US equity indexes closed a little mixed, SPX -3pts (0.1%) at 4890. Nasdaq comp’ -0.4%. Dow +0.2%. The Transports settled -0.3%. R2K +0.01%

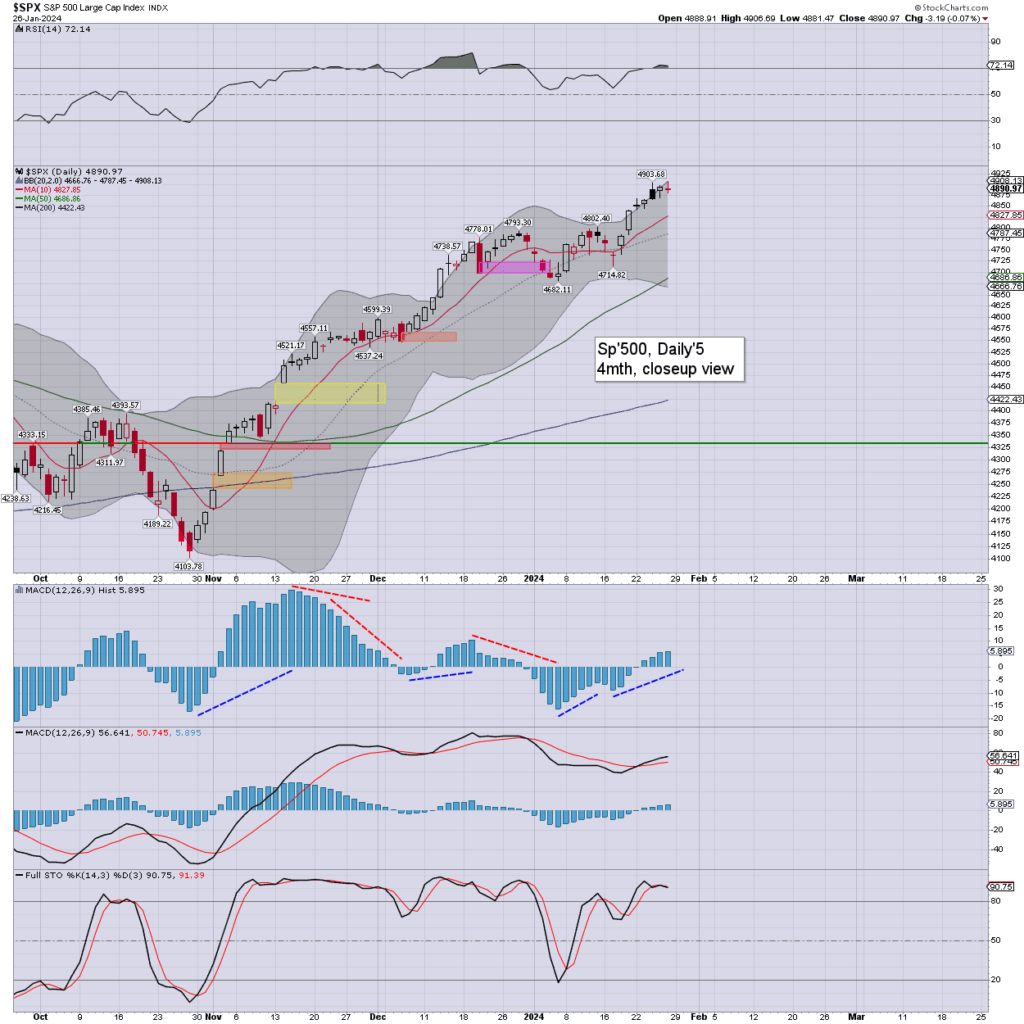

sp’daily5

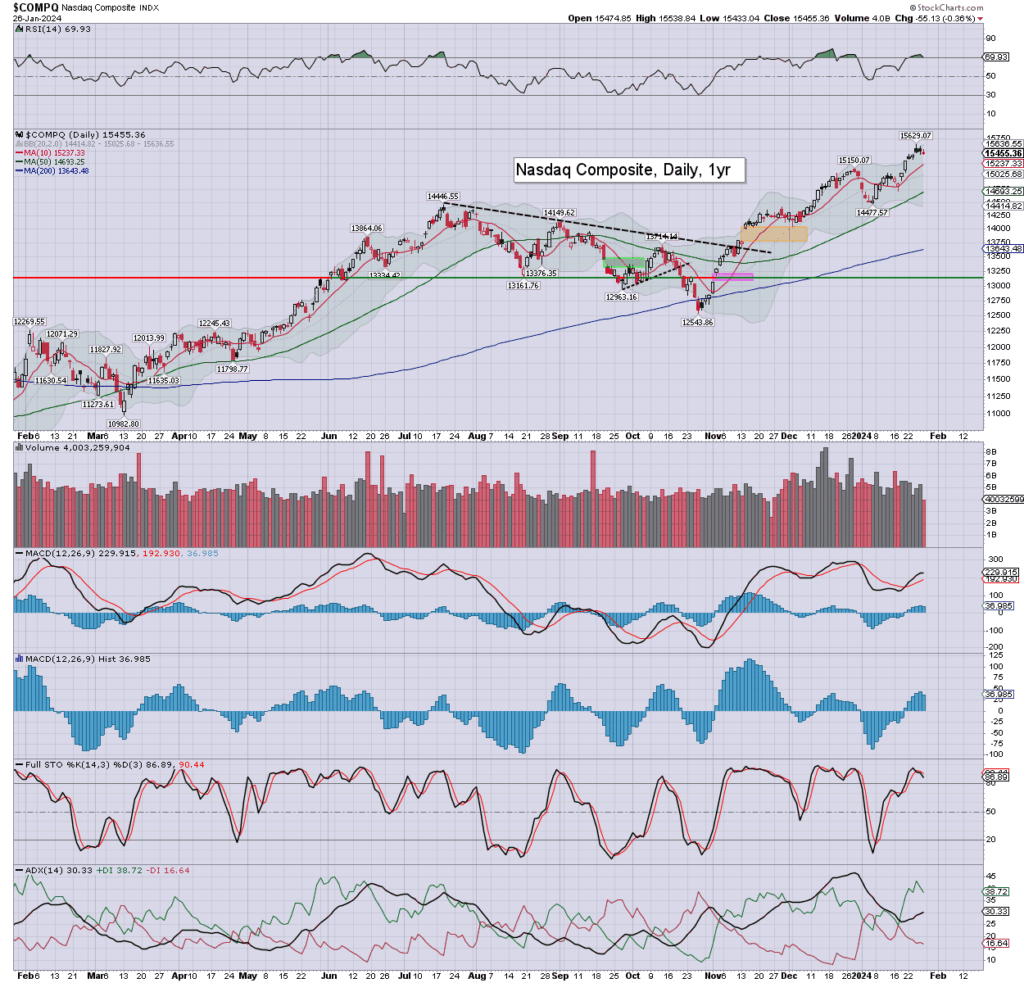

nasdaq comp’

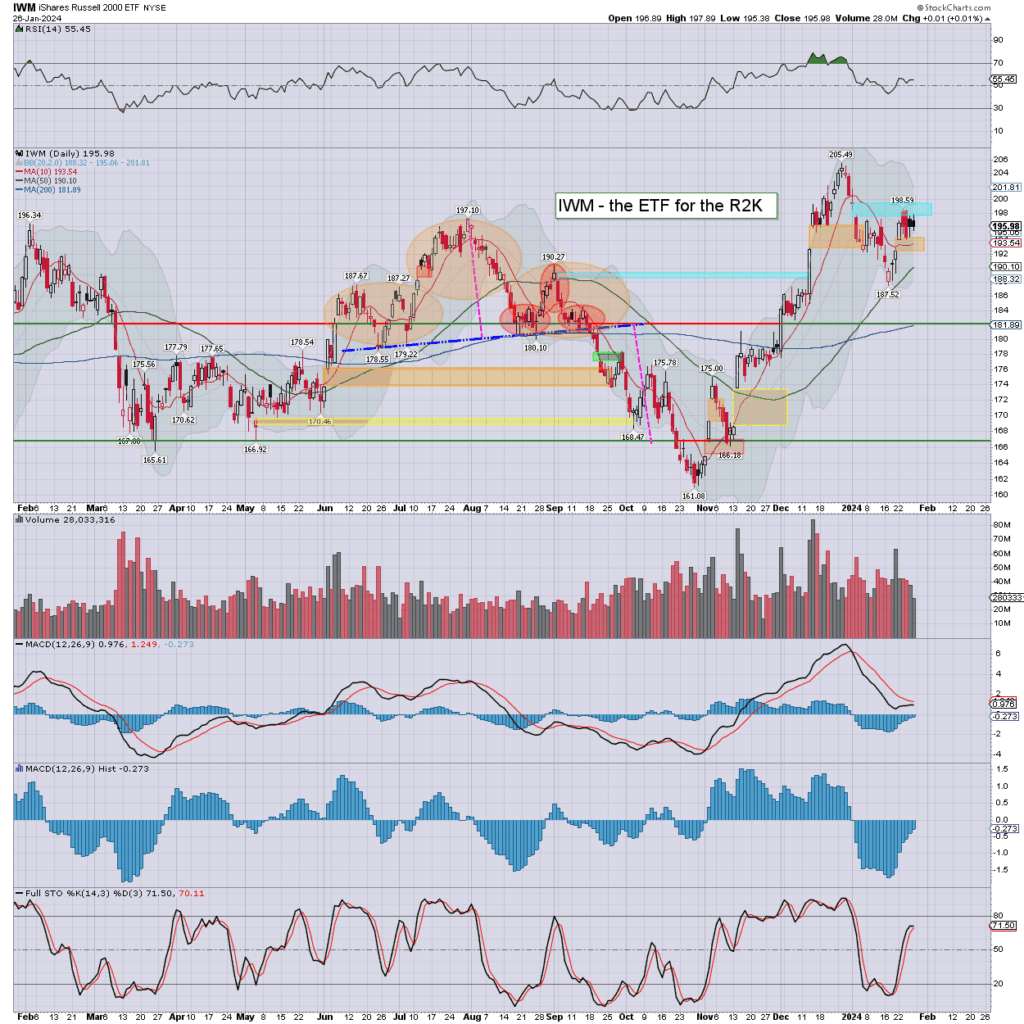

r2k – via proxy IWM

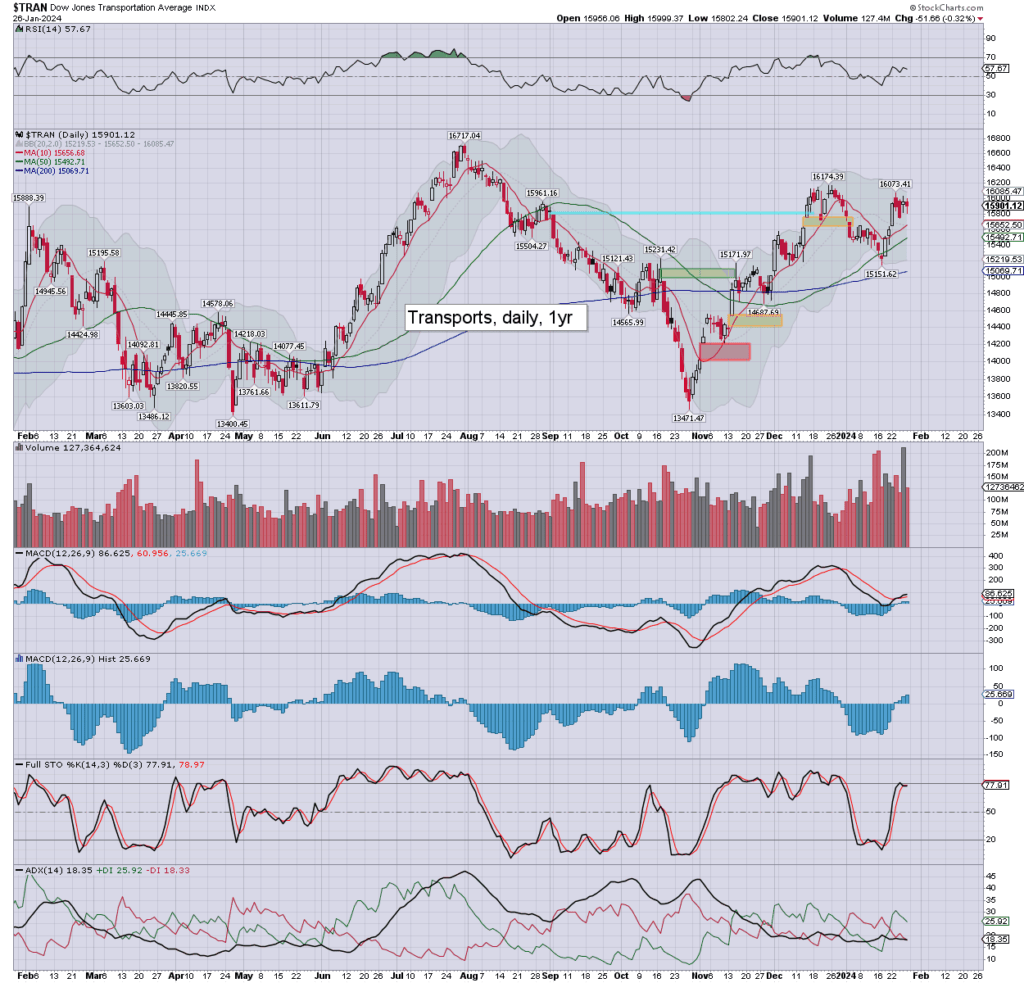

transports

Summary

SPX: printing a new historic high of 4906, if cooling back to settle -3pts (0.1%) to 4890. Today’s candle is a subtle hollow red reversal, and leans s/t bullish, if not necessarily the Monday open.

Momentum ticked upward, and is on the moderately high side. Upper bollinger stands at 4908, and will offer the 4940/50s next FOMC-Wednesday.

—

NAS: settling -0.4% to 15455. Thursday’s black candle played out. Momentum is offering a provisional rollover, as the setup leans a little weak for Monday. More broadly, I’d keep in mind the Nov’2021 hist’ high of 16212.

R2K: settling +0.01% to 195.98. Thursday’s black candle briefly/marginally played out. Friday’s candle is black, and leans s/t bearish, if only early Monday. The Dec’2023 $205s should be cleared in February, and then next target would be the Nov’2021 historic $236s, as look realistic within April/May, which would arguably equate to the SPX 5400s.

Trans: settling -0.3% to 15901. Bulls could argue structure is a bull flag. Any price action >16200 would offer the July 2023 high of 16717.

–

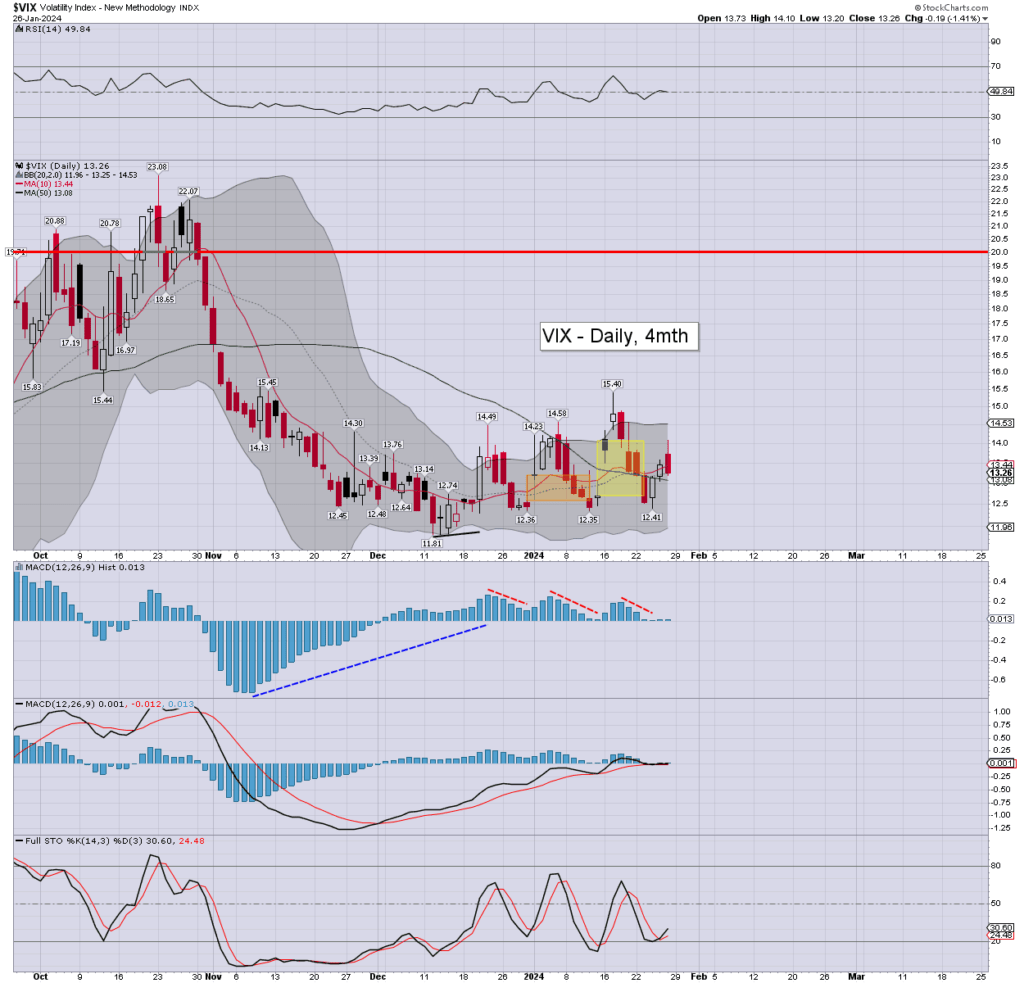

VIX’daily

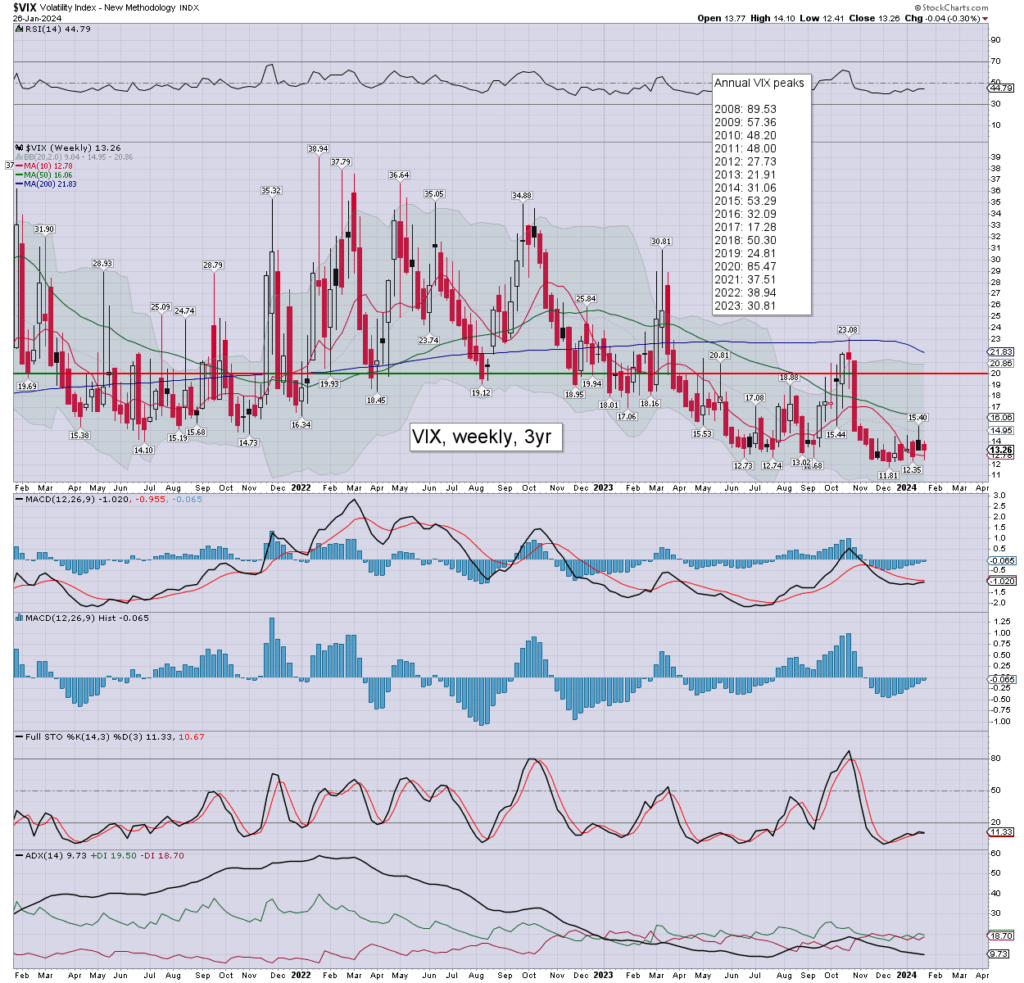

VIX weekly

Volatility was subdued, the VIX printing 13.60, but cooling back to settle -1.4% to 13.26. Momentum is flat-lining on the fractionally positive side.

For the week, the VIX declined by -0.3%. Momentum ticked upward, and threatens to turn positive next week. However, I struggle to see any ‘drama’ coming out of next week’s FOMC, and would instead expect VIX to remain low into early February.

–

a little more… by 6pm EST