Good morning. US equity futures are fractionally higher, SPX +4pts, we’re set to open at 4894. USD is +0.15% at DXY 103.39. The precious metals are broadly higher, Gold +$10 (printing $2033), with Silver +1.0%. WTIC is -0.1% in the $78s (printing $79.29).

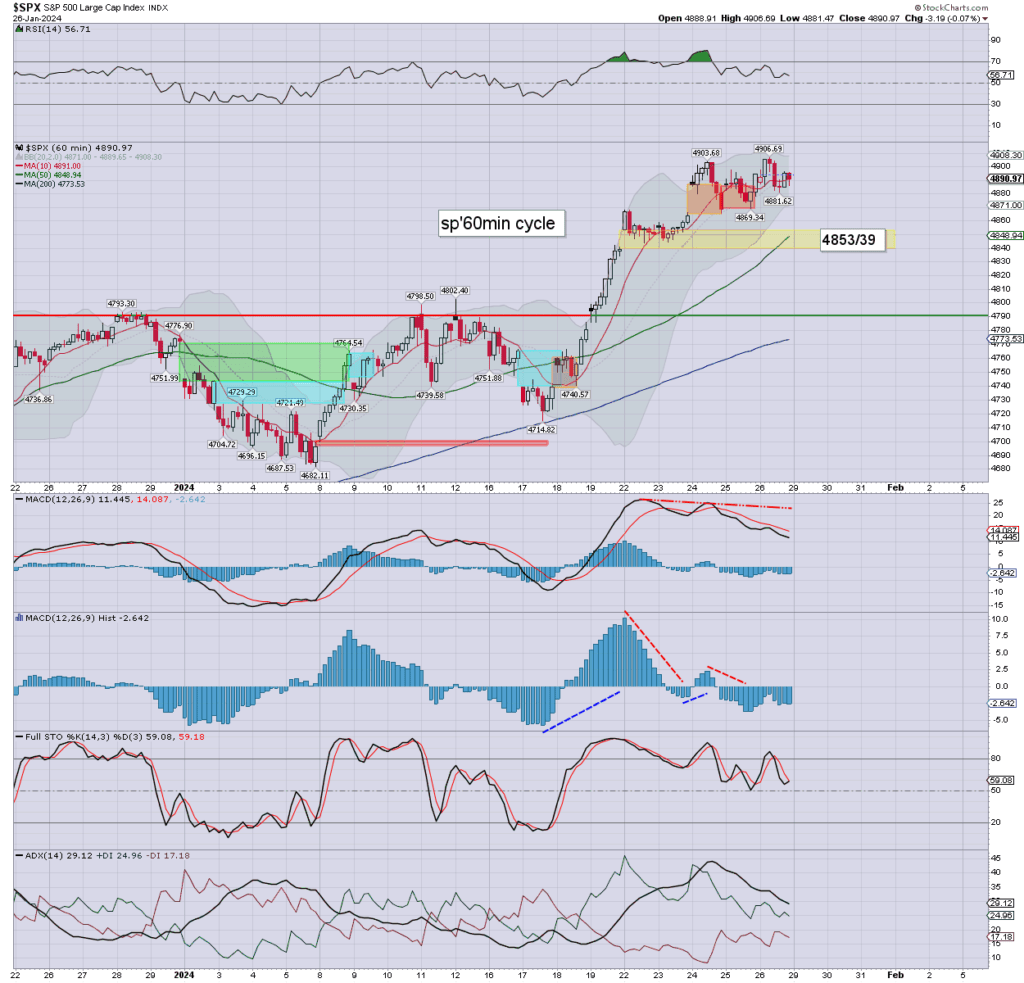

sp’60min

Summary

Last week ended with considerable chop, if still breaking a new hist’ high of 4906. S/t momentum settled on the moderately low side.

Overnight futures have seen a few swings, we’re set to open fractionally higher. Typically, the market will lean upward (if choppily) into the Wednesday afternoon of an FOMC announcement.

Yours truly is merely involved in gold/silver miners, having dropped ET last week. RUM is an attractive… if somewhat speculative idea, but I’ve near zero interest in chasing it higher.

—

Early movers

AAL +1.4%, Citi, neutral>buy, 14>20

–

ADM +2.3%, postponing exec’ bonuses, with an ongoing ‘accounting probe’. Doesn’t sound good.

–

AG +1.2%

ALB -1.3%

AMD +1.7%, Susquehanna 170>210

BA +1.0%

CLF +0.4%, earnings due in AH

–

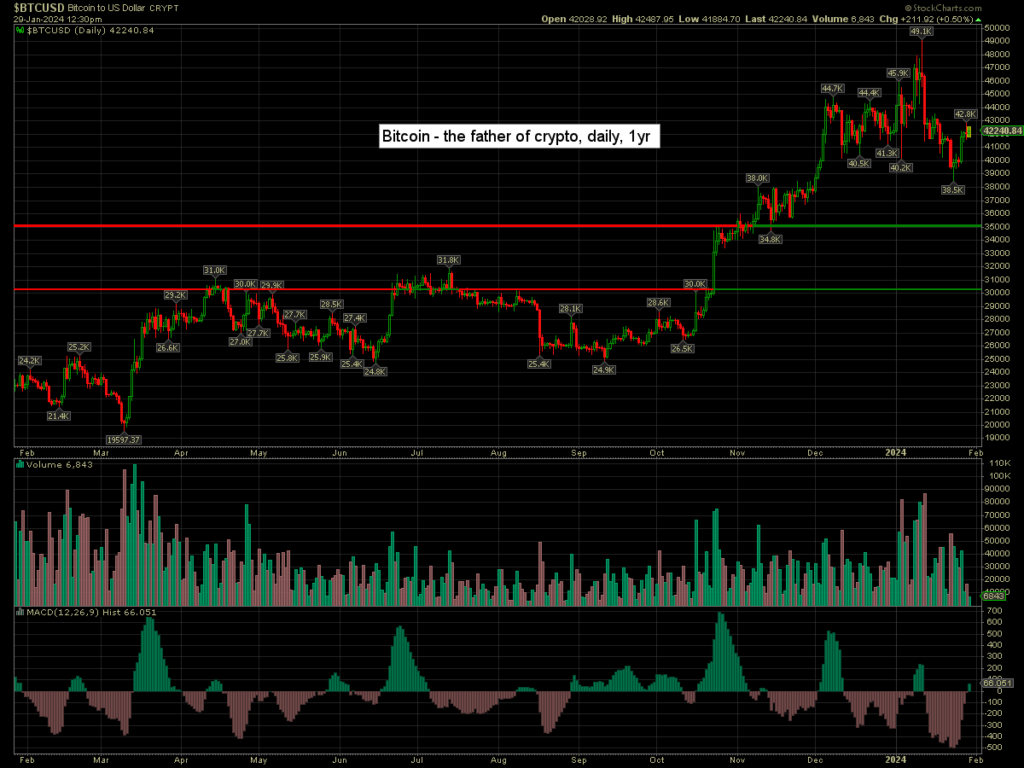

COIN +1.8%

Bitcoin is currently +0.5% at $42240

–

DLTR +2.1%, JPM, neutral>overweight, 122>157

FCX +0.4%, with copper u/c at $3.85

GOLD +0.9%

INTC +0.7%, dead cat bouncing

META +0.4%, earnings due Thurs’ AH

–

MSFT +0.8%, earnings due Tues’ AH

NEM +0.8%

OXY +0.3%

–

PHG -7.3%, EPS €0.41 vs 54est. Rev’ y/y -6.6% to €5.06bn vs 5.42est. A double miss, and the stock is duly getting whacked.

–

RUM -1.0%

SAVE -2.9%, s/t speculative swings.

SLB +0.3%

SMCI +1.4%, earnings due in AH

–

SOFI +9.0%, EPS 2cents vs 4est. Rev’ $615M vs 571est. I still see the company as wrapped in far too much hysteria.

–

TLT +0.6%, as yields cool ahead of the Fed

TSLA +1.2%, Tesla touting Capex of $10bn in 2024, and 8-10bn in 2025 and ’26

UNG -1.9%, with Natgas $2.12

–

VIX +4.7% at 13.89, but much of this gain is due to the new week.

–

WBD -1.5%, Wells Fargo, overweight>equalweight, $12

—

Overnight markets

Asian markets were very mixed, whilst European markets are a little mixed…

Japan: +0.8% to 36026

China: -0.9% to 2883

In communist China…

https://www.bbc.co.uk/news/business-68125359

Rather than deal with the problem – a multi-decade property bubble, the Chicoms have decided to focus their attention on short sellers. Removing the bears will ironically only lead to stronger and more sustained equity downside.

–

Germany: currently -0.4% at 16889

UK: currently +0.2% at 7653

Here in the failed state of the UK…

https://www.bbc.co.uk/news/business-68126878

Retailers continue to struggle. In this case ‘Superdry’ has seen sales drop by -23.5%. It should be clear, the bulk of the UK/western consumers are broken, with zero reason to expect this to change any time soon.

—

Have a good Monday