US equities are broadly lower. Meanwhile, WTIC is currently +3.0% in the $72s. The energy sector ETF of XLE is currently net higher for the week by +2.0% at $85.55.

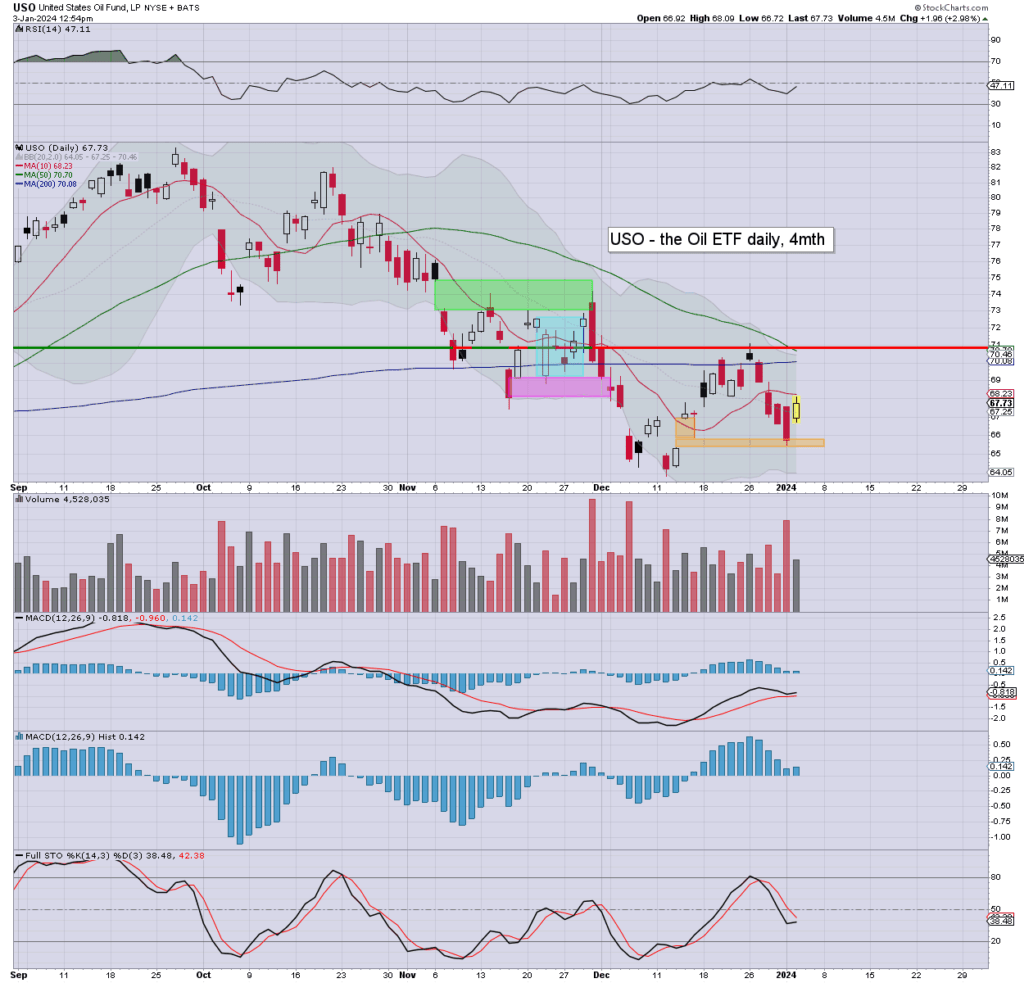

USO daily

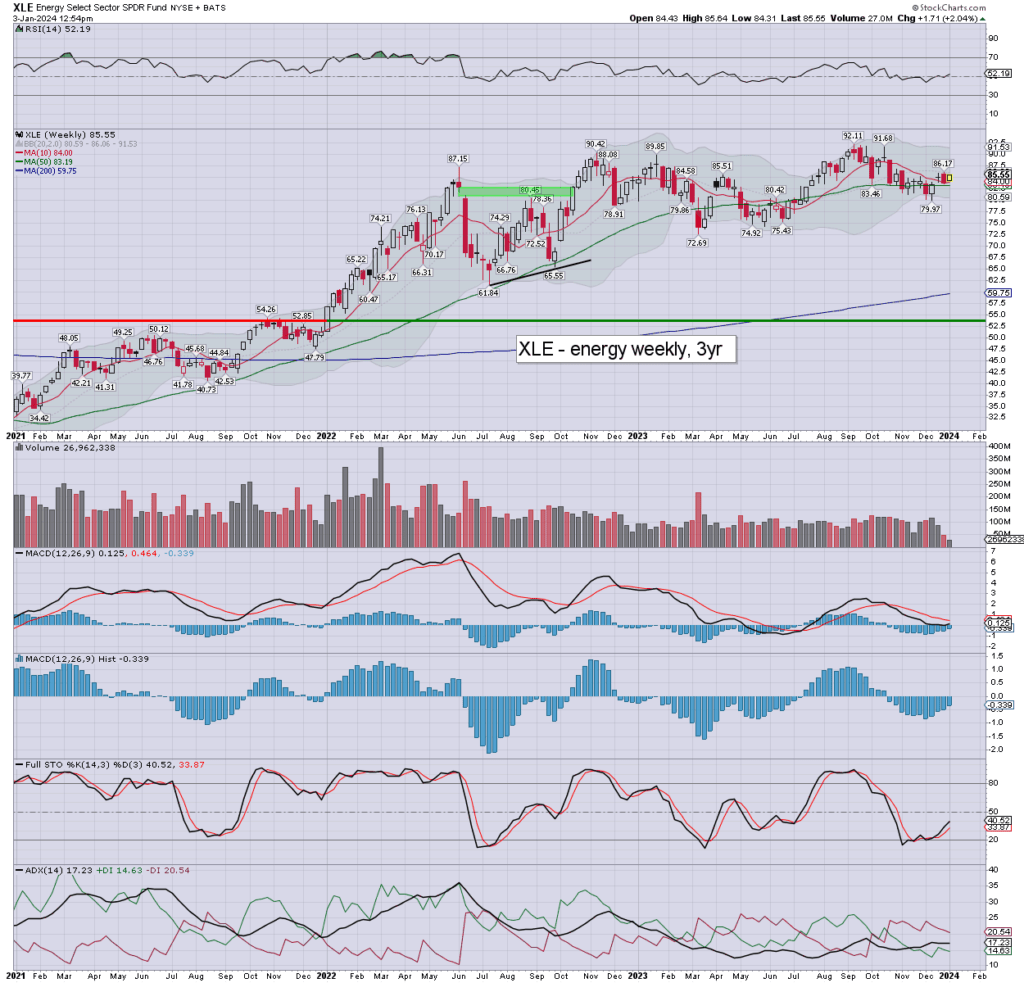

XLE weekly

Summary

WTIC/USO: oil printed $69.28, but swung to $72.90, which is very impressive, relative to the main market, and the stronger dollar. Underlying concern about the middle east? In any case, soft target 76/77s. Oil turns m/t bullish >$78.00, as seems an eventuality.

XLE: energy stocks opened weak, but are battling for sig’ gains, helped by the upside reversal in oil. S/t bullish.

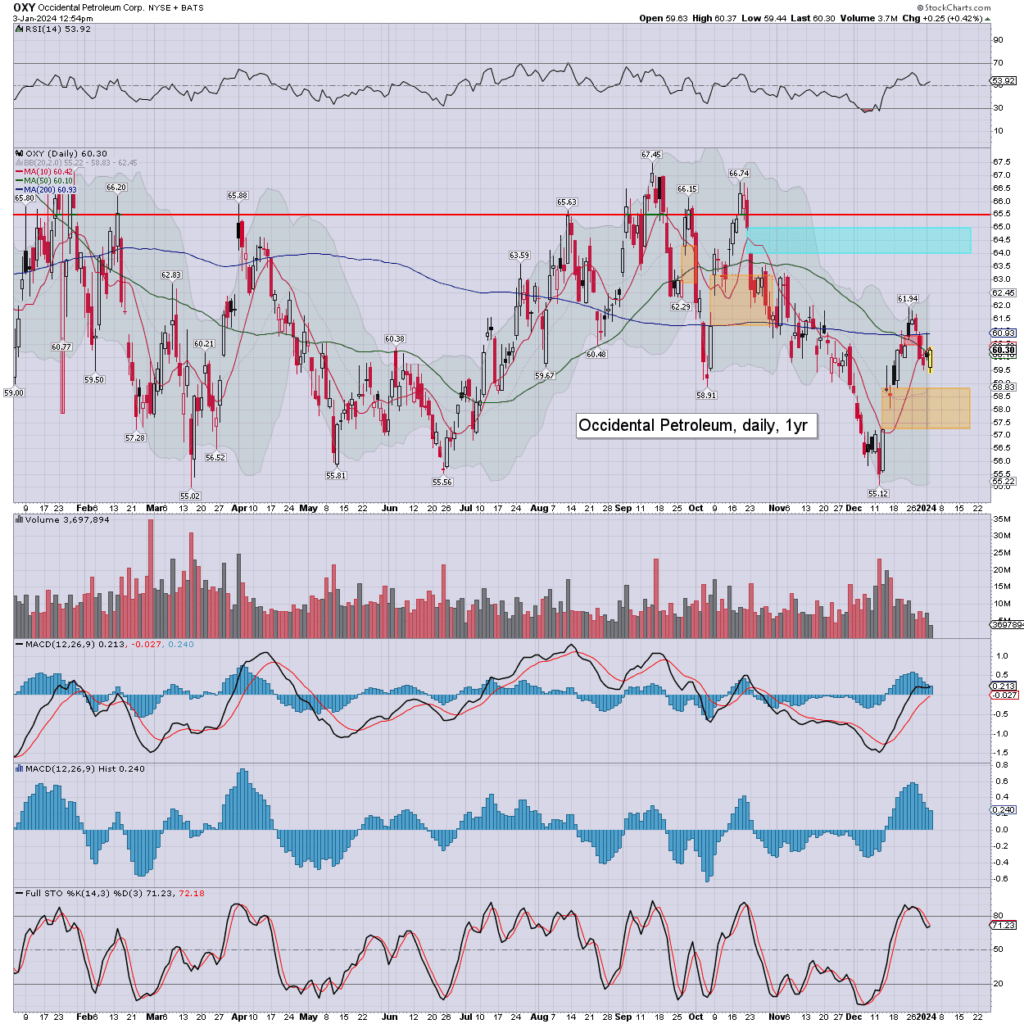

notable stock: OXY

Early weakness, but swinging upward with oil.

Yesterday’s black/spiky candle initially played out.

S/t bullish, and the bolder bulls will be seeking teal gap.

—

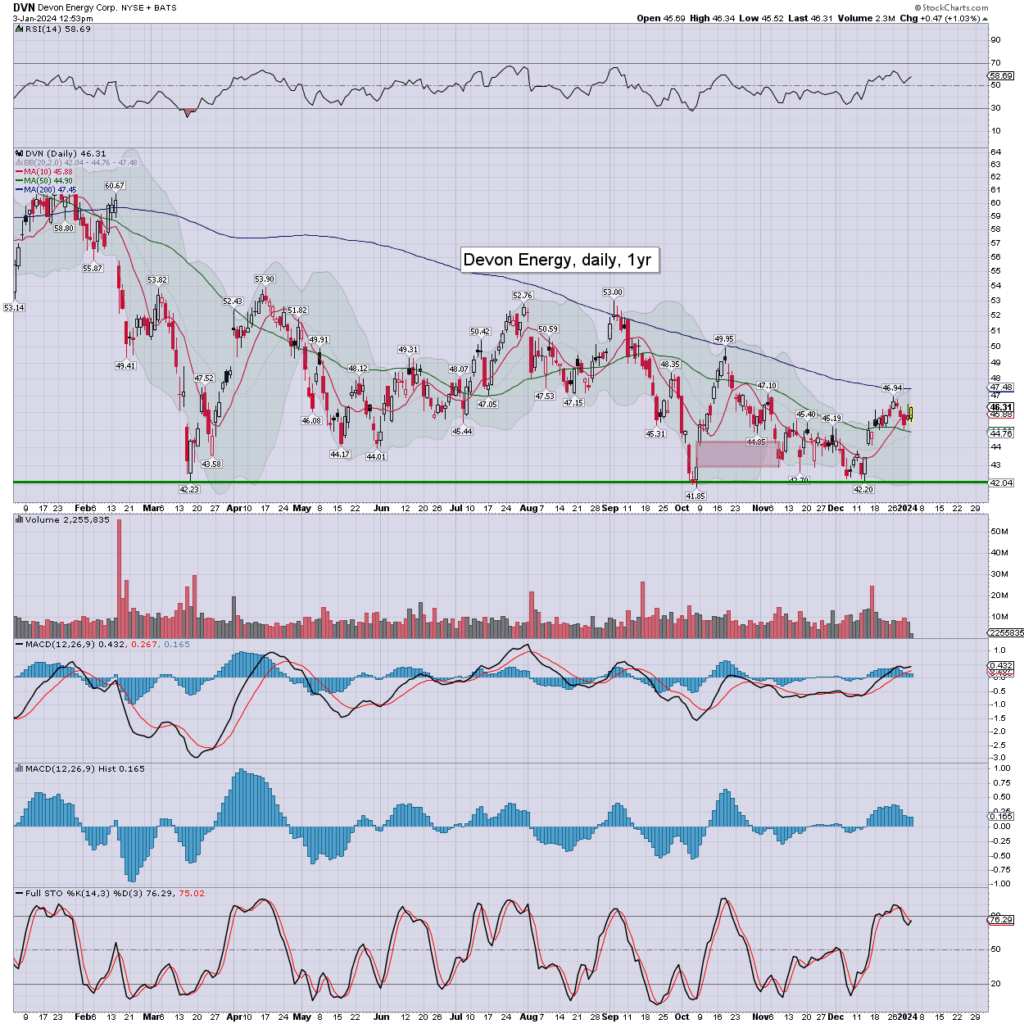

notable stock: DVN

The very cautious will be waiting to chase >200dma. If seen, it would bode bullish into the spring.

—

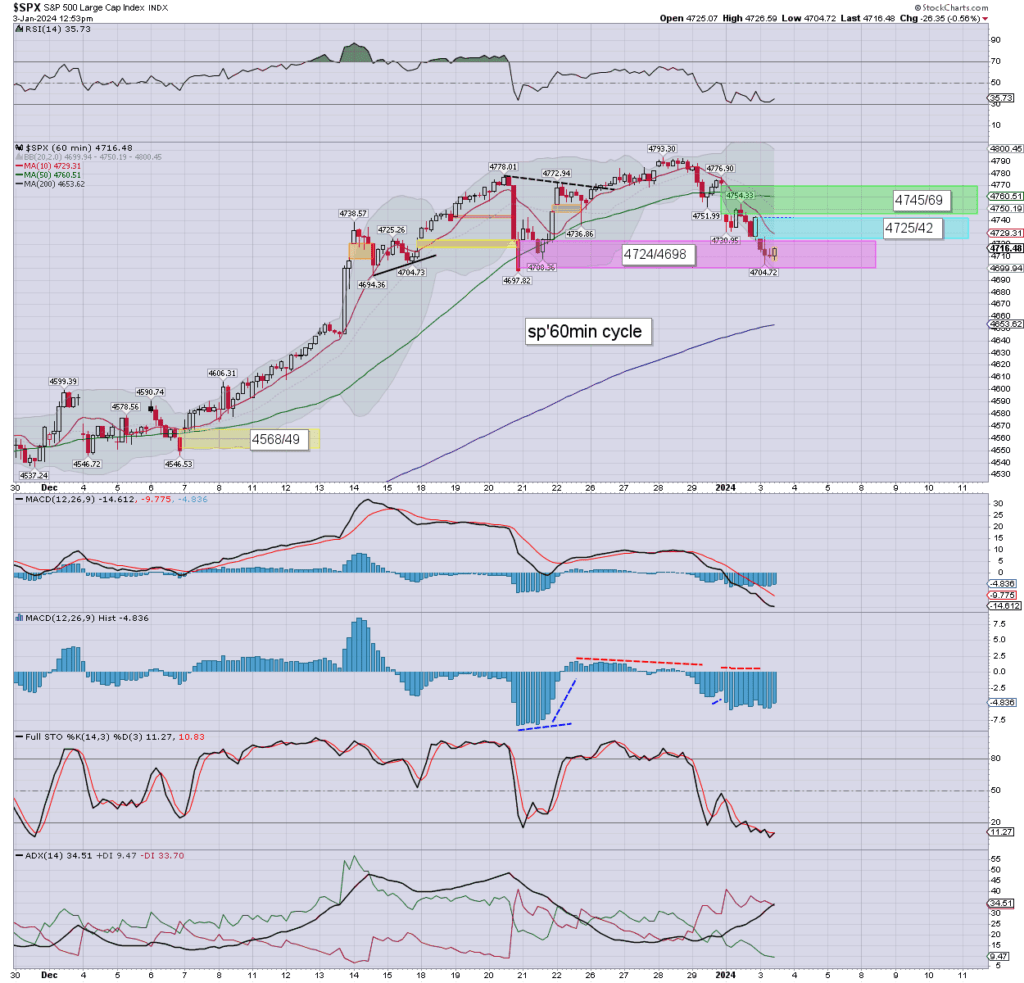

Equities: sp’60min

We’ve a provisional floor from 4704, just 6pts shy of fully filling the gap.