US equity indexes mostly closed a little weak, SPX -16pts (0.3%) at 4688. Nasdaq comp’ -0.6%. Dow +0.03%. The Transports settled -0.04%. R2K -0.2%

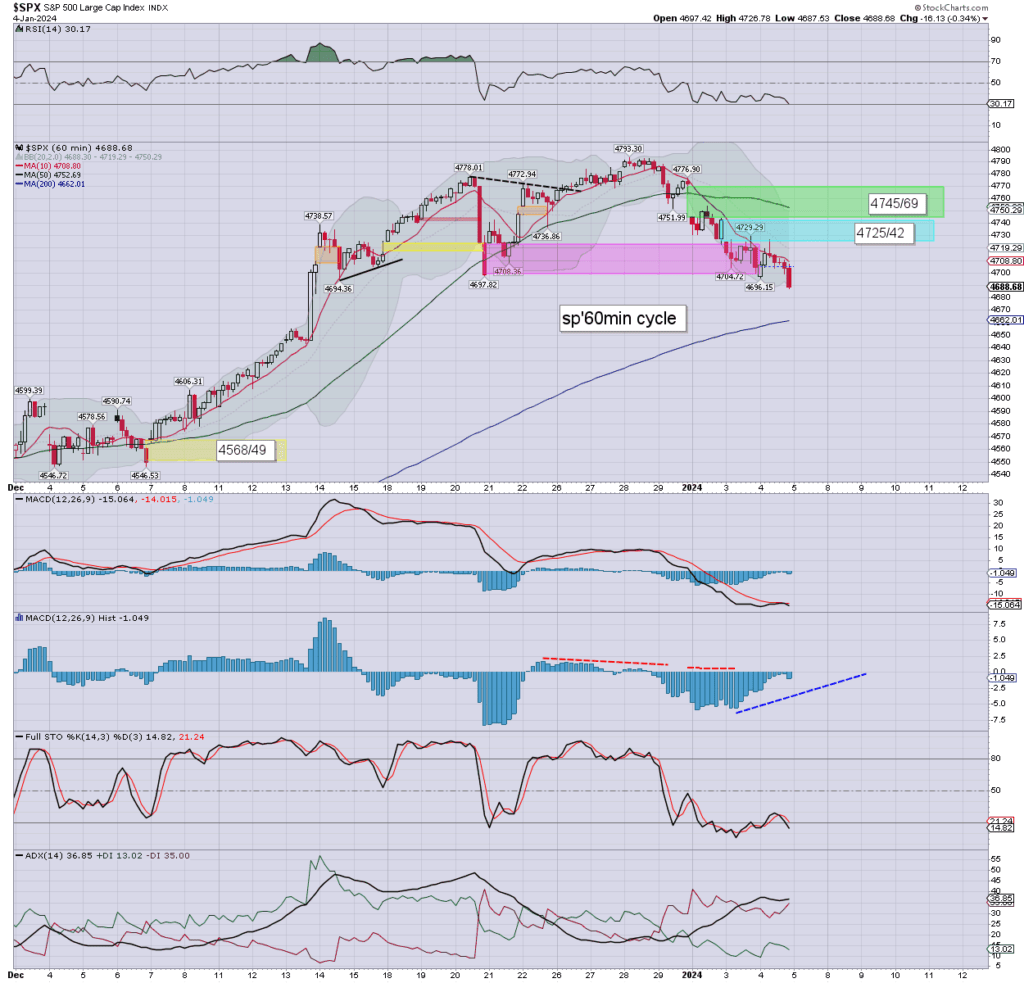

sp’60min

Summary

closing hour action: choppy, if leaning weak to break a new intraday low of 4687. S/t momentum ticked back lower, settling marginally negative.

*awaiting minor earnings from FC, KRUS

–

… and that concludes a subdued Thursday. The ADP jobs came in arguably Goldilocks, but the market wasn’t able to hold moderate gains. I’d accept the monthly jobs data is something of a wild card, but I do lean s/t bullish.

There is a valid H/S structure offering 4610, but even if that were to play out, first we need to go up to around 4770.

–

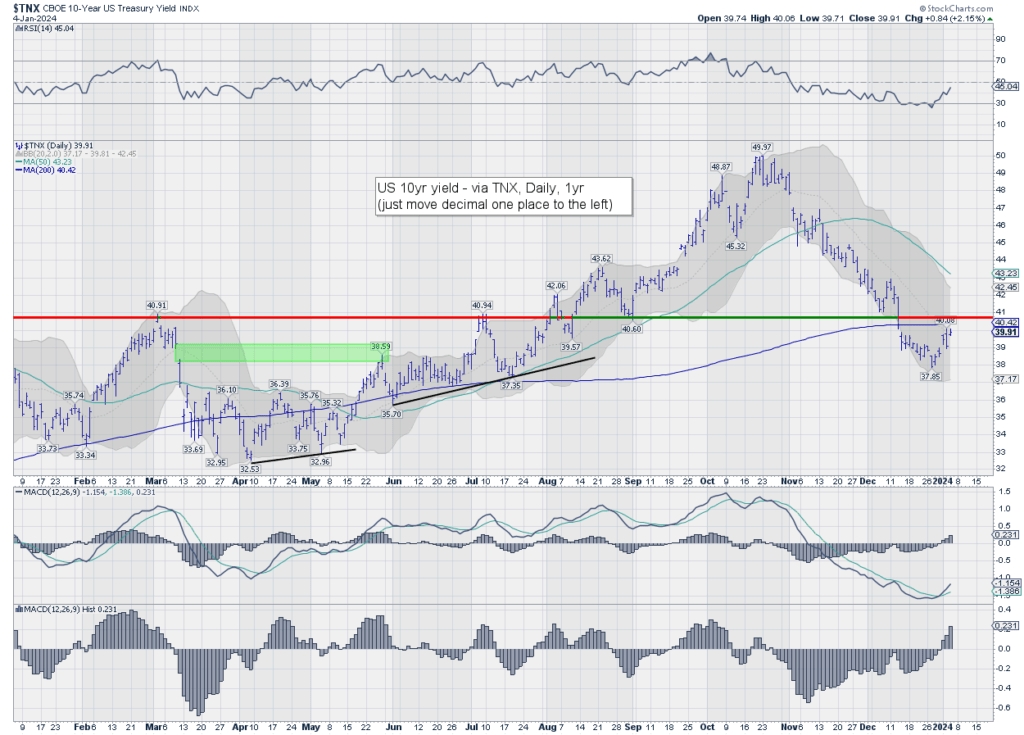

notable bond yield proxy: TNX, daily

An early pop to test 4.00%

More broadly, I’m inclined for 3.25%.

–

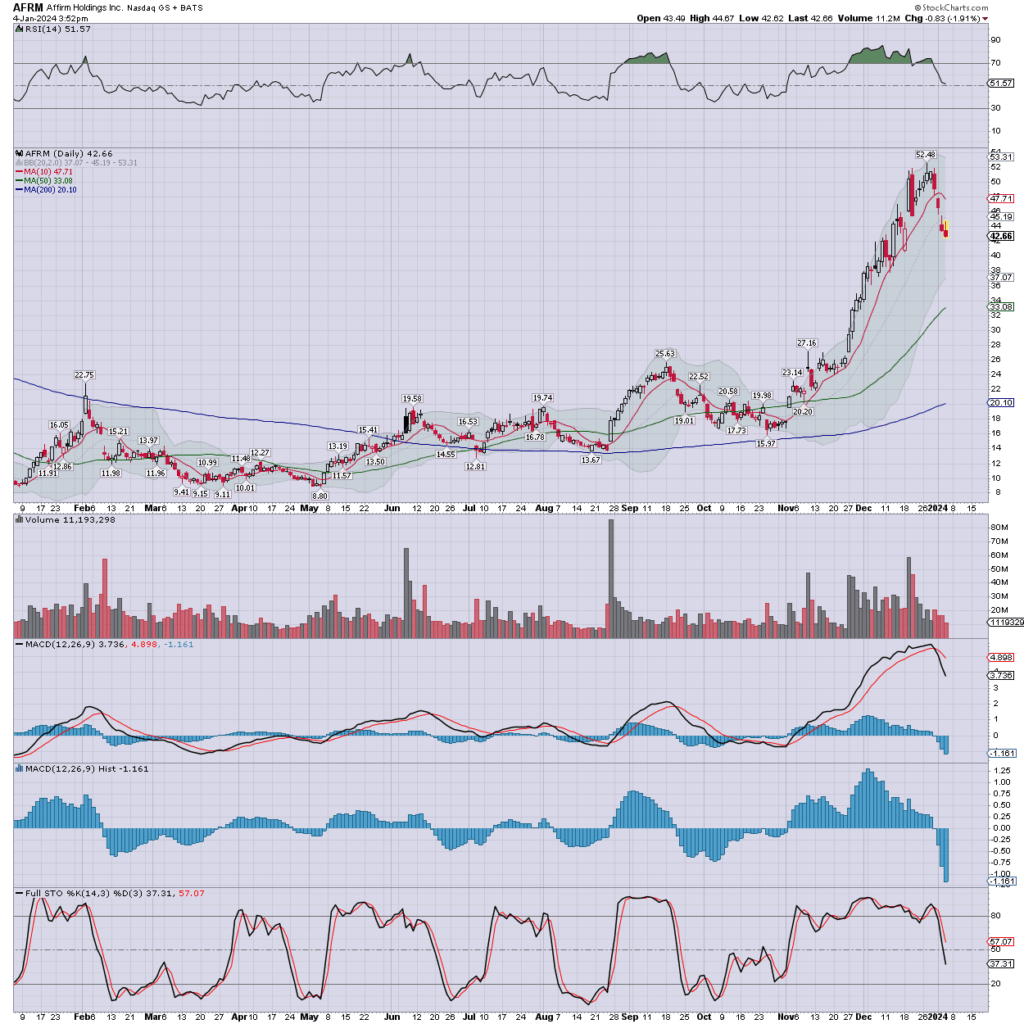

notable stock: AFRM

Recent hysteria about ‘buy now pay later’ has somewhat faded.

I remain skeptical Affirm has a l/t future.

To be clear, I don’t see it as a valid short, whilst the main market is m/t bullish.

–

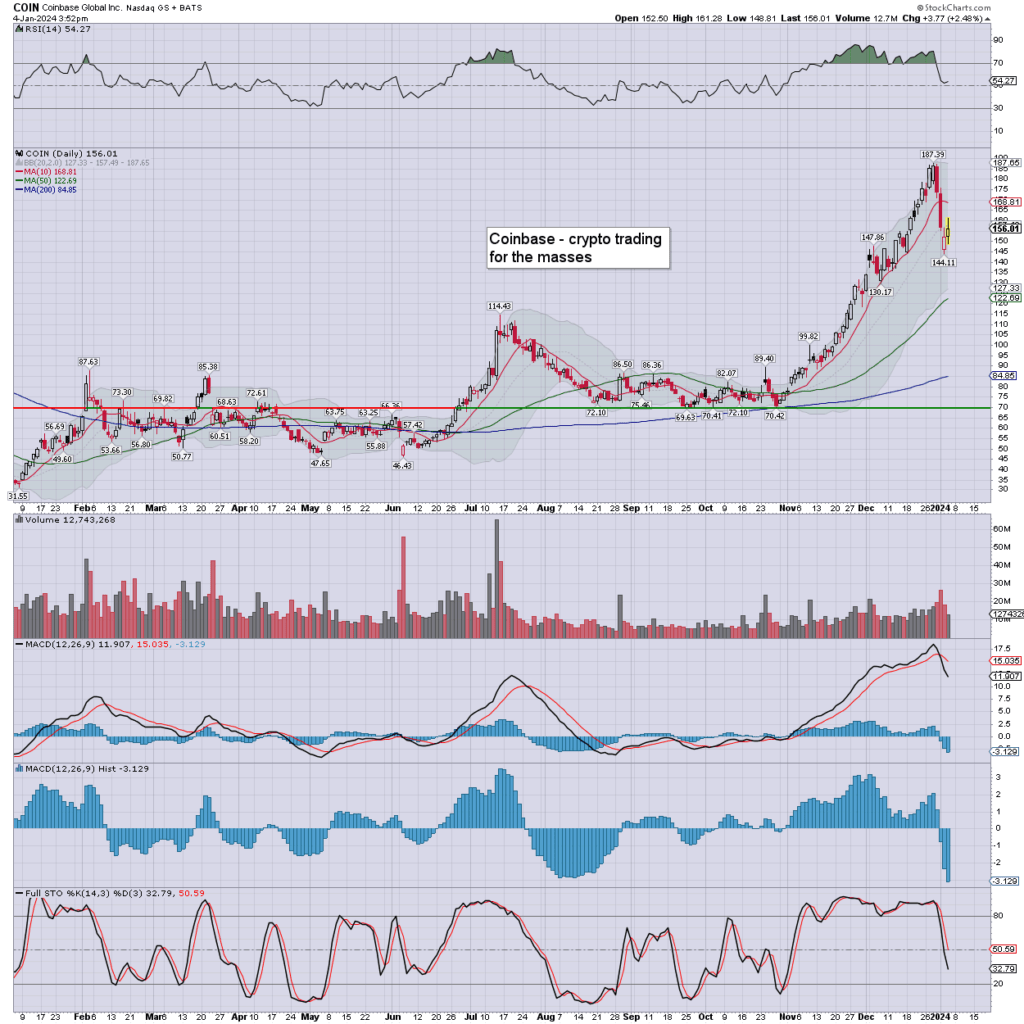

notable stock: COIN

Wednesday’s hollow red reversal candle played out.

–

Here… the heavy rain arrived as night fell… some five hours ago.

Have a good evening

–

more later on the VIX and Indexes by 6pm EST