Equities continued to cool back, the SPX printing 4699, and settling -0.8% to 4704. Meanwhile, WTIC settled +$2.32 (3.3%) to $72.70.

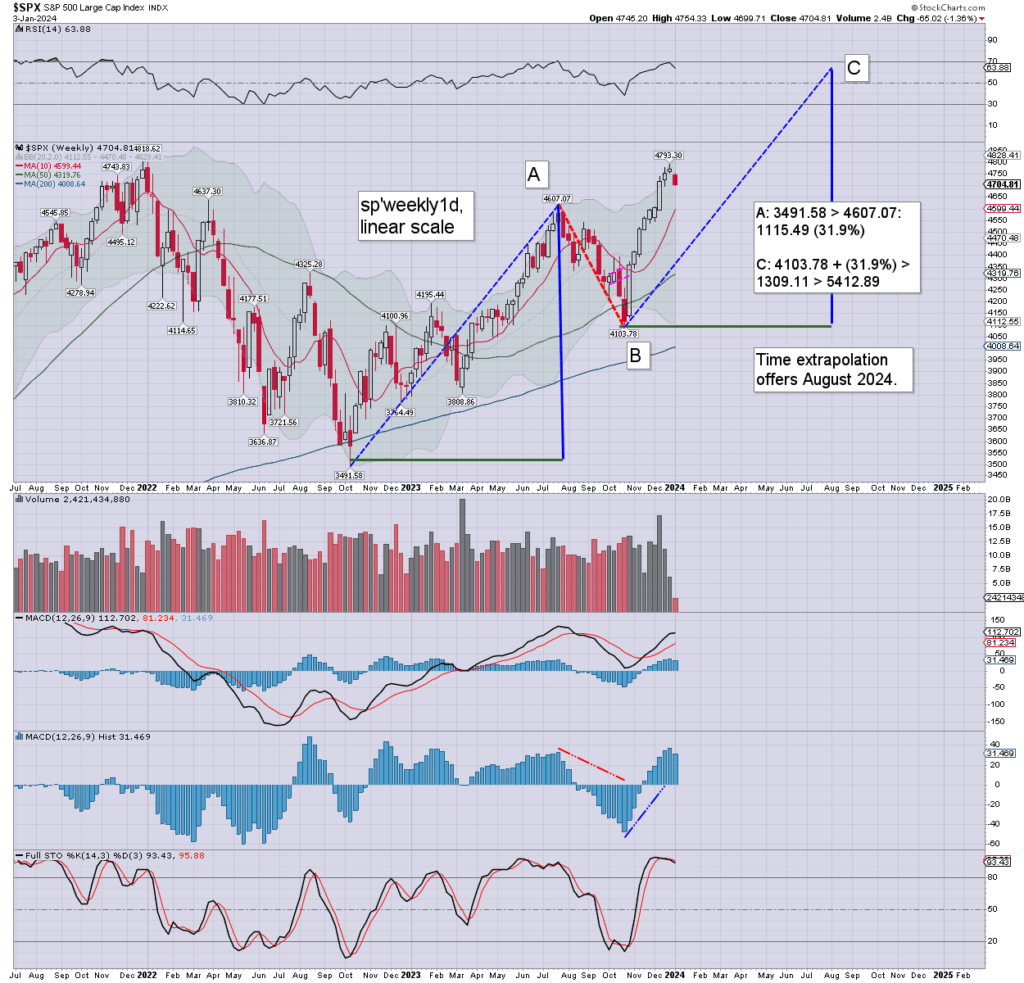

sp’weekly1d

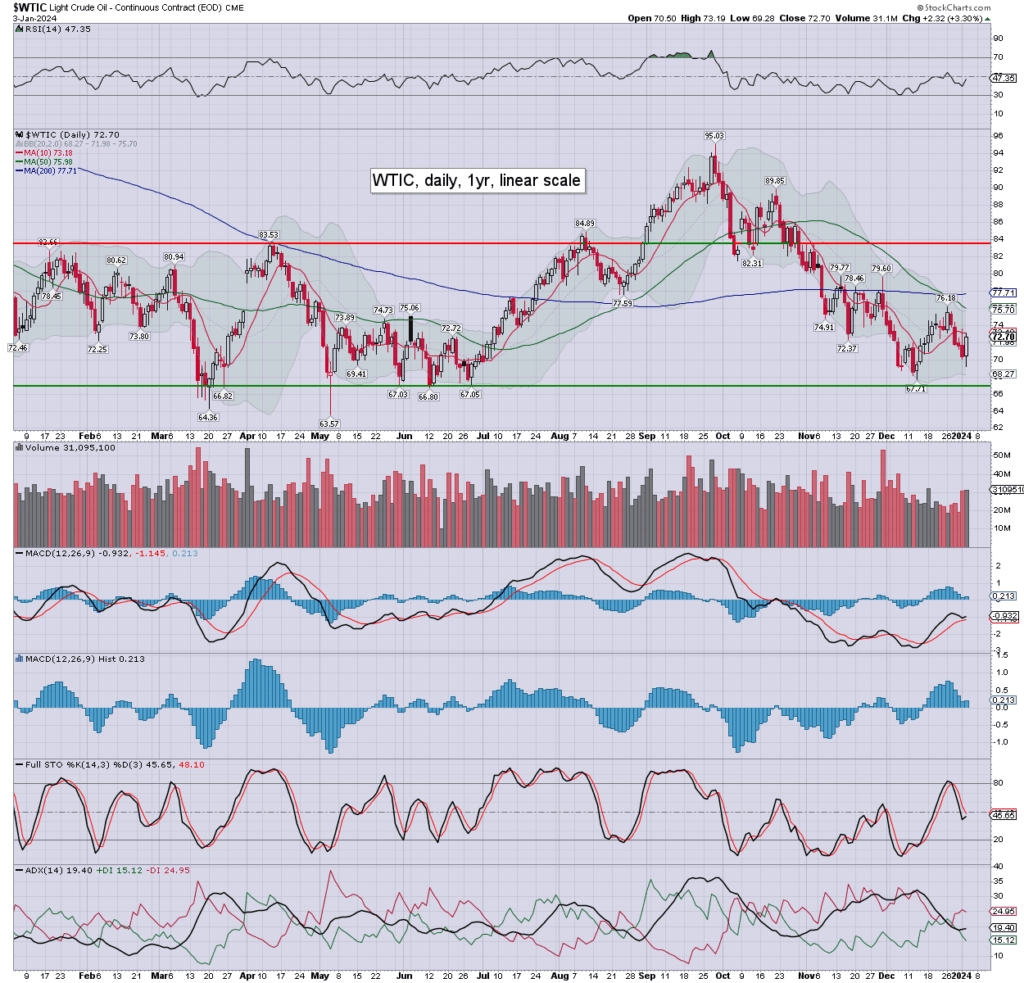

WTIC daily

Summary

SPX: We’re half way through the short week, and net lower by -65pts (1.4%). I’d actually be open to the notion we settle net higher, if the market resorts to the ‘bad news is good news’, with the ADP or BLS jobs data this Thurs/Friday.

Scenario 1d, is primarily based on the notion of the cooling wave across July>Oct’2023, being some kind of wave 2/B.

Bears have nothing to tout unless a monthly settlement under the monthly 10MA (currently 4442, if 4500 in February), and that doesn’t look feasible until at least April.

—

WTIC: oil printed $69.28, but swung upward to print $73.19, which was impressive relative to the weak equity market and the stronger dollar. Wednesday’s candle is bullish engulfing, and leans distinctly s/t bullish.

Clearly, any further escalation in the middle east, and oil will be inclined to hyper spike. The m/t trend can be said to turn bullish >$78.00

–

Looking ahead

Thursday will see ADP jobs, weekly jobs, S&P PMI serv’

Earnings: WBA, LW, RPM, CAG, LNN, SMPL, RDUS, FC, KRUS

–

Final note

#Excessdeaths was trending in the morning…

I dare anyone to disprove to me that #ExcessDeaths are not caused by one common factor in all these countries! pic.twitter.com/S7Tg8vYXBv

— MadMotorman TheMadHatter (@MadmotormanT) January 2, 2024

I’d note the raw death numbers are up to week’44, so you can add another 25% or so for the 2023 totals. The % above the 2015/19 average isn’t pretty, but neither does it merit hysteria.

To my old employers: @MailOnline @LBC @BBCNews @FoxNews @itvnews

Who bought your silence on EXCESS DEATHS?

Boys – I don’t want to start asking you in person, and by name, but be assured, I will. #ExcessDeaths pic.twitter.com/GddxtSs3v1

— Katie Hopkins (@KTHopkins) January 3, 2024

I’m not a particular fan of Ms. Hopkins, but her point is valid, as the mainstream remain silent on a number, which exceeds the civilian deaths in WWII.

–

Was ANYONE mainstream NOT taking money from Pfizer $PFE to promote the toxic mRNA shots? https://t.co/ELMdssJibl

— Philip Calrissian (@Trading_Sunset) January 3, 2024

So… some NFL player was paid around $20M by Pfizer to promote the shots.

Literal blood money.

–

The Celente, on some of the key trends of 2024

—

For this alone, Disney $DIS stock merits being $0.00.

Iger is an utter failure, who actively supports KK, the destroyer of everything within Lucasfilm, not least Star Wars, Indiana Jones, and Willow.

Cancerous. Woke. Garbage. https://t.co/NSvHhnPc23

— Philip Calrissian (@Trading_Sunset) January 3, 2024

… as Walt Disney is spinning in his grave, or is it a cryo tube?

–

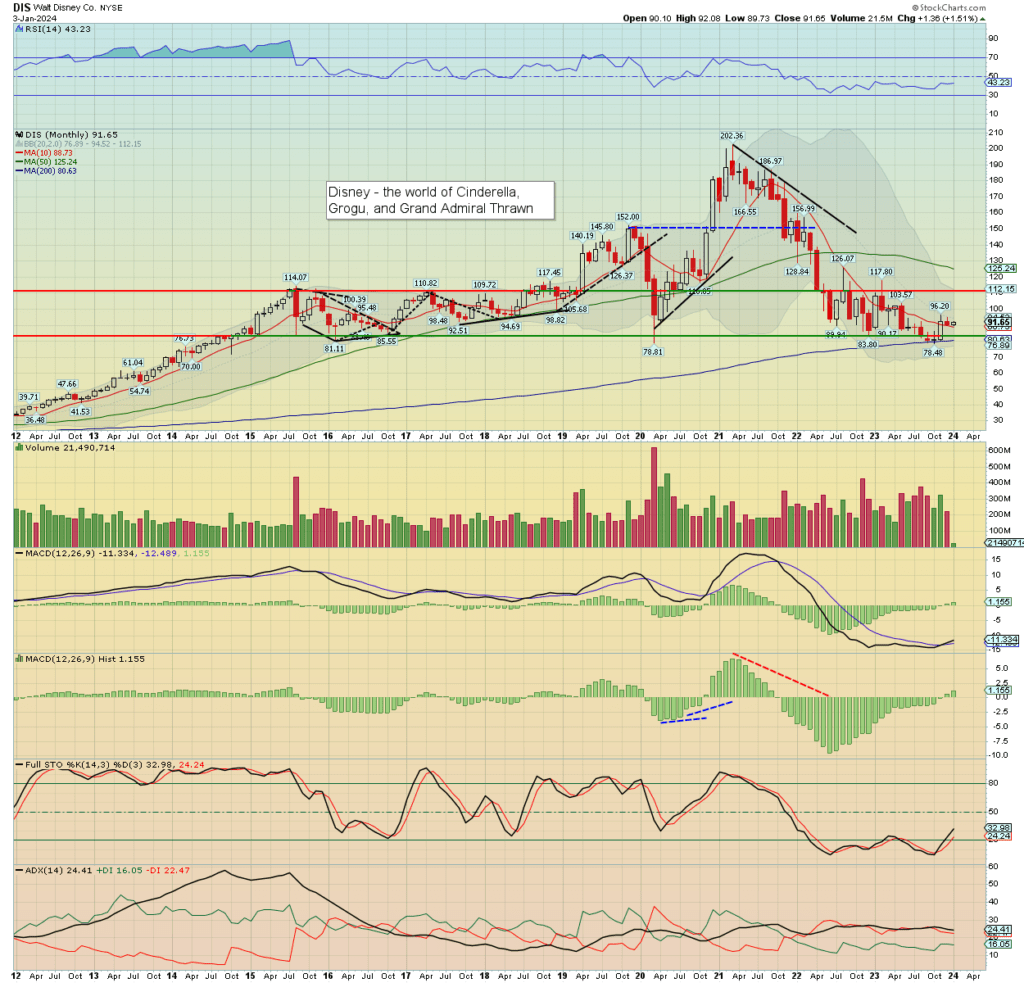

DIS, monthly

Disney settled Wednesday +1.0% to $91.65, with news of another activist group pushing against Trian – lead by Nelson Peltz. This all seems a stupid distraction, whilst the company is set to churn out more (loss making) woke garbage in the years ahead.

More broadly, monthly momentum is increasingly positive, as the trend looks net bullish into the spring.

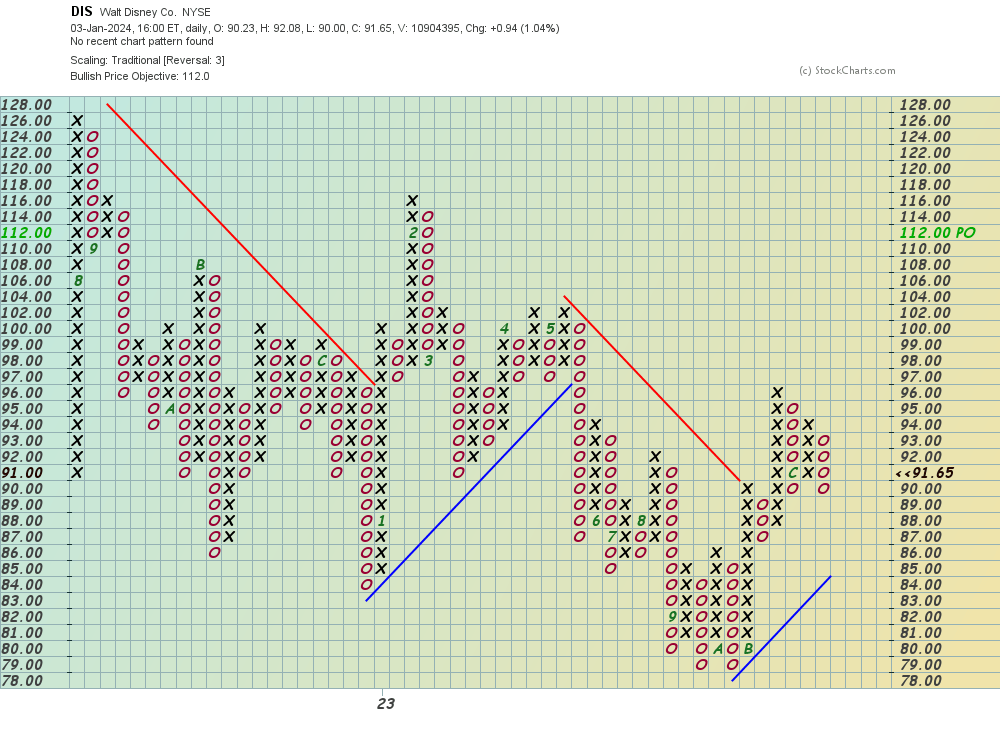

DIS, PF

Computer has a bullish target of $112

Computer has a bullish target of $112

A grander problem for the Disney bears is if the main market powers upward to SPX 5K, or even higher. Arguably, even the bolder bears will leave this one alone until the main market shows a decisive rollover on the monthly charts, and that is likely some months away.

–

Yours truly will sleep soundly with a threesome (or should that be a quartet, if I include myself), via the gold/silver miners of NEM, GOLD, AG. I need to exit/reposition a GLD CALL block. I’ll hope commodity gold can spike to the $2080/90s before the weekend, which would make for an acceptable exit.

Indeed, if there is anything I’d call for this spring… it’d be Gold $2400/2500 no later than April/May. This arguably won’t require a ‘dollar collapse’, or anything geo-politically ‘wild’ to happen.

Goodnight from London