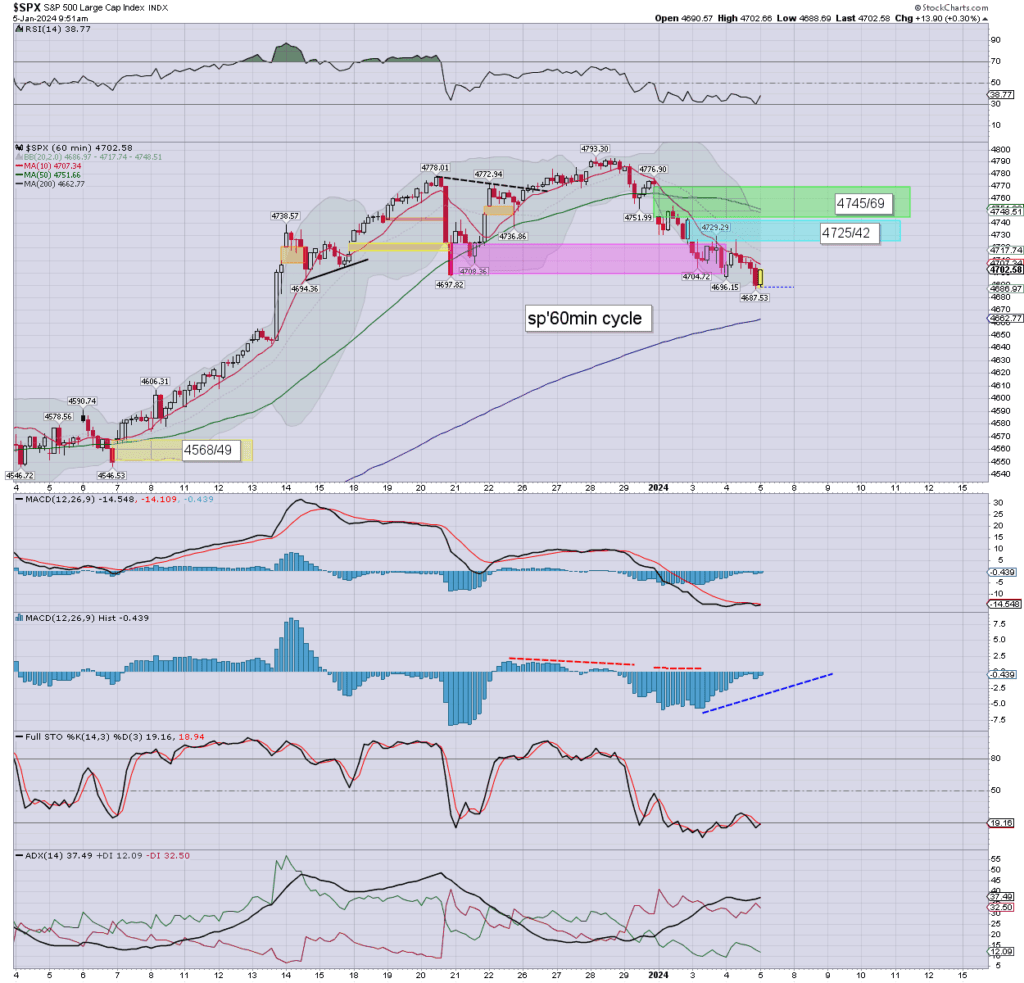

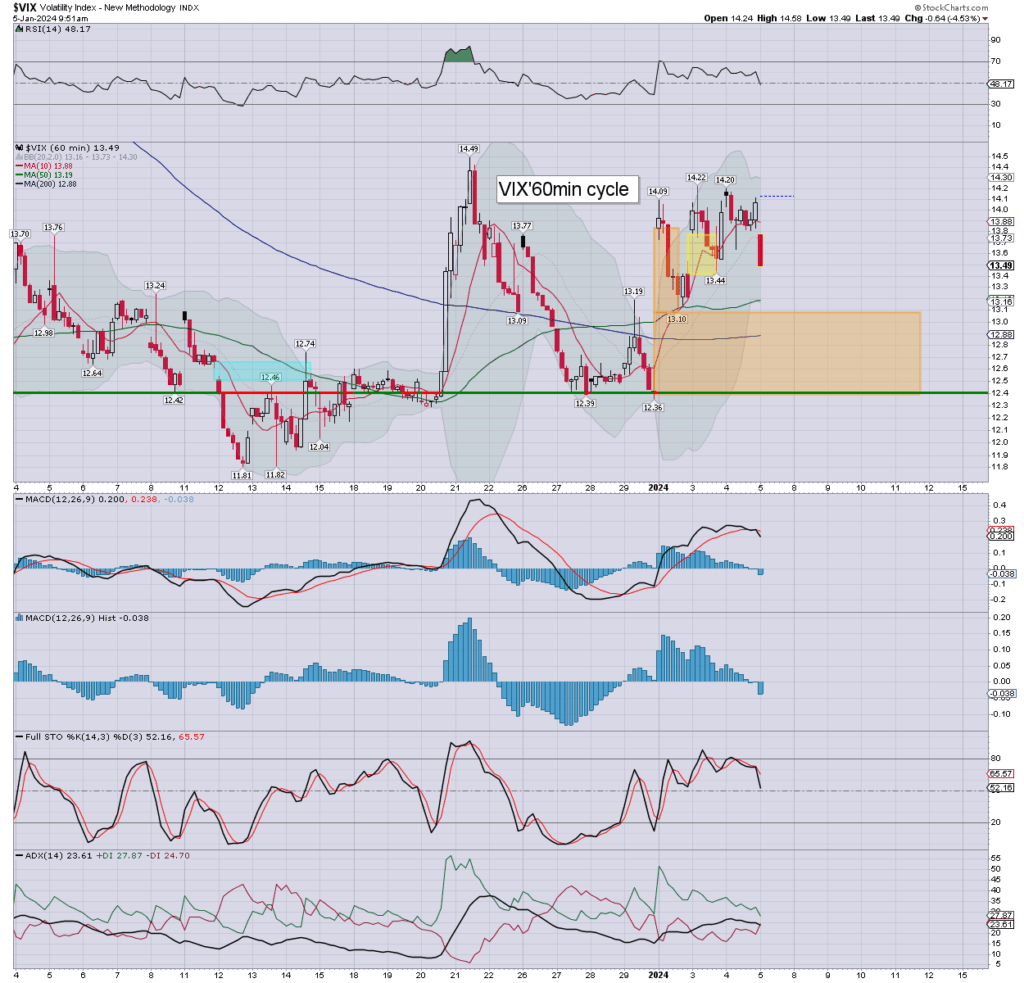

US equities are a little choppy, if leaning on the upward side. With the jobs data out of the way, the VIX has already been ground to the mid 13s. WTIC has spiked to $73.92.

sp’60min

VIX’60min

Summary

Net monthly jobs: 216K, with a headline jobless rate: 3.7%

Mr Market initially used that as ‘moderately good news is bad news’, if broadly recovering to marginal gains.

The s/t cyclical setup favours the bulls into the weekend.

–

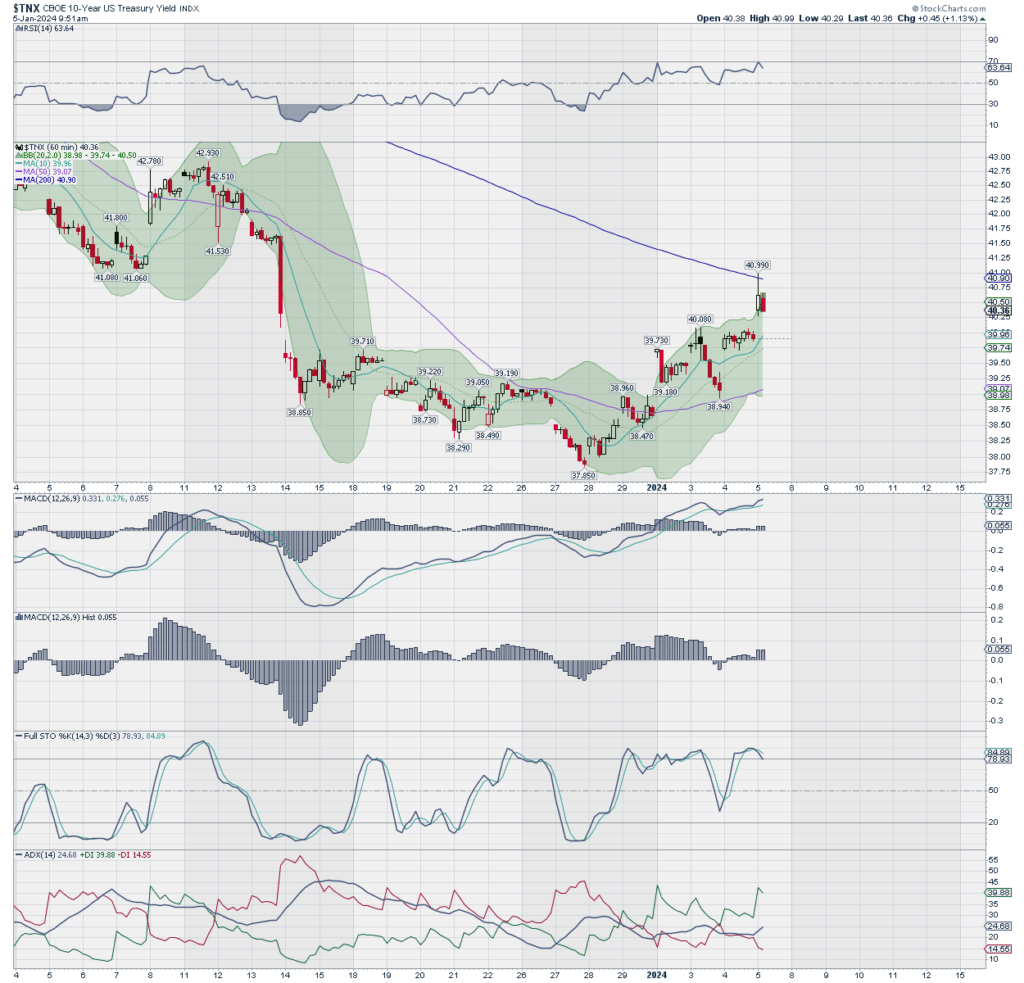

notable bond yield proxy: TNX, 60min

The US 10yr printed 4.099%, but is cooling back.

–

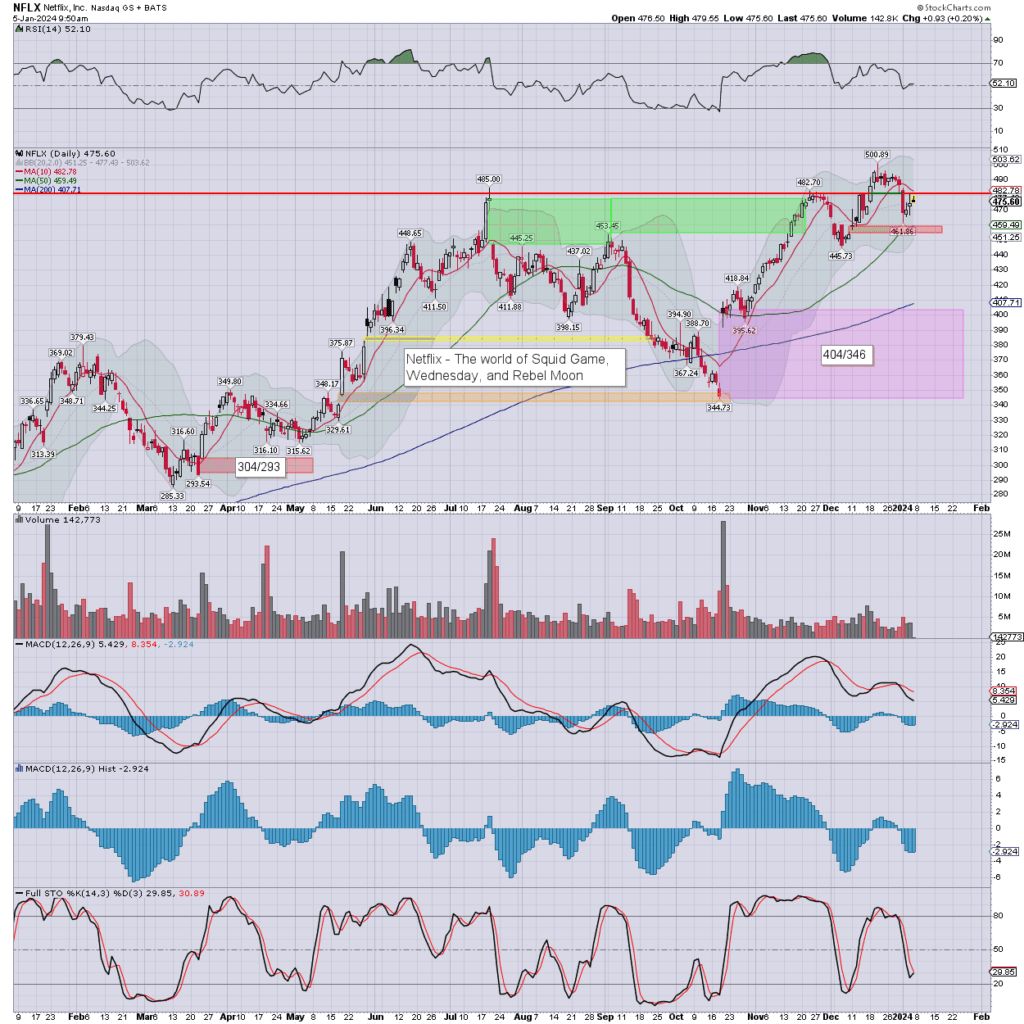

notable stock: NFLX

WSJ chatter that Netflix will be venturing into streaming games. It’d be a very cheap type of content, and there IS a significant audience for it.

—

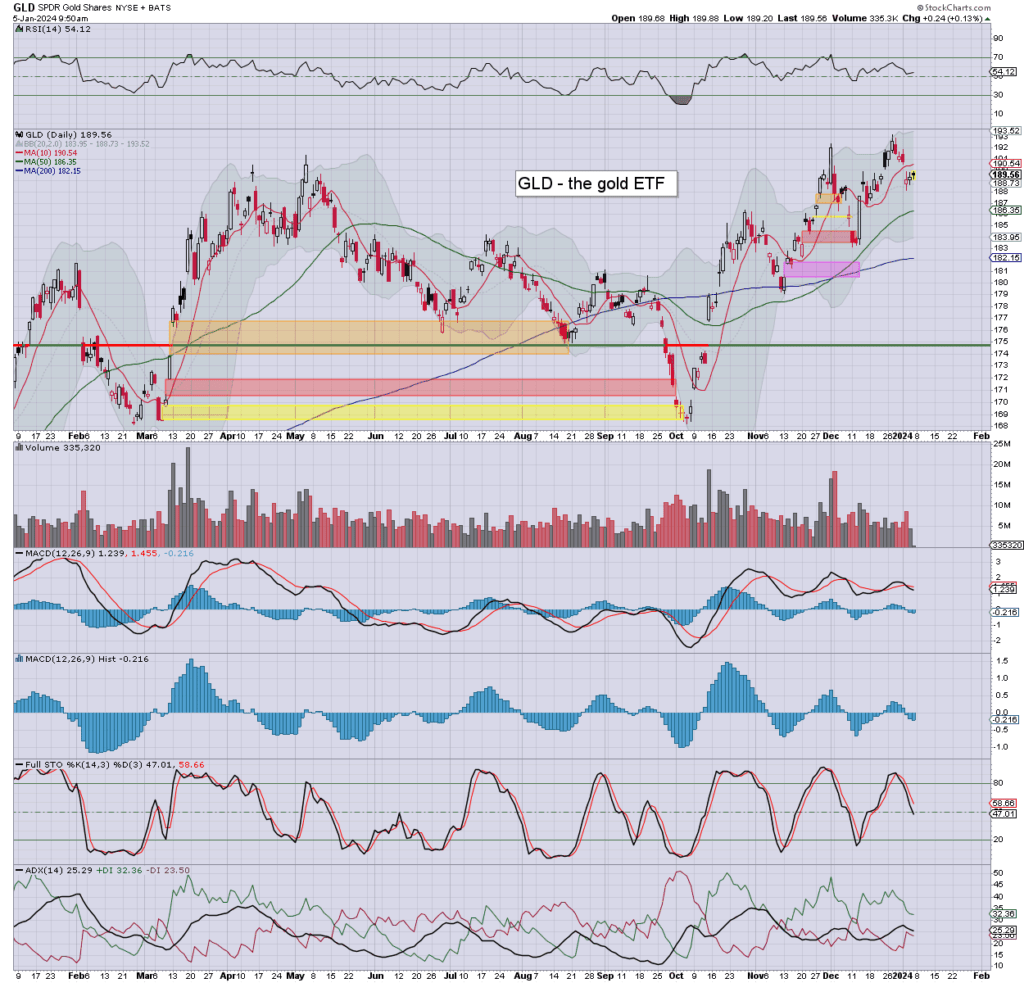

notable gold ETF: GLD

Gold printed $2030 on the jobs data, but has already clawed back to $2050. A daily close >$2060 would be… useful.

—

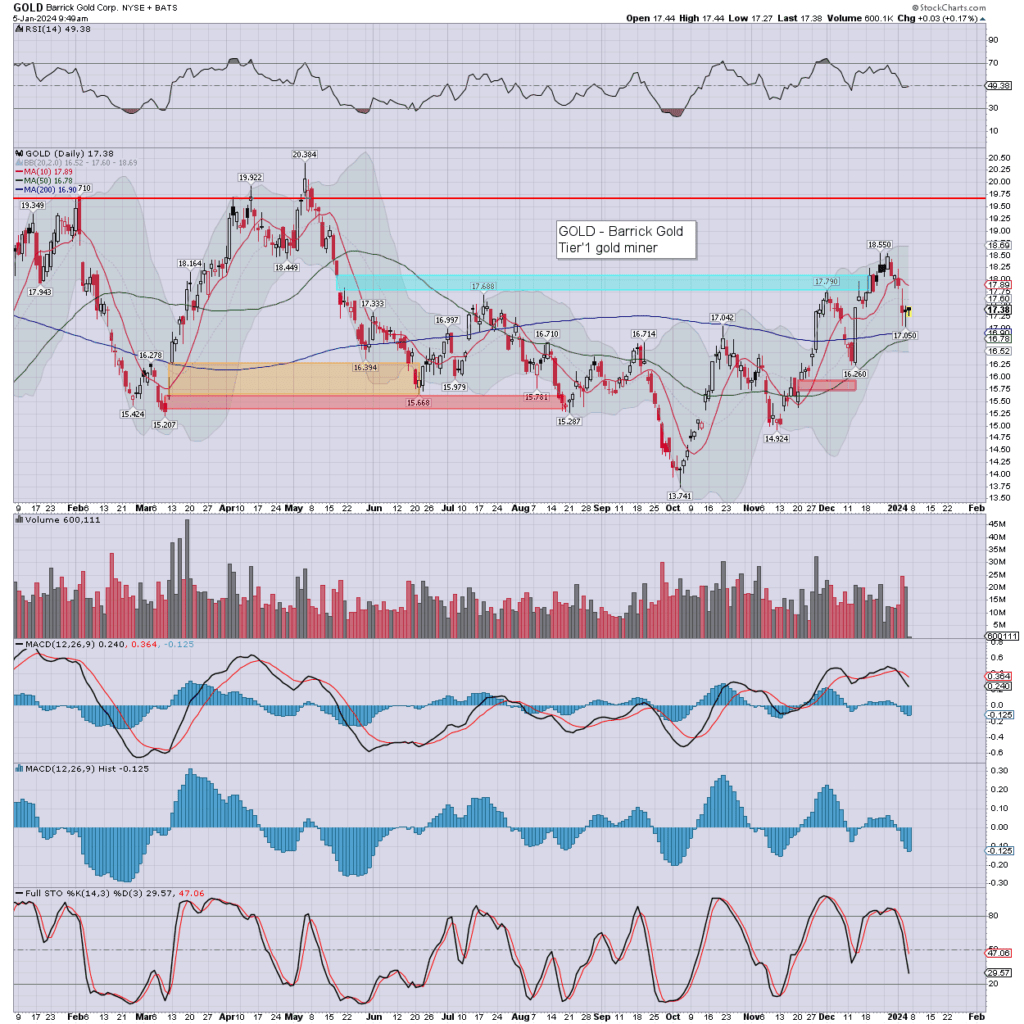

notable miner: GOLD

The Wed’ & Thurs’ daily candles are both spiky on the lower side, suggestive of a s/t floor. A positive daily close would also be… useful.

Time to venture out, if briefly.