It was a net bearish Thursday in equity land, the SPX settling -0.3% to 4688. Meanwhile, WTIC settled -51cents (0.7%) to $72.19.

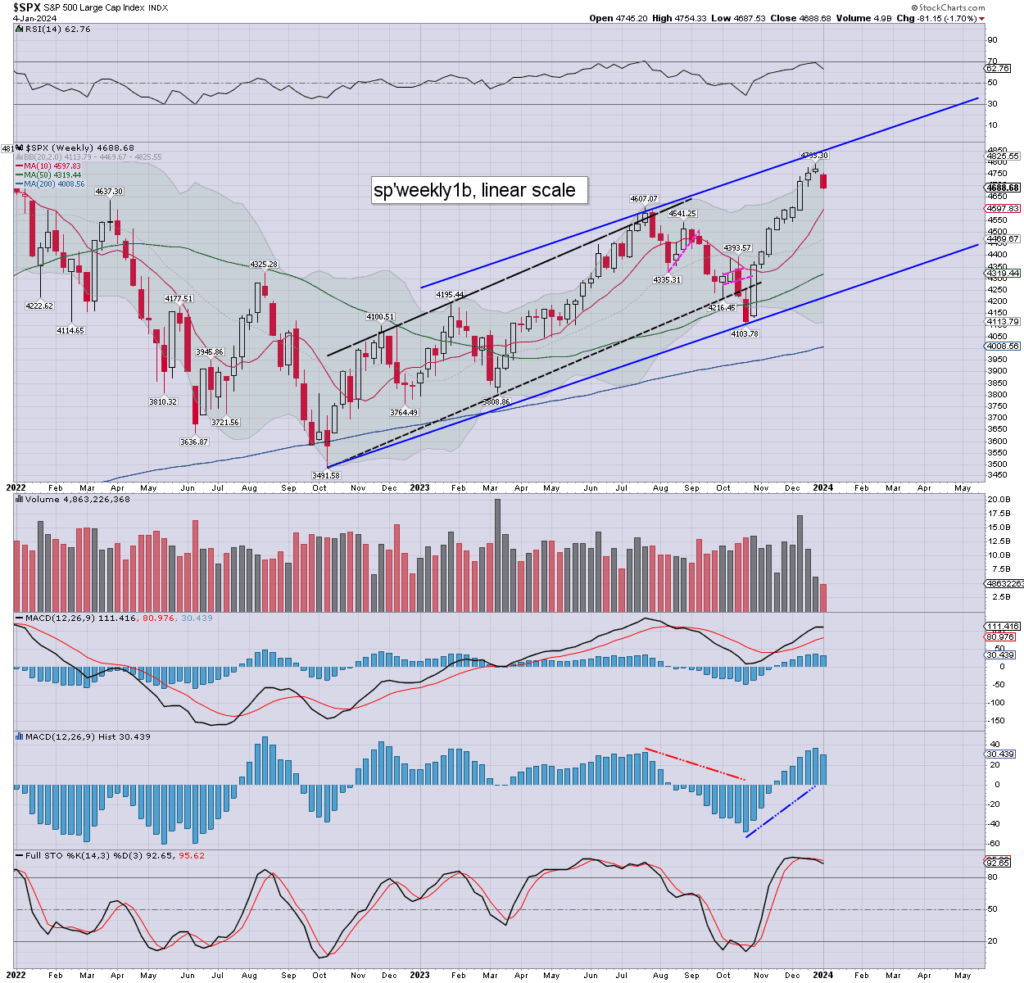

sp’weekly1b

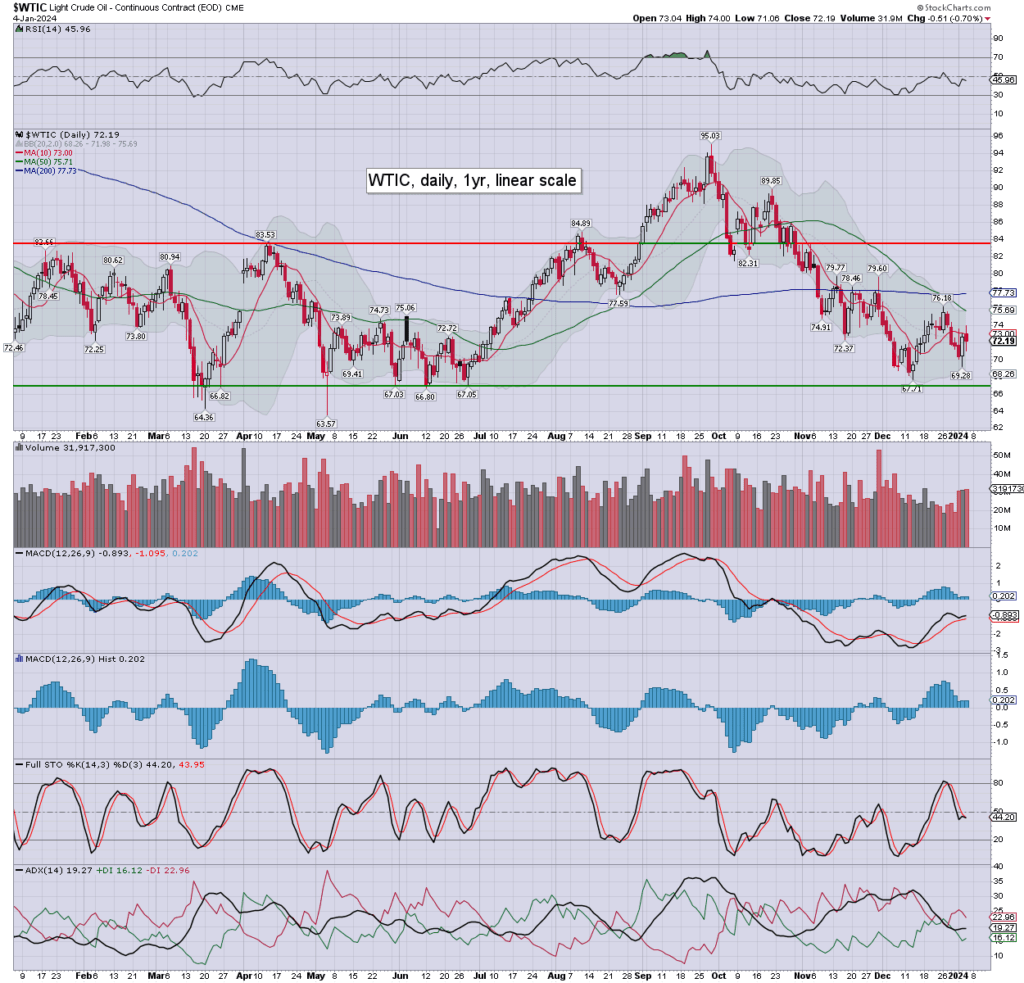

WTIC daily

Summary

SPX: as things are, we’re net lower for the week by -81pts (1.7%). Even if the market can bounce on Friday, we’re very likely set for the first net weekly decline since late October. Weekly momentum is offering a provisional rollover.

On balance, the bears could hope for the low 4600s, before resuming upward after the next long weekend of Jan’13-15th.

—

WTIC: oil printed $74.00, if cooling back to settle in the low $72s. The Dec’$67s might be tested if SPX low 4600s next week. I’d still look for a subsequent up wave to challenge the key $78s… which would turn the m/t trend back to bullish.

–

Looking ahead

Friday will see Monthly jobs, ISM serv’, factory orders

Earnings: STZ, ANGO, GBX

–

Final note

Make of that, what you will. Personally, I’d merely add… first things first… $2400/2500, as seems realistic this spring.

–

The semi flooded ghetto

Looking south east from my office window… the six lane urban freeway, which roars from 4am to midnight. The only time its ever quiet here, is when there is a car crash, floods, or snow. Today, it was a flood (just off picture to the left).

I’ve been here more years than I care to admit. I really need to get the hell out of this ghetto, before I completely lose my mind. I’d accept you could argue the latter has long since happened.

Goodnight from London