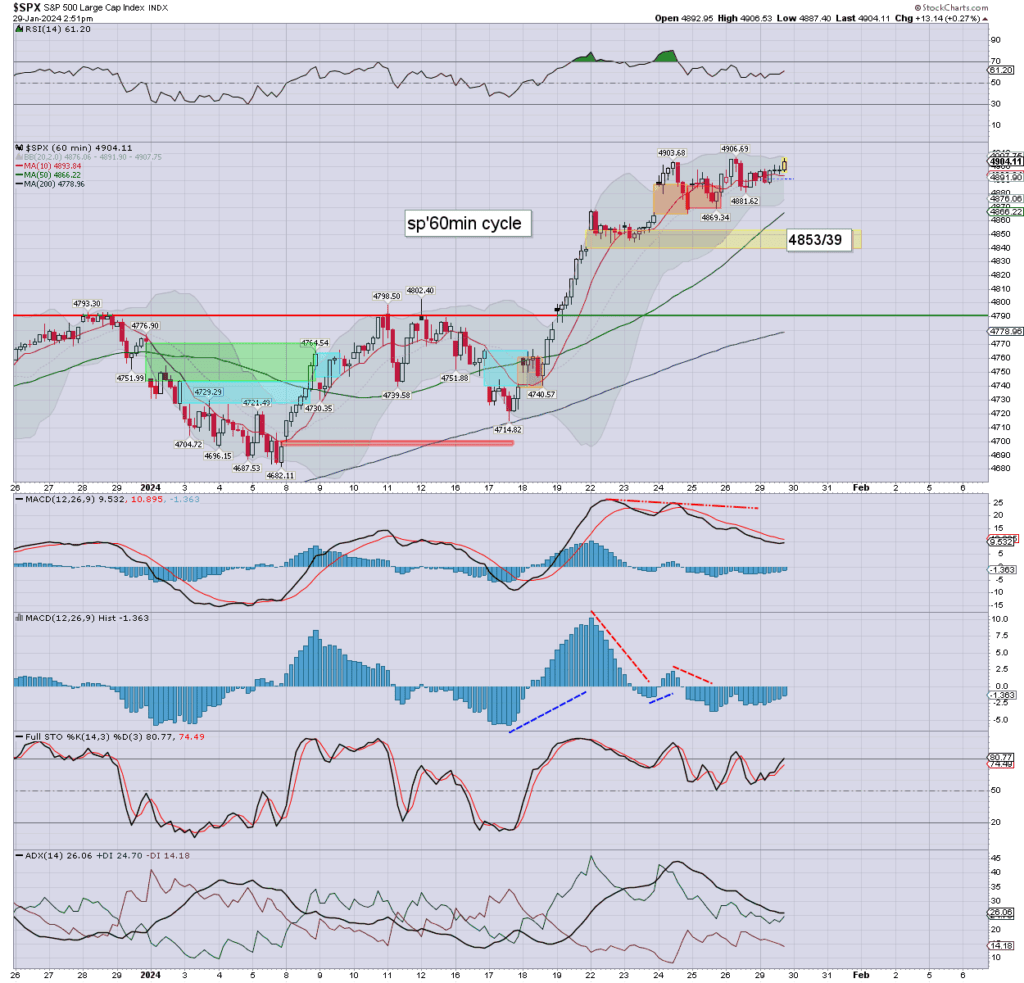

US equities remain a little choppy, if clawing upward, as s/t momentum will be prone to turning positive early Tuesday. WTIC $76s. Natgas $2.04.

sp’60min

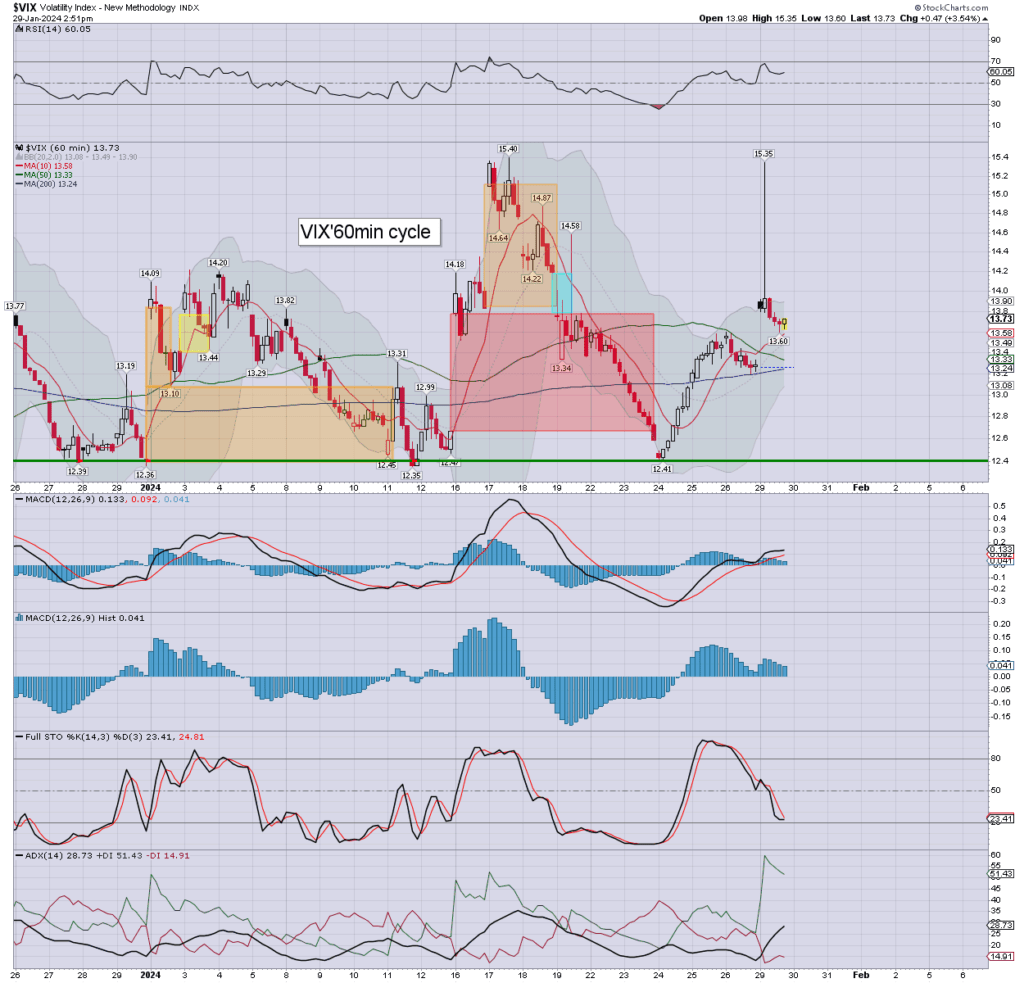

VIX’60min

Summary

We’ve background chatter that US troops are ‘on the ground’ in Yemen.

Regardless, the middle east situation is worse with each day.

Its kinda laughable that oil isn’t already at least around $100.

Just one sunken US/Allied ship… and Mr Market is going to have a really bad day.

Gold/miners, and oil/energy stocks, would be my natural ‘defensive sectors.

I’d accept the military/defensive stocks such as LMT, NOC, would be another way to play this across the year.

—

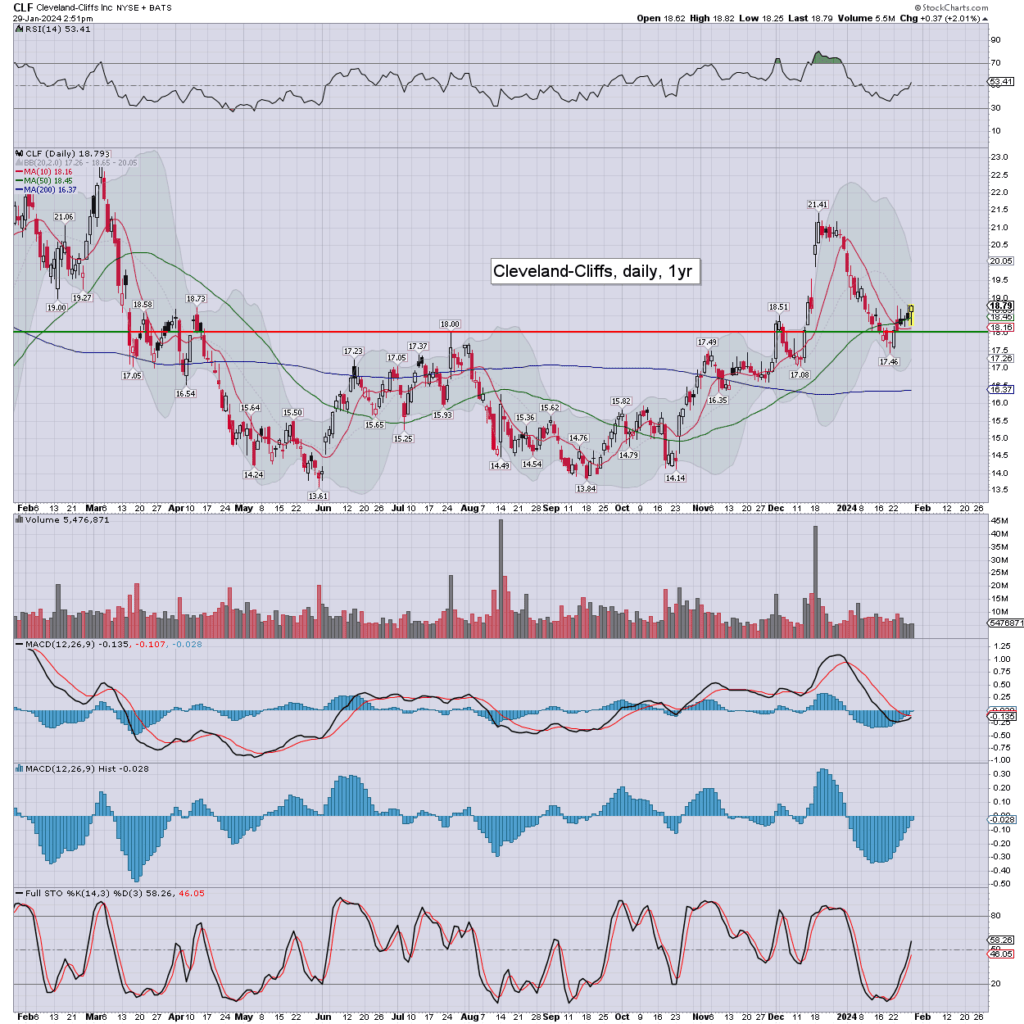

notable stock: CLF

Cleveland Cliffs has earnings in AH. I like the CEO.

The s/t cyclical setup favours the bulls.

Once X is delisted, I’d expect much of that ‘steel money’ to flow into CLF.

–

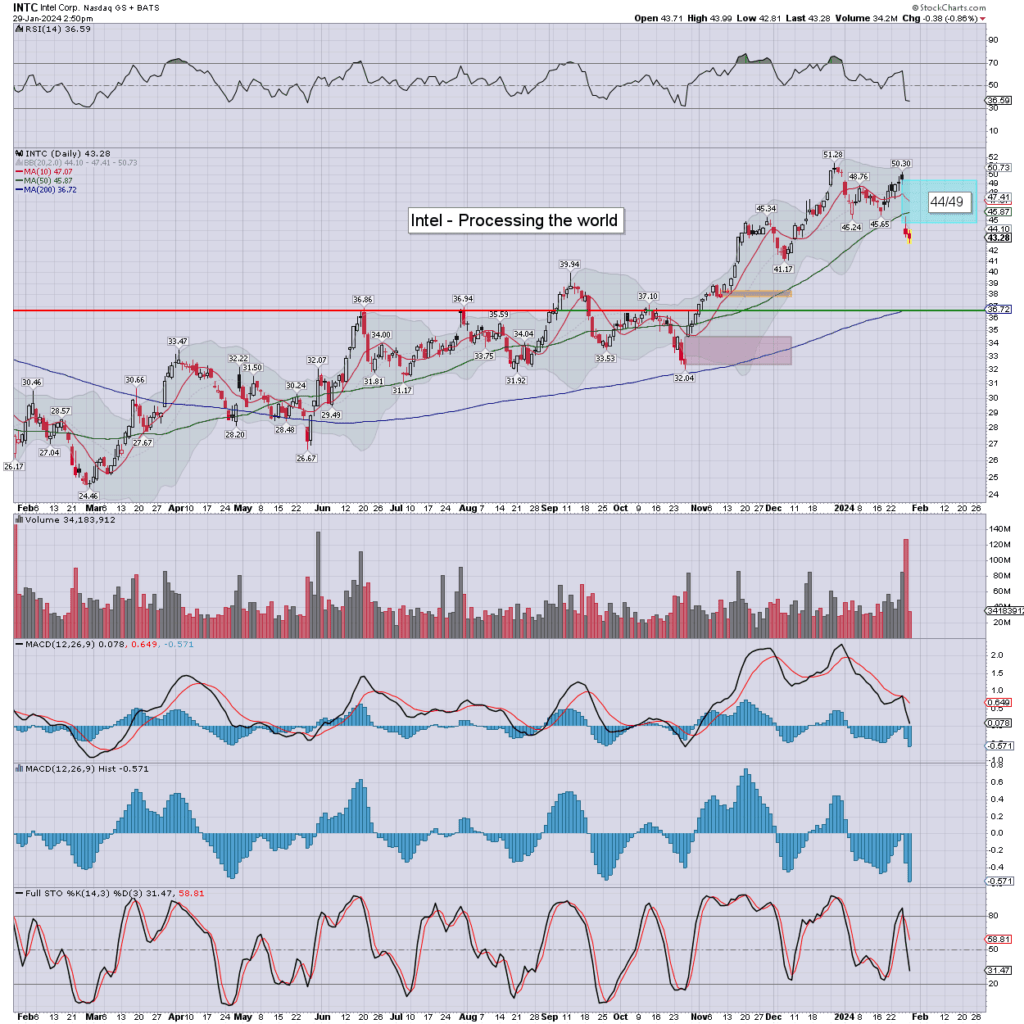

notable weakness: INTC

Failed dead cat bounce.

–

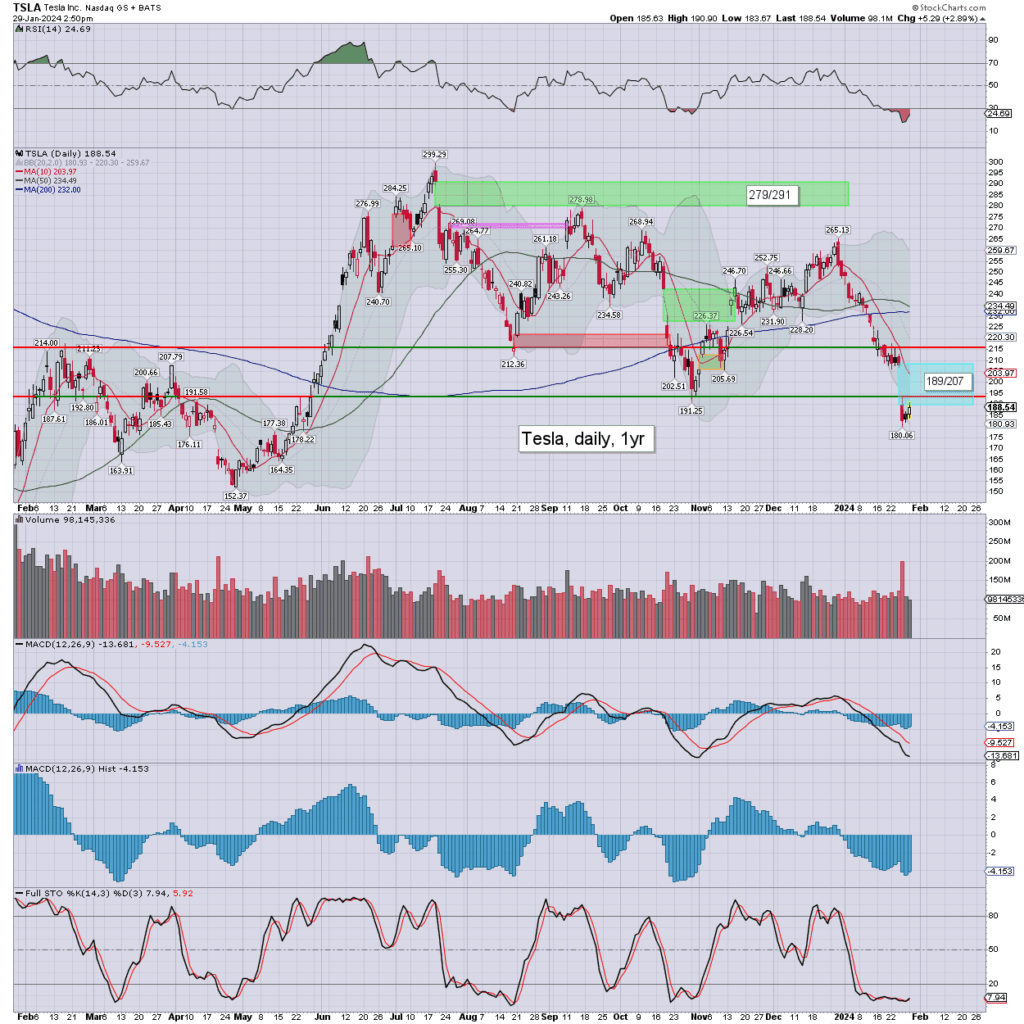

notable strength: TSLA

S/t speculative ‘bargain buyers’.

However, it typically takes 2-3 weeks to build a secure floor.

–

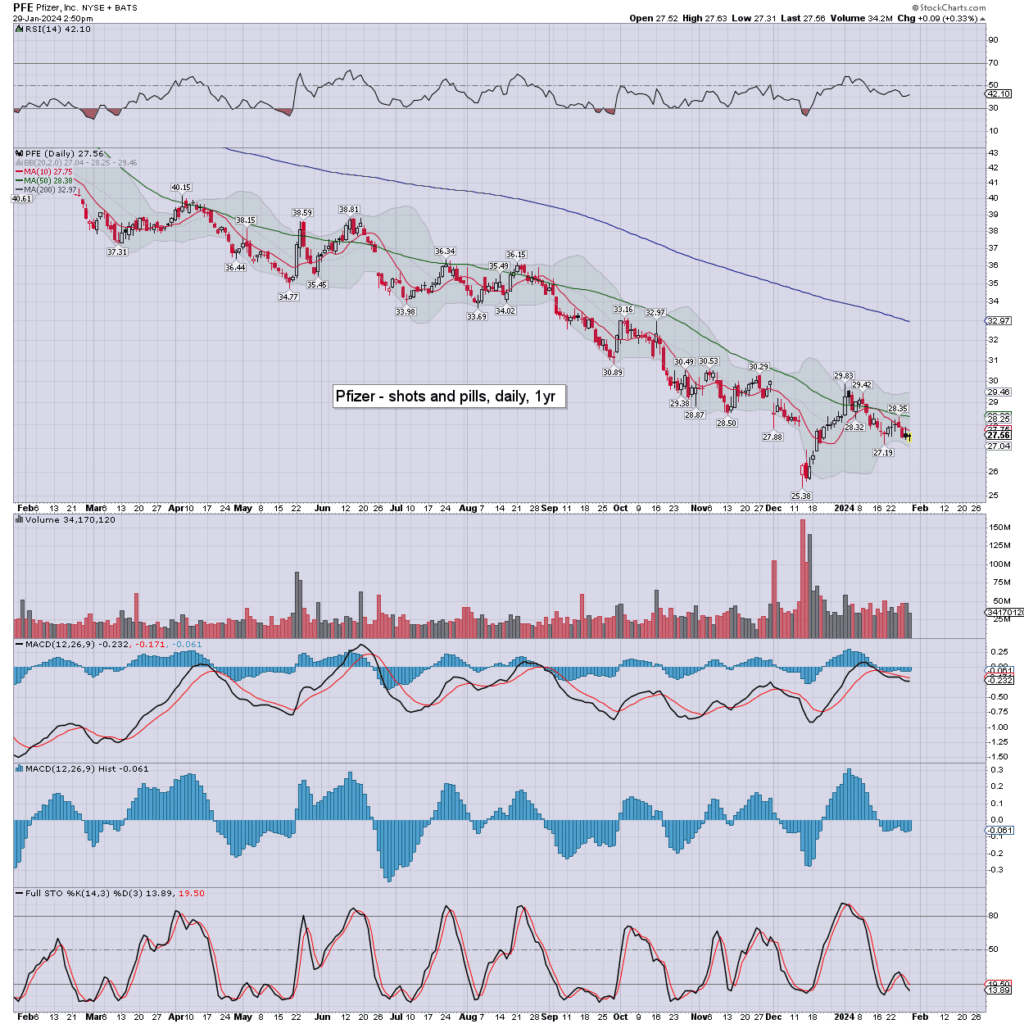

notable stock: PFE

Pfizer has earnings early Tuesday. The cyclical setup favours the bulls, and I’d accept the 200dma looks viable in March. Ethically, this remains a no-touch stock.

back at the close…