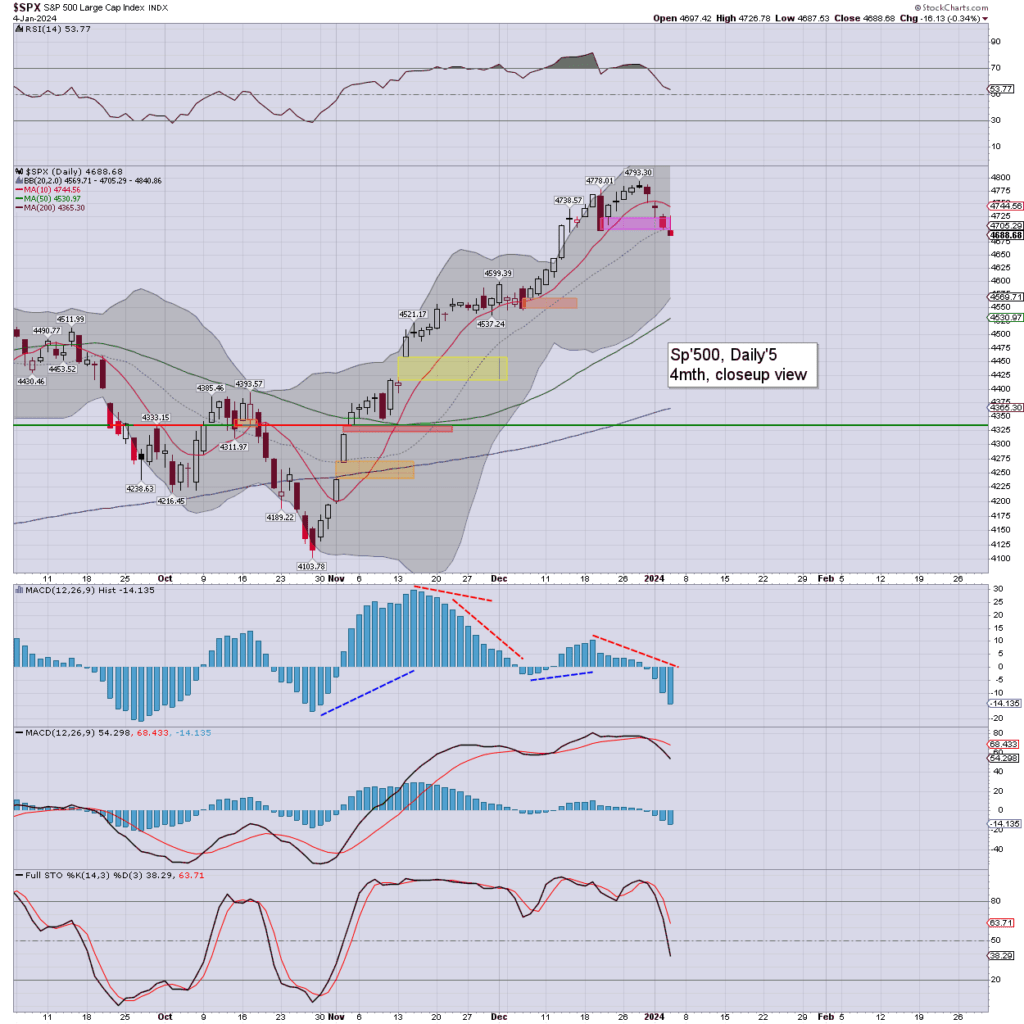

sp’daily5

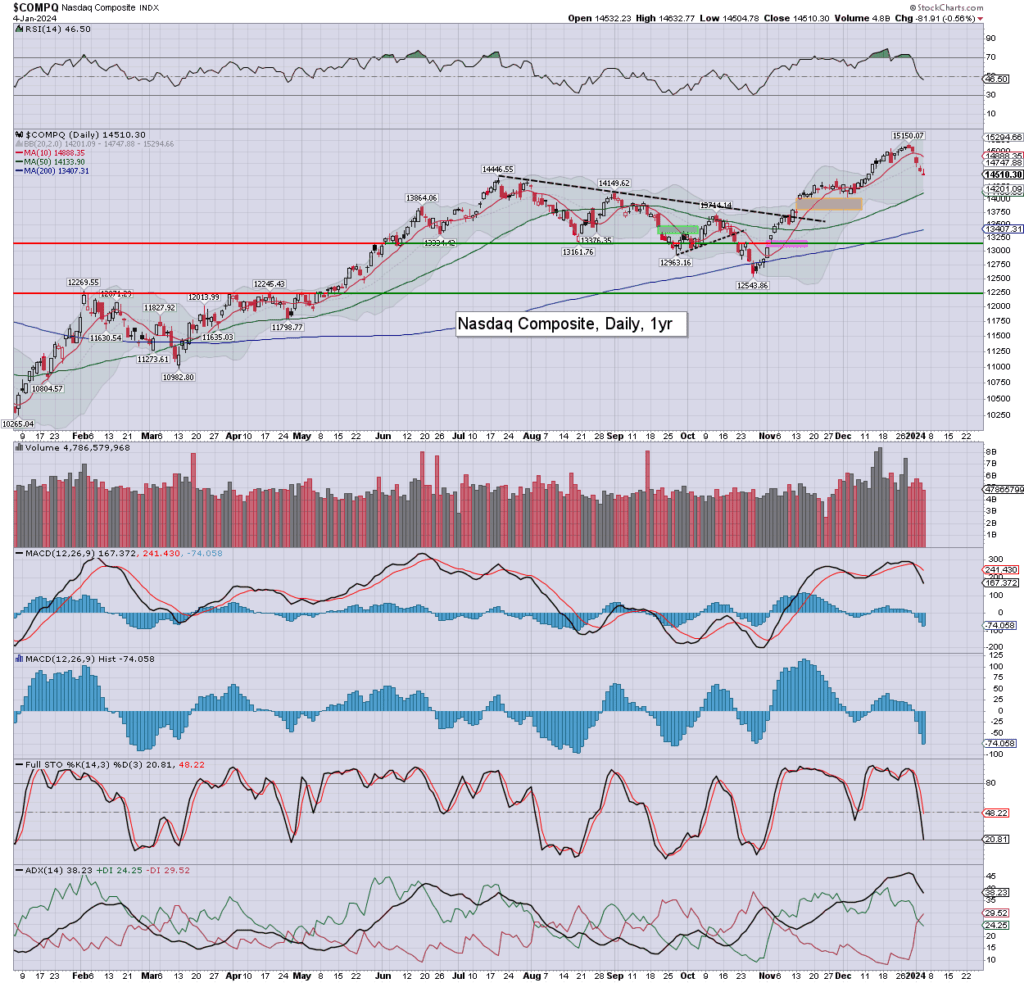

nasdaq comp’

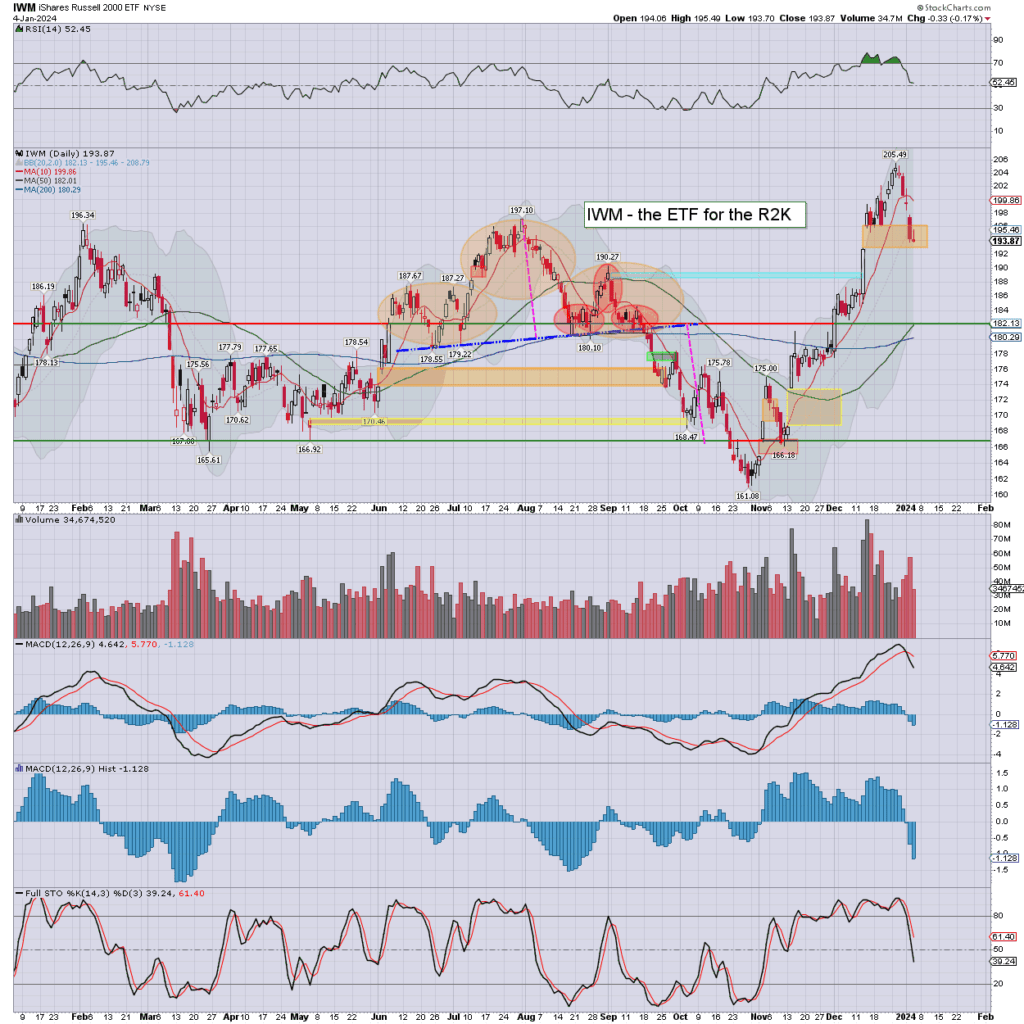

r2k

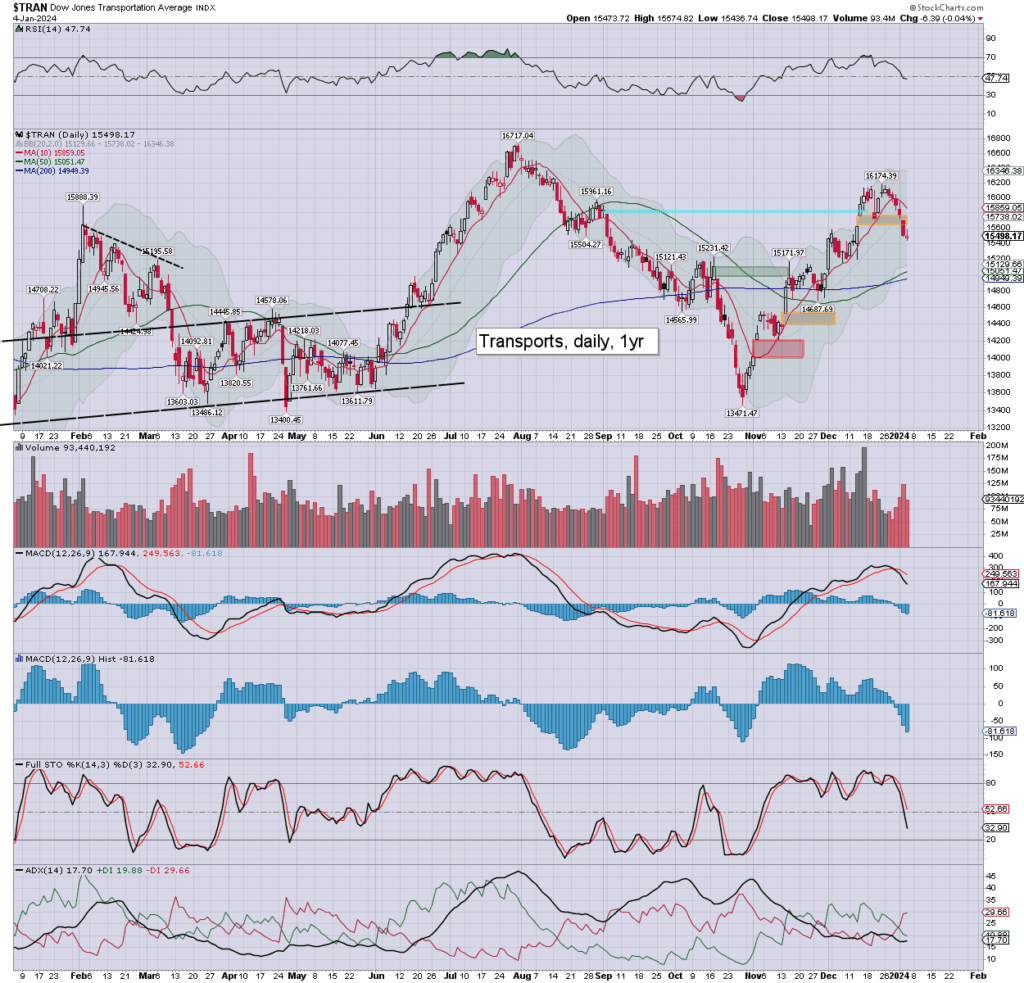

transports

Summary

SPX: initial cooling to 4696, with a moderate upswing to 4726. The late afternoon saw renewed cooling, a fourth day lower, settling -0.3% to 4688. Momentum is increasingly negative, with no sign of a floor/turn.

A H/S (see hourly chart in later post) threatens the low 4600s, where the lower daily bollinger and the 50dma will be near next week.

—

NAS: a fifth day lower, setting -0.6% to 14510. Cyclically low.

R2K: a fifth day lower, setting -0.2% to 193.87. Cyclically low.

Trans: a sixth consecutive net daily decline, settling -0.04% to 15498. Today’s candle is a hollow red reversal, and leans s/t bullish.

–

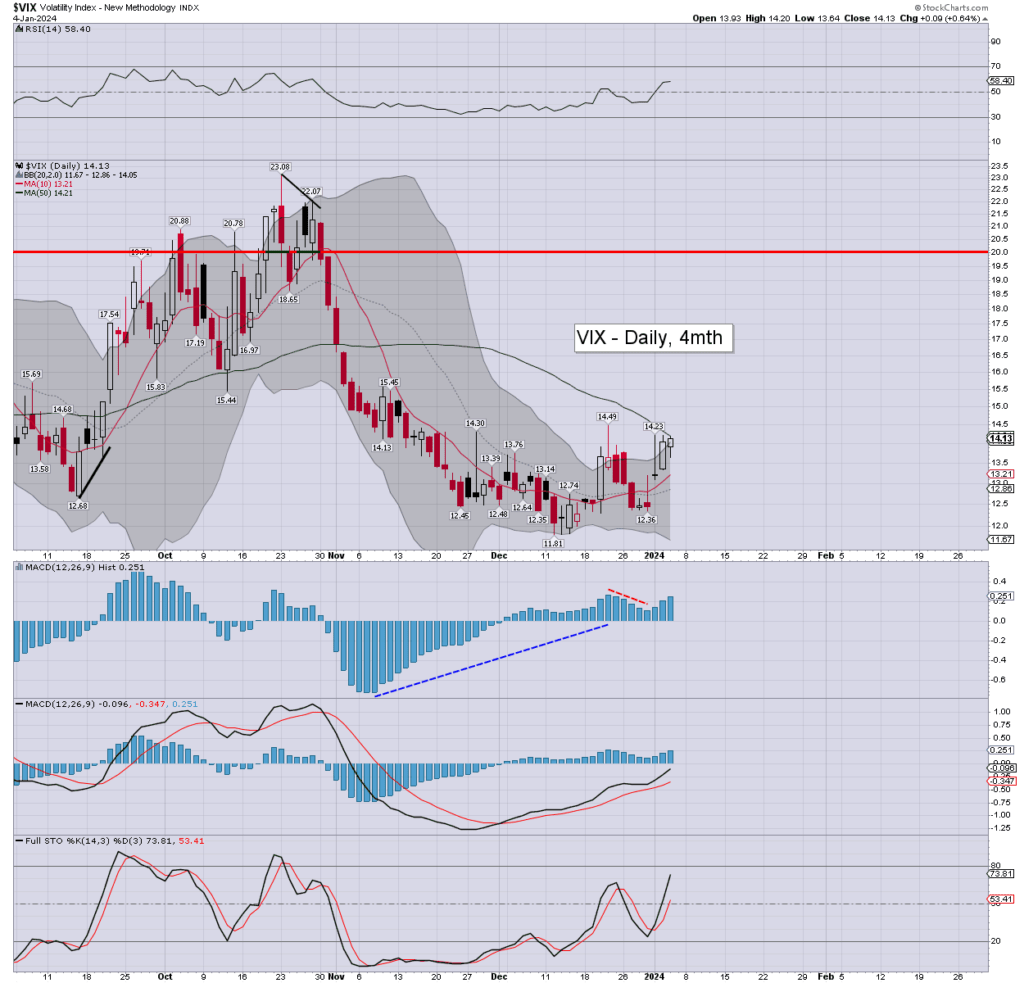

VIX’daily

Volatility was muted, the VIX settling +0.6% at 14.13. Momentum ticked upward for a third day, and is on the moderately high side.

On balance, equities look prone to upside on Friday… perhaps on the ‘bad news is good news’ notion. Typically, VIX could be expected to be ground lower into the weekend, with a (unmarked) gap to the 12s.

–

Looking ahead by 6pm EST